NOTE: This site visit report was sent to Junior Stock Review Premium subscribers on Mar.15th. Get my insights first by becoming a Junior Stock Review Premium subscriber today and save 40% using the promo code PREMIUM, until March 31st.

There is nothing like a site visit to gain perspective on a junior resource company which is moving their project towards a PFS or FS.

You just can’t beat getting a physical perspective on where a road may be built, or the mine’s proximity to a community, or where a tailings facility will be located.

Seeing the lay of the land is an X-Factor.

Additionally, it gives you the chance to spend time with management in a less formal way.

Meeting someone at a conference, at a booth, you are typically seeing a façade.

Breaking bread, having a drink or simply travelling together is a great way to see people for the way they really are.

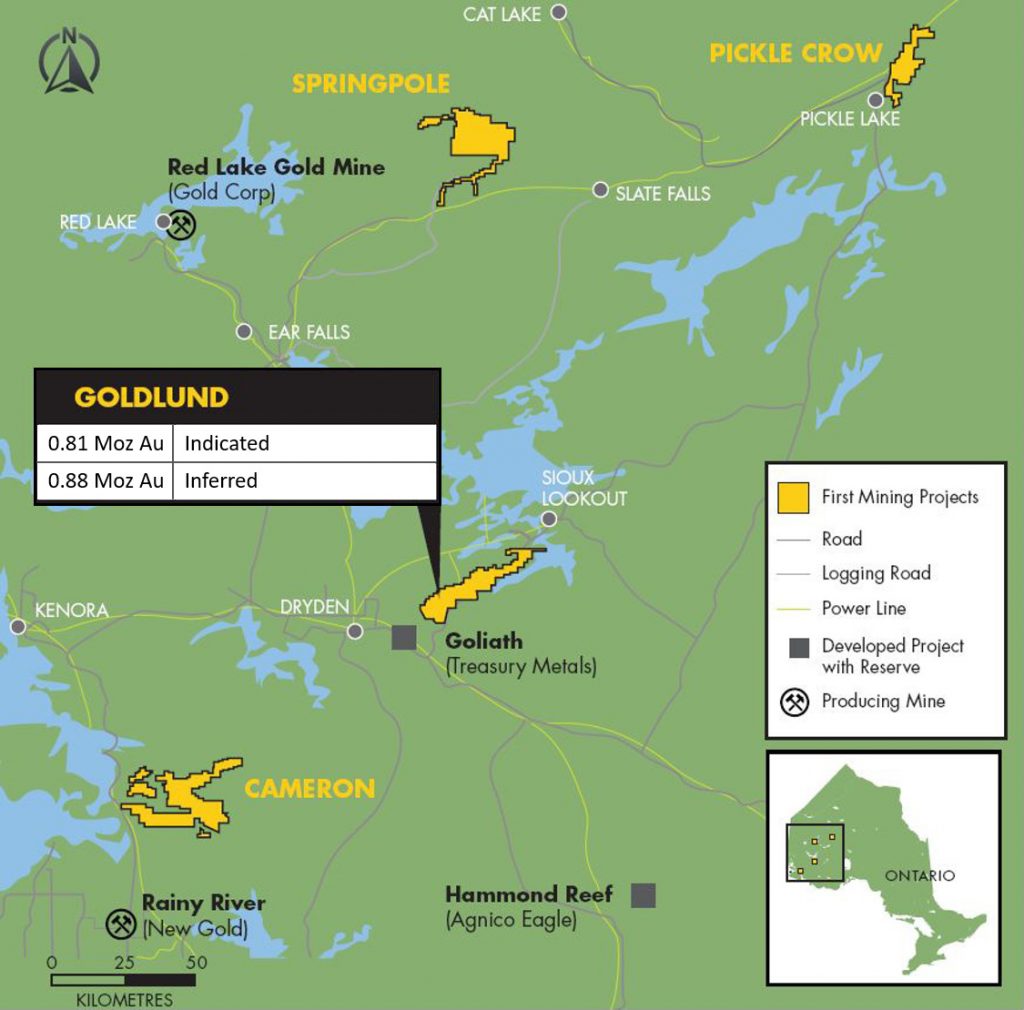

This past week, I had the chance to travel to northern Ontario, specifically Sioux Lookout, to see First Mining Gold’s Springpole and Goldlund projects.

