Speculating is a risky business but it’s the risk that makes such high returns possible. Today, I’m sharing an interview with someone who manages risk on a daily, weekly, monthly and yearly basis as a Senior Portfolio Manager with Sprott Asset Management.

Maria Smirnova has been with Sprott for more than 12 years, is currently the sole manager of the Sprott Silver Equities Class, and part of a team that manages the Sprott Gold and Precious Minerals Fund.

Recently, I had the chance to speak to Smirnova about the current silver market, her outlook for the rest of the year, and the biggest risks in the silver market.

Without further ado, A Conversation with Maria Smirnova.

Enjoy!

Brian: What brought you to where you are today, or more specifically, can you tell me a little about your career experience?

Maria: I started at Sprott in 2005 and was hired by Eric Sprott when he was still actively involved in the business. Coincidently, it was the middle of the gold bull run, so it was a good time and Eric needed more people to help him look at the mining equities.

When I started, Eric asked me to look at base metals, which I did for a couple of years. Then I moved on to gold, as well, and I’ve been doing that ever since.

Today, I’m part of our precious metals team, which means I’m responsible for advising all our precious metals mandates, when it comes to gold and silver. My passion project, of course, is Sprott Silver Equities Class, which is solely invested in companies that explore for and mine silver.

Brian: Since you are the Sprott Silver Equities Class Portfolio Manager, I would like to focus my questions on silver.

2016 was a great year for silver, as the price rose from its bottom around USD $15/oz and almost hit USD $21/oz. Moving into 2017, we’ve seen a couple of spikes in price, but haven’t been able to break USD $18.56.

What’s your outlook for silver for the remainder of 2017?

Maria: Of course, as Sprott, we’re bulls on silver and gold. Interestingly, however, we became really bullish at the beginning of last year, when the Bank of Japan adopted negative interest rates.

We had a bear market in precious metals that lasted four years. What changed was, in the beginning of last year, we realized that while the world has been quantitative easing, what we’re really seeing driving gold and silver, specifically, is real rates in the US dollar, the Japanese yen, etc.

Our call was that real rates will remain low, even though the Fed is talking about raising rates, our thesis still remains that the world, largely due to demographic factors, is not experiencing the same levels of growth as it has in the past.

Populations the world over are getting older. They’re consuming less and, therefore, it’s hard to stimulate the economy to grow faster. Whereas in the past, the normal growth rate would be 4% or 5%, now it’s down to 2%. In China, of course, it’s higher – but you can’t always believe their numbers.

In this environment, the Fed is the bellwether. The Fed sets the tone for the rest of the world and, yes, they’re raising rates, but we think that there’s limited ability for them to do so. In fact, the natural interest rate is actually lower than it has been – and that’s good for gold. Therefore, coincidentally, it’s very good for silver.

Back to your original question of what the outlook for silver is for the remainder of the year. It’s hard for me to see much downside for silver at these levels. We’ve come off a high of $21 last year and now it’s at $16.50. Basically, if you go much lower, companies will go back to environments where they don’t make money.

In that environment, production will have to start coming off and the supply-demand-balance will be pressured and, as it is, I would say that from the physical perspective, silver has been in a physical supply deficit for three or four years now.

What drives silver demand, there’s a lot of industrial uses, but what really drives the growth has been investment demand; ETF inventories have grown to 667 million ounces right now, and even in the bear market were stable, there were no outflows. There were some outflows earlier this year, and at the end of last year, after Trump won, but also towards the end of April.

Since the end of April, we’ve regained all that we lost. Coin and bar demand, in the last few years, has been really strong. Again, it came off at the end of last year with sentiment declining, but that will resume. Also, there were some things that happened in India that probably drove physical demand down, but that should stabilize.

From a physical metal perspective, the fundamentals I see are fantastic for silver. On the mine side, of course, my predicament is that I don’t see a lot of discoveries. I don’t see a lot of projects being built and that means that the mine supply will be constrained.

Also, scrap is a big component of the supply, which has fallen off in the last few years. Even last year, with the silver price rising, we didn’t see an uptick in scrap supply. I found that very interesting.

Again, the price rose to $21 from $14 or so, and you would expect that scrap supply should increase as price is price sensitive. So, if price rises, there should be more ounces coming to market, but I think that it was exactly the same as in 2015. So, from the physical market perspective, it’s very supportive of the price.

