I’m constantly searching the junior resource sector for

companies whose share price is trading for less than their value. In January of

this year, I became an investor in Amarillo Gold, a junior company which I

believe is trading for far less than their value.

A couple of weeks ago, I had the chance to travel to Brazil and

see Amarillo’s flagship Mara Rosa Project, which is located in the northwest

portion of the State of Goias.

Rafael Silveira,

Myself, Frank Baker

The site visit was highly beneficial because it confirmed for

me why I’m invested in Amarillo and why I believe it will be Brazil’s next gold

mine. My reasons are as follows:

- The Amarillo management team is well suited to moving Mara Rosa to and through construction, as their pedigree reveals a history of developing projects in Brazil. From the CEO to the team located in Brazil, each member has been in the mining industry a long time and has a specific skill set which is applicable to the development of Mara Rosa.

- The Mara Rosa Project is advanced with an updated Pre-Feasbility Study (PFS) completed in the fall of 2018. The PFS revealed an after-tax NPV@5% of $US 244.3 million at $US 1300/oz gold, which means, at the time of writing, with a MCAP of less than $30 million CAD, the company is currently trading at less than 10% of its PFS after-tax value.

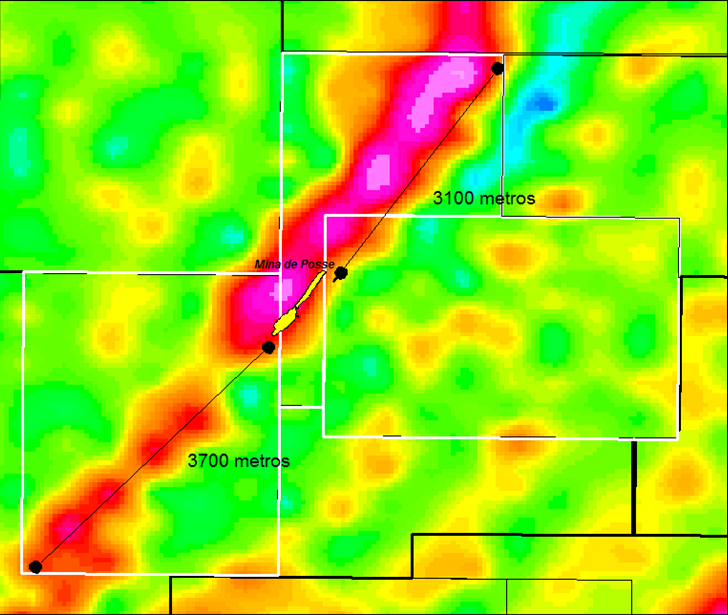

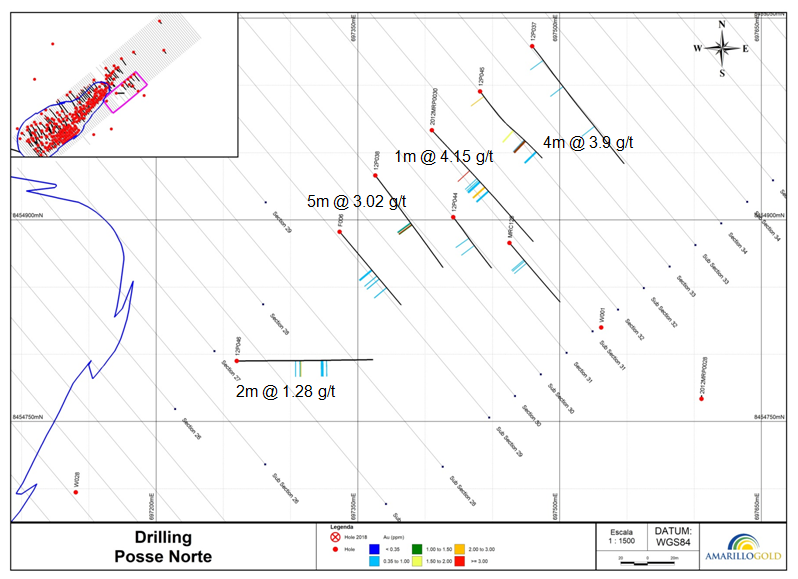

- Expansion of the resource – There is a realistic probability of expansion of the Posse Deposit resource at depth and to the northeast. Examining soil sampling, geophysics and historical drilling, the northeast portion of the property looks particularly interesting to me, given its size. Drilling isn’t a priority at the moment for the company, but could spell more upside potential in the future.

