Gold continues to march its way upward, breaking US$1,500 /oz and setting all-time highs in numerous other currencies, including the Canadian and Australian dollars. While this is music to the ears of the gold producing companies around the globe, the rest of the world is bracing for turmoil.

Tensions in Asia have hit new highs with the protests in Hong Kong appearing to escalate. Hong Kong’s airport has been shut down, and the Hong Kong people have taken to the streets waving the American flag and singing its anthem; a sight I wouldn’t have believed had I not seen the video clips.

China is not only fighting to maintain its control over Hong Kong, but continues to fight the Americans over trade. In my opinion, the longer this goes on, the worse it is for the global economy, as China remains an integral piece of the financial puzzle.

To add further complexity to the global marketplace, the U.S. Federal Reserve cut interest rates by 0.25%, signalling weakness in the U.S. economy. The currency wars continue, as they inch closer to fiats intrinsic value of 0.

While I can’t predict the ebb and flow of any commodity, I think it’s safe to say that the world is, unfortunately, ready for higher gold prices and, with it, we are most likely to see some type of climactic event which will trigger a reset for the global economy.

Now that seems like a gloomy outlook, but on the bright side, while that scenario may be inevitable, it doesn’t mean it’s imminent. Secondly, as an investor, I think you have to ask yourself, ‘how can I profit from a world which is in financial turmoil?’

First off, I should rephrase my question, as it most likely isn’t a case of how to profit, but more how to maintain what you have, given the circumstances.

Buying physical precious metals is definitely prudent and, given the attention high gold prices bring to the precious metals companies, investment in the best junior resource companies should prove to be very profitable.

In my opinion, equating future high metals prices with investment in junior companies is a recipe for inevitable failure, however, given that the majority of the market works this way, I expect to see irrationally high junior company valuations in the not-too-distant future.

Last week, I visited 3 junior gold companies that are all situated in close proximity to Val d’Or, Quebec. For those who aren’t familiar with this area, Val d’Or is famous for its historical gold production, as this eastern portion of the Abitibi Greenstone Belt has produced roughly 70 Moz of gold throughout its history.

All 3 companies appear to give the investor good risk to reward potential, in a gold market which is just starting to heat up.

Let’s take a closer look at the details of my trip.

Enjoy!

Day 1 – Osisko Mining’s Windfall Project

For all intents and purposes, the Osisko story starts back in 2004 with the acquisition of the Canadian Malartic site. Founders, John Burzynski, Sean Roosen and Robert Wares, used an innovative geological analysis model to analyze Quebec’s publicly available geological data (SIGEOM). The data revealed that the Canadian Malartic site had the potential for an open pit mining operation, which prompted the team to acquire the site.

Seven years after acquisition, in 2011, Canadian Malartic poured its first gold bar, and 3 years after that, it was acquired in a friendly transaction by Agnico Eagle and Yamana Gold.

Today, Osisko Mining, the company run by this mine-building team, is focused on developing the Windfall Project, which is located in the Abitibi Greenstone Belt between Val d’Or and Chibougamau in Quebec.

On August 6th, via helicopter, I had the chance to visit Windfall. Here’s a breakdown of what I saw while on site and a few notes on the direction of the company as they push toward the completion of 1,000,000 metres of drilling.

Osisko Mining (OSK:TSX)

MCAP – $965.7 million (at the time of writing)

Shares – 273.2 million

Cash – $300 million in cash and cash equivalents

First, that isn’t a typo, Osisko is at or quickly approaching 1 million metres of drilling on Windfall. If their 3.5 km exploration hole, aptly named ‘Discovery 1,’is successful, there may be even more to come, as the deposit potentially just got a lot bigger.

3.5 km is an incredibly long hole, the longest that I have ever heard of in hard rock exploration, and I believe this is a reflection of the team which is driving the development of Osisko. Burzynski, Roosen and Wares have a vision of what Windfall could be and aren’t held back by the usual difficulties of junior resource companies – I’m mainly referring to money, here.

Osisko has raised around $400 million dollars over the last 4 years through charitable flow through financing. Charitable flow through is raised at a premium to the market share price. In Osisko’s case, the last financing was done at 1.8 times the market price.

The premium is a huge advantage for the company and its shareholders because it’s less dilutive, by almost half, than if they had to raise the cash at market prices.

