To access this post, you must purchase Quarterly Subscription or Yearly Subscription

Upgrade Now

Have we reached peak gold?

I have read this headline multiple times, but never really listened to the commentary. Now, this isn’t for any specific reason, it’s just that, generally speaking, I really don’t read or listen to much sector commentary.

To start, I think it’s really important to define what exactly peak gold is before discussing it.

Personally, when I think of peak gold, it is a scenario whereby global production and discovery never again reaches the highs of the past; essentially, it’s all downhill from here.

To start, does it matter if this is true?

In my mind, it’s debatable, as gold is very different from almost every other metal. Essentially, all the gold that has ever been mined still exists – it isn’t consumed in the traditional sense.

Bullishness on gold based on supply and demand, therefore, is hard for me to accept because supply is readily available to come into the market at any time.

My thought is that peak gold or, really, peak anything, is just a matter of price.

Price or economics is the ultimate motivator; as we have continually seen throughout history, it pushes innovation.

Oil is a great example.

During the years of +$US100 per barrel, much of the narrative focused on peak oil, which coincidently sounds a lot like what we are hearing about peak gold now.

We are finding less, we have to go deeper and explore in more remote jurisdictions or harsher environments, making it more expensive to extract – we have hit peak oil.

Wrong, high oil prices spurred the innovation of horizontal drilling and, of course, have broadened the discussion on other fuel sources.

Each metal is going to be different, I agree. However, generally speaking, my thought remains that scarcity leads to higher prices and higher prices lead to innovation and/or substitution.

In gold’s case, I think we’re going to see the industry innovate itself in exploration and mineral processing.

Firstly, with regards to exploration, I think it will be geophysics that sees a major revelation in the future.

Pre-drilling exploration work is becoming more and more important in identifying and prioritizing targets and I believe this is where we may see the bulk of innovation.

Second, there’s a large portion of known deposits with refractory gold. It’s my guess that money will be spent to optimize the mineral processing techniques that are needed to liberate this trapped gold.

As the gold price rises, more and more attention will be given to producing and discovering it – ergo a new renaissance will emerge and gold’s horizontal drilling equivalent will be born.

Or, maybe not. Time will tell!

Today, I have for you my notes from the field from day 2 of my Nevada site visit tour. U.S. Gold Corp was the focus of the second half of the trip and took us to the northeastern portion of the state, near Elko.

Let’s take a look.

MCAP – US$18.2 million (at the time of writing)

Shares – 23.6 million

FD – 29.9 million

Cash – roughly $2 million

NOTE: On June 20, 2019 U.S. Gold Corp closed a $2.5 million F Series convertible preferred stock in a non-brokered registered direct offering.

NOTE: U.S. Gold Corp was acquired by Dataram in mid-2016. At the time, U.S. Gold Corp. was in possession of a PEA level Copper King project located in Wyoming. Keystone project acquired after formation of the new company.

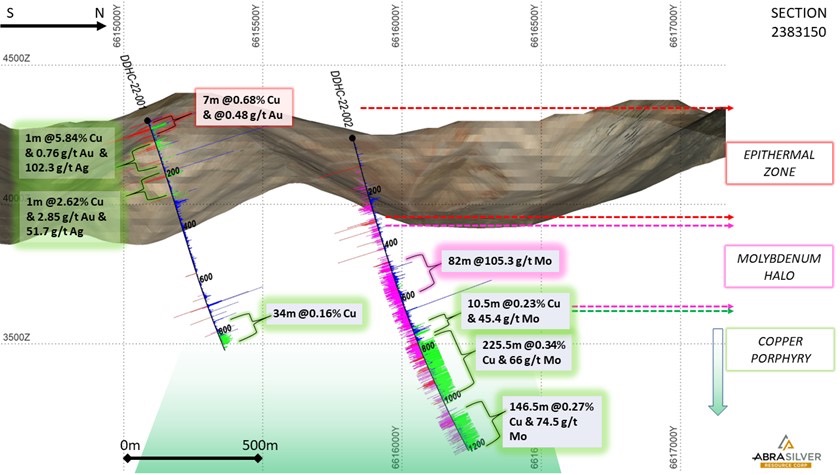

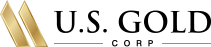

U.S. Gold Corp.’s flagship Keystone project is located on the Cortez Trend, just south of Nevada Gold Mines’ Cortez Hill mine.

NOTE: Nevada Gold Mines was formed through the merger of Barrick Gold’s and Newmont Goldcorp’s Nevada assets.

Keystone, in its current form, represents the consolidation of what used to be a few different properties and, in total, encompasses 20 square miles or roughly 5200 hectares.

Past operators of these various claim blocks were Newmont, Chevron, USMX, Placer Dome and McEwen Mining Co.

Note: Dating back to the 1980s, a total of 240 shallow, less than 100m deep, drill holes have been drilled on the various portions of the property.

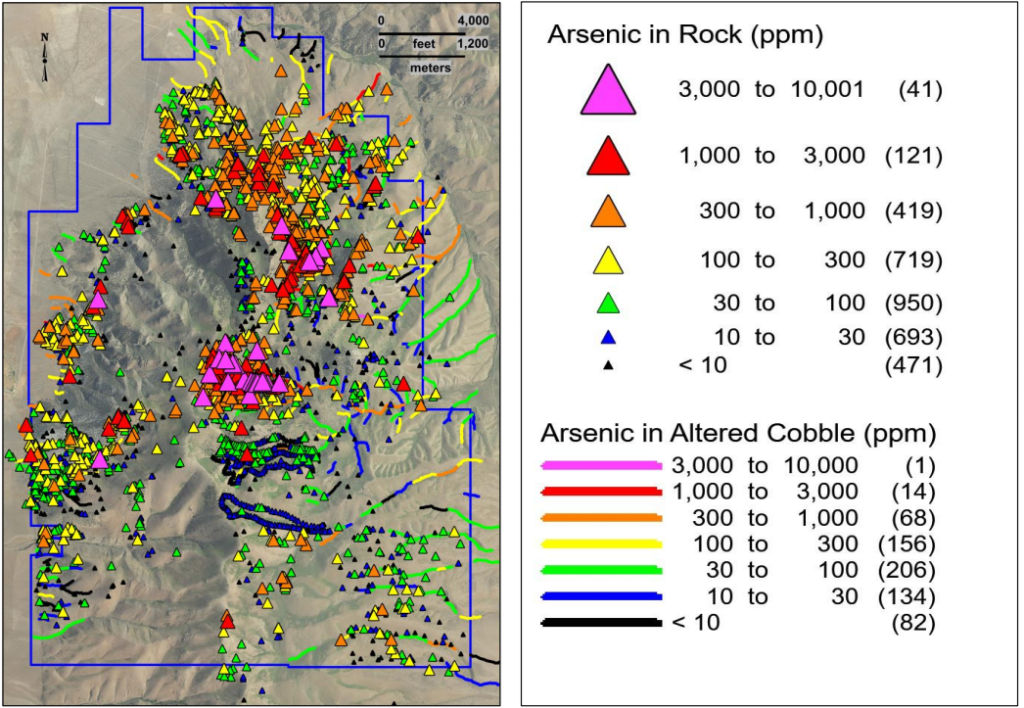

Keystone’s geochemical database consists of 7,372 soil samples, 3,414 rock samples, 666 fine-sediment stream samples and 661 altered stream cobble samples.

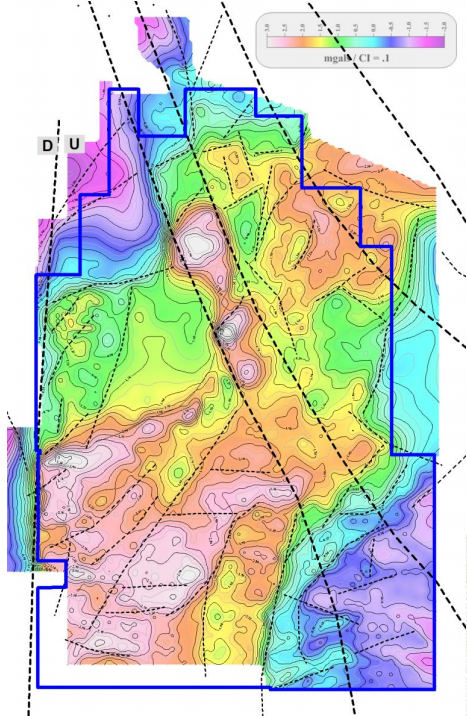

Along with the strong database of geochemical data, they have also completed regional magnetics on the project.

As the image demonstrates, the magnetics are interpreted to reveal a northwest striking structure. These structures have been confirmed by geological mapping and through geochemical testing.

For example, most of the soil sampling data reveals high concentrations of pathfinder metals within this northwest trend.

The arsenic samples in particular provide us with a clear visual concentration along the northwest trend, and also appear to follow a secondary structure to the southwest.

More data can be found within the Keystone specific page, too – geochemical testing, magnetic report, Keystone Master of Science Thesis, etc.