From a macroeconomic/sentiment perspective, like I said, it’s already come off quite a bit and we are positive on the outlook for gold for the second half of the year. We’ve had two hikes in the U.S. since the Trump election, so all the exuberance and optimism of Trump has been priced into the market.

If anything, we see potential for disappointments in the economic data going forward, economic data has been softer recently in the US. Auto sales are softer, other economic data are softer. This will all put pressure on the Fed, making it a lot harder for them to raise rates. Right now, I believe they’re talking about two more hikes for this year. I think there will likely be one by the end of the year.

Brian: The resource market is synonymous with volatility and the last 6 months haven’t disappointed from that perspective. Volatility in the markets isn’t a bad thing, but for some, it can prove unnerving. In particular, silver is especially volatile and suits the “gold on steroids” handle that it’s often given.

In your opinion, what is it that makes the silver market more volatile than, say, gold?

Maria: Number one, the fact that silver is much more accessible than gold to retail or smaller investors. Silver’s price per ounce is materially lower, which makes it easier to buy in smaller increments. Hence why I go back to investment demand, when there’s positive sentiment, we’ve seen tremendous Silver Eagle coin sales.

I think last year, in 2015, there’s been a lot of growth in retail demand for silver products and that’s to do with the lower unit price. It’s easier to buy silver than it is gold. So, when there’s demand and the sentiment is positive, the price percentage rise can go up more than gold.