- While a controversial figure, Jair Bolsonaro will bring about a positive economic change to Brazil. This is already evident with the pension reform bill which is moving through the Brazilian government’s approval process, as I write. Ultimately, I believe Amarillo’s current price to value proposition is well worth the risk.

- The town of Mara Rosa and its people, from what I could tell, view the construction of the mine positively and look forward to the jobs that it will bring. There are many active and former mines in the northern region of the State of Goias, making it a great spot for development.

- Takeover Candidate – while I believe Amarillo is currently a takeover candidate, I believe that upon the completion of the Definitive Feasibility Study (DFS) it becomes much more appealing to senior or mid-tier mining companies, as the DFS will bring more confidence and validation to the economics of the project.

Amarillo isn’t without risk; I

believe there is at least one hurdle which the company must overcome in order

to be fairly valued by the market. That hurdle is the metallurgy of the Posse

Deposit, which has been a major focus for the company since they purchased the

deposit from Western Mining in 2003.

While the mineralization is

complex, I believe the company is on track for proving up and optimizing the

metallurgical process that is needed to economically extract the gold from the

Posse deposit ore.

In my opinion, Amarillo Gold is

trading for less than its value. I was a buyer at 20 cents and believe a

re-rating in the share price is just around the corner.

Without further ado, a look at

why I am a buyer of Amarillo Gold.

Enjoy!

Amarillo Gold

MCAP – $28.8 million (at the time of writing)

Shares – 140.8 million

FD – 185.6 million

Cash – $3.0 million (as of June 30, 2019)

Insider Ownership – 10%

Institutional Ownership – 60%

Bolsonaro’s Affect on Brazil

In the fall of 2018, I wrote an article

on Brazil and why I’m optimistic about its future. My thesis was primarily

based on, at the time, presidential candidate Jair Bolsonaro winning the

election and taking control of the country.

For those who are unaware, Bolsonaro was victorious and is

now the President of Brazil.

So now, roughly 9 months later and with the basis of my

thesis fulfilled, what do I think about Brazil and its future, now having spent

close to a week there? Am I still optimistic?

Determining the answer to this question has been much harder

than I would have guessed prior to my trip. I believe Bolsonaro will have a

positive effect on Brazil’s economy, because he is seemingly dedicated to

minimizing the amount of corruption in the government and to appointing

leadership within it based on merit, not to fulfill a favour or bribe. This

will have very positive effects.

During my trip, I actively engaged as many Brazilians (who

spoke English) as I could to learn about their views of Brazil, mainly where it

is as a country and where it’s headed under the leadership of Bolsonaro.

Interestingly, much like Trump in America, Bolsonaro has a

polarizing affect on people; they either love him or they hate him. Even some

of the Brazilians who said they voted for him, hate him. I found this

particularly interesting and wanted to know why.

Most often, I was

told that there wasn’t anyone else to vote for and, bottom line, government

corruption has to be reduced for Brazil to be successful.

Of the younger generation, let’s say under 30, I met only

one person who thought that Bolsonaro was good for the country. The rest hated

him and said that he is going to destroy it as he takes away some of the

services and “privileges” that many of the Brazilian people have come to rely

upon.

Further, the same younger generation yearns for former

President and now convicted criminal, Lula Da Silva, who is currently in jail

for his involvement (while President) with Operation

Car Wash. In my opinion, this is truly bizarre, but goes to show you that

people only see what they want to see.

There is much more to this discussion, but I will leave it here

because it’s out of the prevue of this article. My conclusion on Brazil is this;

I believe Bolsonaro will have a positive effect economically on Brazil, which,

ultimately, should make it a more desirable place to do business during his

reign.

What I have seen, however, only strengthens my thought that

it takes multiple generations or hundreds of years to change a culture and,

therefore, while Bolsonaro will have an impact during his term, it will be

minimal and short lived, as I do expect to see a return to a left-leaning

government in the future.

With this said, in my opinion, investing within a “risky”

jurisdiction is always a matter of a risk adjusted price to value comparison.

Meaning, am I getting enough upside potential to warrant investment?

Additionally, remember that there is risk in every

jurisdiction, even the ones that are widely thought to be tier 1 locations for

mining investment. I will quote Rick Rule, CEO of Sprott U.S. Holdings, who

recently said to me,

“Mostly the controllable aspect of political risk is price

and probability…I would argue with you right now that the People’s Republic of

British Columbia, which is regarded as a superb place for politics, is

extraordinarily risky. The BC provincial legislature is a joint venture between

the Socialists and the Greens. Not exactly mining’s best friend… Yes, Brazil

has a long standing history of formal corruption. I would ask you what the

difference between a campaign contribution and a bribe is.” ~

Therefore, with regards to Amarillo Gold, in my opinion,

there’s enough upside potential to warrant investment in the company, as it’s

currently trading at less than 10% of its updated PFS after-tax NPV of $US 244.3

million.

Amarillo’s Leadership

Amarillo is led by CEO, Mike Mutchler, who is a mining

engineer by trade. Mutchler’s experience in the sector relates well to the

needs of Amarillo, as he is an experienced mine builder. Most recently,

Mutchler was COO of Largo Resources, which built a vanadium mine in Brazil.

Although he hasn’t been a CEO, his skill set and education,

in my opinion, should be the perfect recipe for what Amarillo needs to be

successful in completing their FS on the Mara Rosa Project and, most

importantly, making it Brazil’s next gold mine.

Next, we have Roland Uloth, who is Amarillo’s Executive

Chairman. Uloth has extensive experience within the business world, with the

last 20 years focused on the mining sector. Notably, Uloth has been a key

executive with both River Gold Mines and Wesdome.

Additionally, I think it should be noted that Uloth has been

a major buyer of Amarillo stock on the open market, as the SEDI insider buying

report is littered with his purchases. According to SEDI, Uloth currently owns

over 6 million shares, excluding warrants.

Finally, and arguably the most important member of the

Amarillo team at this juncture, is Arao Portugal, who was just officially named

Amarillo’s

Country Manager. Country Manager isn’t a common position within a junior mining

company, but makes complete sense in this case.

Portugal brings a unique set of skills and experience to

Amarillo, which I believe are vital to the overall success of the company as

they look to attain their final 2 permits – the Installation License (IL) and

the Operation License (OL).

There are a few more important players on the Amarillo team: Frank Baker – Metallurgist and Project Manager, Luis Carlos F. Da Silva – Geology Manager, Alexandre Elisel and Rafael Silveira – Geologists.

Mara Rosa Project

The Mara Rosa Project encompasses roughly 60,000 ha and sits

just a few minutes’ drive from the centre of the town of Mara Rosa, which is

located in the northern portion of the State of Goias. This region of the State is very familiar

with mining, as there are a number of former and currently operating mines in

the region.

Most notably is Lundin’s Chapada copper-gold Mine, AngloGold

Ashanti and Kinross’ Serra Grande Gold Mine, and Anglo American’s Barro Alto

nickel mine, to name just a few. The point is, with these mines being within

100 km, the people of Mara Rosa and the surrounding area are very familiar with

mining and the benefits that come with it.

Amarillo’s Main

Office and Core Shack – Located in Mara Rosa

As well, given the amount of mining in this portion of the

State, infrastructure is good; in particular, power is readily accessible with

a sub-station within 4 km of the Mara Rosa Project. The hydro power in this

area is supplied by the 450 MW Serra Mesa Hydro Electric dam.

Pre-Feasibility Study Economics

In September of 2018, Amarillo released an updated

PFS on Mara Rosa and revealed some very robust economics.

Contractor Mine Scenario

Gold Price Assumption – $US 1300 per ounce

After-tax Net Present Value (NPV) at a 5% discount – $US

244.3 million

After-tax Internal Rate of Return (IRR) – 50.8%

CAPEX – $US 122.9 million

AISC – $US 655 per ounce

Reserves (Proven and Probable) – 1.087 Moz of gold

Resources (Measured and Indicated) – 1.3 Moz of gold

Satellite Image of

Mara Rosa Project

In my opinion, the Mara Rosa Project has great economics,

with good downside risk protection in terms of the gold price. Robust economics

at the PFS stage of development is a really good sign, as there is a higher

degree of confidence that the Project can deal with issues that may arise given

the rigorous analysis which is yielded by the DFS.

Site Visit – July 2019

My trip to Mara Rosa, Brazil from Toronto was very

straightforward. I flew overnight from Toronto to Sao Paulo, which is

approximately a 10.5 hour flight. To note, Sao Paulo’s Guarulhos International

Airport has seen some great upgrades since I was last in Brazil in 2011. I’m

guessing that the 2016 Rio Olympics brought about this overhaul.

Next, I had a short 2 hour flight from Sao Paulo to Brazil’s

capital, Brasilia. Interestingly, after doing a 17.5 hour flight from San Francisco

to Singapore in April of this year, I found these flights to be easy!

Brasilia Airport –

Domestic Terminal

From Brasilia, a company representative picked me up at the

airport and we headed northwest to the town of Mara Rosa, which is roughly a

4.5 hour drive. The drive between Brasilia and Mara Rosa is pretty good

considering the amount of heavy truck traffic those roads appear to receive.

Rest Stop Along the

Road Between Brasilia and Mara Rosa

Along with the multiple 2 lane highways that head north out

of Brasilia, there is also a railway which runs right beside the Mara Rosa

Project. Rail is a great way to reduce the amount of truck traffic, however, it

sounds like this railway isn’t used to its full extent, which is too bad as it

would save the roads and, ultimately, make them safer for commuters.

2011 View from Sugar Loaf

Mountain – Rio de Janeiro

My previous trip to Brazil was spent in and around Rio de

Janeiro, which is much different than what I encountered in the capital region.

Rio is a very mountainous and lush environment, which clearly gets an optimal

amount of sun and rain, as it is a veritable jungle surrounding you as you

drive into Rio.

Future Mine Site in

the Distance

By comparison, the Federal District of Brasilia and the

Northern portion of the State of Goias is much different. In terms of

topography, it is much flatter, drier and open, with farmers’ fields lining the

highways. The region, however, does have a rainy season where the rain fall is

very heavy, which allows for the endless farmers’ fields and well-established

jungle-like vegetation.

Northeast Corner of

the Posse Deposit

NOTE: The area

surrounding the town of Mara Rosa is known for its production of turmeric

spice. While walking the property, one of the geologists pointed out some

turmeric bulbs lying on the ground. There are fields of these plants, their

bulbs are harvested, dried and ground into a powder, which is then packaged and

sold in grocery stores. Farming is the major industry in this part of Brazil

and is what currently drives (economically) towns such as Mara Rosa.

Expansion of the Posse Deposit

As per the 2018 updated PFS, the Posse deposit has 1,087 koz

of proven and probable gold reserves at an average grade of 1.42 g/t. While

this is great, more ounces would be even better and, given what I saw onsite

and reviewing historical exploration data with the geological team, there’s

reasonable probability that the Posse Deposit could be extended at depth and to

the northeast.

Reviewing some of the past geophysics on the deposit, you

can clearly see that the anomaly, of approximately twice the size of the

existing deposit, extends out to the northeast. The focus of previous drilling

campaigns has been on the main deposit, however, there is historical drilling

data on a few holes that have been drilled along the northeast extension.

As you can see in the image above, there hasn’t been much

step out drilling, but what has been done has returned some decent hits. I

believe it will be well worth the time and money to see if it’s something of

significance.

One other note, while an

extension to the northeast of Posse would be great, under the current

Preliminary License (LP), the seasonal creek that cuts perpendicularly across

the strike of the northeast extension would prevent Amarillo from expanding

their current pit to include the new discovery.

However, the company does have

the option to apply for modifications to their existing LP, which, if they

choose to, could include the temporary re-routing of the creek so that this

northeast area is available for mining.

Seasonal Creek in the

northeast of the property

Tailings Dam

The tragic failure

of Vale’s tailings dam in the neighbouring State of Minas Gervais resulted

in the death of 300 people. Talking to many mining engineers, the design of the

dam that failed has long been known to have some major weaknesses and, thus, in

my mind, was preventable.

Moving forward, similarly designed tailings dams can be

upgraded to prevent this from occurring again in the future. It sounds like the

Brazilian government, however, is going a step further and will announce the

banning of all tailings dams in future construction, regardless of the design.

In my opinion, this is a knee-jerk reaction to an issue

which is solved through proper engineering and, most of all, the diligence of

the companies that operate these mines and tailings facilities. Banning the

construction of this integral part of a mine is crazy.

In saying this, there are alternatives to the traditional

tailings facilities and, with this in mind, Amarillo’s leadership has decided

to proactively pursue one of these alternatives given the potential direction

of the Brazilian Government.

Reviewing the

location of Tailings Mat Storage

So how does this new approach affect Amarillo’s mine plan

and economics? That’s a great question. First off, the company is pursuing a horizontal

filtration technology which is proven to reduce the moisture content of the

tailings. The end product of the process yields what the company reps were

describing as tailings mats.

These tailings mats are still required to be stored in a

lined storage facility, meaning the basis of construction for the original

tailings dam will still be used to dry stack the mats. The company reps tell me

that this change in process shouldn’t cause any issue with their already issued

preliminary license (LP).

In all, the cost for the filtration system is roughly $US 10

million in CAPEX dollars and is estimated to require another $US 1 per tonne in

operating cost per year over the course of the life of the mine. I haven’t

added this new cost to my discounted cash flow model yet, but given the

economics of the project, I’m guessing this won’t be a huge issue.

Archeology Testing

Standard practice in Brazil is to conduct archeological

studies on the properties that are moving toward construction. This process

requires a certain amount of area on a property to be studied for historical

significance.

During my visit, a team of archeologists was on site

performing the study. For someone who finds these studies really interesting, it

was great to have the opportunity to see part of the process in person.

At the dig site I visited, they had just discovered some remnants

of bowls and an area which had been used

for fires at some point. In the image below, to the right of the teal pan, the

bowl artifacts have been outlined in small white pins. These artifacts will be

removed from site and stored in a museum.

While the archeological study is not over, it is expected to

have minimal to no impact on the Mara Rosa Project construction plans, which is

good to hear.

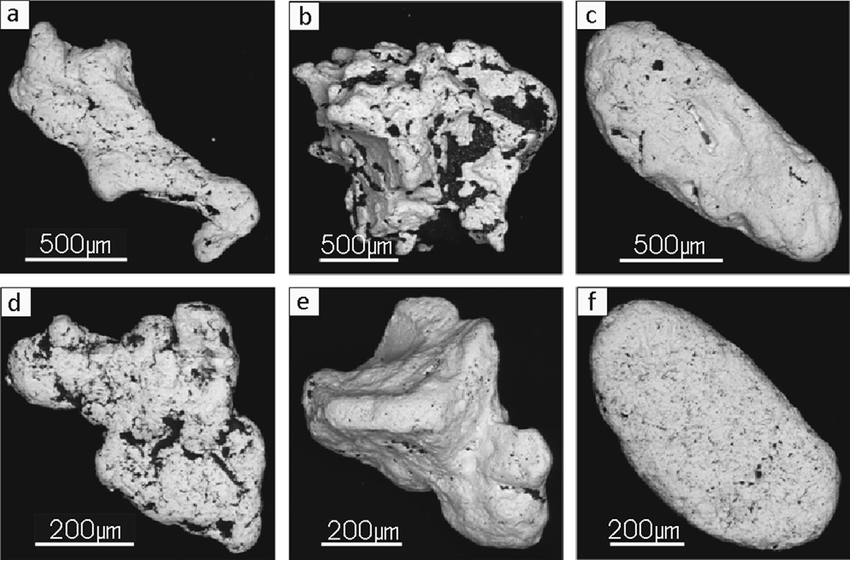

Metallurgy

As I mentioned in my intro, the metallurgy of the Posse

Deposit is most likely the largest hurdle to the success of Amarillo moving

forward. I am, however, personally very encouraged by what I see in the testing

the company has performed to date, and believe that the metallurgical testing

performed for the FS will turn the tide, in terms of how the market views the

risk associated with the economic extraction of the gold.

There’s much to cover with regards to the metallurgical

processing of the Posse Deposit mineralization, so I’m going to cover this in a

separate Part 2 of this article.

Concluding Remarks

Currently, Amarillo Gold is selling at a fraction of its

updated PFS NPV, which, I believe, gives an investor plenty of upside potential

given the risk associated with the company. Amarillo’s focus is completion of their DFS,

which will pave the way for the remaining permits and, ultimately, the

construction of Brazil’s next gold mine.

Stay tuned for Part 2 of my Amarillo Gold Site Visit article, where I will cover the Posse Deposit’s metallurgy and why I believe the company is on the right track to put this risk behind them.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer:

The following is not an investment recommendation, it is an investment idea. I

am not a certified investment professional, nor do I know you and your

individual investment needs. Please perform your own due diligence to decide

whether this is a company and sector that is best suited for your personal

investment criteria. Currently, I do own Amarillo Gold Corporation stock.

All Amarillo Gold Corporation analytics were taken from

their website and press release. Junior Stock Review has NO business relationship with Amarillo Gold Corporation. Amarillo Gold Corporation did pay for travel expenses for the site visit.