Discovery 1

Why plunge the roughly $1.0 million, 3.5 km hole into the ground? There are a couple of reasons, and I believe it’s important to touch on them as they speak to the speculative upside potential in the share price.

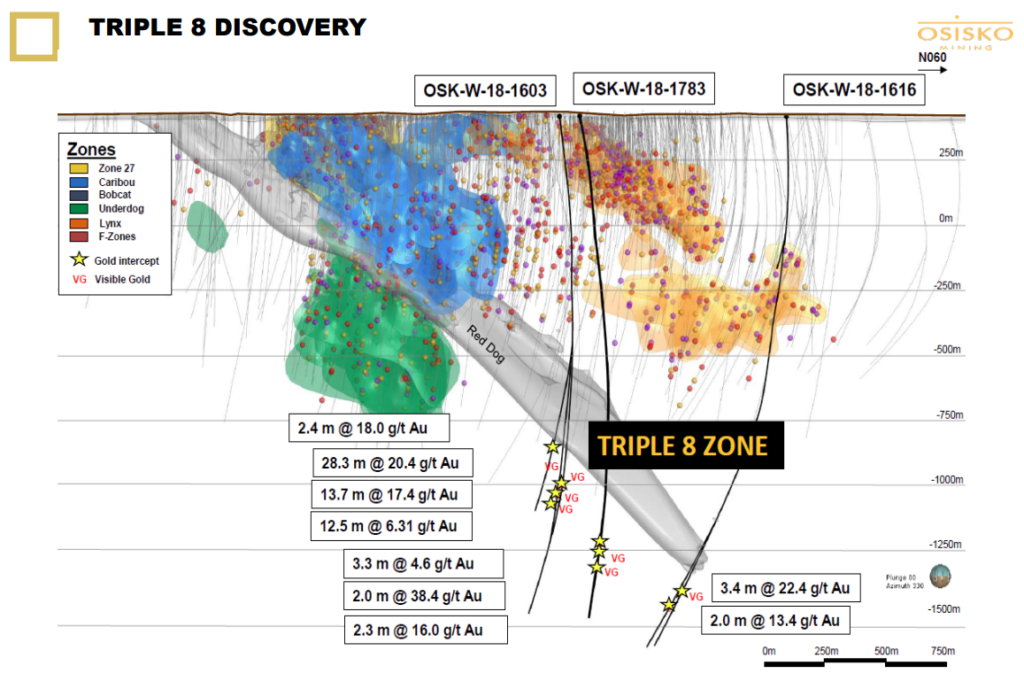

First, in exploration drilling below the known zones, that is, at depths below 750 m, they discovered the Triple 8 zone, which hit some great intervals of gold, highlighted by 28.3 m of 20.4 g/t Au, 13.7 m of 17.4 g/t Au and 12.5 m of 6.3 g/t to list just a few.

Along with these high-grade gold discoveries, they also encountered andesite porphyry and garnet and biotite alteration, which is associated with high heat, ergo they might be getting closer to the intrusive heat source.

Second, discovering gold mineralization at the bottom of this 3.5 km hole will play a huge role in the layout of a future mine. Most importantly, it would dictate if and where a shaft would be sunk to most efficiently mine the deposit.

Osisko’s geological model for the deposit is supported by the Triple 8 zone discovery and has clearly given the company’s leadership a good view of the upside potential to justify the risk of coming up with nothing.

