On April 6th, I had the opportunity to visit Northern Empire’s Sterling Gold Project, located north-west of Las Vegas, Nevada. My visit was great and really gave me a good perspective of the Sterling Gold Project’s scale and its potential for further resource expansion.

In particular, the Crown Block stood out as having great exploration potential, as not only is this area a focus for Northern Empire, but also has drawn a lot of attention from Corvus Gold, whose Mother Lode Open Pit is completely surrounded by Northern Empire.

In all, I left the site visit very optimistic that Northern Empire’s 2018 drill program should shed a lot of light onto the Sterling Gold Project’s potential and am eagerly awaiting news flow!

Las Vegas

After landing in Vegas, I hopped in an Uber to get to my hotel. As this was my first visit to the area, I was mesmerized by the bright lights, massive celebrity advertisements and sheer size of the Las Vegas Strip.

View from the bridge connecting the Bellagio and Ballys

Las Vegas truly is the center of the universe when it comes to marketing, because the corporations that reside here clearly understand human behaviour and how to manipulate it. Everything about the strip is designed to put a smile on your face while simultaneously extracting the maximum amount of money from your wallet.

Along the strip, a Starbuck’s tall Americano is $5.50 USD, a tall can (493ml) of domestic beer $10.00 USD, and a ‘big gulp’ slushy with rum or tequila will run you $30 USD. These prices remind me of those typically reserved for sporting events or concerts, which may be a good comparison for the confines of the Vegas Strip.

A view of New York New York from my hotel parking lot

While my comments here may seem negative to some, they aren’t meant to be. I have a high regard for the marketing expertise that has created this ‘wonderland.’

View of the Bellagio

Bottom-line, even if you aren’t a gambler, Las Vegas is a place that everyone should visit at some point in their lives. It truly is unique in terms of what it has to offer.

Sterling Gold Project

The day of the site visit started early, as we met in the lobby of the hotel at about 6:30 am. I, however, hadn’t adjusted to the 3 hour time change and was up some time before. One thing about starting your day at 4 am in Vegas is that you aren’t alone. That said, I’m sure most of the people I encountered at that time of the morning had yet to go to bed!

From our hotel, it was about a 2 hour drive up the I95 to the Sterling Gold Project. Given the size of our group, we split up into 3 vehicles. In the SUV with me was Executive Chairman, Doug Hurst, and The National Investor newsletter Editor/Publisher, Chris Temple. Both men are very experienced in the mining and investment worlds and shared several, great anecdotal stories about their experiences and lessons they’ve learned from the sector.

Drones and Area 51

Roughly half way to our destination, we drove past a U.S. Air Force base which, famously or infamously, is the site of at least a portion of the U.S. drone fleet.

A drone flying in the Sterling Gold Project Vicinity

One of the most intriguing, yet mysterious, sites along the way was Area 51. Of course, you can’t actually see Area 51, but many of the businesses along the highway have names inspired by this mysterious U.S. Air Force base. I’m by no means an expert on the lore surrounding Area 51, but after spending the day at the Sterling Gold Project, you very quickly become aware of a U.S. military presence.

2 (small) Helicopters in the distance

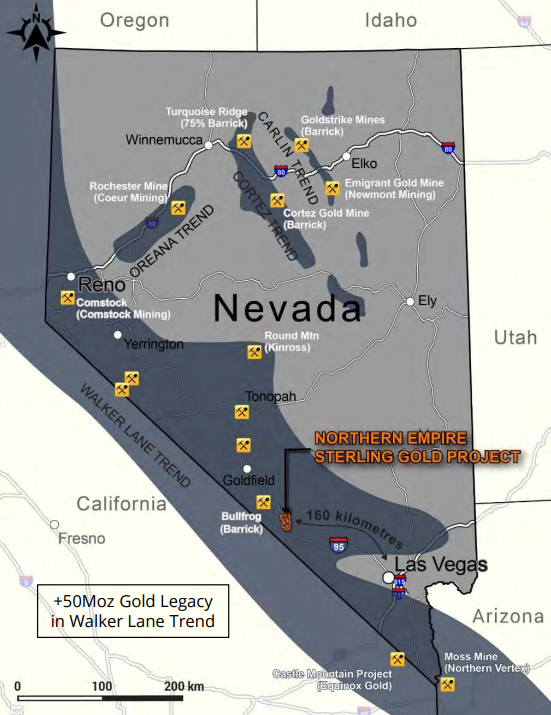

Walker Lane Trend

The Walker Lane Trend extends north-west from Las Vegas to Reno, running parallel to the Nevada and California state borders. While not as famous as the Carlin or Battle Mountain-Eureka Trends in the northern portion of the state, the Walker Lane Trend has a very rich gold mining history.