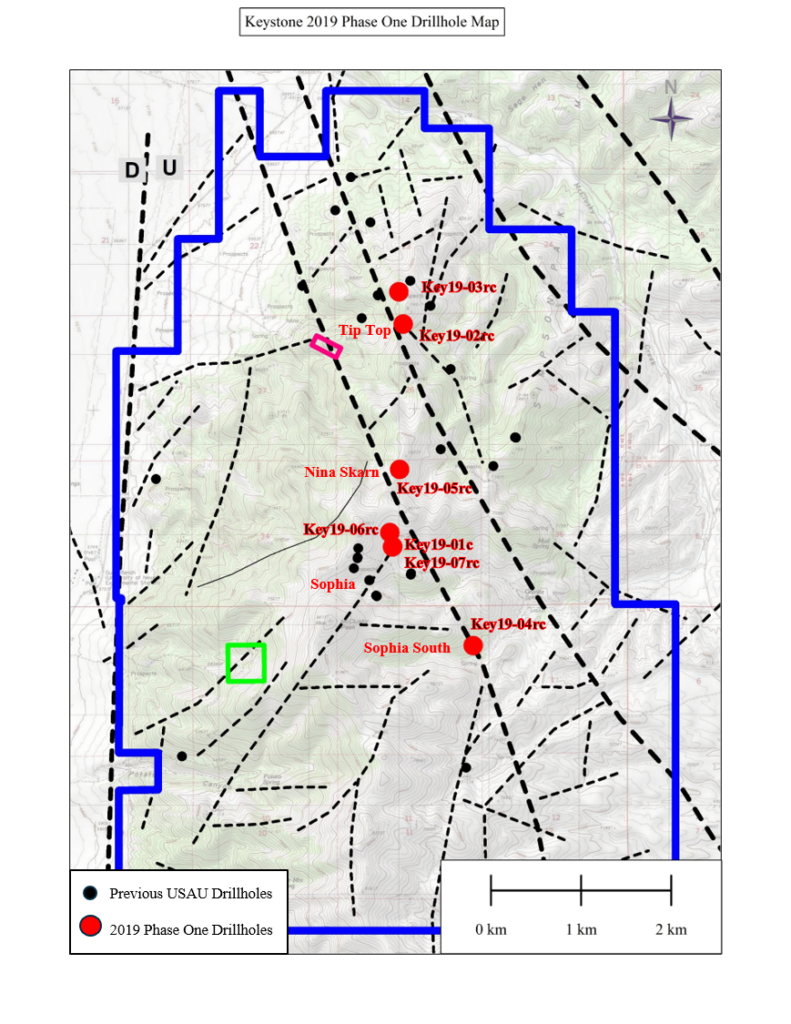

The 2019 drill program consisted of 7 holes, 6 RC and 1 diamond, totalling 4,000m. The first hole of the program was a follow up on hole 18-09rc, in Sophia Target Zone, from the 2018 program, which encountered over 350m of nearly continuous oxidized breccias, but was lost approximately 1600ft or 500m down hole, due to hitting a 20ft void.

CEO, Ed Karr, explained to me that they were very interested to follow up on this lost hole because of its possible similarities to Nevada Gold Mine’s Gold Rush deposit.

Gold Rush is a deep deposit, with voids or a Swiss cheese like matrix of rock above it. Hence, their excitement. Unfortunately, the follow up hole was a dud, returning mostly clay.

The 6 remaining holes, all RC, were drilled within the Tip Top, Sophia South and Nina Skarn Target Zones.

To date, U.S. Gold Corp. has really had no significant gold intercepts to list, but have shown many intersections with anomalous gold, which they define as greater than 10ppb gold over 50ft thick.

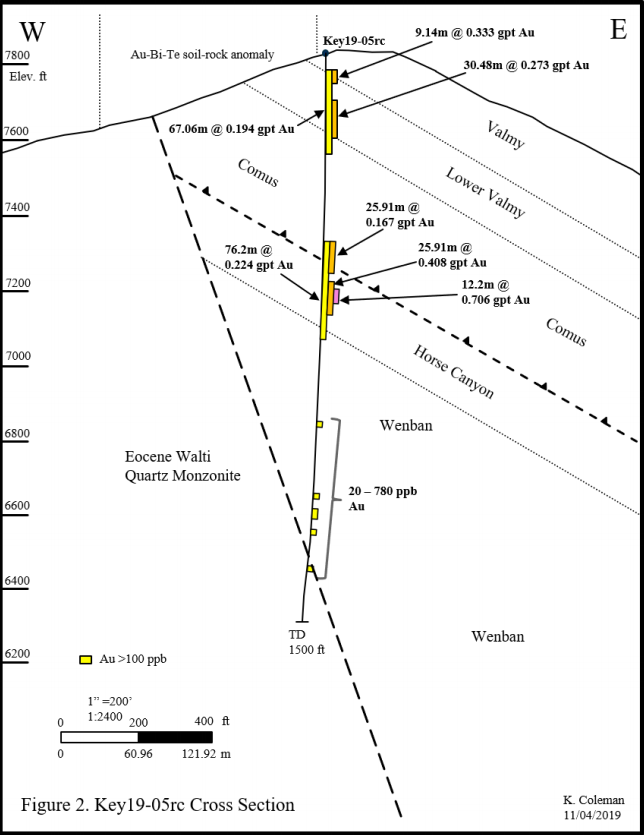

The 2019 drill program continued with similar results, mainly low grade gold over thin widths, except for hole 19-05rc which was drilled within the Nina Skarn Target Zone.

19-05rc intercepted 67.06m of 0.194 g/t gold, which includes intervals of 9.14m of 0.333 g/t gold and 30.48m of 0.273 g/t gold.

Additionally, further down hole, it intercepted 76.2m of 0.224 g/t gold, which includes 25.91m of 0.167 g/t and 25.91m of 0.408 g/t gold, which includes 12.2m of 0.706 g/t gold.

Now, these aren’t high grade hits by any means, but compared to historical results and the bigger geological picture, they may indicate the presence of a larger gold system.

Karr explained that they believe this mineralization is a part of a halo surrounding what could be a larger, higher grade gold deposit northeast of drill hole 19-05rc. U.S. Gold Corp.’s geologists believe that it’s an intrusion in this northeast area of the property which may have acted as the heat engine for the mineralization intercepted in this hole.

This area between hole 19-05rc and the northeast intrusion will be the main focus of the company’s next drill program, as they try to vector in on what they hope is a high grade gold deposit.

While they have narrowed their exploration focus on Keystone, in my opinion, it’s still akin to finding a needle in a haystack – 2020 drilling at Keystone should be interesting.

Winter is upon them in this mid portion of the Battle Mtn – Eureka / Cortez Trend, and given the mountainous terrain, they will not be able to get drills back into Keystone until next spring.

To add, with roughly $2 million in cash left, U.S. Gold Corp will have to raise more money before conducting next year’s program.

The Copper King project is 100% owned by U.S. Gold Corp. and is located in southeastern Wyoming, approximately 32 km west of the city of Cheyenne.

An updated version of the PEA was completed for U.S. Gold Corp. in 2017 and can be found here.

In my discussion with Karr, he indicated that they are working on a PFS for the project and expect it to be complete by mid-year.

Personally, I’m interested in seeing the mineral processing results, as they will have to use a wider range of samples in their testing, as the PEA met work mainly used high grade material from the centre of the deposit.

Here are the high level highlights from the 2017 PEA:

Gold Price Assumption – US$1275

Copper Price Assumption – US$2.80

Pre-tax NPV@5% – $178.5 million

Pre-tax IRR – 33.1%

CAPEX – $113.66 million

Measured Resource – 13.7 Mt at 0.62 g/t Au (272K oz) and 0.198% Cu (60.1 mlbs)

Indicated Resource – 40.4 Mt at 0.48 g/t Au (654K oz) and 0.182% Cu (162.8 mlbs)

Inferred Resource – 14.1 Mt at 0.38 g/t Au (174K oz) and 0.2% Cu (62.5 mlbs)

Currently, U.S. Gold Corp. has a MCAP of around $25 million CAD and, in my opinion, makes it fairly valued given their assets.

In my view, the bulk of U.S. Gold Corp.’s value is found within their PEA level Copper King project, where I’m happy to hear they are moving forward with PFS level development work.

On the other hand, while the Keystone project has the right address, the visual hallmarks of a prospective Carlin style gold project, it just hasn’t produced the results for me to give it much value.

In saying this, hole 19-05rc may end up being the key needed to discover Keystone’s yet to be found gold deposit. More time and money is going to be needed to move this forward and prove their current thesis.

As an investor in the junior resource sector, I have learned that it’s integral to protect my downside risk and, therefore, I’m always looking to put my money into companies that are selling for less than their intrinsic value.

As I said, I believe at its current MCAP, U.S. Gold Corp. is arguably selling for its intrinsic value and, therefore, makes it less appealing to me considering the money and upcoming catalysts needed for share price appreciation.

I’m not a buyer of U.S. Gold Corp., but will be adding it to my watchlist, as tax loss season is upon us and who knows where the market may be headed.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with any of the companies discussed in this article, however, U.S. Gold Corp. did pay for my site visit expenses. I do NOT own shares in U.S. Gold Corp.

Does successful investing within the junior resource sector start with choosing the right metal?