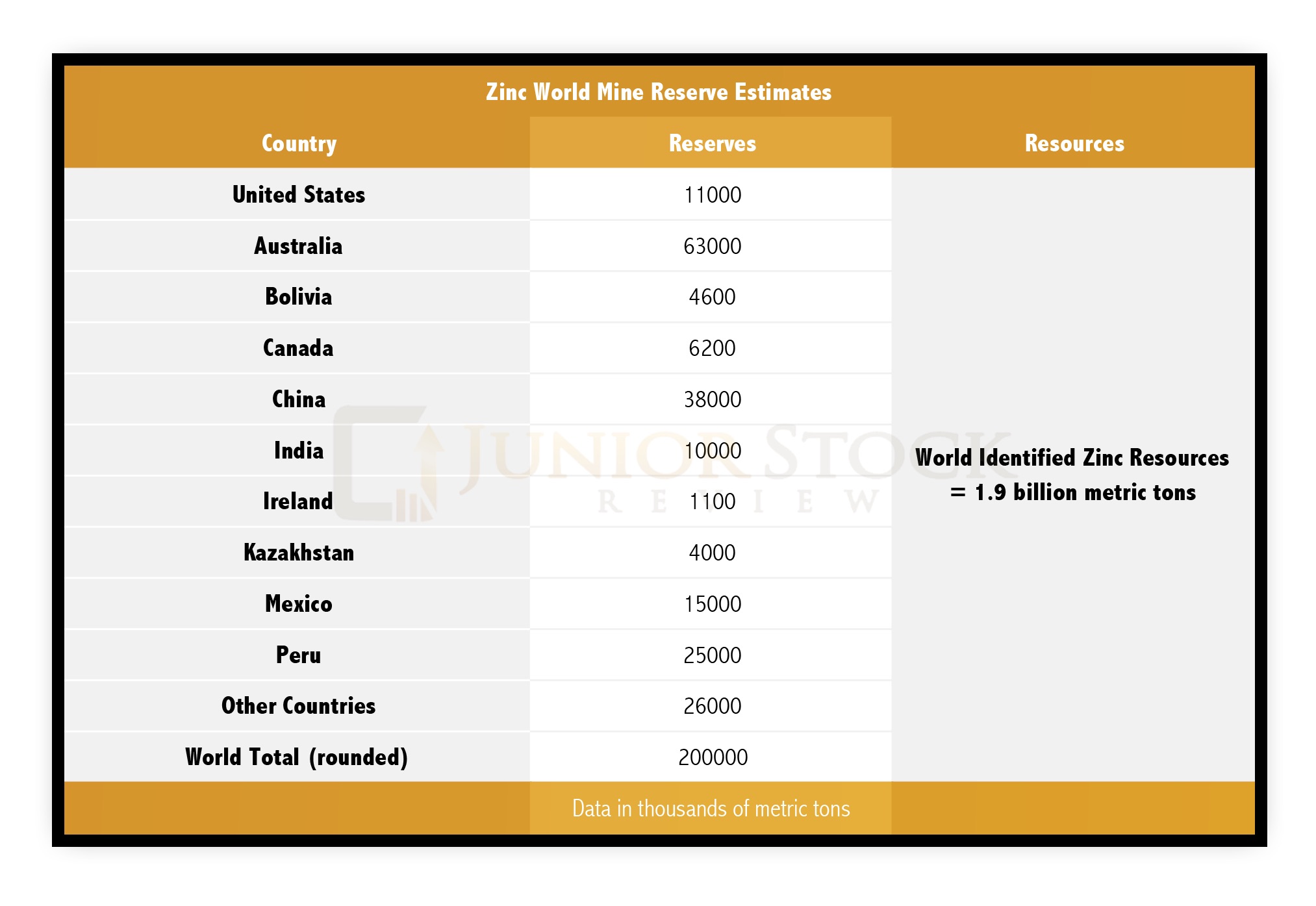

The second factor is how much is available to invest. In silver’s case, it’s much less than it is for gold. GFMS estimates about 187,000 metric tons total have been mined over our history. If we subtract jewelry and what’s held in central banks, that leaves us with 65,000 metric tons of above ground investable gold, which is worth about $2.6 trillion. We can say that’s the investable gold universe.

On the silver side, we calculated about $47 billion. That’s a huge difference. If people are moving towards these metals and trying to buy them, from a dollar perspective the silver pool is much less. If there’s demand, incremental price movements will be amplified in silver.

Brian: We all need to manage risk in our portfolios. Whether it’s jurisdictional risk, metal price risk or exploration risk, risk in the resource market is viewed in a slightly different light depending on who you talk to.

In your opinion, where is the most risk in the silver market as a whole, currently?

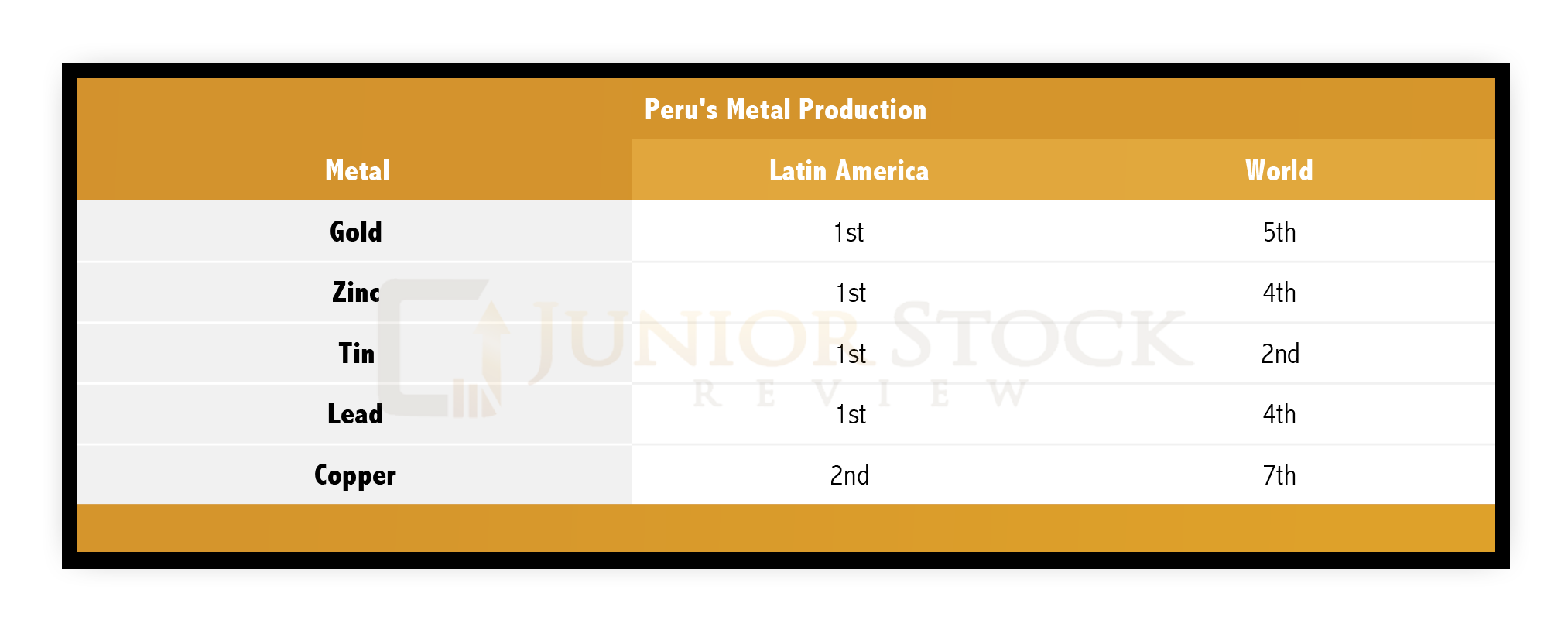

Maria: As far as the companies are concerned, it’s price risk that they’re most sensitive to. From a jurisdictional risk perspective, Mexico has been quite stable, and if you look at other producing countries, like Peru and Chile, they’ve been quite politically stable, too. If it’s an exploration company, it’ll have the exploration risk. If it’s a producer, there could be operational risks or price risk, which would be greater as your revenues depend on it.