It’s estimated that 50 million ounces of gold have been discovered within the Walker Lane Trend, with the Comstock Lode Mine located near Reno being, arguably, the most famous. Additionally, the Round Mountain and Bullfrog Mines are other examples of gold producing mines within the trend.

Interestingly, Barrick’s past producing 2.3 million ounce Bullfrog Open Pit Gold Mine can be seen from Northern Empire’s Crown Block. I was able to snap a photo, while standing at the top of the Secret Pass Open Pit – see below.

View from the Secret Pass Open Pit – Barrick’s Bullfrog Mine

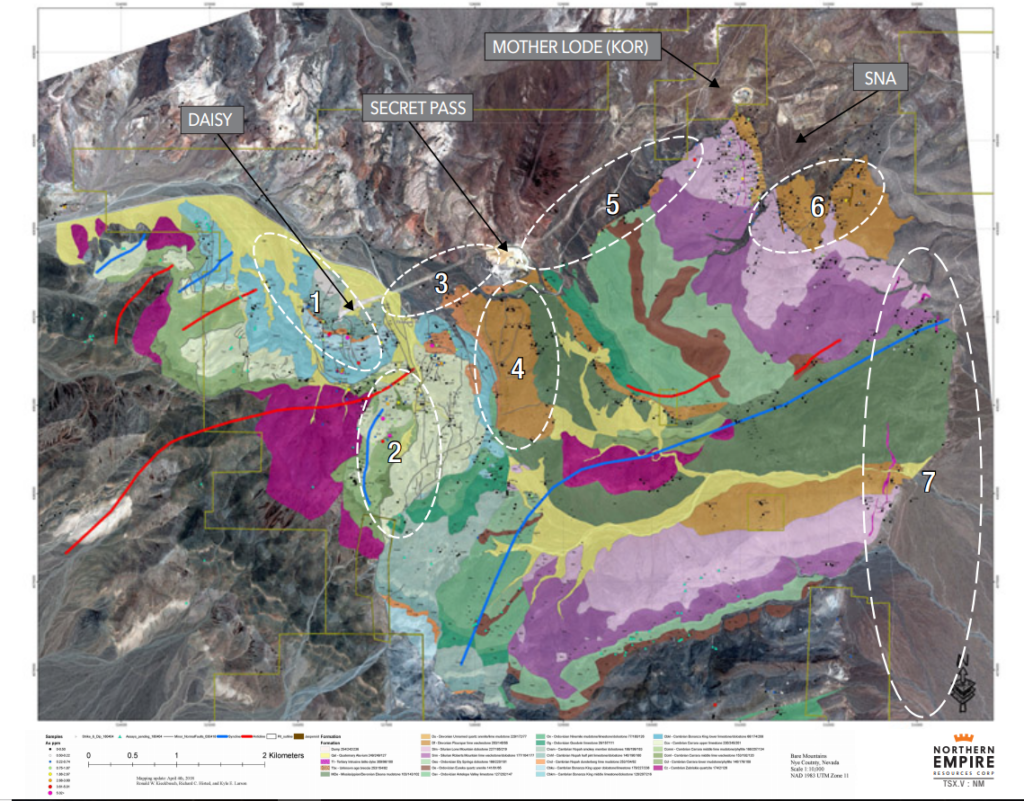

Satellite Image of the Crown Block

As you can see in the satellite image above, the Bullfrog Detachment Fault and the Fluorspar Canyon Detachment Fault run in a similar east-west fashion, and lay host to the past producing open pit mines. Also, the Faults divide the tertiary volcanic rocks in the north and the sedimentary rocks in the south.

Sterling Mine

The site visit began at Northern Empire’s permitted Sterling Mine, which is in the southern region of the property. After completing our site safety orientation and collecting our PPE, we hit the road, making our first stop at the heap leach pads.

Sterling’s Main Entrance Road, Looking away from the Sterling Mine

Sterling’s Main Entrance Road, Looking at the Sterling Mine

Currently, there’s one active leach pad; at the time of our visit, it was being turned over by the bulldozer featured in the photo below. The ore is mixed on the pad to help oxygenate the pile and break up any fluid channels that formed over the last cycle. Ultimately, this leads to higher recoveries in the processing plant. These are simple smart things that the Company does to improve efficiency show the respect that they treat shareholder capital. Also to note, the existing facilities and processing plant appear to be in great shape, which is a real plus when it comes time to begin production.

Active Leach Pad

We then moved into the Sterling Mine open pit area, more specifically up onto the Water Tank Hill, which gives a great vantage point for viewing all three open pits.

Northern Empire CEO, Mike Allen, on Top of Water Tank Hill

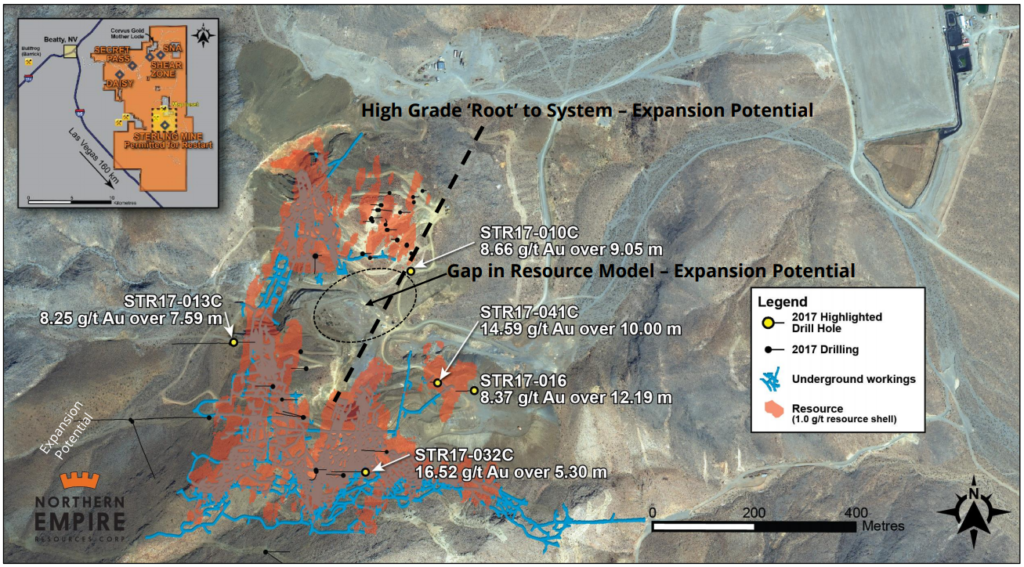

While standing on Water Tank Hill, CEO, Mike Allen, took the opportunity to explain how they will attempt to expand the Sterling Mine resource. As explained in my introductory article, the company will follow up on recent high-grade drill holes that sit on the pit shell edge, as seen in the satellite photo below.

Sterling Gold Project Mineralization – Core Shack

Next, we headed back to the main offices for lunch and a look at the core shack. As with all Carlin-Style gold, the core doesn’t possess any eye-catching visible flakes or nuggets, but instead it is the orange oxidized material (the more broken up the better) which should catch your eye, as it is gold bearing. The samples, however, were still very interesting as the fluorite and calcite mineralization found on the property can be seen in the core samples. In the photo below, for instance, the purple mineral is fluorite.

Core Sample with Purple Mineral Fluorite

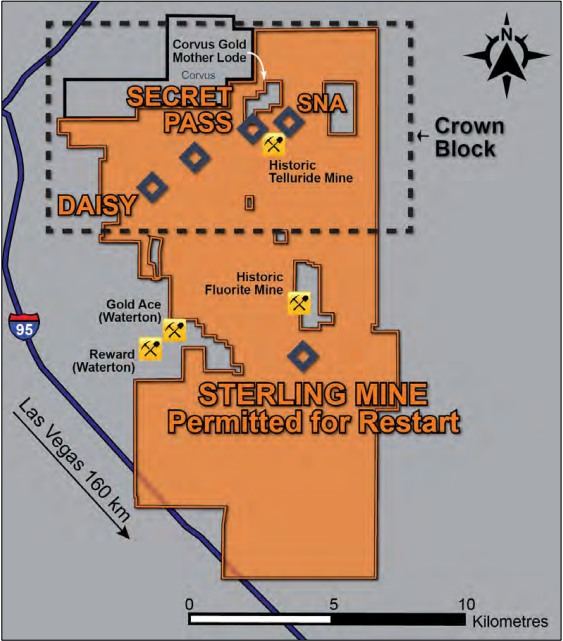

In fact, the Sterling property boundaries not only surround Corvus Gold’s Mother Lode Project, but also historic fluorite and mercury mines, which can be seen in the property map below. Interestingly, it was mentioned during the visit that the fluorite mine was hampered by gold contamination, what a wonderful issue to have!