I’ve said it many times, I believe speculating in the direction of a metal price is essentially impossible to do with any consistency, and shouldn’t be the reason for investing in a junior resource company.

This statement is more controversial than I had imagined and has been challenged many times over the last 3 or 4 months.

Let’s use the gold price as an example. The narrative surrounding higher gold prices can take many forms, but for most people, a higher future gold price is driven by the instability of the global financial system, which has been propped up by quantitative easing and low interest rates throughout the world.

I have no issue with that argument.

However, from 2011 to 2015, the gold price was almost cut in half and, as we all know as junior resource sector investors, besides the 8 month blip in 2016, the juniors, on a whole, have been in a bear market since 2012.

So why the precipitous fall from grace?

Not a chance. In my opinion, the global financial system has only worsened over the last 8 years. Countries are more in debt than ever and interest rates continue to be near record lows.

Maybe, but honestly, I find it very hard to accept any thesis on gold supply and demand considering that, essentially, all the gold ever mined still exists.

I’m not sure I have heard anyone use that argument to explain the fall in the gold price, but I think that there is some sensibility to it. Personally, though, given where we are today, I think we will see the gold price break US$2000/oz.

When? Great question! I have no idea and there-in lies one of the main issues with metal price speculation.

In reality, given a long enough timeframe, you can be right about the direction of the metal price, however, given the time value of money, are you actually right?

My point with this example is to show that while the popular narrative and the fundamentals of a metal appear to be pointing to a rising metal price, global markets are complex and hard to predict.

Thus, it’s my opinion that especially for the average investor, there’s very little value in trying to guess or follow someone who believes that they can predict the direction of a metal price.

If you’re bullish on the metal, buy the metal – it doesn’t come with the risk associated with the miners, who can lose you money due to a variety of factors that include exploration failure, poor metallurgy or political strife.

Successful investing in junior resource companies is predicated on 3 main criteria: Invest in the best people, protect your downside risk, and be a deep thinker – see through the popular narrative.

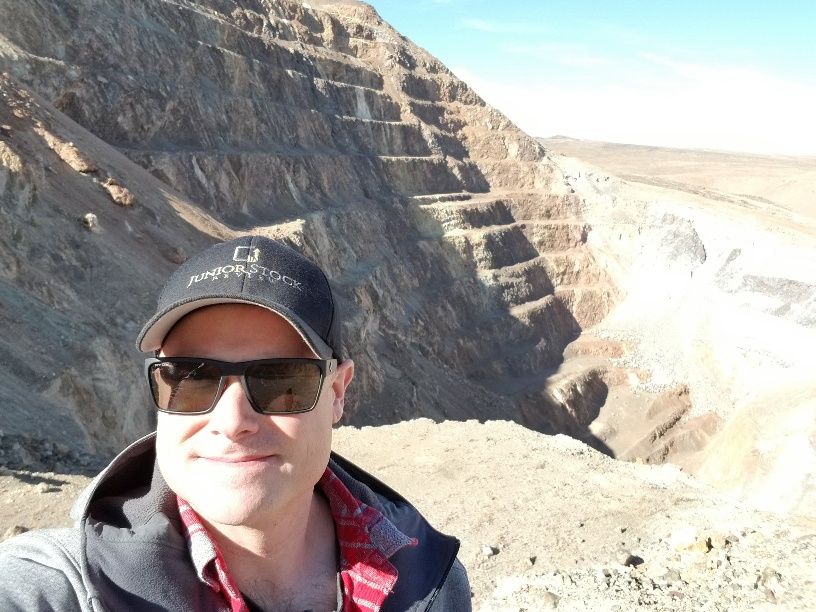

Today, I have for you the details from Day 1 of my Nevada Site Visit Tour, where I had the chance to visit Silver One Resource’s flagship Candelaria Project, which is located in the northwestern portion of Nevada, near Hawthorne.

Let’s take a closer look.

On October 28,th I caught the 6:20am flight out of Toronto to Denver and hopped on a connecting flight which brought me to Reno, Nevada before noon Pacific time.

Unless you’re travelling to Las Vegas, in my experience, Nevada is always multiple flights from the east coast. It’s even worse if you’re flying into Elko, Nevada, which is located in the northeastern portion of the state – it’s been a marathon 3 flights the last 3 times I’ve taken the trip.

Flights aside, I really enjoy this part of the United States. The air is fresh and clear and once you leave the cities and begin to travel into the smaller towns, it’s like going back in time from a number of perspectives.

After landing in Reno, we made the 3ish hour drive south to Hawthorne, where we spent the night. The next morning, it was a short drive to Candelaria and a good review of what Silver One is planning at its flagship asset.

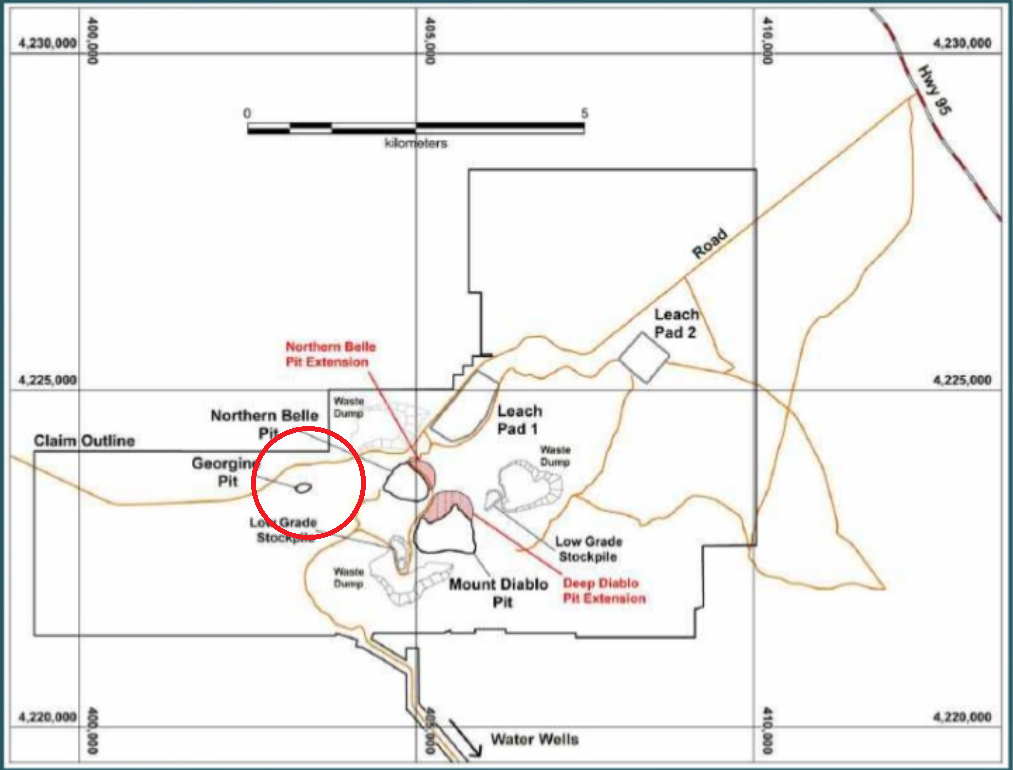

Source: Technical Report

Hawthorne sits directly south of Walker Lake and, interestingly, is home to the world’s largest ammunition depot. The depot covers 147,000 acres and has over 600,000 square feet of storage space within 2,427 bunkers.

Unfortunately, I don’t have a picture to share. You will have to trust me when I say that it’s an amazing sight to see and really confusing if you don’t know what you’re looking at.

Besides being home to the world’s largest ammo depot, Hawthorne is home to 3,000 people.

At our hotel, at least half of the guests looked to be with the mining industry in some shape or form. The other half were older couples, whom I’m sure were using Hawthorne’s Travel Lodge as a stopover on their way to Las Vegas.

MCAP – $44.79 million (at the time of writing)

Shares – 149.3 million

FD – 187.1 million

Strategic Shareholders – Eric Sprott 10.8%, SSR Mining 6%, Insiders 5.5%, First Mining Gold 3.4%

NOTE: Silver One closed a $4.976 million financing at a share price of $0.125 and a 3 year – ½ warrant at $0.20 on July 11, 2019. The PP shares will be free trading very soon and there’s a chance that some buyers may sell their shares and hold the warrants moving forward – FYI.

NOTE: Silver One has 1 remaining $1 million option payment on Candelaria, which is due in January 2020 to Silver Standard. Additionally, under the option agreement, Silver One must assume a $2 million reclamation bond relating to the historic heap leach pads at Candelaria. Instead of coinciding with the last option payment, this will be deferred until January 2023.

Being a past producing mine site, the Candelaria project has great infrastructure. It begins with close proximity to the interstate and a paved road right up to the main gates of the project.

Turning off the interstate, power lines follow you up and into Candelaria, with the sub-station sitting right next to a steel building. This is where Silver One is currently holding samples and other exploration equipment.

Additionally, Candelaria has access to water via wells that produce 500 to 600 gpm, I’m told, and sit in the southern portion of the property.

NOTE: From 1980 to 1999, the Candelaria mine produced 47 million ounces of silver before being closed due to low silver prices.

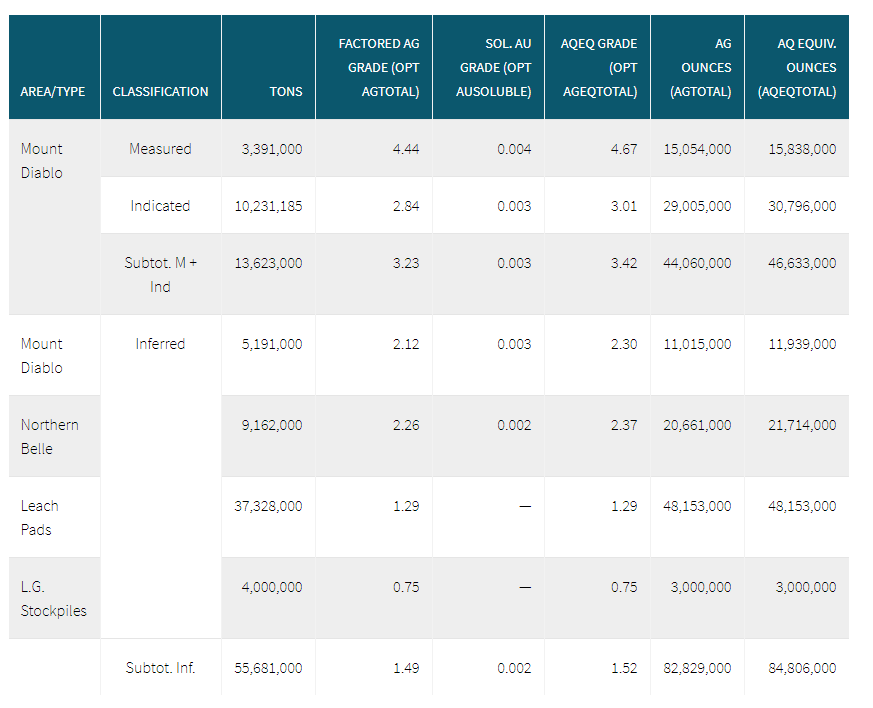

The Candelaria project has no 43-101 compliant resources on any of its heap leach pads or deposits – Northern Belle, Mount Diablo, Lucky Hill Mine or Georgine Pit.

Thus, the historical resource table which I have included for your reference should be taken with a grain of salt.

HISTORICAL RESOURCE – NOT 43-101 Compliant

Silver One’s CEO, Greg Crowe, who led much of the discussion during the site visit, mentioned that an updated resource was a priority for the company moving forward.

In fact, most of the drilling this fall will be used to produce a 43-101 compliant resource.

In terms of priorities, next to setting a base number for Candelaria’s resource estimate, the company will also focus a lot of attention on the project’s metallurgy.

As it stands right now, roughly 30% of Candelaria’s silver is non-recoverable through coarse grinding and cyanide leaching.

Preliminary mineralogical testing suggests that most of this non-recoverable silver is held within jarosite.

Having 30% of your resource non -recoverable is significant and, thus, is why it’s a priority for Silver One to improve.

NOTE: Initial metallurgical results show that 56% of the silver on the heap leach pads is cyanide soluble, leaving 44% in the non-recoverable category.

In my view, the metallurgical work represents biggest opportunity for the company. How or where else can they add that many payable ounces within a year for what is a fraction of the cost and risk of drilling.

Crowe explained that they are focused on finding the optimal milling (grinding) size needed to liberate the silver from the jarosite.

Of course, the amount of milling has to be balanced with the economics of the whole process. It’s one thing to liberate all the silver out of the jarosite, but if you need $50 silver to do it, is it worth it?

It will be very interesting to watch for these results, and much like the resource estimate, see what silver price is needed for this to be economic.

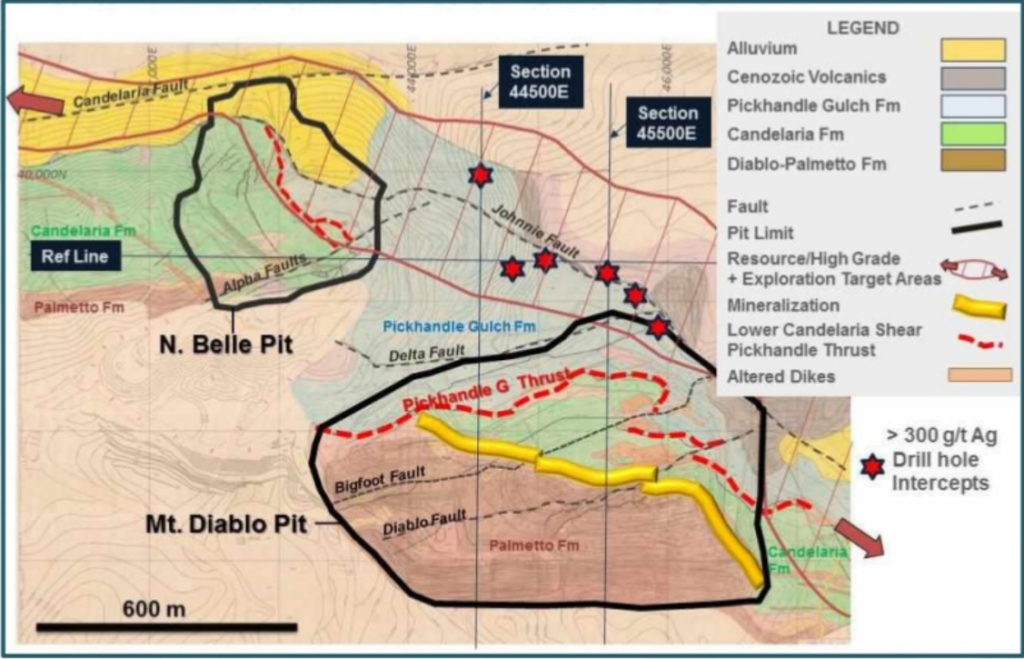

Next to the Candelaria’s priority work, the resource estimate and metallurgical testing, there are some interesting exploration drill targets across the entire property.

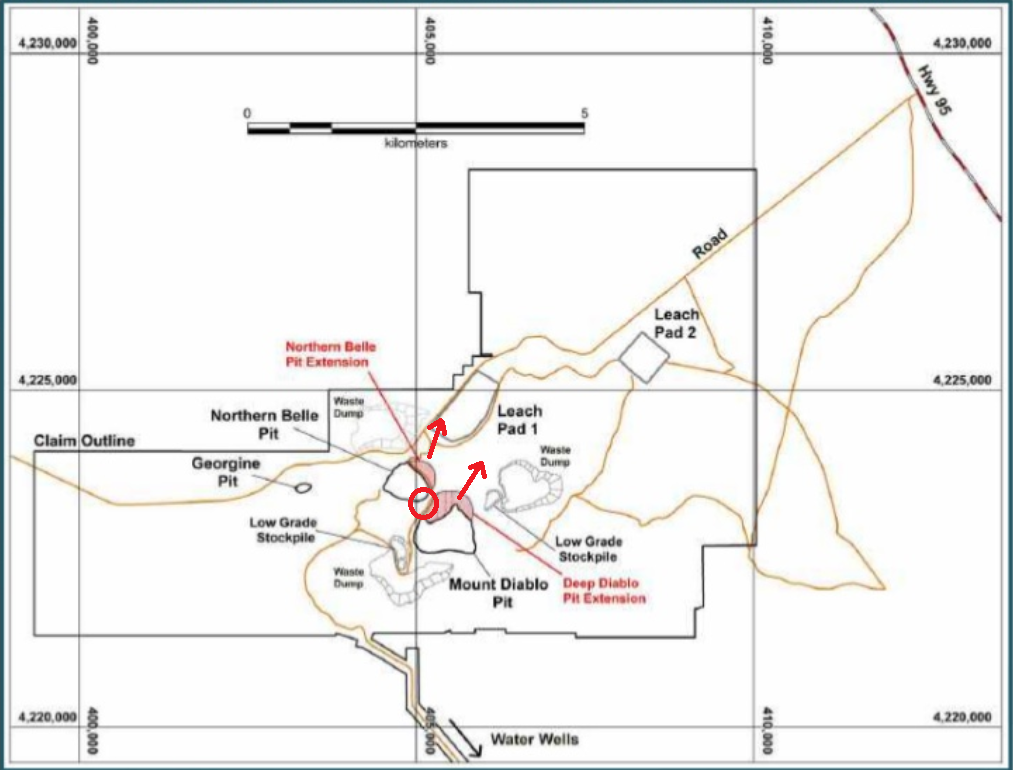

I will draw your attention to the image above, which gives us a top view of the project.

The Northern Belle and Mount Diablo pits are labelled and sit on either side of the red circle.

The first 2 targets are the most obvious. Silver One will be drill for down dip extensions, which I have represented using red arrows, on both pits.

Second, both deposits will be drilled for lateral extensions, specifically in between the 2 pits to see if they connect. Represented as the area within the red circle.

Historic Silver Standard Drilling

Historically, Silver Standard did hit silver mineralization in a number of holes in between the 2 pits, represented as stars in the image above.

Now let’s take a look at the more abstract exploration targets at Candelaria.

In the image above, I have circled the next most prospective area within Candelaria.

This region of the property is interesting as it either represents a parallel or off-set mineralized structure to that which hosts Northern Belle and Diablo.

Currently, there are 2 known past producing pits in this area – Georgine and the Lucky Mine. Both are small, but when mixed with the magnetic anomaly the company has identified, could represent a much bigger system.

I couldn’t find a picture, but Crowe mentioned that the magnetic anomaly lies just north of the Georgine pit. Given this, they subsequently staked more ground along the north claim boundary you see in the image above. The new claim block represents an area of approximately 8 square kilometres.

Another interesting note on this area is the grab samples they have found. Crowe showed us one of the high grade copper, low grade gold samples they found in the immediate area surrounding Georgine.

Sample found near Georgine Pit

Crowe speculated about the possibility of there being an Iron Oxide Copper Gold (IOCG) deposit in this area.

They plan to follow up the grab sample with an IP survey, which could shed some light on any concentrations of sulphide mineralization in the area.

It was a good site visit to Silver One’s Candelaria project, I believe I have a good understanding of where the company is and where they are headed.

I look forward to seeing the initial drill results from the company, which I am sure we will see before the end of the year. Additionally, more geophysical work on the new claim block and area surrounding Georgine pit should be really revealing to what may be there.

I, however, am not a buyer of Silver One Resources at this point; as there are a number of questions I have yet to answer.

First, will there be an onslaught of selling as this summer’s private placement shares become free trading?

Second, the metallurgical work is a HUGE part of this story and, really, I think, will be the main factor in classifying it as a good or great project.

Silver One has been added to my watchlist, as I eagerly await drill and preliminary met work results.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with any of the companies discussed in this article, however, Silver One Resources did pay for my site visit expenses. I do NOT own shares in Silver One Resources.

“The desire for more, the fear of missing out, the tendency to compare against others, the influence of the crowd and the dream of the sure thing-these factors are near-universal. Thus they have a profound collective impact on most investors and most markets. The result is mistakes, and those mistakes are frequent, wide-spread and recurring. “ ~ The Most Important Thing Illuminated pg.97

Success in the junior resource sector is predicated on a few key things.

First and foremost, it’s vital to invest your money with the right people. The wrong people have the capability of destroying any semblance of value in a good project.

Second, you need to protect your downside risk as it pertains to a company’s share price versus its intrinsic value.

Finally, you need to be a deep thinker and see through the narrative of the herd. This point is as much about brains as it is about courage – it’s rare to have both.

Today, in mid-October, at the highest precious metals prices we have seen in 6 years, the junior resource sector is, for the most part, selling off.

It begs the question, why?

Is it profit-taking? Maybe for a few of the best names, but for the most part, I think many companies haven’t seen much of an uptick in their share price, even with the spike in metal prices over the last 3 months.

Is it premature tax-loss selling? I don’t think that’s totally out of the question.

Is it the narrative surrounding a large correction in precious metals prices, which has caused many to anticipate the fall in prices and sell?

Social media is a powerful tool, it wouldn’t surprise me if those calling for a correction are influencing a percentage of investors. There’s comfort in following the herd.

Or, is it a lack of confidence in high precious metals prices in the future? I think that makes a lot of sense.

Human behaviour suggests that most people project their immediate past into the future. I can, therefore, see a high percentage of investors expecting to see the gold price fall, which ultimately would lead to them incurring losses on the companies within their portfolio.

In the end, it’s probably the confluence of all of these points and many more which have caused there to be more sellers than buyers, at this point.

For me, I see it as an opportunity to add to my positions in companies already in my portfolio or buy tranches in new companies in which I have been waiting for weakness.

Today, I have some thoughts on a company that I believe has all of the right ingredients for success and, in my opinion, is selling at a discount to their intrinsic value.

The company is O3 Mining, the 3rd iteration from the Osisko mining group.

Let’s take a look!

MCAP – $107.2 million (at the time of writing)

Shares – 46,174,125

Cash – $32.0 million (approximately)

Strategic Shareholders – Osisko Mining 54.1%, Insiders 3.7%

Earlier this year, Osisko Mining entered into a definitive agreement with Chantrell Ventures Corp (CV-H:TSXV), which saw Osisko’s non-core assets transferred to Chantrell, resulting in the Reverse Take-Over (RTO) of Chantrell by Osisko Mining.

The company was renamed O3 Mining, its shares were consolidated 40:1, it raised $18.6 million at $3.88 per share with a full warrant at $4.46, and the 3rd iteration of the Osisko team was born.

NOTE: For those who don’t know, the founders of Osisko Mining consists of John Burzynski, Robert Wares, Sean Roosen. Jose Vizquerra Benavides became part of the leadership team in 2011.

O3 Mining is led by CEO, Jose Vizquerra-Benavides, who is a geologist by trade. Vizquerra-Benavides is a native of Peru and comes from a long line of miners, as his grandfather is the founder of Buenaventura, a major mining producer company in Peru listed on the NYSE.

Vizquerra-Benavides began his career in the sector with Buenaventura, but eventually moved to Canada where he worked as a production and exploration geologist at the Red Lake gold mine.

From here, Vizquerra-Benavides joined the Osisko team where he has held a number of different roles or positions, such as Executive Vice President of Strategic Development & Director at Osisko Mining, and President & CEO of Oban Mining Corp.

While he is arguably the least known of the Osisko leadership team, I think that will soon change because, in my opinion, it’s obvious to me that Vizquerra-Benavides has the right pedigree to be successful in his new role as CEO of O3 Mining.

I’m not going to go into any detail about the jurisdictions, because unless you have been living under a rock or are new to resource sector investing, you will know that Quebec and Ontario are two of the best jurisdictions for mining investment attractiveness in the world.

The Fraser Institute continually has both jurisdictions rated in their top 20 places to explore, develop and mine worldwide.

With the formation of the new company and Vizquerra-Benavides appointed as CEO, O3 didn’t waste any time adding to their already impressive land position within the Abitibi Greenstone Belt.

First was the acquisition of the Quebec subsidiary of Chalice Gold Mines Limited (details of the deal can be found here). A company with projects along the Cadillac Break.

NOTE: Chalice Gold Mines was acquired for $12.0 million in O3 stock.

Next, in another all shares deal, Alexandria Minerals was acquired (details of the deal can be found here). Clearly, given where O3 has focused their attention in their first drill program, Alexandria’s projects located in the Val d’Or region were particularly appealing.

NOTE: Alexandria Minerals had issued and outstanding 529,790,966 shares. O3 acquired Alexandria for $0.07 a share or 0.018041 for each O3 share, therefore, the purchase price was roughly $37.1 million.

Finally, in another all shares deal, O3 acquired Harricana River Mining Corporation, whose Harricana Mine Project is located in the Val d’Or area of the Cadillac Break (details of the deal can be found here).

NOTE: Harricana

was acquired for 773,196 shares in O3 with a stock price of $2.59 in the

announcement date – August 23, 2019. Therefore, the value of the transaction is

$2.0 million.

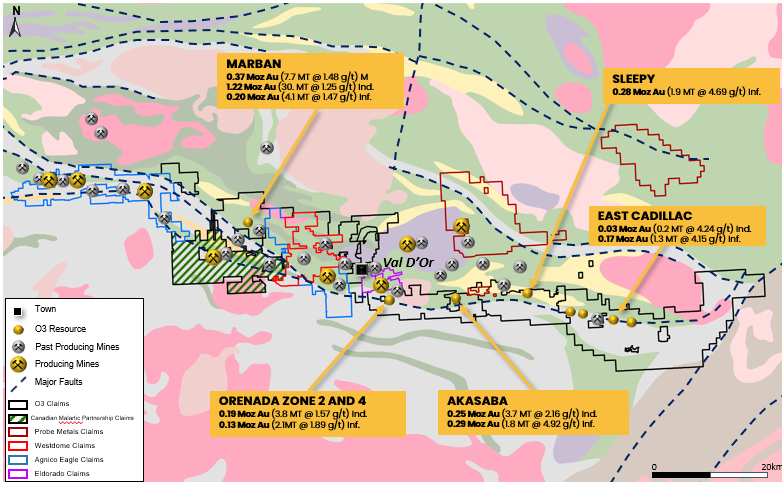

Figure 1: Val d’OR Consolidation – Post Acquisitions

Source: O3 Mining Inc.

In my opinion, protecting your downside risk is an integral part of consistently making profit from your investments within the junior resource sector.

Let’s do a quick calculation of O3’s underlying value:

Therefore, if you add up the value of O3’s acquisitions, Osisko’s non-core project portfolio and their cash (which will be lower than the total amount that they raised), the underlying value of O3 Mining is roughly $200 million or almost twice the current MCAP.

NOTE: No value is assigned to the exploration potential.

In my opinion, while the share price can undoubtedly move lower, I like the downside protection which O3 presents at its current price.

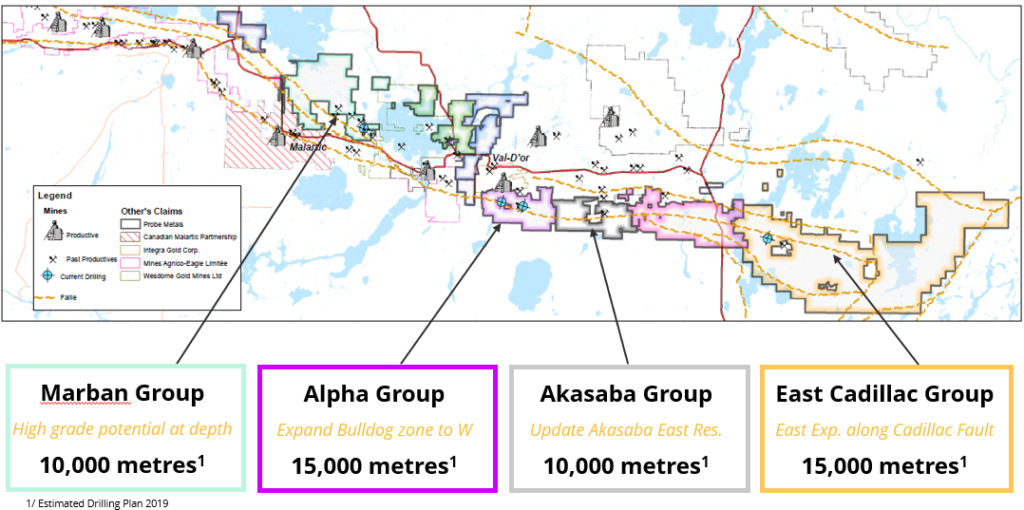

With the acquisitions in place, O3 is continuing to march forward with a 50,000m drill program on 4 main target areas within their Val d’Or region properties.

Figure 2: Aggressive Osisko Style Exploration

Source: O3 Mining Inc.

The drill program is being funded by a $10.08 million charitable flow-through private placement which closed on September 26th.

For those who don’t know about charitable flow-through shares, they’re typically issued at an even higher multiple above the market share price value than regular flow-through shares.

The ability to raise cash through charitable flow is a tremendous advantage compared to a regular hard dollar private placement, as it reduces the amount of dilution by the raise, while also giving the buyer an even higher tax reduction for participating.

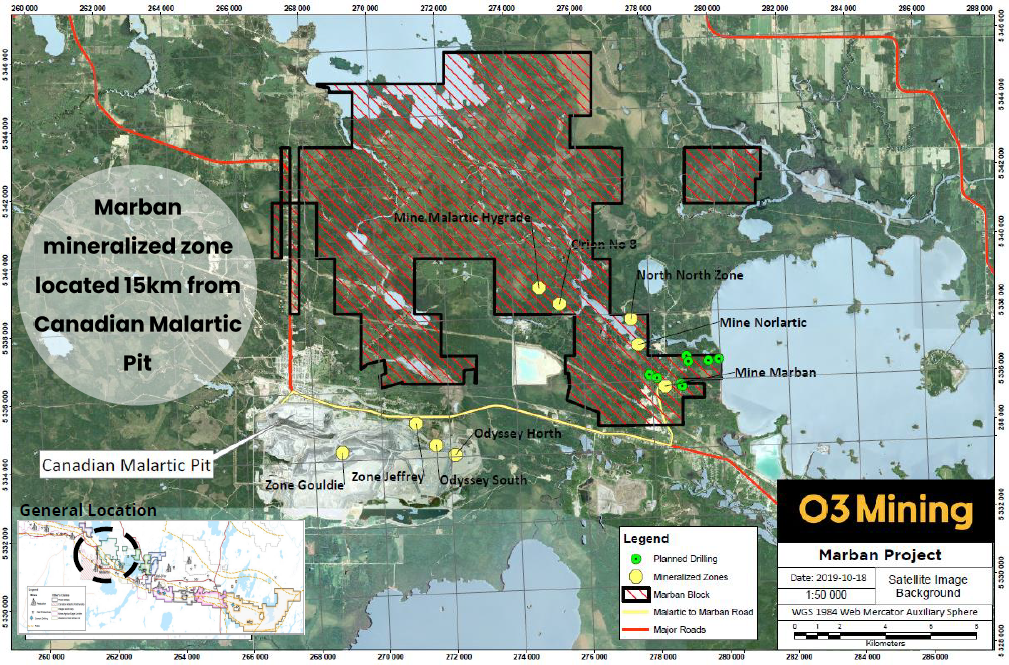

The Marban Group consists of the Marban and Harricana projects. The Marban project is located near the town of Malartic, Quebec, which sits roughly 30 km west of Val d’Or.

It’s one of the non-core assets which was spun out from Osisko Mining in the RTO with Chantrell Ventures. Marban was originally acquired by Osisko (Oban Mining at the time) from Niogold in 2016 when the 2 companies merged.

Marban has a 43-101 in-pit measured and indicated resource of 37 Mt at 1.24 g/t for 1.48 Moz of gold and an in-pit inferred resource of 3.6 Mt at 1.15 g/t for 0.13 Moz of gold.

In my conversation with Vizquerra-Benavides, O3 is planning to drill 8 holes there, which will be targeting high-grade gold below the existing resource – which means below 400m.

For those who aren’t familiar with Abitibi shear zone gold deposits, they can be deep, high grade and steeply dipping.

Therefore, exploration below 400m for high-grade gold mineralization is a legit prospect and one that I am very interested to see tested.

Figure 3: Marban Project

Source: O3 Mining Inc.

Additionally, as mentioned earlier, Marban is located in close proximity to the town of Malartic, which also means it’s in close proximity to the Canadian Malartic Open Pit Gold Mine owned by Agnico Eagle and Yamana Gold.

It is speculation, but I believe it’s valid to think that Marban becomes an attractive acquisition target for the Canadian Malartic Mine moving forward, as its reserves dwindle and precious metal prices remain strong.

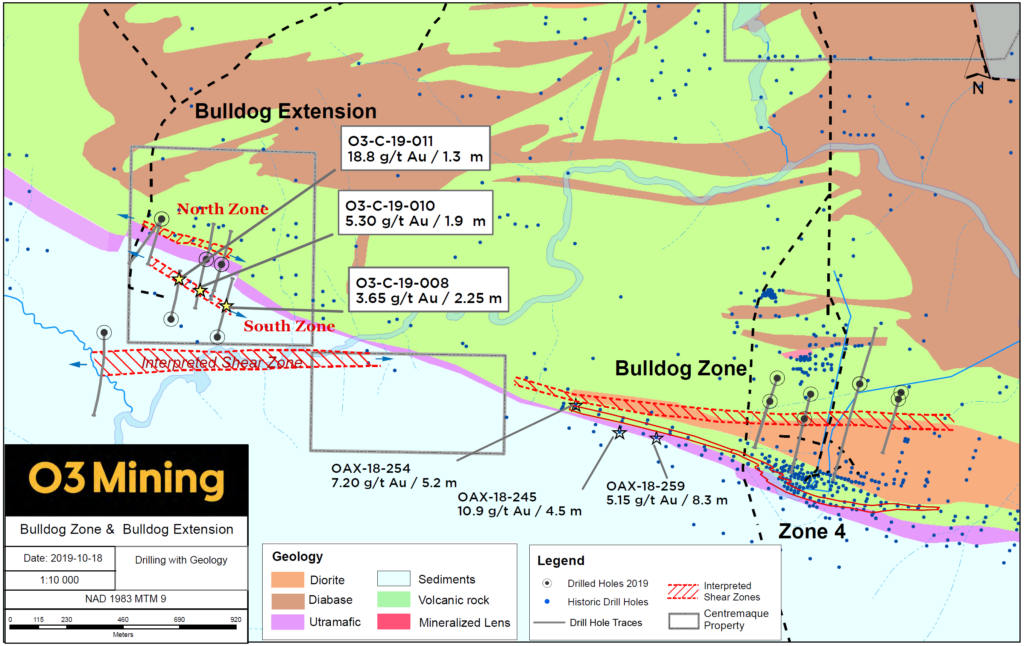

The Bulldog zone was discovered by Alexandria Minerals in late 2018.

Reviewing the results in the December 11th, 2018 news release, the Bulldog zone is east-west trending and has been confirmed over 500m with a thickness ranging from 20 to 40 metres.

There were 8 initial holes drilled on the Bulldog target in 2018 and they returned some great results, which were highlighted by:

With regards to drilling at Bulldog, Vizquerra-Benavides mentioned the phrase, “drill for structure, drift for gold”. Meaning, first and foremost, they want to establish or understand the structures that are controlling the gold mineralization.

Early this week, O3 announced results that confirm the extension of the Bulldog mineralized structure located 1,500 metres to the east and importantly, demonstrate the potential for gold-bearing structures in the Pontiac sediments.

The Bulldog gold-bearing mineralized structure discovered in December 2018, demonstrates good continuity in gold grades over several metres and is over 500 metres in strike length.

Figure 4: Alpha Group – Bulldog Zone

Source: O3 Mining Inc.

O3 will continue with its 15,000m drill program in the Alpha Group, systematically drilling every 80 meters across the known zone, with the intent of establishing an inferred resource.

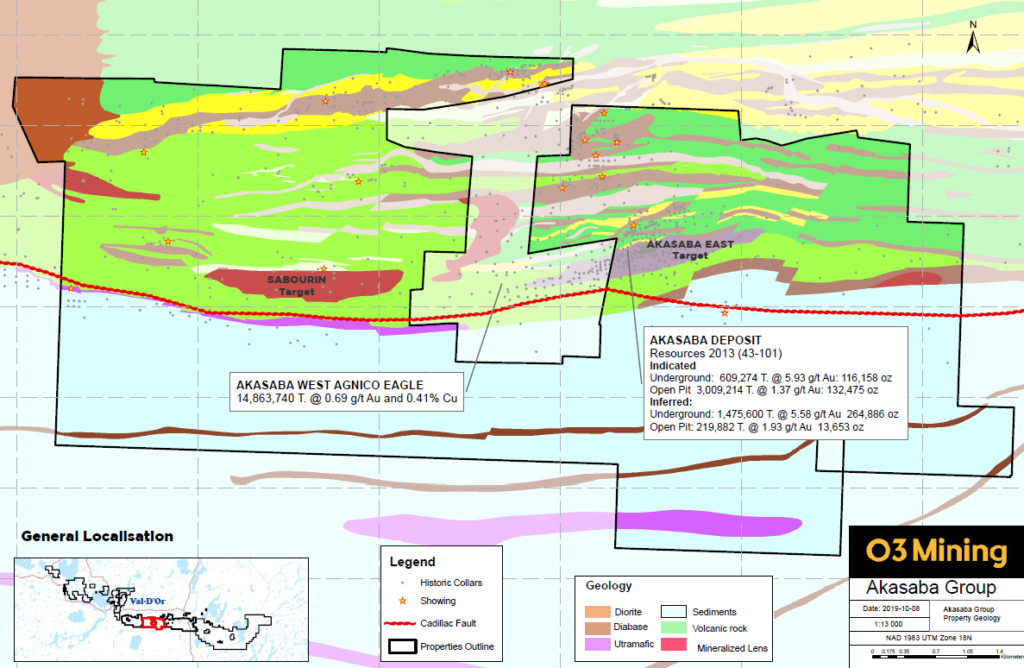

Akasaba sits east of the Bulldog Zone and, of course, on the east side of Akasaba West, which is an open-pit development project owned by Agnico Eagle. Akasaba West has an inferred resource of 14.8 Mt at 0.69 g/t for 332,074 oz of gold and 0.41% for 61.2 Mkg of copper.

O3 will perform a 10,000m drill program in the Akasaba Group

to confirm and expand resources in the Akasaba east target.

Figure 5: Akasaba Group

Source: O3 Mining Inc.

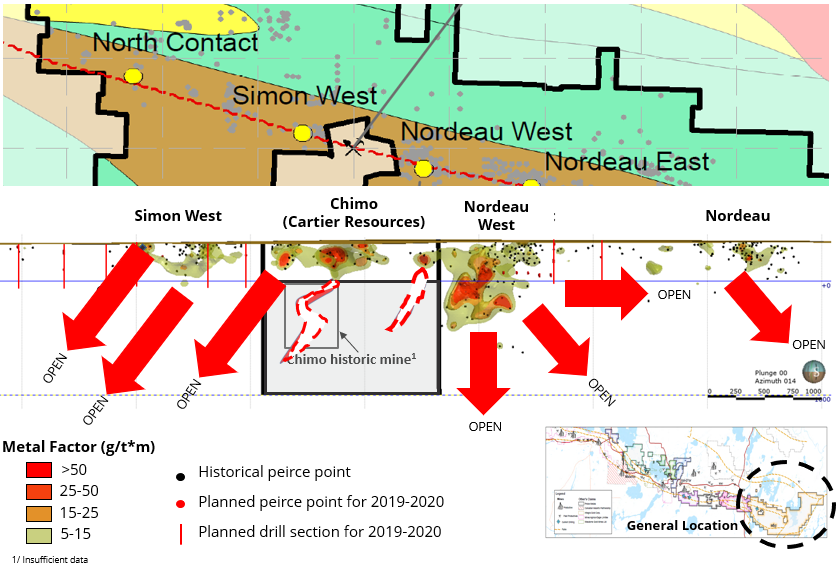

The Nordeau West target in the O3’s East Cadillac Group, which was acquired in the acquisition of Quebec portion of Chalice Gold Mines, sits to the east of Val d’Or and of O3’s other 3 drill target areas.

Nordeau West has a JORC

indicated resource estimate of 225,000 tonnes at 4.17 g/t for 30,200oz of

gold and an inferred resource of 1.112 Mt at 4.09 g/t for 146,300 oz of gold.

Figure 6: East Cadillac Group

Source: O3 Mining Inc.

As you can see in the image above, O3 now controls essentially all of the land which surrounds the historic Chimo Mine, which is owned by another junior gold company – Cartier Resources (ECR:TSXV).

If you take the time to review the 3D resource model which is available on VRIFY’s website or in the video on Cartier’s website, you will get a good idea of the deposit and how it relates to the prospects on O3’s property.

Given the existing resource on the Nordeau West target and where O3 will be targeting their drilling, there’s a good chance that gold mineralization, possibly high grade, will be discovered.

As I mentioned in the intro, success in the junior resource sector, I believe, is predicated on 3 main factors.

First, invest in the best people.

Second, protect your downside risk.

And, finally, take a contrarian view of the market and/or the company.

There is risk in any investment, especially when it comes to mineral exploration, but by sticking to the highest quality issuers, I believe, you give yourself the best opportunity for profit!

I own shares in O3 Mining and will continue to buy on weakness in the weeks ahead.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with any of the companies discussed in this article. I do own shares O3 Mining and Cartier Resources.

Produced by Cambridge House International

My presentation, Nickel: A Short and Long-Term Outlook, covers all the major topics affecting the nickel market in 2019 and beyond.

Topics include:

All views are my opinion and are not investment advice!

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Enjoy!

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do own shares of FPX Nickel Corporation. I have NO business relationship with FPX Nickel Corporation.

Produced by Cambridge House International

Junior Stock Review Nickel Panel featuring FPX Nickel’s CEO Martin Turenne, Giga Metal’s CEO Mark Jarvis and RNC Minerals Director of Investor Relations Rob Buchanan

Nickel panel discusses the bullish and bearish factors affecting the nickel market in 2019 and beyond. Topics include:

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Enjoy!

Brian Leni P.Eng

Founder – Junior Stock Review

On April 6th, I had the opportunity to visit Northern Empire’s Sterling Gold Project, located north-west of Las Vegas, Nevada. My visit was great and really gave me a good perspective of the Sterling Gold Project’s scale and its potential for further resource expansion.

In particular, the Crown Block stood out as having great exploration potential, as not only is this area a focus for Northern Empire, but also has drawn a lot of attention from Corvus Gold, whose Mother Lode Open Pit is completely surrounded by Northern Empire.

In all, I left the site visit very optimistic that Northern Empire’s 2018 drill program should shed a lot of light onto the Sterling Gold Project’s potential and am eagerly awaiting news flow!

After landing in Vegas, I hopped in an Uber to get to my hotel. As this was my first visit to the area, I was mesmerized by the bright lights, massive celebrity advertisements and sheer size of the Las Vegas Strip.

View from the bridge connecting the Bellagio and Ballys

Las Vegas truly is the center of the universe when it comes to marketing, because the corporations that reside here clearly understand human behaviour and how to manipulate it. Everything about the strip is designed to put a smile on your face while simultaneously extracting the maximum amount of money from your wallet.

Along the strip, a Starbuck’s tall Americano is $5.50 USD, a tall can (493ml) of domestic beer $10.00 USD, and a ‘big gulp’ slushy with rum or tequila will run you $30 USD. These prices remind me of those typically reserved for sporting events or concerts, which may be a good comparison for the confines of the Vegas Strip.

A view of New York New York from my hotel parking lot

While my comments here may seem negative to some, they aren’t meant to be. I have a high regard for the marketing expertise that has created this ‘wonderland.’

View of the Bellagio

Bottom-line, even if you aren’t a gambler, Las Vegas is a place that everyone should visit at some point in their lives. It truly is unique in terms of what it has to offer.

The day of the site visit started early, as we met in the lobby of the hotel at about 6:30 am. I, however, hadn’t adjusted to the 3 hour time change and was up some time before. One thing about starting your day at 4 am in Vegas is that you aren’t alone. That said, I’m sure most of the people I encountered at that time of the morning had yet to go to bed!

From our hotel, it was about a 2 hour drive up the I95 to the Sterling Gold Project. Given the size of our group, we split up into 3 vehicles. In the SUV with me was Executive Chairman, Doug Hurst, and The National Investor newsletter Editor/Publisher, Chris Temple. Both men are very experienced in the mining and investment worlds and shared several, great anecdotal stories about their experiences and lessons they’ve learned from the sector.

Roughly half way to our destination, we drove past a U.S. Air Force base which, famously or infamously, is the site of at least a portion of the U.S. drone fleet.

A drone flying in the Sterling Gold Project Vicinity

One of the most intriguing, yet mysterious, sites along the way was Area 51. Of course, you can’t actually see Area 51, but many of the businesses along the highway have names inspired by this mysterious U.S. Air Force base. I’m by no means an expert on the lore surrounding Area 51, but after spending the day at the Sterling Gold Project, you very quickly become aware of a U.S. military presence.