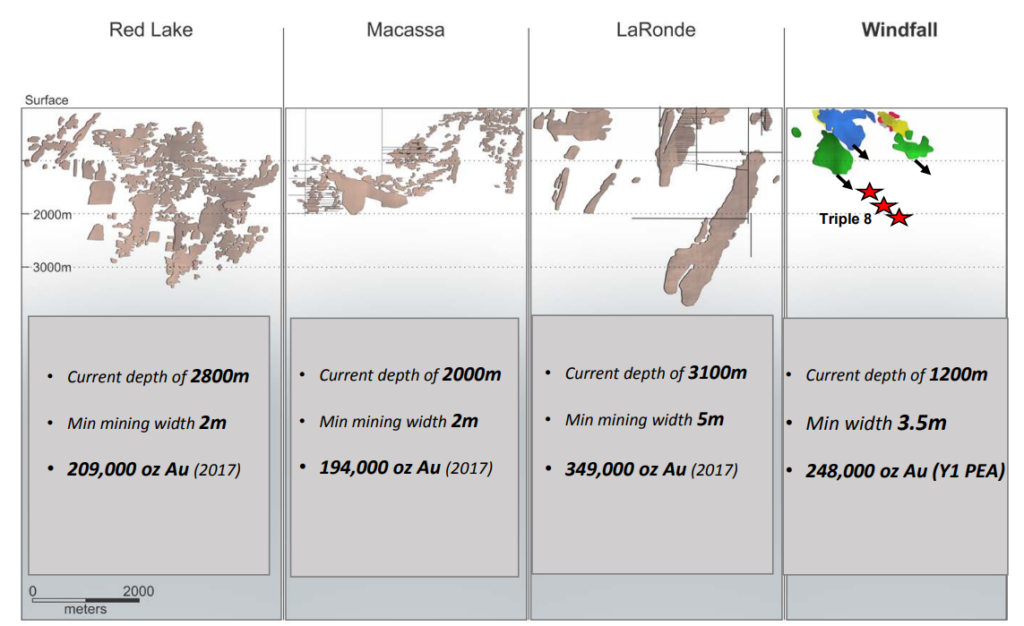

Additionally, it should be noted that there are other examples of archean gold deposits that plunge to extremes depth, none further at the moment than Agnico Eagle’s La Ronde mine, which is currently mining at 3100 m vertically below surface.

Discovery 1 has a lot of potential; it could arguably be a game changer for the Windfall Project as there is a chance that this already large gold deposit could get much bigger. In my opinion, the only risk is the roughly $1 million it cost to drill the hole, which, to a team who seemingly is a magnet for cash, doesn’t seem like as big of a risk as it would be to most junior companies.

Bottom line, at the very least, Discovery 1 should provide Osisko’s geologists with plenty of structural data on the very deepest parts of this system and, if they are so bold, will give them a good map for another shot at the prize.

Underground at Windfall

The highlight of the entire site visit tour was going underground at Windfall. It was a first for me and something that I will never forget!

We suited up in our PPE – steel-toe boots, safety glasses, hard hat + ear muffs + head lamp, coveralls, gloves and belt, and proceeded to load up into the truck which would bring us to a depth of 300 vertical metres.

8 of us were in the back of the truck, making it a cozy, hot trip down the ramp, which, I might add, was much steeper than I imagined when we started the journey.

Upon exiting the vehicle, however, it was well ventilated and cool at our first stop, where they happened to be core drilling. Being underground may not be for everyone. Heck, it may not be for me in any capacity except for a 20-minute tour, but I’m really glad I had the chance to do it at least once.

Windfall PEA Highlights

After-tax NPV@5% – C$413.2 million

After-tax IRR – 32.7%

Pre-Production CAPEX – C$392.3 million

Base case at US$1300/oz Au and US$17.00/oz Ag

A PEA on Windfall was completed last summer and released to the market. Currently, Osisko is in the process of completing a Feasibility Study (FS) on Windfall and, I believe, will show a big improvement on the NPV of the project.

One of the reasons I believe there will be an improvement is as follows:

- Removal of the triple cap on grade, which

cascades from 60 g/t, to 30 g/t, to 15 g/t on certain portions of the deposit.

- A 5500 tonne bulk sample of Windfall’s Zone 27 returned a grade of 8.53 g/t, almost 2 g/t more than the 6.76 g/t used in 2018 PEA.

- The Triple 8 Zone was discovered roughly 750m

below the surface, extending Windfall’s known mineralization much deeper than

the existing resource. As mentioned earlier, not only was high-grade gold

encountered, but also mineralization, which indicates proximity to the

intrusive heat source for the whole system.

- I believe a bigger gold resource, while being much deeper, will add to the overall value of the project.

Concluding Remarks

The investment case for Osisko Mining is compelling, as I have a high degree of confidence that the management team will be successful in constructing Windfall into Quebec’s next gold mine. The only questions I have are related to how much upside potential they can create leading up to a construction decision.

As I covered in this article, there are a number of factors that I think will make Windfall more economically appealing in the months ahead, but how appealing will be answered by the drill bit leading up to the end of the year.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with Osisko Mining, nor do I currently own any shares. However, all of my expenses for the site visit were paid for.