First Mining’s land bank strategy, which the company was founded on, is gone.

A new management team, led by CEO Dan Wilton, is in, and with them, have brought a renewed focus on the development of their best projects.

In short, I will not be adding First Mining Gold to the Junior Stock Review Premium Portfolio.

While I do see value in owning the company at its current share price, I think that the risk to reward profile of the company isn’t good enough to make its way into the portfolio at its current valuation.

There are other companies that have better upside potential and less risk associated with them.

With that said, I have put together my thoughts on First Mining Gold for you here.

Enjoy!

First Mining Gold (FF:TSXV)

MCAP – $107.6M (at the time of writing)

Shares – 633M

FD – 722M

Strategic Ownership – Management 3.3%, First Majestic 2.3%, Institutional 7%

Cash – roughly $12M after recently closed $8.5M financing at $0.22 and a 3 year ½ warrant at $0.33

Site Visit – March 9th and 10th

After being away from home at PDAC the week previous, I decided to forego a hotel the night before my 8:20am flight to Thunder Bay.

It was great to sleep in my own bed, but waking at 3am to drive to Toronto’s Pearson International Airport was tough – especially with the time change the night before!

From Thunder Bay, I took a small jet operated by Bearskin Airlines to Sioux Lookout.

Sioux Lookout is a key location in northern Ontario because it’s home to one of the major hospitals – Meno Ya Win Health Centre.

Next to health care, I’m told the other major draws to the area are forestry, construction, mining and one of my favourite pastimes, fishing.

Day 1 – Goldlund Project

Upon landing in Sioux Lookout, I was picked up by a representative of First Mining Gold and brought to the Goldlund project.

The Goldlund property has good infrastructure with a main office building, a few maintenance structures, a large core shack and 2 core storage facilities.

Historically, Goldlund was host to an underground and open-pit mine between 1982 and 1985. In fact, the mine’s old infrastructure is still around today, with the main office building being one of the historic structures.

Goldlund is an advanced exploration project which encompasses 280 square kilometres and has a current 43-101 compliant resource on it.

Indicated Resource – 12.8Mt at 1.96 g/t for 809,200 ounces of gold.

Inferred Resource – 18.3Mt at 1.49 g/t for 876,954 ounces of gold.

Prior to First Mining, Goldlund was owned by a private company, Tamaka Gold Corporation. This changed in 2016, when Tamaka was absorbed by First Mining.

In December of 2019, First Mining closed a flow through financing at $0.27 per share. I was told by management that this money will be used exclusively at Goldlund for mostly infill drilling on its main deposit.

After lunch on Day 1, we had the chance to have a Q&A with Goldlund exploration geologist, Andrew Wiebe. Wiebe outlined the geology of the project and gave us an overview of its exploration potential.

I was particularly intrigued with the discussion over the exploration targets: Miller prospect, Camreco South and the Mustango target.

First Mining is concentrated on converting the inferred portion of the resource into the indicated category, which should be straightforward considering it is an intrusion-related deposit and makes sense from a corporate point of view.

First Mining can afford to risk capital to exploration drilling given the market and their current MCAP. Money needs to be spent on straightforward valued-added actions.

Clearly, however, there is potential outside of Goldlund’s main deposit, making the project even more attractive than it is already, considering its size, grade and location.

After discussing high level points for the project, we visited the core shack and drove to the drill rig which was set up on the Main deposit for infill drilling.

As you can see, Goldlund’s core has visible gold (VG), which is always exciting to see.

Day 2 – Springpole Project

Day 2 started early, with a quick 6:30am breakfast.

Once finished, we were headed straight to the airport, where we caught an eight seat Cessna Caravan which flew us to the Springpole project.

The flight was roughly 50 minutes long and we landed on the frozen Springpole lake.

Upon landing we headed straight for the camp’s cafeteria where they were set up for the Springpole presentation, covering the mine plan outlined in the updated PEA, and the improvements that they were looking to make heading into the PFS.

After going through the project’s high level points, including a good briefing from First Mining’s David Mchaina, VP of Environmental and Sustainable Development, we jumped in a helicopter to get a good look at the lay of the land.

Specifically, for me, this gave a good perspective of the location of the proposed coffer dams and tailings facility locations.

In retrospect, I wish I had more time at Springpole to really take it in and ask more questions, but we were on a tight schedule.

I will cover more of Springpole in the following Risks to the Investment section, and following that, in my valuation metrics.

Risks to the Investment

Investment in First Mining is not without risk. Here are what I believe are the biggest risks:

- Environmental Permitting – All mining projects have the risk of not being permitted, however, in First Mining’s case, it’s just as much if they get permitted, as it is when they get permitted.

Time is money.

As I mentioned in the overview of the project, a bay on Springpole lake will have to be dammed and drained to allow for the open pit to be mined.

Not only this, but the planned tailings facility is almost completely surrounded by water.

These are very real risks to the environment, which will have to be clearly addressed and explained to the Federal and Provincial governments, plus eight First Nations’ communities.

Management explained that they plan to submit one Environmental Assessment document to both the Federal and Provincial governments for simultaneous approval.

Also, the company is considering incorporating the use of a synthetic tailings liner and dry stack tailings into the PFS mine plan.

This will no doubt come at a higher cost, but will give themselves the best possibility of being approved.

Further, it should be noted that the damming of the lake for the construction of an open-pit mine isn’t unheard of in Canada.

Examples are Agnico Eagle’s Meadowbank gold mine and Rio Tinto’s Dvavik Diamond mine.

Permitting is going to be a long process and could be a hindrance to value recognition from the market.

Or, maybe the market will turn bullish and permitting risk won’t matter to a portion of investors.

- CAPEX Cost – Last fall, the updated PEA saw the upfront capital cost to construct Springpole into a mine almost double, moving to over $800 million.

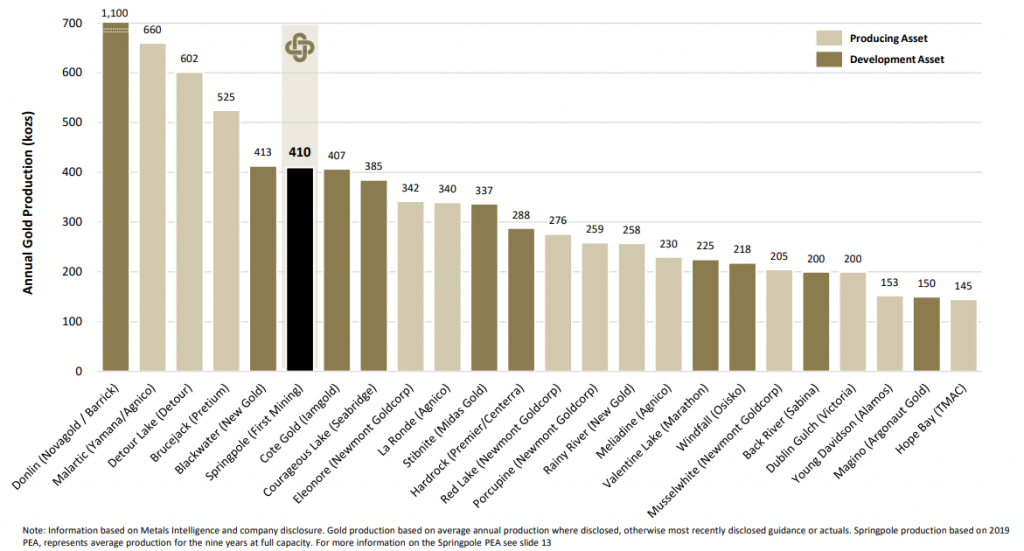

At first glance, this seems very high, however, remember that Springpole is expected to produce roughly 400,000 ounces of gold per year – this is rare. Given other large undeveloped gold projects of similar size, the cost, from what I can tell, is in line.

Consider the following graph provided in the First Mining Corporate presentation:

New Gold’s Blackwater is estimated to cost $1.8 billion to construct, Iamgold’s Cote Lake is estimated at $1.5 billion, Seabridge’s Courageous Lake US$1.52 billion, Midas Gold’s Stibnite is $1.12 billion and Sabina’s Back River is $476 million (but it is half the production).

