I’m bullish on uranium’s future and believe those who are positioned in the right companies will see extraordinary gains in the future. One of the companies that I believe will excel with a rising uranium price is Energy Fuels. For those unfamiliar with the Energy Fuels story, check out my article, written last December, here.

Today’s article is an interview that I conducted with a member of the Energy Fuels management team, Curtis Moore. Moore is VP of Marketing and Corporate Development, and is involved in a wide range of company activities, such as uranium sales, mergers and acquisitions, investor and public relations, and corporate legal.

Enjoy!

Â

Brian: The uranium spot price has recovered well since hitting a low of $17.75 per pound, late last year. Kazatomprom, Kazakhstan’s giant uranium producer, played a major part in this price appreciation with the following announcement on January 10th, 2017:

“[A]nnounced today that due to the prolonged recovery in the uranium market, planned 2017 production from Republic of Kazakhstan will be reduced by approximately 10%. This will amount to a volume greater than 2,000 MtU or more than 5 million lb U3O8 reduction in 2017 planned output. For greater context, this is equal to 3% of total global uranium production (based on 2015 UxC Consulting figures)†~ Kazatomprom

Today, the UxC U3O8 price sits at $23.25 USD per pound, while this is a great appreciation in the spot, prices below $30 USD per pound are still uneconomic.

Where do you think the uranium price is headed in 2017? And, how will it affect the way Energy Fuels does business this year?

Curtis: We believe the price of uranium will be higher at the end of 2017 than they are today. However, considerable uncertainty remains. After shooting up from $18 to the mid-$20’s earlier this year, uranium spot prices have stalled for the time being. I understand that utilities have not been particularly active in the spot market this year, which actually might be a good thing. We also understand that utilities intend to enter both the spot and term markets to an increasing extent this year, so that is demand that has not yet materialized. Indeed, several non-US utilities already have begun to dip their toes into the market to soak up some of the cheap uranium that is available. I’ll also point out that uranium markets are thinly traded, and there are relatively few market participants. Therefore, small changes in supply or demand can create large changes in prices. The price volatility we’ve seen in the spot market this year exemplifies this fact, as we’ve seen large daily increases and decreases in spot prices based on very small quantities of material traded.Â

Producers, including Energy Fuels, typically want to minimize exposure to today’s spot market. This is likely a reason behind some of the recently announced production cuts. Indeed, as long-term contracts continue to expire, I would expect producers to simply continue to cut production, rather than sell our valuable resources into a weak spot market. These production cuts, along with the fact that global uranium demand is growing, will eventually create the conditions needed to bring rationality back to uranium prices.Â

At Energy Fuels, we are certainly happy to see uranium prices rise off of their near-historic lows in late-2016. However, we still plan to cut production, thereby preserving cash, until prices rise above about the mid-$30’s to $40 level. I would like to think we would be one of the first companies back in the market, since we can ramp-up production relatively quickly, and we can make good operating margins from our lower cost sources of production at or above the $40 price level. But, until that happens, we’re happy to sit back and keep our powder dry.

Â

Brian: As you know, a uranium producer can protect itself in periods of low U3O8 prices in two key ways: a hedged contract sales book and access to uranium In-Situ Recovery (ISR) operations. While prices below $30 USD per pound make even low cost ISR operations uneconomic, they are a huge advantage when operating in conjunction with a hedge sales book.

Energy Fuels possesses both conventional uranium mining operations and, most importantly right now, ISR operations within the United States. They also have a hedged sales book, which allows them to sell uranium above the current spot price.

How is Energy Fuels using their long-term contracts and ISR production to their advantage while the uranium price is low?

Curtis: You are correct that Energy Fuels holds long-term contracts, and those contracts have pricing at levels that are well above our costs of production. One of the reasons we are not currently profitable is that we do not have enough of these higher-priced contracts. However, once prices rise into the $40’s per pound, we believe it will be prudent to secure a certain portion of our production into new contracts. Though, we will leave additional proportions available for sale at even higher prices.

You are generally correct that ISR production is lower cost than conventional, while conventional production can produce much more pounds of uranium at higher prices. However, our Canyon Mine, a fully-permitted, mostly-developed, high-grade conventional mine in Arizona, is an exception to this “ruleâ€, as it is probably the lowest cost source of production in our portfolio right now. Still, we don’t plan to bring Canyon into production until we can realize sales prices at least above the high-$30’s.

Nevertheless, our Nichols Ranch ISR Project, which is currently in production in Wyoming, and our Alta Mesa ISR Project, which is currently on care and maintenance in Texas, have costs that are right behind Canyon. As prices rise into the $40’s, with Canyon, Nichols Ranch, and Alta Mesa, we believe we have the ability to bring about 2-3 million pounds of annual production into the market within a relatively short period of time. So, we think we’ll be one of the first companies to benefit from even modest rises in uranium prices.

Â

Brian: One thing that I admire about the Energy Fuels management team is that they aren’t afraid to progress their assets during a bear market. This methodology will allow them to capitalize on a turn in the market, and fully focus on production when the uranium bull market returns.

On Febuary 2, 2017, Energy Fuels released some fantastic chemical assay results from their Canyon Mine, which confirm more high-grade uranium and copper mineralization. A couple of the highlights from the assay are: Hole No. 14, intercept length 4 feet, average uranium grade 8.35% U3O8 and average copper grade 1.64%;Â Hole 11, intercept length 18 feet, average uranium grade 1.23% U3O8 and average copper grade 7.74%. More assay results can be found in the news release.

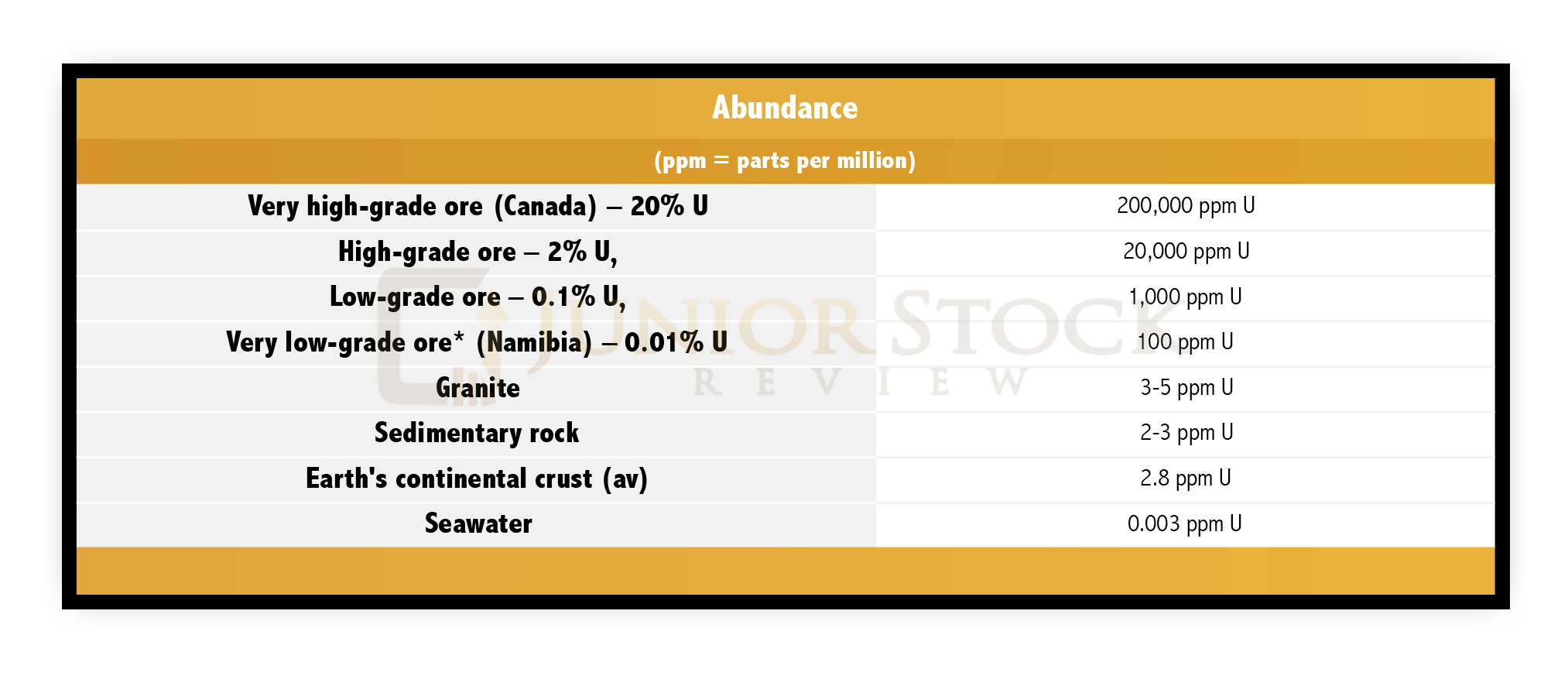

NOTE: The World Nuclear Association says that high grade uranium is considered to be about 2% U3O8 and low grade is around 0.1%. This should put Energy Fuels results into perspective. Â Also, the lowest % Copper for the typical economic project these days is 0.4% copper, again putting these high grade figures into perspective.

The latest assay results from the Canyon Mine are very promising. What does Energy Fuels have planned for the Canyon Mine in 2017 and beyond?

Curtis: We are very excited about the Canyon Mine. According to the WNA table you mention, the only country with significant high- or very high-grade uranium deposits is Canada. But, ex-Canada, the Canyon Mine is very high-grade on a global basis. I believe it is the highest-grade uranium mine actually being developed in the World today. And, keep in mind that most of the high-grade Canadian deposits you hear a lot about are not permitted or developed. They’ll require large dollars to finance. As a result, production from these deposits is likely many years away. In my opinion, these are truly exceptional deposits that will make enormous contributions to uranium supply in the long-term. But, they probably won’t be ready to produce during the upcoming uranium super cycle.

By contrast, we believe the Canyon Mine can capitalize on the upcoming uranium super cycle. It has the dual advantage of being high-grade and low-cost on a go-forward basis. And, all the pieces are in place to start production. It is fully-permitted, all surface development is complete, the production shaft is complete, and our White Mesa Mill is ready with the capacity to process the ore into salable product.Â

The current NI 43-101 Technical Report shows the project having 1.6 million pounds of inferred uranium resources. However, we recently completed an underground drilling program from the shaft. And, we intercepted very large areas of previously undiscovered high-grade uranium mineralization. We expect to release a new technical report later this year incorporating the results of our drilling program, and we hope to significantly increase the size of the resource and upgrade the resource classifications.Â

You also mention the copper mineralization we discovered. We still have a lot of core samples to assay and evaluate. But, so far we have assayed 509-feet of core with an average grade of over 10% copper. This is extremely high-grade copper mineralization.   We don’t know yet whether we will be able to economically produce a salable copper concentrate. However, we are taking a very close look at the potential to reconfigure the White Mesa Mill to produce this copper. And, if it can be produced as a profitable by-product, it will lower our costs at Canyon even more.

Brian: It should be noted that the process to get a uranium property permitted in North America is long and sometimes difficult. The Energy Fuels team, however, is proficient at getting their properties approved for mining.

On January 10, 2017, Energy Fuels released news that the U.S. Bureau of Land Management had issued a Final Environmental Impact Statement and Record of Decision for the Sheep Mountain Project. These are the final governmental approvals needed to commence mining at the project.

The Sheep Mountain Project is a conventional type development property located in the Crooks Gap Mining District of central Wyoming. The deposit holds 18.4 Mlbs of U3O8 probable reserves and an indicated resource of 30.3 Mlbs U3O8.

Also, Energy Fuels announced in a news release on March 23rd, 2017 that they have received permits to expand Nichols Ranch in the future. Nichols Ranch is an ISR property, which is located in the Powder River Basin, Wyoming. Currently the facility has 2 Mlbs U3O8 production capacity per annum and has a measured and indicated resource of 2.8 million pounds (Mlbs) of U3O8, with a lot of exploration potential ahead of it.

The Energy Fuels team’s ability to successfully navigate the permitting process is an asset to the company. Can you give us an overview of what the permitting of Nicholas Ranch and Sheep Mountain will do for the company?

Â

Curtis: Thank you for recognizing the success our company enjoys on the permitting front. It is not easy to permit new uranium projects in the U.S., and we believe our permitting team is truly second-to-none in the U.S. But for some reason, lots of investors take licenses and permits for granted. In reality, permitting a project is time-consuming and expensive. It can take 10 years and millions of dollars to permit a large new mine or mill in the U.S. or Canada.  Even less developed countries have difficult permitting pathways. I can’t emphasize enough that existing permits are an extremely valuable asset to any company. No permits, no production.

We recently finished permitting the expansion of our Nichols Ranch Project in Wyoming into the Jane Dough wellfields with the EPA, NRC, and Wyoming state agencies. At Nichols Ranch, we are currently producing from 9 wellfields. But, under the previous permit, we were only able to develop 4 more wellfields. However, the recently approved expansion allows us to construct 22 additional new wellfields. We also have the permits in place to build 8 more wellfields beyond the 22 mentioned prior. This gives us a lot of runway for future production at Nichols Ranch. We also recently completed permitting at the Sheep Mountain Project, a large conventional mine located in Wyoming. And, we have some permits pending for a couple of our other conventional projects, including the Roca Honda Project in New Mexico and the expansion of our La Sal and Daneros projects.Â

We also have existing permits for a number of developed projects that are currently on care and maintenance, including the Alta Mesa ISR Project in Texas, the La Sal Complex, the Daneros Mine and Tony M Mines in Utah, and the Whirlwind Mine in Colorado. Again, these existing permits are valuable assets to Energy Fuels.Â

As prices rise, there will be a lot of uranium companies talking about their deposits. We will be talking about ours, too. But, we will actually be mining, producing finished product, selling uranium to utilities, and putting those dollars into our treasury.

Â

Brian: Last year, I wrote an article entitled, Invest like an Insider, where I discussed how important it can be to watch a company’s insiders’ buying and selling. The actions of a company’s insiders typically, but not always, provide the investor with an indication of the company’s health and future prospects. Over the last few months, Energy Fuels has seen both insider buying and selling.

Curtis, can you give us an overview of the insider buying and selling over the last few months?

Curtis: No problem. Investors deserve to understand what is happening. And despite one Board member selling over the past several months for personal financial reasons, we recently had 11 members of the board and senior management buy stock in the Company. We believe we put our money where our mouth is.  I would also point out that insiders own about 5.2% of our common shares outstanding. And, most of these shares have been purchased on the open market over the years, as no one received founders’ shares and we only recently instituted an RSU program to save cash. In short, our insiders have invested very large sums of our own money into this Company. We believe in this Company, and we believe in the long-term prospects for uranium.

Â

Brian: I believe President Trump’s election has played an integral role in the initial rise in the uranium spot price. Jonathan Crawford writes in a Bloomberg article posted on February 7th, 2017,

“Trump will throw more support behind nuclear power than the Obama administration, which gave a higher priority to wind and solar power, Maria Korsnick, president and chief executive officer of the Nuclear Energy Institute, said in an interview Tuesday at Bloomberg headquarters in New York. The industry’s goal of expanding the number of U.S. nuclear reactors dovetails into Trump’s campaign promise to add jobs and boost investment in infrastructure.†~Bloomberg

Crawford further states,

“’The U.S. nuclear industry contributes $60 billion to the economy and employs more than 100,000 people, according to the Nuclear Energy Institute. That was a key message the Washington-based group delivered to the White House after Trump campaigned on a promise to boost employment, Korsnick said.†~Bloomberg

No one has a crystal ball, but can you please give us your best guess as to whether or not nuclear power will play a greater role in America’s energy future?

Curtis: In our opinion, the U.S. will remain a leader in nuclear energy. However, we anticipate nuclear to be flat or decline somewhat in the U.S. We are shutting down some of our smaller, older plants. But, we are also replacing them with some larger, newer plants. We are also moving forward with some new small modular reactor (SMR) designs. However, the growth of nuclear, and hence uranium demand, will not be in the U.S. or Europe. It will mainly be in Asia, as countries like China, Russia, South Korea, and India move forward with their programs. China will likely surpass the U.S. in nuclear generating capacity by the early- to mid-2020’s. And, Energy Fuels is well-positioned to sell our product to the U.S. and nations around the World. We have a track-record of international sales. We have accounts at all of the western conversion facilities. And, our projects are ready to increase production. In short, we will be ready to produce and sell more uranium when the market wishes to pay us fair value for our product.

Â

Brian: Curtis, thank you for taking the time to answer my questions.

Â

Â

Summarizing from my conversation with Curtis, here are a few of the highlights for Energy Fuels, right now:

- The permitting of their Sheep Mountain project and, most importantly, the permitting for the expansion of their ISR Nichols Ranch operation.

- 11 Energy Fuels insiders are putting their money where their mouth is and are buying Energy Fuels stock

- High grade Canyon Mine continues to release encouraging drill results, and looks to be the source of both high grade / low cost uranium and, potentially, copper concentrate.

These are all positives in the mining business but, of course, as investors, we must be mindful of the potential pitfalls associated with our investments. One big one in any uranium company, at this moment in time, is where is the uranium spot price headed? Most uranium producers and prognosticators feel it is going up, but when and by how much? These are the questions that you need to contemplate and decide where the risks are and how much you’re willing to take on.

For me, I believe in the Energy Fuels management team and their properties, and it’s where I will be putting my money.

Until next time,

Brian Leni  P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do NOT own Energy Fuels stock. All Energy Fuels analytics were taken from their website and press releases. Energy Fuels is a Sponsor of Junior Stock Review.Â