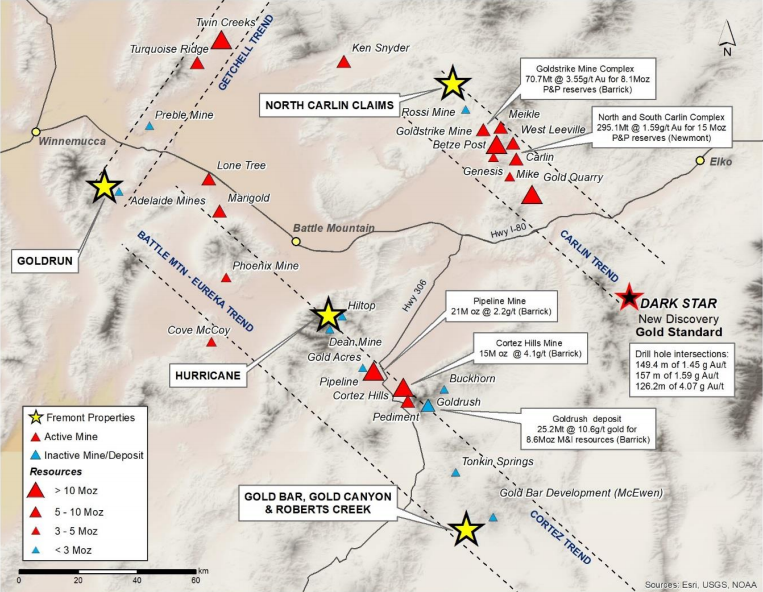

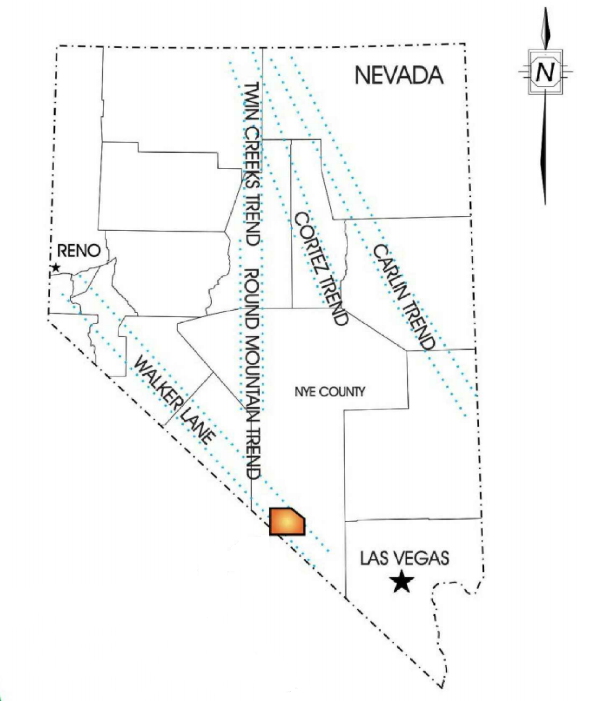

A couple of weeks ago, I had the opportunity to visit Fremont Gold’s Gold Bar Project in Nevada. The Gold Bar Project is located within Eureka County, which is home to the famous Battle Mountain-Eureka-Cortez gold trend, and lies in close proximity to McEwen Mining’s Gold Bar mine.

I’ve put together a few of my notes from the trip and a little colour on Nevada’s history.

Nevada: A Premier Jurisdiction for Mining

Nevada is situated in the western United States and has a long history of mining dating back to the 1840s. Although mining began over 150 years ago, Nevada’s real fame in the gold mining industry didn’t come until the 1960s when ‘Carlin Style’ or sediment-hosted disseminated gold deposits started being mined.

Why did Carlin Style gold deposits take so long to be mined? Simply, nobody saw them. Unlike the outcropping gold bearing epithermal veins that were discovered by early prospectors, Carlin Style gold is very fine grained and not visible to the naked eye. Since the 1960s, Nevada has produced around 20 million ounces of gold, making it truly a world-class destination for gold mining.

Small Lessons Learned on Site Visits

In my opinion, one of the best parts of doing a site visit is the unexpected things you learn during the trip. These things can vary from learning about the summer housing issues in Dawson City, Yukon, or the Swedish influence on Millertown, Newfoundland.

While some of these ‘lessons’ might not seem like they have much value or significance, I, personally, view them as priceless. The fact is, I’m not sure I would have come across these tidbits of information if I hadn’t made the trip.

The reason they are important has less to do with the actual company and more to do with the culture of the jurisdiction in which the company operates. Taking in information like this prompts more questions and, with more questions, comes deeper thinking and, in my opinion, a fuller understanding of what and where exactly you are putting your money.

Basque Culture

On my latest site visit to Fremont Gold’s Gold Bar Project, there was one tidbit of information that I ignorantly stumbled upon, oddly, by asking, “what is Basque food?”

Star Hotel in Elko, Nevada

After visiting the Gold Bar Project during the day, we headed back to Elko and specifically to the Star Hotel for what was referred to as ‘Basque style’ dining. While I’ve travelled to a large number of European countries, they’ve been predominantly in the eastern part of the continent and I, therefore, knew nothing about the Basque region, which is located along the border of Spain and France.

Officially, the Basque region is comprised of 7 provinces; 4 in Spain and 3 in France.