Sterling Gold Project

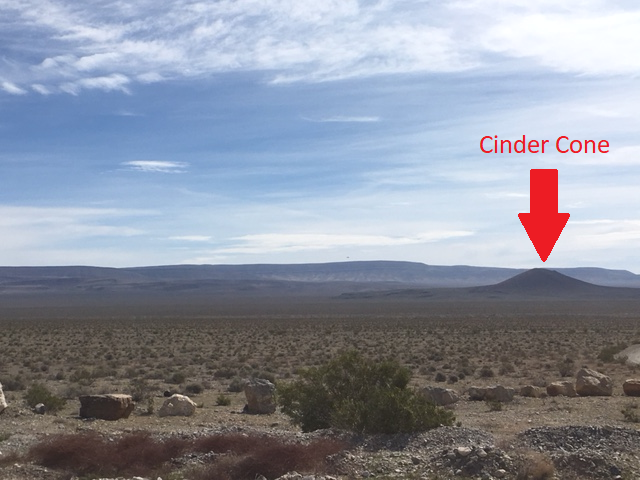

Sterling Mine Site Manager Chuck Stevens , who worked previously in the Sterling underground mine, showed me a few excellent calcite samples in his office and, additionally, pointed out the massive calcite sample sitting outside the geologist’s office trailer. Also, Executive Chairman, Doug Hurst, pointed out a couple of cinder cones which lie just east of the property; another example of the geological diversity of the property and its surrounding area. The immediate area around Northern Empire’s Sterling Project features fluorite, decorative rock, precious metals and marble mines demonstrating both the endowment of the area, the impact of mining on the local economy, and the ability to permit both large and small mines effectively.

NOTE: A Cinder Cone is formed by volcanic eruptions of mafic / intermediate lavas, which collect to build a cone around a volcanic vent. On the east side of I95, on your way up to the Sterling Gold Project from Las Vegas, a cinder cone is currently being mined for decorative stone used in landscaping.

The Crown Block

Yours truly with the Secret Pass Open Pit in the background

Heading back out onto the I95, we then headed north toward the town of Beatty, to the Crown Block. As you will remember from my introductory article, the Crown Block is made up of 4 main targets: Daisy, Secret Pass, Shear Zone and SNA, all of which are located along the Fluorspar Canyon Detachment Fault.

Our first two stops were at Daisy and Secret Pass deposits, where Senior Geologist, Ron Kieckbusch, and Exploration Manager, Rich Histed, discussed the geology of the area, the work they completed in 2017, and where they were headed in 2018.

Geology of Crown Block

South of the fluorspar detachment fault, mapping has defined an asymmetric fold-thrust belt in the sediment package, with a northwest vergence and northeast plunge likely of Mississippian age (327-290 Ma).

It’s my understanding that the folding of the sediment package generated perpendicular faults, which were later made larger during a caldera collapse. For those who aren’t familiar, a caldera is a large volcanic crater, which can be formed by either an explosive volcanic eruption or the collapse of surface rock into an empty magma chamber. The now larger faults become easier conduits for fluid flow, thus explaining the mineralizing event.

Geological Mapping and Geochemical Sampling

Currently, 30% of the 141 square-kilometer property package has been geologically mapped and geochemically sampled, with the Crown Block being the primary focus. Mapping and sampling is a very efficient and cheap way of acquiring drill targets. In total, 580 rock chip samples have been taken, returning grades within a range of undetectable to a high of 13.85 g/t gold, and 34 samples returned greater than a 1.0 g/t gold.

As stated, the mapping and sampling within the Crown Block has identified new exploration targets, which were noted in the April 25th news release and can be found in the image above.

- Road Zone – located north of the Daisy Deposit and features several up-dip surface samples of greater than 1.0 g/t gold, which indicates potential for shallow mineralization.

- Gold Ace Fault – located south and up-dip of the Daisy Deposit and features a large undrilled area of high-grade surface samples, including a high of 13.85 g/t gold.

- Crowell Extension – located east of the Daisy Deposit and features reported gold grades of up to 7.0 g/t from the historic Crowell fluorite mine. The Crowell Extension target has a strike length of roughly 800 meters.

- Radio Tower – Anomalous surface geochemistry to the south of the Secret Pass pit indicate a possible target at depth.

- Secret Pass East – As the name suggests, this target lays on the under-explored eastern portion of the large Secret Pass Deposit. Surface sampling has returned up to 5.0 g/t gold and represents a potential strike length of roughly 1200 meters.

- Ronko Jasperoids – Located south of the SNA, undrilled Jasperoids returned sample values of up to 2.0 g/t at surface. Jasperoids are excellent host rocks for mineralization and represent a strike length of roughly 500 meters.

- Range Front Fault Zone – Range front fault systems have, historically, laid host to many of the largest Carlin-Style gold deposits in Nevada. The range front fault, which runs along the eastern portion of the land package, is sizeable and untested, which has the potential to host a large deposit. Historic sampling returned values upwards of 5.0 g/t gold at surface on secondary structures. It should be noted that range front structures host 3 deposits on the eastern side of the Bare Mountain Range; Motherlode, SNA and the 144 Zone.

In my opinion, there is a TON of potential here, as Northern Empire begins to expand and fill the gaps between these historic deposits. As seen in the image above, it looks like one big shallow gold system, with good grade. In the gold mining world, it doesn’t get much better!

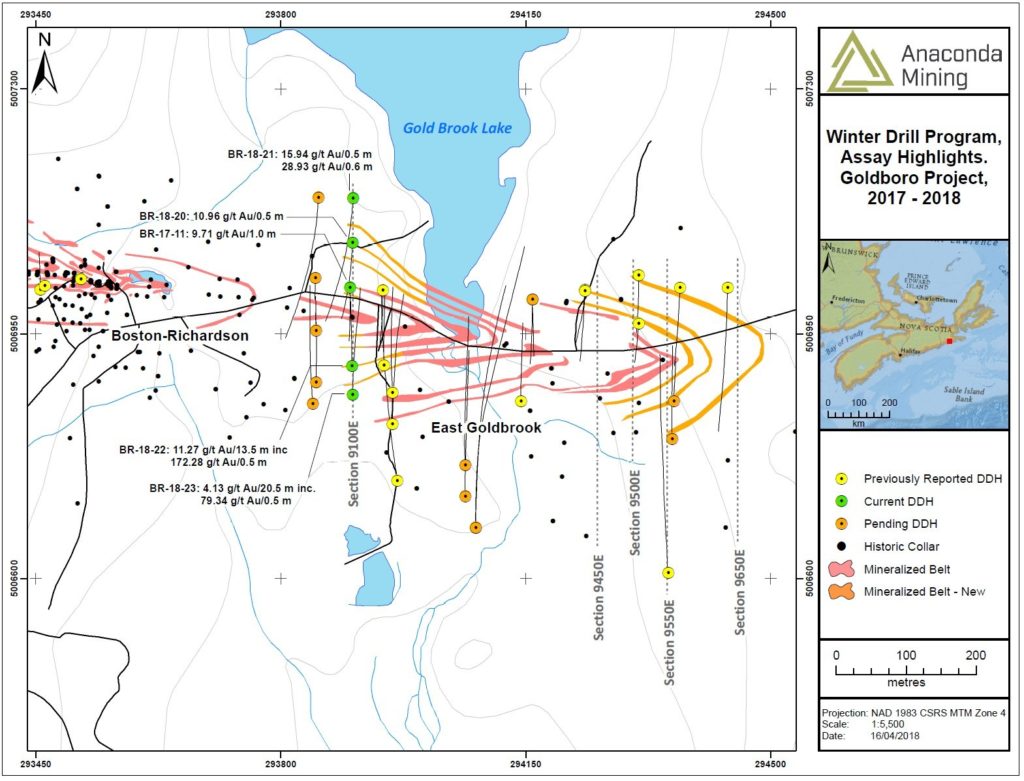

With the identification of these high prospective targets, Northern Empire is expanding their current drill program to 18,000 meters and have already begun the permitting process for a larger 50,000 meter program, which will focus on expanding the Crown Block resource and testing these new regional targets.

Exploration Drill Results – Daisy and Secret Pass

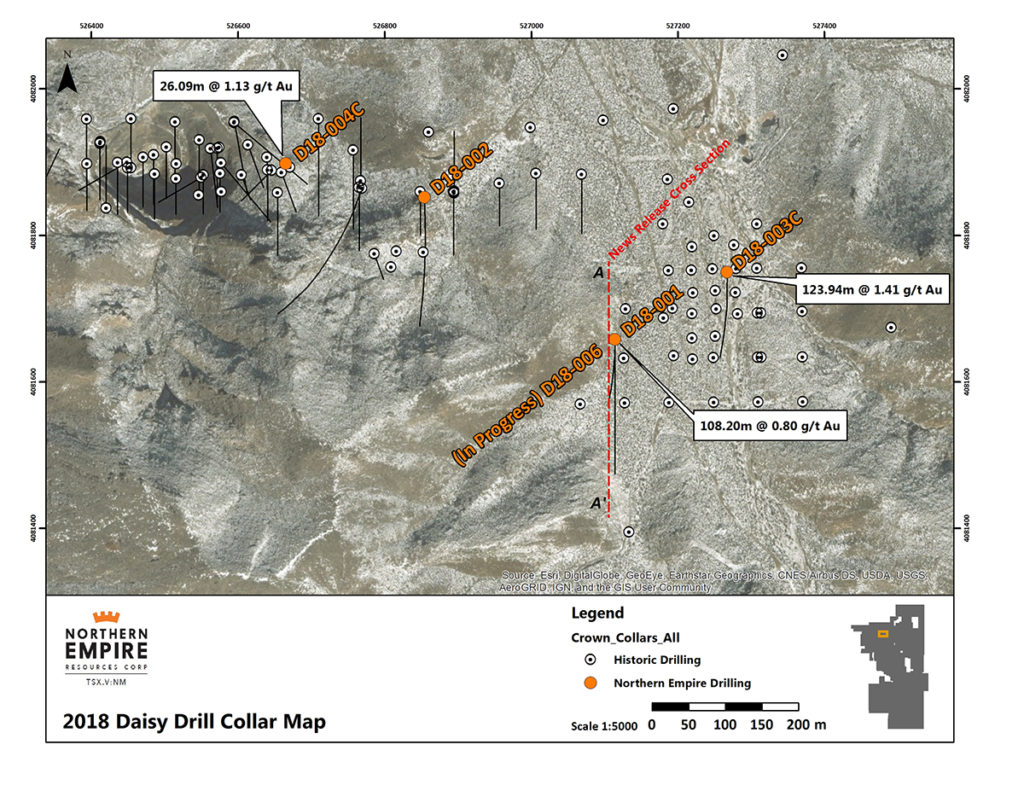

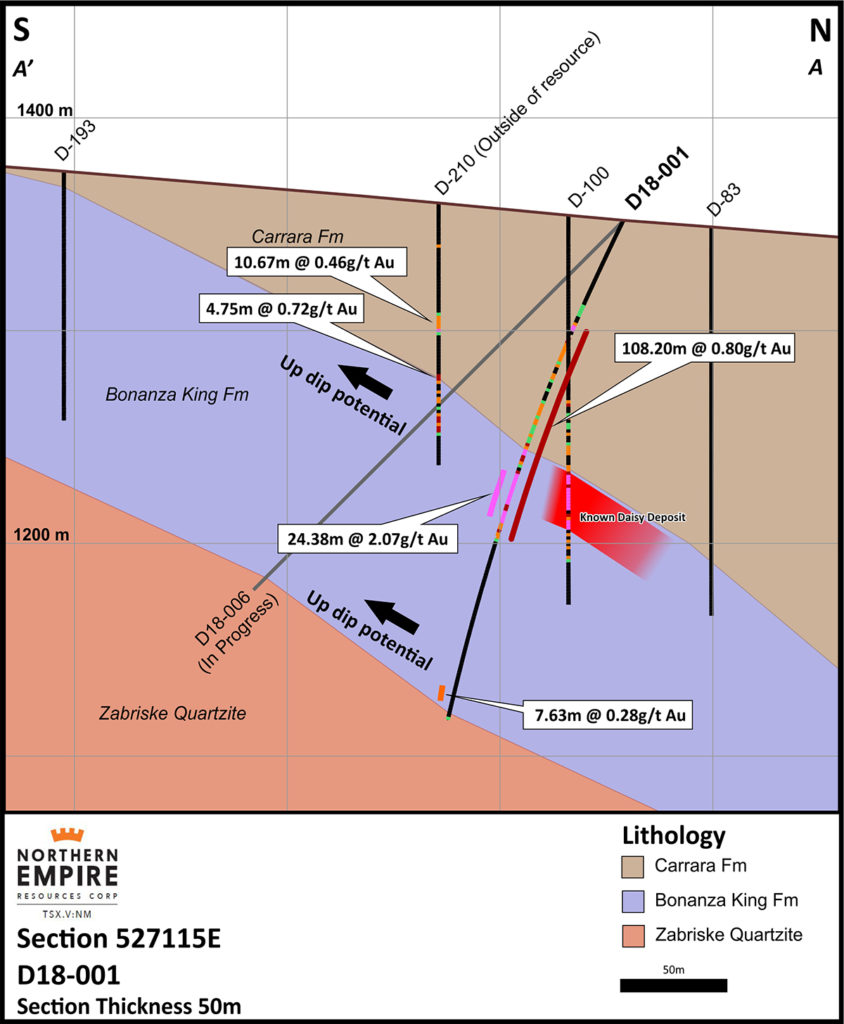

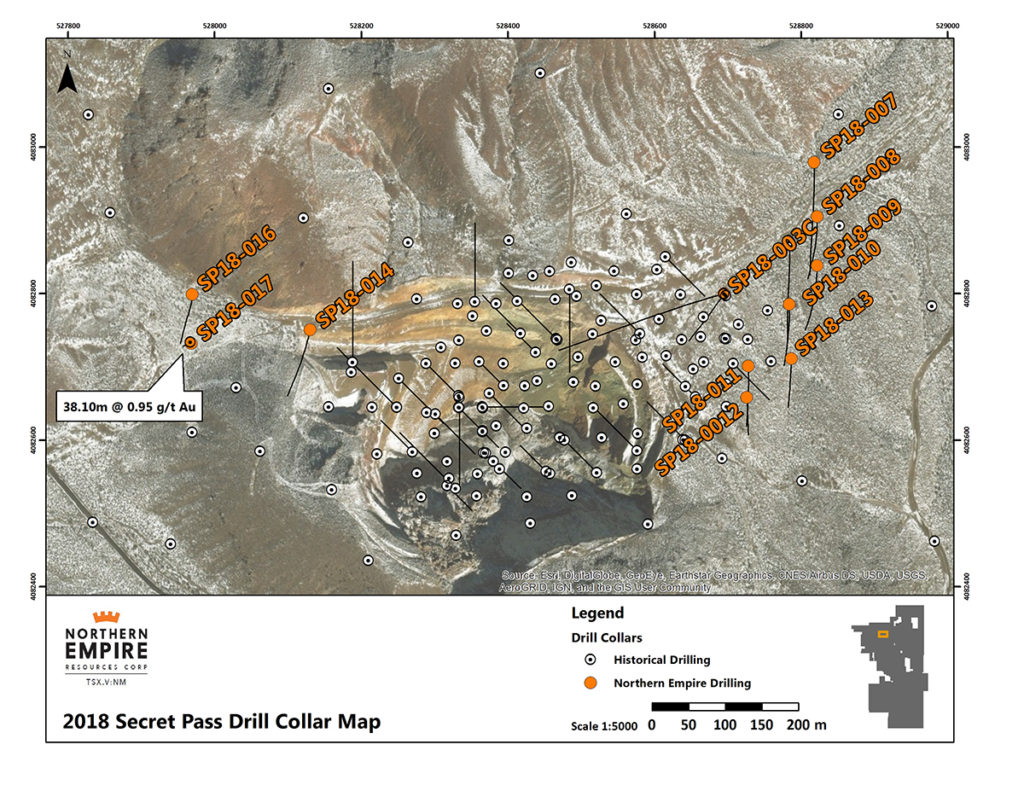

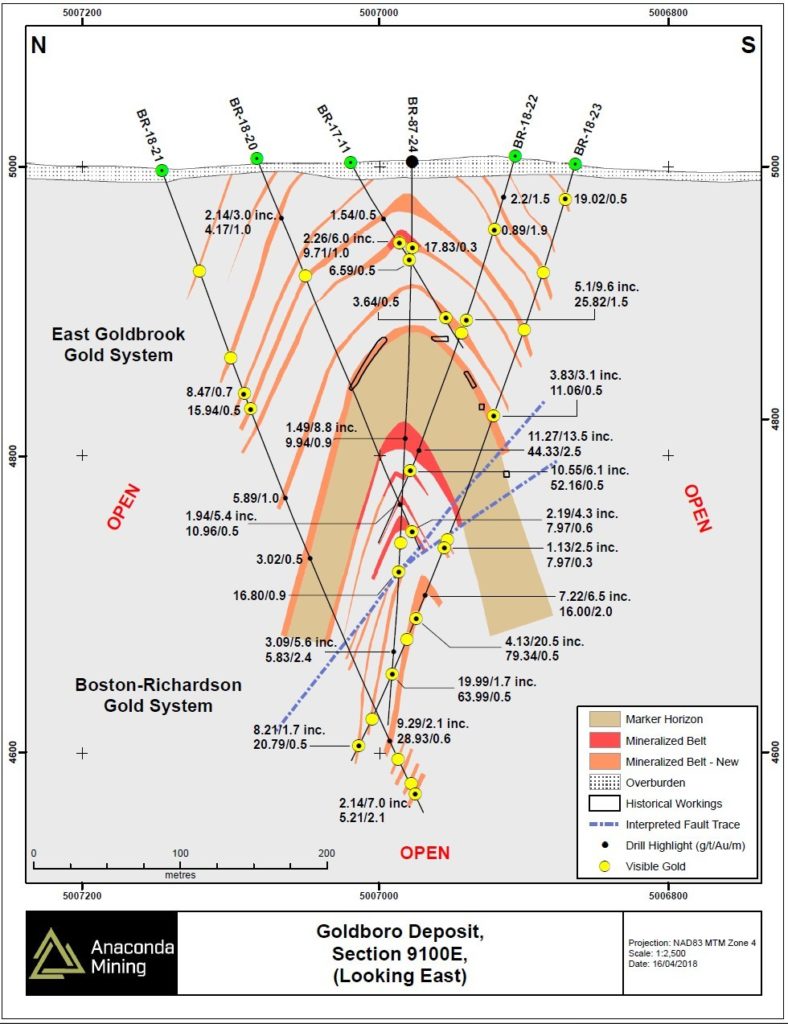

Step-out drill results from the Daisy and Secret Pass, released May 2nd, not only returned good grades and widths, but confirm that both deposits are open for expansion. The results are highlighted by,

- Daisy Deposit –D18-001 step-out hole returned 108.2 meters grading 0.80 g/t gold.

- Secret Pass Deposit – SP18-017 step-out hole returned 38.1 meters grading 0.95 g/t gold.

Daisy Drilling

The highlighted D18-001 step-out hole encountered mineralization 53.35 meters down the hole, which was shallower than expected. Additionally, mineralization was encountered at the base of the Cararra formation, which suggests that there is a possibility for further mineralization to be discovered lower in the stratigraphic sequence. In all, the drill results confirm that the Daisy Deposit remains open up-dip for further expansion. Please see the news release for complete details.

Secret Pass Drilling

The highlighted SP18-017 drill hole stepped out 200m west from the known Secret Pass Deposit and 196.9 meters deep encountered mineralization grading 0.95 g/t gold over 38.1 meters. To note, this hole was terminated before losing mineralization. Northern Empire states within the news release that they intend on re-drilling the hole to better understand the full extent of what has been discovered. This step-out is a great result as it confirms that the Secret Pass Deposit mineralization is open to the west.

Corvus Gold

The last stop of the day was at the SNA Deposit, in the north-east corner of the property. As we approached the SNA Deposit, we first drove past Corvus Gold’s Mother Lode Open Pit, which is completely encompassed by Northern Empire’s Crown Block.

Corvus Gold’s Mother Lode Open Pit

For those who are not familiar, the Mother Lode Deposit has been a major focus for Corvus over the last year, with 10,000m of drilling in 2017 and another 13,000m of drilling planned for the first half of 2018. For those that may not be familiar, Corvus has a MCAP around $300 million, which is largely based on the drilling success at Mother Lode. I find this interesting as a Northern Empire shareholder, because I’m intrigued by the amount of drilling that’s occurring around the existing open pit and, specifically, how that mineralization may extend out toward, or connecting to, the SNA Deposit.

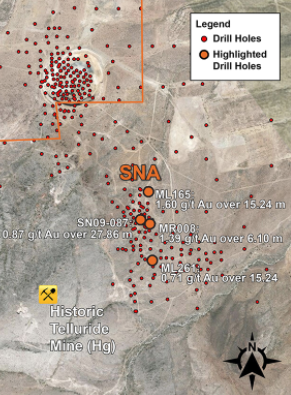

Examining the satellite image below, you can see the concentration of Corvus drill holes not only in the vicinity of the open pit but, more importantly, along the claim boundary.

This is a fairly obvious observation, one that didn’t get past Northern Empire management; while viewing the SNA Deposit during our visit, drilling was taking place along the Corvus claim boundary. In news released April 17th, Northern Empire confirmed that the Mother Lode mineralization does extend south towards the SNA deposit and have drilled significant gold grades from structures which cut favourable host rock for Carlin-type gold mineralization beneath the historic Telluride Mercury Mine.

Northern Empire Drilling beside Mother Lode Open Pit

Concluding Remarks

As I’ve said in the past, site visits are an excellent way for you to bring your due diligence to the next level, and nothing beats seeing the property and interacting with the people in person. My visit to the Sterling Gold Project was no different, as it gave me a better view of the upside potential of the property and the type of people managing the company.

Just to recap, here’s a list of what I see as the strengths for Northern Empire:

- Good management team with extensive experience exploring and developing gold projects in Nevada.

- The Fraser Institute ranks Nevada 3rd in the world for Mining Investment Attractiveness.

- Northern Empire is in possession of all the necessary production permits to restart the Sterling Mine.

- The Sterling Mine potential production scenario should be low-cost, as the Carlin Style gold mineralization will be mined from an open pit and is amenable to heap-leaching.

- Exploration Potential – The Crown Block, especially, holds a lot of resource expansion potential as it appears all of the existing deposits have the potential to be larger; potentially, one large, shallow and good grade gold system.

- 18,000 meter drill program underway and a larger 50,000 meter drill program on the horizon as it is currently being permitted!

- Existing inferred global resource of 985,000 ounces of gold at 1.29 g/t.

- CASH – $16 million!!

I believe there’s a lot of upside potential for Northern Empire if they’re able to execute their plan of expanding the resource at both the Sterling Mine and the Crown Block. I look forward to good news flow over the coming months as this story really begins to come together on the back of their 18,000m drill program.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do own shares in Northern Empire Resources. All Northern Empire Resources’ analytics were taken from their website and press release. Northern Empire Resources is a Sponsor of Junior Stock Review.