So, to me, in any commodity, the metal the price risk is the biggest factor. Because you can try to manage around the other things.

Brian: People are widely accepted as the most important facet of any junior resource company.

Outside of a proven track record of success, in your opinion, are there any characteristics that are commonly shared by successful people in the resource sector? Characteristics that investors should look for?

Maria: That’s an interesting question. What sets some managers apart from others? Outside of me saying “the right time at the right place,” which, by the way, for some of the really well-known guys, has been the case. I think to be successful in mining you have to be able to dream and you have to be able to take on risk and see the bigger picture.

If you’re not a risk-taker in mining, you won’t succeed because you don’t know what’s in the ground until, literally, it’s been produced. When I say you need to see the bigger picture, what I mean is that if you’re a geologist, sometimes you can get too caught up in the rocks, get excited about the geology or the structures you’re seeing, and forget that you actually need to find an economic deposit.

To me, the guy who’s going to be successful is the one who’s going to be able to put together a multitude of factors, infrastructure, grade, size, metallurgy, and see the potential to have a great mine, and their ability to market, as well.

I think the CEOs that I’ve seen, be it a woman or a man, that have been successful with their companies, are the people who can promote what they’re doing, who are able to foster relationships not just with investors but with communities, because community relationship is hugely important in mining.

And that is kind of marketing, too. You’re forming relationships with all the stakeholders around you. So people skills are quite important, as well. You can’t just be technically strong, you have to also be people strong.

Brian: Technology is rapidly improving, improving so quickly that many believe that in the next 10 years, we will see more advancements than we did in the last 100 combined.

How do you think this technological advancement will affect the mining industry?

Maria: That’s also an interesting question because, I would argue, we haven’t seen nearly the amount of technological ingenuity in the mining sector as we have in so many other sectors. In many ways, the miners do the same thing they did 100 years ago. So, to me, I would love to see advancements in technology in mining. That would lead to better safety, fewer casualties.

I would love to see some improvement, some kind of creativity on how you mine to improve economics, how you recover the metal, and all of this will lead to, again, safer mines, better environmentally-friendly mines, fewer environmental disasters. It would, hopefully, even improve the image people have of mining.

So, actually, that’s something I would love to see more often in the industry.

Brian: What are the advantages of investing in a fund, such as your Sprott Silver Equities Class, versus buying individual companies?

Maria: Number one, diversification. Mining is a dangerous business. Mining is a risky business. As I said, unless you’re a dreamer you likely won’t succeed. So you want to have a basket of names, be it in a fund or be it in a portfolio. You can’t just own one or two names, you really do need to have a few to even out the operational risk and the political risk.

And the second advantage of the fund would be that, over time, my goal, as a portfolio manager, is to lose less money in downturns, i.e. preserve capital through being in cash or cash equivalents, to the loading of the portfolio with more beta when I think that the market will rock and my job is to find new stories that will lead to exciting discoveries in the future. Not everyone has the time to do that and that’s my job; so that’s why we have funds.

Silver truly is gold on steroids. For those with the intestinal fortitude to navigate its volatility, tremendous gains should be made in the months and years ahead. It has been said by many that people are what make a company a success. Do your diligence and find the people who are serially successful in the companies that they create, and you will be successful during this precious metals bull market.

For those who want exposure to silver but don’t have the time or expertise to pick the right companies to invest in, you may want to check out Maria’s Sprott Silver Equities Class. Buying funds, such as this, put your investing dollars in the hands of a professional and give you great odds at being successful in any market.

Finally, the Sprott Natural Resource Symposium held in Vancouver this July, offers a great value proposition, as Sprott has handpicked a group of speakers and companies that have out-performed the broader junior resource market in each of the last 4 years. If you’re going to attend just one natural resource conference, this is it.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer – The following is not an investment recommendation. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence.