NOTE: This article was originally published for Junior Stock Review Premium readers on July 3rd, 2020. Subsequently, Monarch’s share price has appreciated 20%. Get my best investment ideas first by becoming a member today.

Finding companies that are trading for less than their value is integral for success in the junior resource sector.

With that said, investors have to be cognizant of why the company is trading at a discount to its value.

Value traps do exist and can either put your investment dollars into neutral or worse – lose you money.

You must, therefore, spend the time to understand the reasons for the discount and decide if it’s realistic, given the company’s action plan, to change the market’s perception.

In my research to identify the top M&A candidates in the sector, I have found that the companies that fall in this category are well known in the market and, in some cases, trade at a premium to their value.

The company I have for you today is not only trading at a steep discount to its value, but it also has, in my opinion, all the makings of a premier M&A candidate.

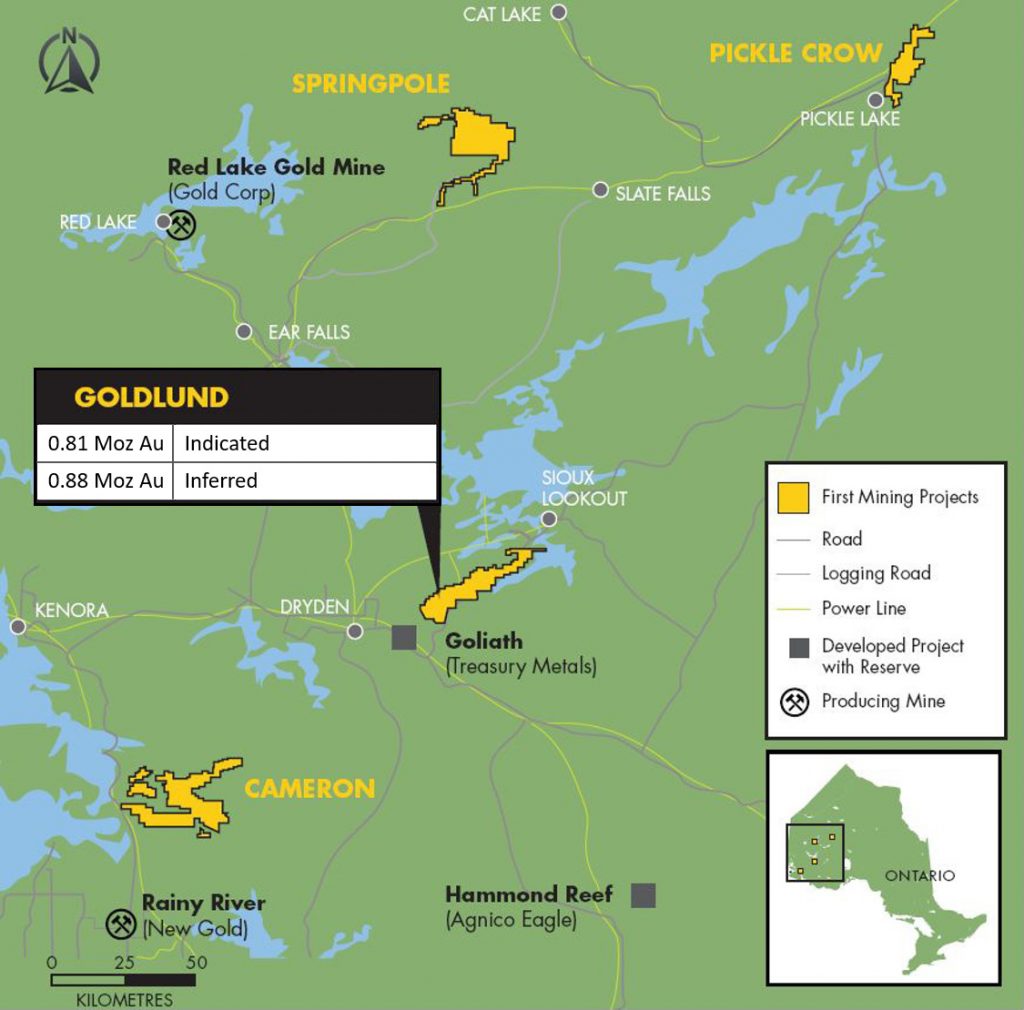

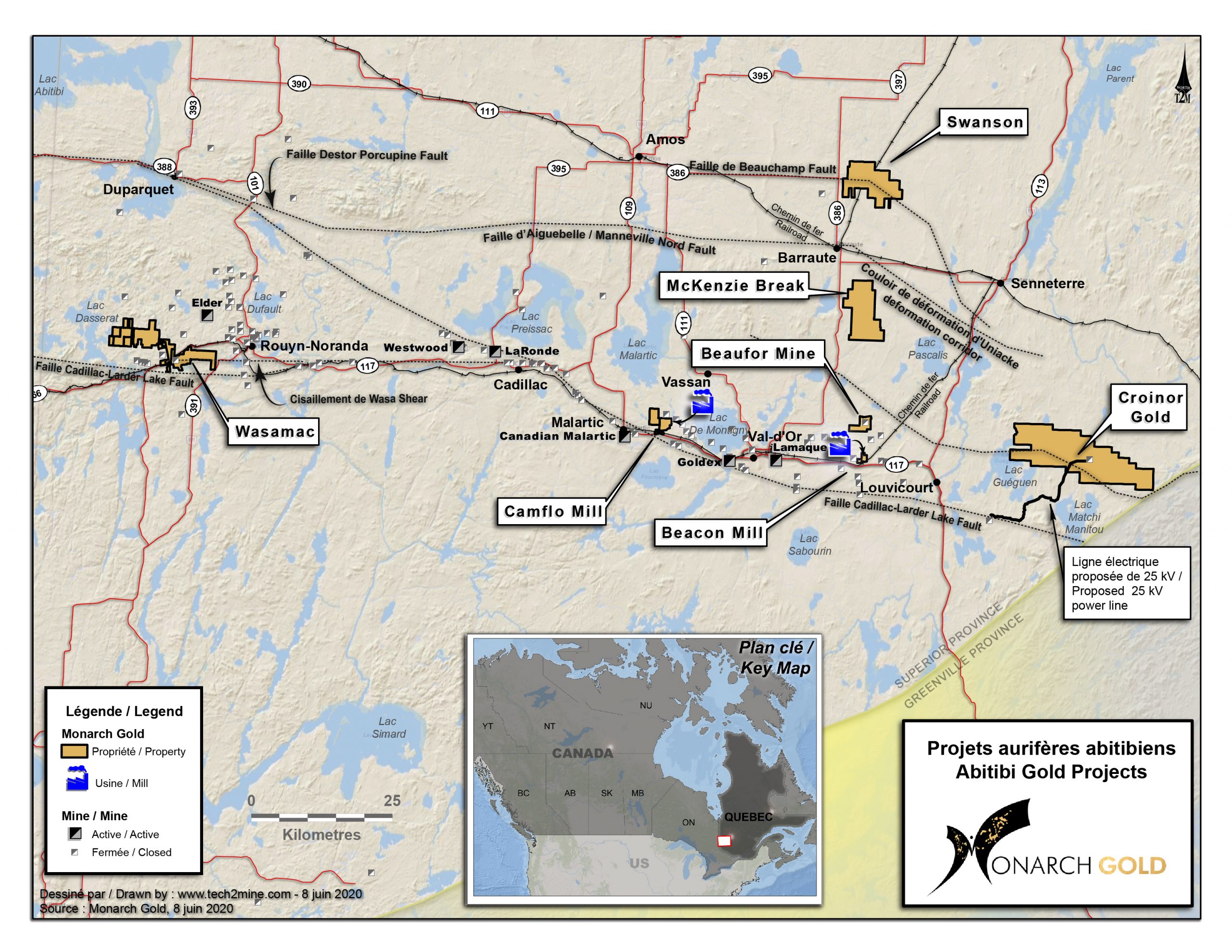

The company is Monarch Gold and they are developing their flagship Wasamac project in the heart of the world-famous Abitibi Greenstone Belt.

Let’s take a closer look.

Monarch Gold (MQR:TSX)

MCAP – $141.6M (at the time of writing)

Shares – 294.1M

FD – 333.7M

Cash – roughly $25M

Strategic Investors – Alamos Gold (16%), Yamana Gold (6%), Hecla (4%), Agnico Eagle (3%)

Total Equity Holdings –$3.2M As of March 31st, 2020 (O3 Shares, Probe Metals, etc.)

Debt – $3.8M of which $2.4M is due this year.

The People

Monarch Gold is led by CEO Jean-Marc Lacoste. Lacoste has a financial background and, in my opinion, a clear understanding of how to add value to a junior resource company.

Over his close to 8 years as CEO of Monarch, Lacoste has demonstrated that he and his team are able to execute the company’s vision of acquisition and development.

The ability to buy projects cheaply, add value through exploration and development, and then have the wherewithal to make a deal and sell the project to unlock the value for shareholders isn’t done successfully, all that easily, in the junior resource market.

Lacoste and supporting cast are clearly capable of executing this process and, given the current market, should be able to reap the benefits of multiple years of practice.

Lacoste is supported by CFO Alain Levesque, VP Corp Development Mathieu Seguin and VP Operations Marc-Andre Lavergne, together with a committed board of directors which has a strong track record of mine discovery and development.

I’m confident that the Monarch Gold team has the experience and focus to unlock the value at Wasamac and the rest of their secondary projects.

Wasamac

As I mentioned in my intro, I believe Monarch is trading at a discount to their value.

As investors, we must try and understand why.

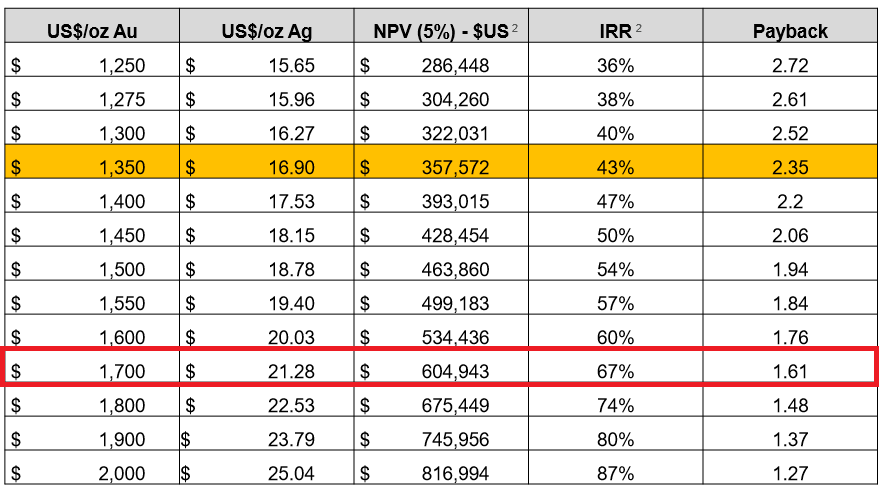

In Monarch’s case, at least a portion of the issue, I think, is directly related to the upfront capital cost and low after-tax internal rate of return (IRR) reported in Wasamac’s 2018 FS.

Wasamac 2018 FS Highlights:

At US$1300/oz gold

- After-tax NPV@5% – $311M

- After-tax IRR – 18.5%

- Upfront CAPEX – $464M

- P&P Reserves – 1.767Moz

- Average Production – 142Koz/year

- Mine Life – 11 years

- AISC – US$630/oz

When you examine the numbers, you can see that the upfront CAPEX and the IRR stand out like a sore thumb.

Let’s start with the upfront CAPEX, which is estimated at $464M, and includes roughly $230M for the mill and tailings facility.

This is a good chunk of cash, especially when put into context with other gold projects of similar size – it is much higher.

A big reason for this, at the moment, is that most of Wasamac’s comparisons are open-pit mines, which do typically have lower upfront capital costs – but not always.

Second is the poor after-tax IRR of 18.75% at US$1300/oz gold.

For those who are not aware, IRR is a measure of profitability, comparing the upfront capital cost to the estimated cash flow.

For further perspective, the best gold projects typically have after-tax IRRs over 25%.

Now, at today’s gold prices, Wasamac’s after-tax NPV and IRR increase and, most importantly, bring the IRR above the 30% mark – which is great.

Wasamac’s comparables, however, also respond well to rising gold prices and, therefore, are still better.

In my view, the stigma of these metrics has resulted in the discount to value, thus far.

The obvious question is, then, how does Monarch improve the upfront CAPEX cost and IRR metrics?

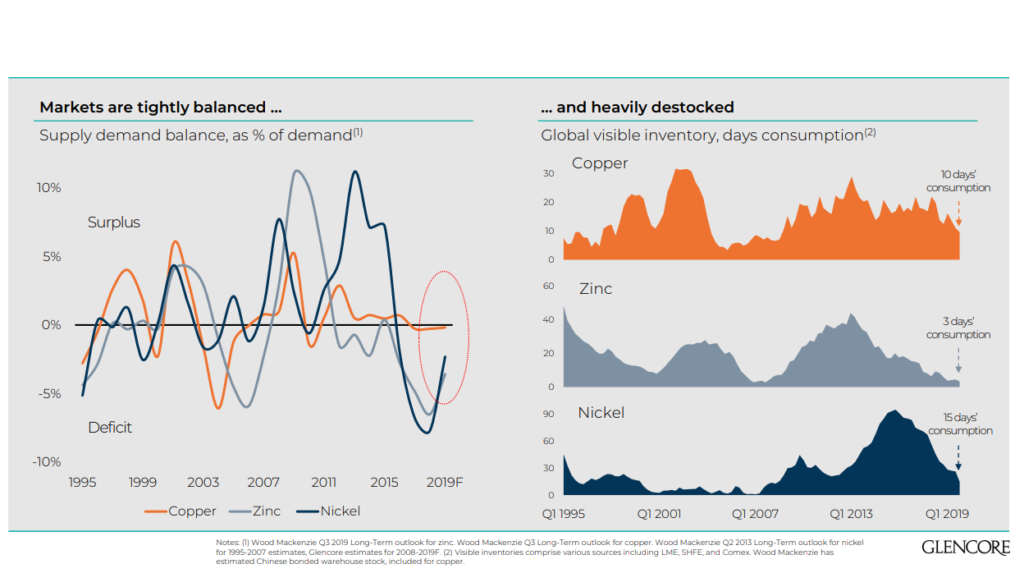

On May 14th, Monarch announced a MOU with Glencore regarding the potential use of the Kidd concentrator in Timmins, Ontario for the treatment of ore to be mined from Wasamac.

The MOU consists of 4 stages: Phase 1 – Upgrading Study (to be completed before Dec.31, 2020), Phase 2 – Negotiation and Signing of a Toll Milling Agreement (to be completed before March 30, 2021), Phase 3 – Concentrator Upgrading Work (to be completed before July 31st, 2021) and, finally, Phase 4 – Performance of the Toll Milling Services (First delivery to take place by Dec.31, 2023).

Further, on June 22nd, Monarch awarded the Phase 1 Upgrading Study on the Kidd Concentrator to Ausenco Engineering Canada.

These steps, if executed and with acceptable results, have the ability to address the 2 issues which I think have been impacting Monarch’s valuation, and could result in a substantially higher IRR.

To add, I believe the addition of Yamana (YRI:TSX) to the list of Monarch’s strategic investors is a bigger deal than the market has given it credit.

Yamana not only participated in the latest financing, but also wanted a Board of Directors seat, which I think is very telling with regards to future possibilities.

Clearly, to me, this move suggests that Yamana sees the potential in Wasamac.

With the Canadian Malartic mine, their 50% owned operation, sitting just east of Wasamac, it’s possible that Monarch will have another option outside of Glencore’s Kidd Concentrator when it comes time to negotiate terms of a toll mining scenario.

Plus, it’s entirely possible that a deal with Glencore, and Monarch’s valuation at the moment, could push Yamana to acquire Monarch.

That is entirely speculation, but something that, I think, has weight.

Either way, Wasamac’s resource size, production profile, sensitivity to higher gold prices and location put it at or near the top of my list of M&A targets.

Monarch’s Other Projects

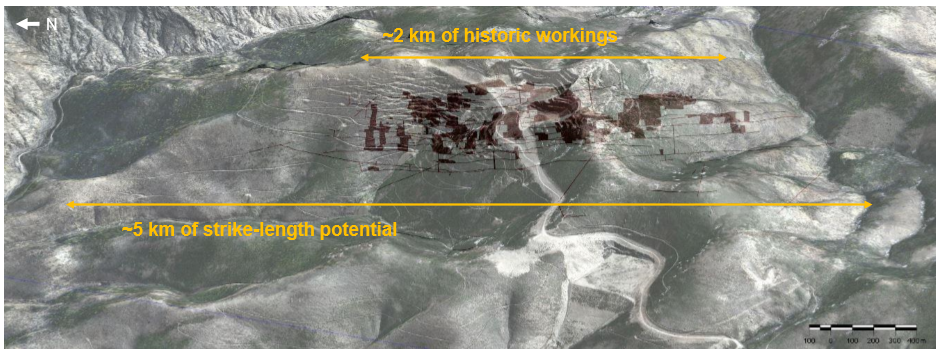

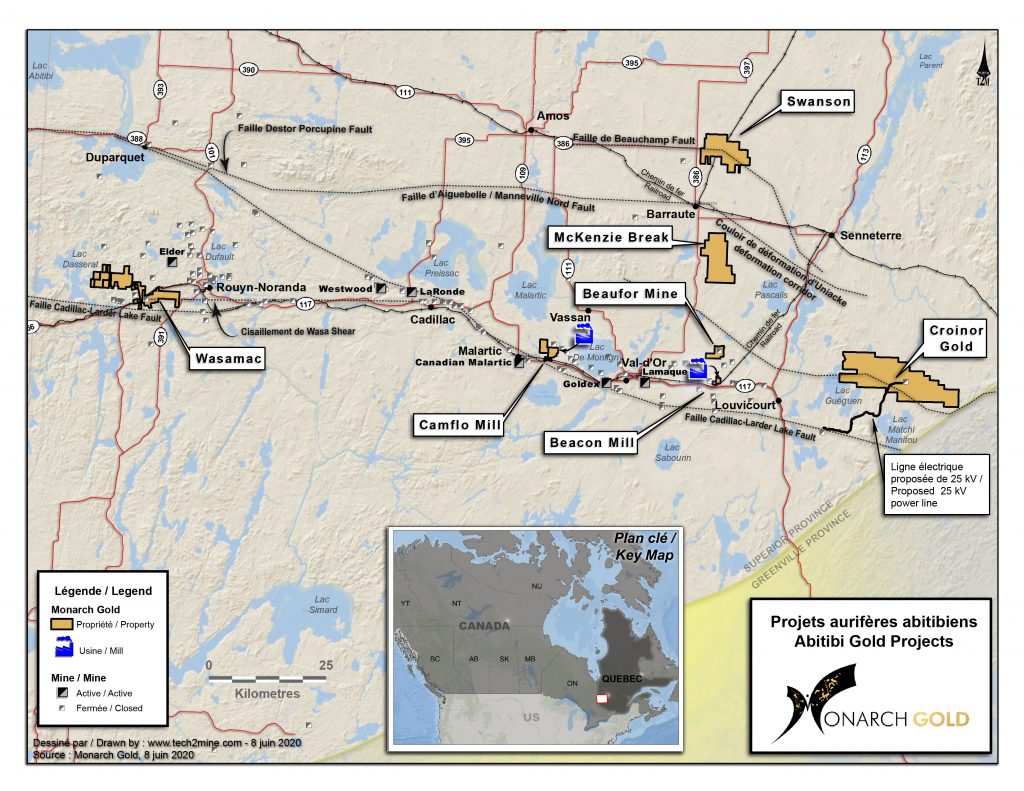

There is far more to the Monarch Gold story than just Wasamac, with 4 other advanced stage projects in the Beaufor Mine, Croinor Gold, McKenzie Break and Swanson projects.

Additionally, Monarch has 2 fully permitted mills in Camflo and Beacon.

Clearly, project development in the Val d’Or region of the Abitibi is a major part of Monarch’s growth strategy.

Further, scanning their news releases, you will find a history of acquisitions and sales.

A great example of this comes from earlier this year with the sale of Monarch’s Fayolle project to IAMGOLD (IMG:TSX) for $11.5M.

A willingness to monetize secondary projects for cash and/or shares is a great way for Monarch to advance their flagship Wasamac project without further dilution to existing shareholders.

As Lacoste mentioned to me in conversation, the focus is Wasamac and Monarch becoming a +100Koz/year producer.

The proceeds and the reason for the investment and development of these secondary assets is to, therefore, progress Wasamac with as little dilution to shareholders.

Let’s take a closer look at their current project inventory and the potential value that it could unlock for the company moving forward.

Let’s begin with the 2 mills – Camflo and Beacon.

Camflo Mill

- Fully permitted

- 1600 tpd

- Available tailings capacity

- Capable of crushing, grinding, cyanidation and precipitation via zinc powder

- Camflo Mine produced 1.6M ounces over its history (The original Barrick asset)

- Monarch announced that they will be re-evaluating the exploration potential of this project using modern technology this year

Beacon Mill

- Fully permitted

- 750 tpd

- Available tailings capacity

- 500m shaft

- Additional buildings

So what are they worth?

That’s a great question and one that is hard to answer.

For perspective, along with at least a 5-year development and permitting timeline, the upfront capital needed to construct a new mill could be in the order of $40M to $50M.

With that said, we do have a recent deal on a mill in the Val d’Or area which I think we can use as a conservative estimate for the value of Beacon and Camflo.

In May, O3 Mining (OIII:TSXV) acquired QMX’s (QMX:TSXV) Aubrel Mill for $5M.

With that set as our precedent, we will assume Camflo and Beacon are worth $5M each.

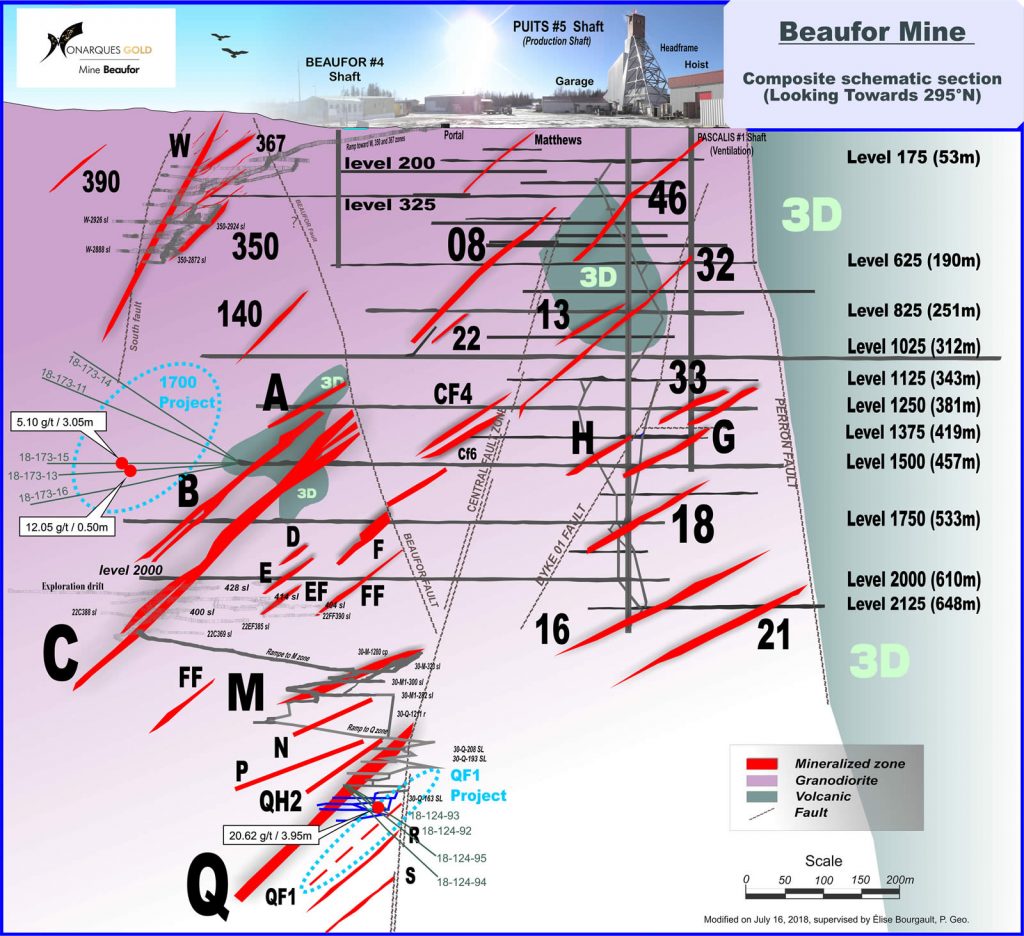

Beaufor Mine

Next to Wasamac, the Beaufor Mine is arguably Monarch’s 2nd most important asset, as it was a producing mine up until last summer when it was put on care and maintenance.

Beaufor was formerly owned by Richmont Mines, who sold it to Monarch along with the rest of its Quebec assets before being acquired by Alamos Gold in 2017.

Beaufor presents an interesting dynamic to Monarch’s valuation, because it both proves the management team’s ability to operate a mine and gives the added potential for cash flow moving forward.

On May 7th, Monarch announced that they had sold a 3% NSR on the Beaufor Mine to Caisse de depot et placement du Quebec (CDPQ) for $5M (with the option to redeem up to 2%).

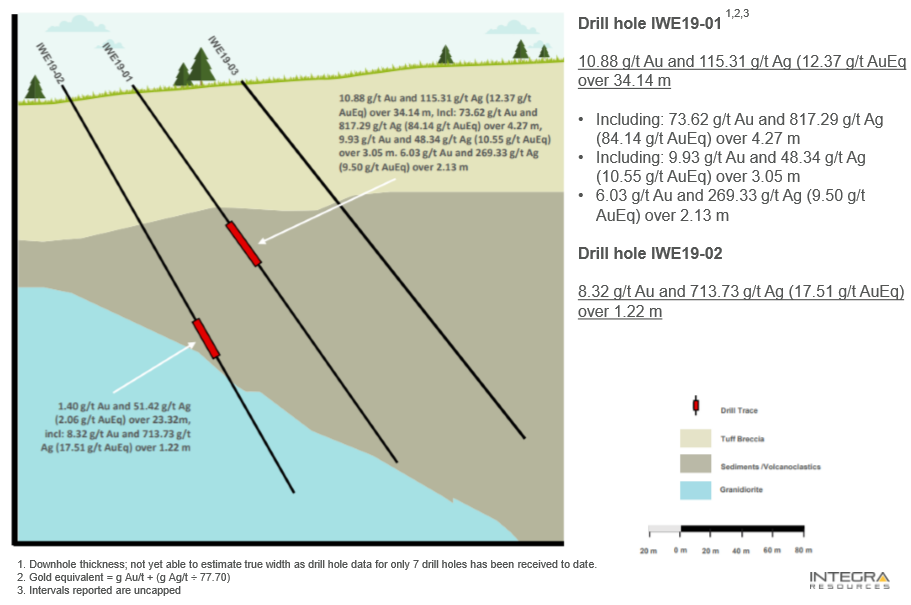

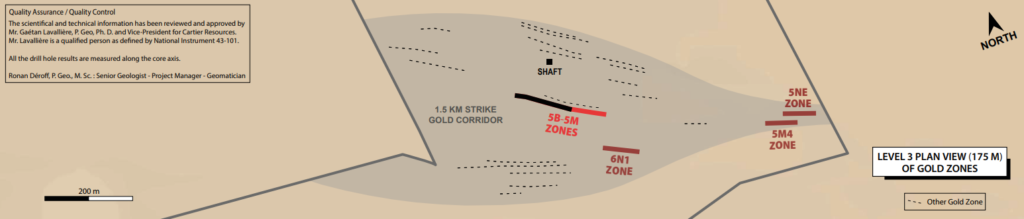

This cash will be put to work right away with a 42,500m drill program, which currently has 95 high grade gold targets, many of which are below 800m.

Monarch has retained the services of Goldspot Discoveries (SPOT:TSXV), which uses their expertise in geosciences and advanced artificial intelligence algorithms to aid in the efficiency and success rate of exploration.

The company hopes to delineate enough resources for 3 to 4 years of production and are targeting a re-start of the operation by Q1 2021.

So, economically speaking, what can we expect from Beaufor upon re-start?

That’s a very important question.

As I mentioned, last summer, Beaufor was put on care and maintenance because it was losing money at roughly US$1350/oz gold.

We can conservatively say, therefore, that the operating cost moving forward is probably around US$1400/oz gold.

At gold’s current price, therefore, we are looking at a profit margin in the order of $300/oz, which is great.

Monarch operated Beaufor for 18 months prior to shutdown and was producing at a rate of roughly 20,000 oz per year.

Now, assuming that this is the rate which they will produce at in the future, we can make a rough estimate that Beaufor could cash flow $6M a year.

Honestly, though, considering that the company is targeting grades much higher than the 4.5g/t gold, which they were mining prior to the shutdown, the cash flow generation could be much higher.

For the sake of this valuation, let’s assume that Beaufor on a discounted basis is worth $20M.

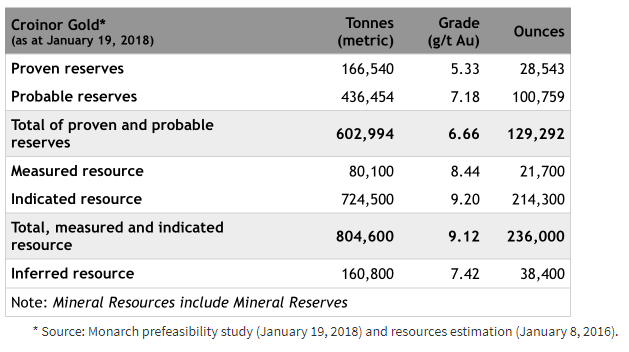

Croinor Gold

The Croinor Gold project sits just 55km east of Val d’Or and encompasses over 151 square kilometres.

Croinor is well developed with a 2018 PFS on the project.

Croinor Gold Project 2018 PFS Highlights:

At US$1280/oz gold

- After-tax NPV@5% – $18.3M

- After-tax IRR – 30%

- Mine Life – 2.6 years

- Upfront CAPEX – $32.8M ($17.2M sustaining CAPEX over LOM)

Using the PFS sensitivity table, you can see that at roughly today’s gold price, US$1664/oz, the after-tax NPV of the project increases to $50.64M.

Now, these aren’t earth-shattering numbers, but I can clearly see how Croinor has the potential to be a great spin out or acquisition target for a new junior gold company – especially given the current market dynamics.

For the sake of our valuation, let’s assign a value of $15M, which is roughly 30% of the project value given the current gold price.

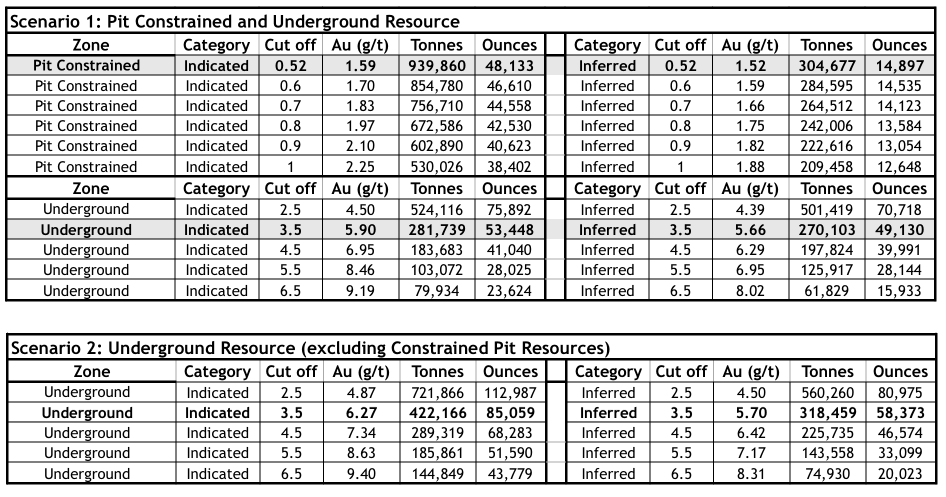

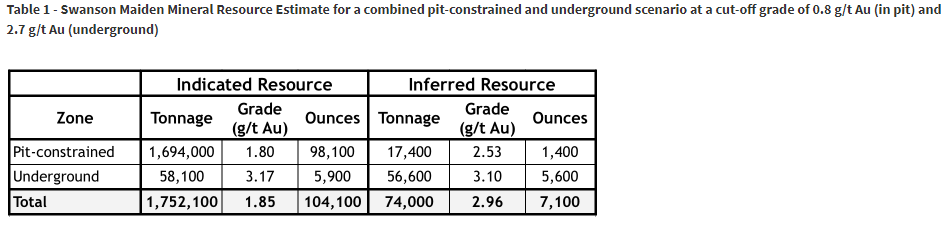

McKenzie Break & Swanson Projects

Last but not least, we have the McKenzie Break and Swanson projects.

Both projects have 43-101 resources, but no economic studies completed on them.

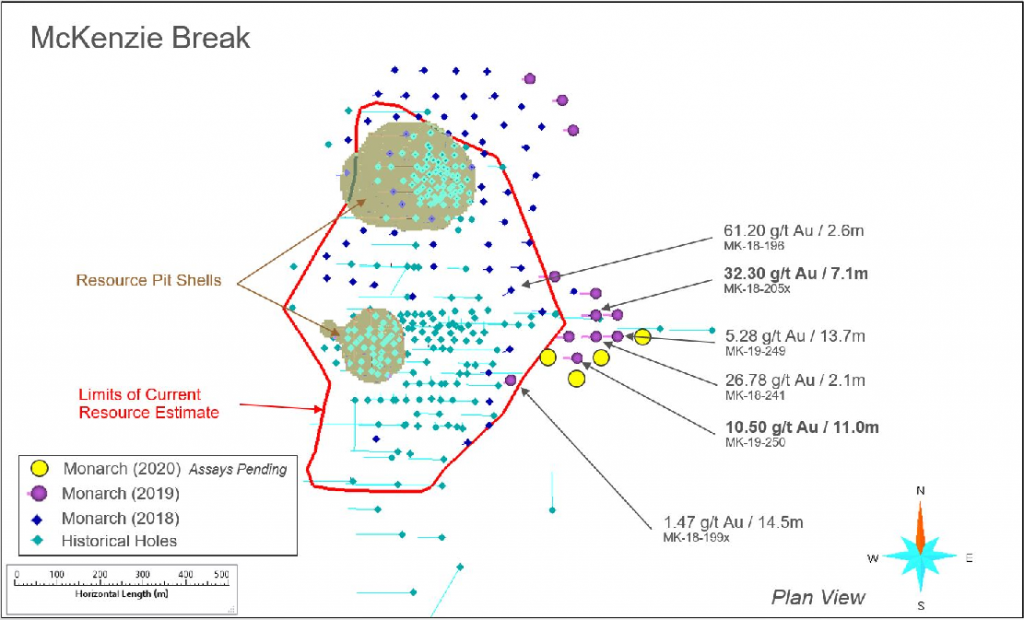

Most notably, exploration drilling below the current resource at McKenzie Break returned some fantastic intervals in February which were highlighted by:

- MK-18-205ext – 32.30 g/t gold over 7.1m, including 142.80 g/t gold over 1.2m, 26.97 g/t gold over 1.3m and 24.60 g/t gold over 0.7m

- MK-19-249 – 5.28 g/t gold over 13.7m, including 58.17 g/t gold over 0.6m and 21.04 g/t gold over 0.8m

- MK-19-250 – 10.50 g/t gold over 11.0m, including 156.00 g/t gold over 0.6m and 13.15 g/t gold over 1.0m

- MK-19-251 – 7.04 g/t gold over 6.0m, including 25.92 g/t over 1.0m

Monarch plans to follow up and continue to explore the McKenzie Break property. It recently completed a 1,600-metre drilling program, with results pending.

Building on these results will further increase the value of the project and make it another prime candidate for Monarch to sell into this high gold price environment.

To round out the valuation of Monarch’s secondary projects, let’s assume that collectively the McKenzie Break and Swanson projects are worth $5M.

Risks to Investment

Gold Price – The gold price remains, in my opinion, the biggest risk to Monarch Gold’s share price. As I have noted before, however, this risk is ubiquitous across the sector. In my view, the gold thesis has never looked better and, thus, I’m inclined to think that there is a much better chance we will see higher gold prices ahead – time will tell.

Covid-19 – The Covid-19 pandemic continues to present a risk to the entire world. For companies such as Monarch, the risk is in the delayed development of their projects. A 2nd wave of lockdowns due to Covid-19 could put Monarch’s action plan on hold and, therefore, provide little return to investors as cash would only be going to G&A.

At this point, it’s still hard to say where we are headed this fall.

Wasamac – It’s entirely possible that the market will not recognize the value of Wasamac until there is more clarity on the reduction in upfront CAPEX costs. Ausenco is mandated to have their report completed by October of this year, so we should have a good idea of the cost of upgrading the Kidd concentrator by then.

In my estimation, I’m guessing we will see a number of around $50M. Therefore, the overall savings with the toll milling agreement should be around $180Mish.

Will this be good enough for the market?

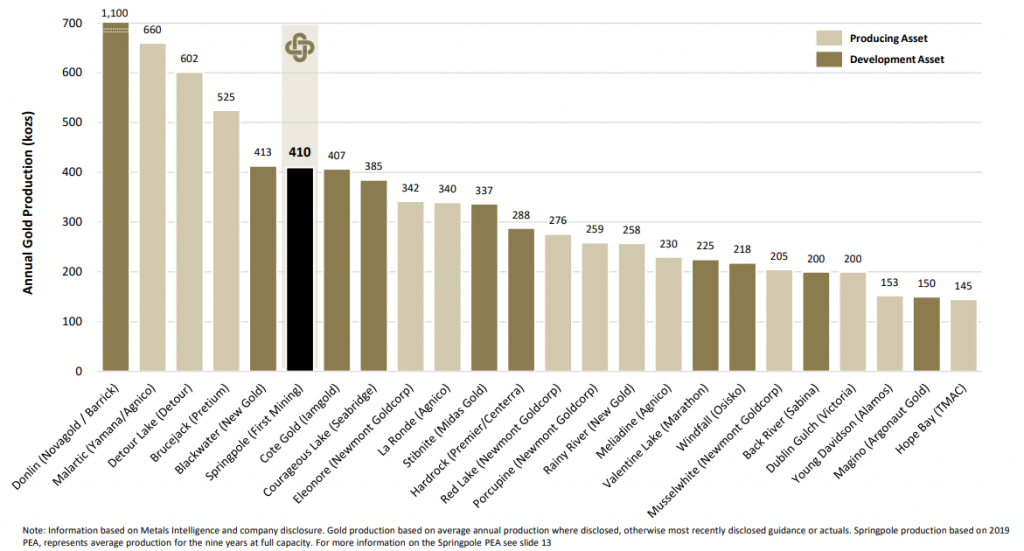

Remember, the Wasamac gold project is one of only a handful of projects in Canada and the United States that has had an FS completed and has the production capacity of at least 100Koz/year.

With that in mind, I think it’s only a matter of time before the market recognizes Monarch’s true value.

Concluding Remarks

Putting it all together, Monarch has roughly $25M in cash, a total equity holding of $3.2M (this is most likely higher given the market dynamics), and, conservatively, has a collection of secondary projects that are collectively worth $50M.

The market is, therefore, currently valuing Wasamac, which is a FS level project with an after-tax NPV@5% of $750M at the current gold prices, at approximately $63.4M.

In comparison to its peers, no matter how you slice it, this is incredibly cheap.

With that said, Monarch does have some work to do to improve on upfront CAPEX costs for Wasamac.

They must make a good deal with Glencore or another suitor in the area to toll mill Wasamac’s future production.

The economics of the toll milling agreement will be officially shown in the updated FS, which is expected next year.

Along with this, they must continue to development and have an eye to monetize the secondary projects within their portfolio.

Given the current market dynamics and very strong case for high gold prices, Monarch is in an enviable position when it comes to negotiating for the best deals on their projects.

Monarch Gold is selling at a fraction of its value and, given management’s plan for the next 6 to 12 months, I believe it’s only a matter of time before their value is recognized.

I am a buyer of Monarch Gold (MQR:TSX).

Get the e-book Junior Resource Sector Investing Success: The Risks, Rules & Strategies You Need to Know today, when you become a FREE Junior Stock Review VIP

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review Premium

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with Monarch Gold Corp (MQR:TSX). I do own shares in Monarch Gold Corp.