A Conversation with Martin Turenne, CEO of FPX Nickel Corp.

In the junior resource sector, people are everything.

Find the right people and, more often than not, you will have found a successful investment.

For me, I met FPX Nickel Corp.’s CEO Martin Turenne in the summer of 2018 and, right then and there, I knew I’d met someone worth investing in.

Turenne is as good as CEOs get in the junior mining sector – Intelligence, Integrity and Drive.

To date, FPX has generated an 800% return for myself and my subscribers, and I believe it has the potential to reach much higher levels in the future.

In our conversation, Turenne gives his opinion on the current nickel market, an overview of the recently released updated PEA on FPX’s Baptiste project and, finally, outlines FPX’s plan for the next 6 to 12 months.

Enjoy!

Brian: The Covid-19 pandemic has affected the mining industry, shutting down or drastically reducing production from a number of different mining operations worldwide.

In terms of supply, has the Covid-19 pandemic affected the worldwide nickel supply, and if so, how?

Martin: Earlier in the year, there was significant disruption to nickel mine supply in the Philippines and temporary shutdowns of certain nickel operations in Canada and Madagascar – at one point, approximately 20% of nickel mine supply was off-line. Even with the restart of most of those operations, BMO recently noted that, taking into account disruptions to both nickel supply and demand owing to the pandemic, it expects nickel demand to exceed nickel mine supply this year. However, BMO also expects that refined nickel supply (including refining of previously stockpiled nickel ore) will exceed demand in 2020.

Brian: Measuring the impact of the Covid-19 pandemic on the metal’s supply fundamentals is fairly straightforward. When it comes to demand, however, the answer is a little more ambiguous.

I will split this next question into 2 parts.

First, in your view, regarding present or near-term nickel demand, has the Covid-19 pandemic affected nickel demand, and if so, how?

Martin: The pandemic has resulted in an approximate 5-10% reduction in most nickel analysts’ 2020 demand projections versus what they had been forecasting before the pandemic – so this removes approximately 100-200 kt of demand from 2020. As the year goes on, and as Chinese demand continues to surprise to the upside, we expect that demand disruption to be closer to 5% than 10%.

Brian: Second, it seems to me that the long-term effect of the pandemic on nickel demand could be much different than the near term.

With many questions still surrounding near-term nickel demand, how do you view the long-term nickel demand thesis; are EVs at the core of a bullish future?

Martin: Yes and no. Stainless steel demand accounts for approximately two-thirds (or approximately 1.5 million tonnes per year) of total nickel demand, so this will continue to drive overall demand growth in the short-term. According to Shanghai Metal Market, stainless steel output is only down 1.7% year-to-date – this is more robust than most analysts predicted in light of the pandemic. Remember that stainless growth has averaged 5% CAGR over the last 5- and 15-year periods and has always surprised to the upside versus analyst expectations. If stainless grows by 5% per year, this adds about 75 kt per year of new demand to the market.

In terms of EVs, they represent about 5% of nickel demand, or approximately 100 kt per year. BMO figures this number will reach about 160 kt by 2023, or an incremental 20 kt or so per year. There will be a massive impact from EV demand on nickel, but it likely won’t reach that “hockey stick” growth phase until 2025 or so.

Brian: The nickel market has attracted a lot of attention over the last few months and, in my opinion, it is directly related to a few comments by Billionaire Tesla Founder, Elon Musk.

Musk made a reference to nickel during one of Tesla’s post-earnings conference calls saying,

“Tesla will give you a giant contract for a long period of time, if you mine nickel efficiently and in an environmentally sensitive way.”

In your opinion, have Musk’s comments had an effect on the nickel market? If so, please explain.

Martin: Yes, they have. Among his many other qualities, Musk might be the best market promoter of all-time, so his call for “green” nickel has raised a huge amount of investor interest in nickel. In order to keep the cost of EV batteries (and therefore of EVs themselves) low, Tesla and other carmakers need a lot of nickel at the lowest possible price – because the price of nickel is a key driver of battery pack cost. His comments also highlight the fact that nickel is, in general, a highly carbon-emitting and polluting industry, so his call for “green” nickel really places a spotlight on the need for responsible practices in this sector – and that’s where we think Canadian projects like ours have a big advantage over nickel production in places like Russia, Indonesia and the Philippine.

For the first time in more than a decade, we are starting to see mainstream, generalist interest in nickel. For investors looking for nickel exposure, the landscape of nickel equities is very small, and generally constrained to smallcap companies like ours with market caps under $200 million. There’s potentially a lot of capital out there waiting to be deployed into a relatively small number of investable nickel companies.

Brian: The updated PEA results on FPX’s Baptiste project were just announced and I think they look great. In fact, better than I had guessed.