So, the obvious question is how did a region located in western Europe influence Nevada, a state located in the western United States?

I was very surprised to learn that the roots of Basque influence in Nevada are rooted in the mid 1800s, specifically with the California Gold Rush. The allure of gold and the riches which could follow drew in people from all over the world and, in the process, resulted in many of the gold seekers setting down roots in the regions in which they were searching.

For the Basque people, they recognized the potential for raising sheep in California and started setting up their operations. Fast-forwarding to the 1870s and this became a popular vocation for many of the Basque people, and with the crowding in California, many made the move into Nevada.

What’s my point? Personally, I’m always interested in getting a better understanding of the cultural influences within a jurisdiction. In my mind, without a doubt, Basque culture has had an effect on Nevada and the people who reside there.

From the moment you walk into the Elko airport, you know you’re in a mining town. Now, the Basque influence isn’t necessarily direct for mining, but more the entrepreneurial spirit that the immigrants brought with them; they came chasing gold and stayed to farm.

In my opinion, the future of mining is very bright in Nevada and this is only enhanced by a local population which embraces it and looks to grow with it.

NOTE: An interesting fact regarding Nevada politics; former Nevada Governor and U.S. senator Paul Laxalt was the son of Basque immigrants. Laxalt came from humble beginnings in Reno, Nevada where he assisted his parents in the operation of their restaurant/hotel. Also, Laxalt is known for his close relationship with former U.S. President, Ronald Regan.

Fremont’s Gold Bar Project

Fremont Gold (FRE:TSXV)

MCAP – $7.49 million (at the time of writing)

Shares – 53.0 million

FD – 67.2 million

NOTE – Leading the site visit was CEO, Blaine Monaghan; President, Dennis Moore; and VP Exploration, Clay Newton.

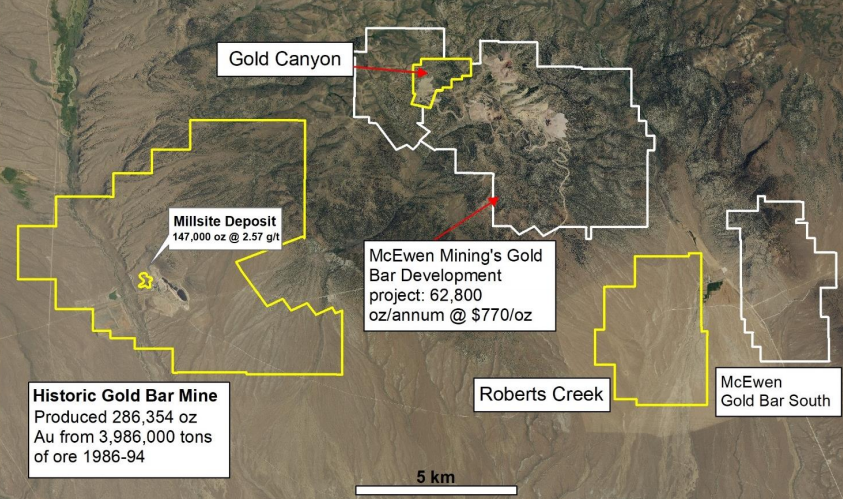

Fremont has a number of gold exploration projects throughout the Battle Mountain-Eureka-Cortez and Carlin trends. Gold Bar, however, is particularly interesting given its production history and its proximity to McEwen Mining’s Gold Bar Mine.

Also, it should be mentioned that Fremont owns the Gold Canyon project, a claim block which directly borders McEwen’s Gold Bar Mine. Although we were in close proximity during the site visit, we were unable to get up there due to weather (snow drifts), and access is a little complicated given the fact that you must enter through McEwen’s active mine site.

During our visit, Fremont had just started a 1,000m RC drill program on the Gold Bar Project, where they are targeting a possible extension of the previously producing Gold Bar mine. Key to this drill program is the involvement of long-time Nevada geologist, Clay Newton, who has interpreted data collected on the property to theorize that a possible extension of the gold bar pit sits to the southeast, or offset. This contrasts the prior owners’ premise, which was to test for extensions in-line with the existing deposit – they came up empty handed.

I’m interested to see the results of the RC program, which has recently been completed and samples sent to the lab for assay.

It’s clear that any discovery here or at Gold Canyon could be very tempting for McEwen Mining to acquire. In this case, proximity or ‘close-ology’ makes a lot of sense; the key being that Fremont does discover an extension and, secondly, adds enough value that it’s recognized and desired by McEwen to purchase in the short term.

One final note, Fremont had planned on a 500 m diamond core drill program at Gold Canyon to follow the 1,000 m RC meters at Gold Bar. These plans, however, have been put on hold due to extreme weather conditions in northern Nevada. The company will reschedule in the weeks to come.

Concluding Remarks

Fremont has an experienced management team with a great track record in gold exploration, and it’s my thinking that this will continue as they progress with their portfolio of Nevada based projects in 2019.

The day I spent on site was very insightful and I’ve learned a great deal more about the company and its management team.

I believe Fremont Gold is a company to watch as we move into a gold bull market, and it may be a company that fits your investment criteria. If you’re in Toronto for PDAC or the Metals Investor Forum, be sure to check them out.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do not own Fremont Gold stock. I have NO business relationship with Fremont Gold, however, Fremont did pay for my travel and expenses to conduct the site visit.