2 (small) Helicopters in the distance

The Walker Lane Trend extends north-west from Las Vegas to Reno, running parallel to the Nevada and California state borders. While not as famous as the Carlin or Battle Mountain-Eureka Trends in the northern portion of the state, the Walker Lane Trend has a very rich gold mining history.

It’s estimated that 50 million ounces of gold have been discovered within the Walker Lane Trend, with the Comstock Lode Mine located near Reno being, arguably, the most famous. Additionally, the Round Mountain and Bullfrog Mines are other examples of gold producing mines within the trend.

Interestingly, Barrick’s past producing 2.3 million ounce Bullfrog Open Pit Gold Mine can be seen from Northern Empire’s Crown Block. I was able to snap a photo, while standing at the top of the Secret Pass Open Pit – see below.

View from the Secret Pass Open Pit – Barrick’s Bullfrog Mine

Satellite Image of the Crown Block

As you can see in the satellite image above, the Bullfrog Detachment Fault and the Fluorspar Canyon Detachment Fault run in a similar east-west fashion, and lay host to the past producing open pit mines. Also, the Faults divide the tertiary volcanic rocks in the north and the sedimentary rocks in the south.

The site visit began at Northern Empire’s permitted Sterling Mine, which is in the southern region of the property. After completing our site safety orientation and collecting our PPE, we hit the road, making our first stop at the heap leach pads.

Sterling’s Main Entrance Road, Looking away from the Sterling Mine

Sterling’s Main Entrance Road, Looking at the Sterling Mine

Currently, there’s one active leach pad; at the time of our visit, it was being turned over by the bulldozer featured in the photo below. The ore is mixed on the pad to help oxygenate the pile and break up any fluid channels that formed over the last cycle. Ultimately, this leads to higher recoveries in the processing plant. These are simple smart things that the Company does to improve efficiency show the respect that they treat shareholder capital. Also to note, the existing facilities and processing plant appear to be in great shape, which is a real plus when it comes time to begin production.

Active Leach Pad

We then moved into the Sterling Mine open pit area, more specifically up onto the Water Tank Hill, which gives a great vantage point for viewing all three open pits.

Northern Empire CEO, Mike Allen, on Top of Water Tank Hill

While standing on Water Tank Hill, CEO, Mike Allen, took the opportunity to explain how they will attempt to expand the Sterling Mine resource. As explained in my introductory article, the company will follow up on recent high-grade drill holes that sit on the pit shell edge, as seen in the satellite photo below.

Next, we headed back to the main offices for lunch and a look at the core shack. As with all Carlin-Style gold, the core doesn’t possess any eye-catching visible flakes or nuggets, but instead it is the orange oxidized material (the more broken up the better) which should catch your eye, as it is gold bearing. The samples, however, were still very interesting as the fluorite and calcite mineralization found on the property can be seen in the core samples. In the photo below, for instance, the purple mineral is fluorite.

Core Sample with Purple Mineral Fluorite

In fact, the Sterling property boundaries not only surround Corvus Gold’s Mother Lode Project, but also historic fluorite and mercury mines, which can be seen in the property map below. Interestingly, it was mentioned during the visit that the fluorite mine was hampered by gold contamination, what a wonderful issue to have!

Sterling Gold Project

Sterling Mine Site Manager Chuck Stevens , who worked previously in the Sterling underground mine, showed me a few excellent calcite samples in his office and, additionally, pointed out the massive calcite sample sitting outside the geologist’s office trailer. Also, Executive Chairman, Doug Hurst, pointed out a couple of cinder cones which lie just east of the property; another example of the geological diversity of the property and its surrounding area. The immediate area around Northern Empire’s Sterling Project features fluorite, decorative rock, precious metals and marble mines demonstrating both the endowment of the area, the impact of mining on the local economy, and the ability to permit both large and small mines effectively.

NOTE: A Cinder Cone is formed by volcanic eruptions of mafic / intermediate lavas, which collect to build a cone around a volcanic vent. On the east side of I95, on your way up to the Sterling Gold Project from Las Vegas, a cinder cone is currently being mined for decorative stone used in landscaping.

Yours truly with the Secret Pass Open Pit in the background

Heading back out onto the I95, we then headed north toward the town of Beatty, to the Crown Block. As you will remember from my introductory article, the Crown Block is made up of 4 main targets: Daisy, Secret Pass, Shear Zone and SNA, all of which are located along the Fluorspar Canyon Detachment Fault.

Our first two stops were at Daisy and Secret Pass deposits, where Senior Geologist, Ron Kieckbusch, and Exploration Manager, Rich Histed, discussed the geology of the area, the work they completed in 2017, and where they were headed in 2018.

South of the fluorspar detachment fault, mapping has defined an asymmetric fold-thrust belt in the sediment package, with a northwest vergence and northeast plunge likely of Mississippian age (327-290 Ma).

It’s my understanding that the folding of the sediment package generated perpendicular faults, which were later made larger during a caldera collapse. For those who aren’t familiar, a caldera is a large volcanic crater, which can be formed by either an explosive volcanic eruption or the collapse of surface rock into an empty magma chamber. The now larger faults become easier conduits for fluid flow, thus explaining the mineralizing event.

Currently, 30% of the 141 square-kilometer property package has been geologically mapped and geochemically sampled, with the Crown Block being the primary focus. Mapping and sampling is a very efficient and cheap way of acquiring drill targets. In total, 580 rock chip samples have been taken, returning grades within a range of undetectable to a high of 13.85 g/t gold, and 34 samples returned greater than a 1.0 g/t gold.

As stated, the mapping and sampling within the Crown Block has identified new exploration targets, which were noted in the April 25th news release and can be found in the image above.

In my opinion, there is a TON of potential here, as Northern Empire begins to expand and fill the gaps between these historic deposits. As seen in the image above, it looks like one big shallow gold system, with good grade. In the gold mining world, it doesn’t get much better!

With the identification of these high prospective targets, Northern Empire is expanding their current drill program to 18,000 meters and have already begun the permitting process for a larger 50,000 meter program, which will focus on expanding the Crown Block resource and testing these new regional targets.

Step-out drill results from the Daisy and Secret Pass, released May 2nd, not only returned good grades and widths, but confirm that both deposits are open for expansion. The results are highlighted by,

The highlighted D18-001 step-out hole encountered mineralization 53.35 meters down the hole, which was shallower than expected. Additionally, mineralization was encountered at the base of the Cararra formation, which suggests that there is a possibility for further mineralization to be discovered lower in the stratigraphic sequence. In all, the drill results confirm that the Daisy Deposit remains open up-dip for further expansion. Please see the news release for complete details.

The highlighted SP18-017 drill hole stepped out 200m west from the known Secret Pass Deposit and 196.9 meters deep encountered mineralization grading 0.95 g/t gold over 38.1 meters. To note, this hole was terminated before losing mineralization. Northern Empire states within the news release that they intend on re-drilling the hole to better understand the full extent of what has been discovered. This step-out is a great result as it confirms that the Secret Pass Deposit mineralization is open to the west.

The last stop of the day was at the SNA Deposit, in the north-east corner of the property. As we approached the SNA Deposit, we first drove past Corvus Gold’s Mother Lode Open Pit, which is completely encompassed by Northern Empire’s Crown Block.

Corvus Gold’s Mother Lode Open Pit

For those who are not familiar, the Mother Lode Deposit has been a major focus for Corvus over the last year, with 10,000m of drilling in 2017 and another 13,000m of drilling planned for the first half of 2018. For those that may not be familiar, Corvus has a MCAP around $300 million, which is largely based on the drilling success at Mother Lode. I find this interesting as a Northern Empire shareholder, because I’m intrigued by the amount of drilling that’s occurring around the existing open pit and, specifically, how that mineralization may extend out toward, or connecting to, the SNA Deposit.

Examining the satellite image below, you can see the concentration of Corvus drill holes not only in the vicinity of the open pit but, more importantly, along the claim boundary.

This is a fairly obvious observation, one that didn’t get past Northern Empire management; while viewing the SNA Deposit during our visit, drilling was taking place along the Corvus claim boundary. In news released April 17th, Northern Empire confirmed that the Mother Lode mineralization does extend south towards the SNA deposit and have drilled significant gold grades from structures which cut favourable host rock for Carlin-type gold mineralization beneath the historic Telluride Mercury Mine.

Northern Empire Drilling beside Mother Lode Open Pit

As I’ve said in the past, site visits are an excellent way for you to bring your due diligence to the next level, and nothing beats seeing the property and interacting with the people in person. My visit to the Sterling Gold Project was no different, as it gave me a better view of the upside potential of the property and the type of people managing the company.

Just to recap, here’s a list of what I see as the strengths for Northern Empire:

I believe there’s a lot of upside potential for Northern Empire if they’re able to execute their plan of expanding the resource at both the Sterling Mine and the Crown Block. I look forward to good news flow over the coming months as this story really begins to come together on the back of their 18,000m drill program.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do own shares in Northern Empire Resources. All Northern Empire Resources’ analytics were taken from their website and press release. Northern Empire Resources is a Sponsor of Junior Stock Review.