My point is, although the CAPEX to construct Springpole will rise, in my view, costs will still be in a range which is in line with other large projects.

With that said, Springpole will have to rely on other factors to make it stick out from the crowd.

Other factors could possibly be location, mine life, exploration potential or AISC.

- Burn Rate – Management tells me that the company burns roughly $5 million per year without any value added work. Breaking that down, $3.5 million is spent in G&A and roughly $1.5 million is spent on project up keep.

$3.5 million in G&A is a lot and is rarely justified in my books. Management teams that are making this kind of money usually have share price charts that move in the opposite direction of First Mining.

Examining the chart, you can see that over the last three to four years, shareholders have been delivered nothing but losses and dilution.

Conversely, good people demand top dollars, which I won’t argue with. Given that First Mining’s new team has only been around for a year, I think that they deserve a chance to deliver on their vision.

From what I can tell, the right people are now leading the company.

I haven’t met CEO Dan Wilton, but in asking around, he does have a good reputation.

Second most important is COO Ken Engquist.

Engquist is a technical guy with a very relevant skill set and resume.

Personally, having heard Engquist’s pitch on the path of the company, I’m interested to see how they develop their portfolio of projects over the next year.

With that said, it only goes so far.

As I mentioned, with a $5M per year burn rate outside of value-added work, they will be coming back to the market most likely before the end of the year.

Further, if First Mining were to finance under $0.22 in the future, I would consider it a colossal failure.

Concluding Remarks

As I said, I will not be adding First Mining Gold to the Junior Stock Review Premium portfolio.

With that said, I will be following the share price, as there may be opportunity to add it to the portfolio if the share price were to fall further.

You will be alerted if I change my mind.

To close, this is how I break down the value opportunity in First Mining Gold:

- Springpole’s Valuation – Springpole is not perfect, there is definite environmental permitting risk, but conversely, we are talking about a deposit that has 4.6 Moz (M&I) of gold and an estimated production capacity of around 400,000 ounces per year.

The fact is, there are just not many development projects like this.

At US$1500/oz gold, Springpole’s after-tax NP@5% is US$1.22 billion with a 28% IRR. Let’s assume that Springpole’s value is 10% of its NPV, which is, therefore, US$122 million. With the current USD to CAD exchange rate that is roughly $168M CAD.

The company has a MCAP of approximately $107 million CAD. Conservatively, there is almost 70% upside in the share price just in considering Springpole, never mind the other projects.

- Goldlund’s Valuation – Goldlund has an Indicated and Inferred resource totaling around 1.6 Moz of gold. Currently, there is no economic study on the project, but in my opinion, you can clearly see the value in owning a gold deposit next to the highway and power.

Because of this, Goldlund is easily the best bargaining chip First Mining has to play with moving forward.

Treasury Metals’ Goliath project is located in close proximity and shares some commonalities as far as I can tell. Many analysts that I know believe that Goliath and Goldlund should be in the same company at some point in the future.

However, we probably need a better market to make this happen.

For now, I think that assigning a value equal to Treasury’s current market valuation makes a lot of sense.

At the end of trading on Friday March 13th, Treasury’s MCAP was roughly $30M.

- AuTecto Minerals Joint Venture on the Pickle Crow project – AuTecto is led by a team with a history of success – Bellevue Gold Ltd. and Gryphon Minerals Ltd. Considering Pickle Crow is a 3rd string asset in First Mining, I think this is a great deal with a lot of potential to pay dividends on something that would otherwise be sitting on a shelf.

In terms of valuing the JV agreement, I will discount the $3 million spend over the next 3 years and say it is worth $2 million. This only assigns value to the spend, no value to the project.

- Other projects – Hope Brook, Cameron, Pitt, Duquesne, Duparquet and Mexican assets. There is a lot of value here, but considering there will most likely be no real value-added work completed here, I will view it purely as icing on the cake.

Putting it all together, First Mining Gold is trading at half of its intrinsic value, conservatively speaking.

While this gives us as investors plenty of downside risk protection, given the risks associated with the company, I believe there are better places to invest our money.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review Premium

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with First Mining Gold, however, they did, along with Soar Financial Partners, pay for most of my travel expenses.