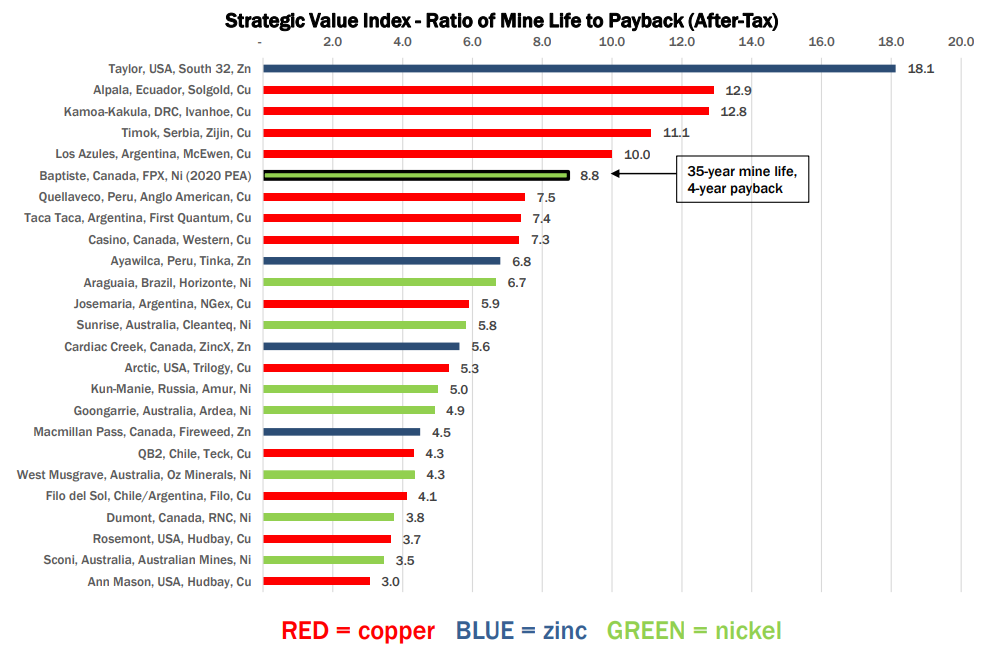

A few of the highlights – An after-tax NPV of US$1.7 billion, 35 year mine life, 1st quartile operating costs of US$2.74/lbs Ni and AISC of US$3.21/lbs Ni.

On the other side of the coin, some investors may be concerned with the upfront CAPEX cost of US$1.6 billion and, coincidently, the low after-tax IRR of 18.5%.

Martin, first, can you review the highlights as you see them from the updated PEA?

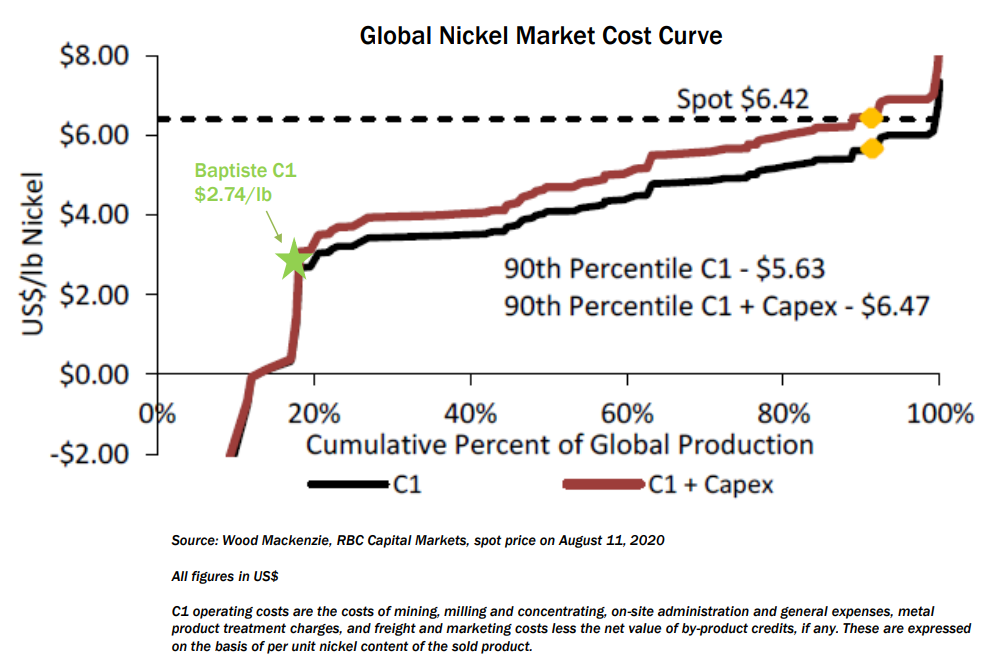

Martin: The PEA really highlights the huge strategic value of Baptiste. First, with annual output of 99 million pounds per annum, this could be one of the 10 largest nickel mines in the world. Second, the very long mine life (35 years) provides exposure to multiple up cycles in the nickel market, which as you know can be a volatile market with big swings between price highs and lows. With C1 operating costs at US$2.74/lb, Baptiste would sit in the bottom quartile of the industry cost curve, and thus provide margin protection even in periods of very low commodity prices. Finally, the fact that our testwork has demonstrated the potential to produce nickel for both the stainless market and the EV market – this really emphasizes the strategic long-term flexibility of the project for decades to come.

Brian: Following that, can you please address the concerns over the upfront CAPEX and IRR? I believe it needs further context.

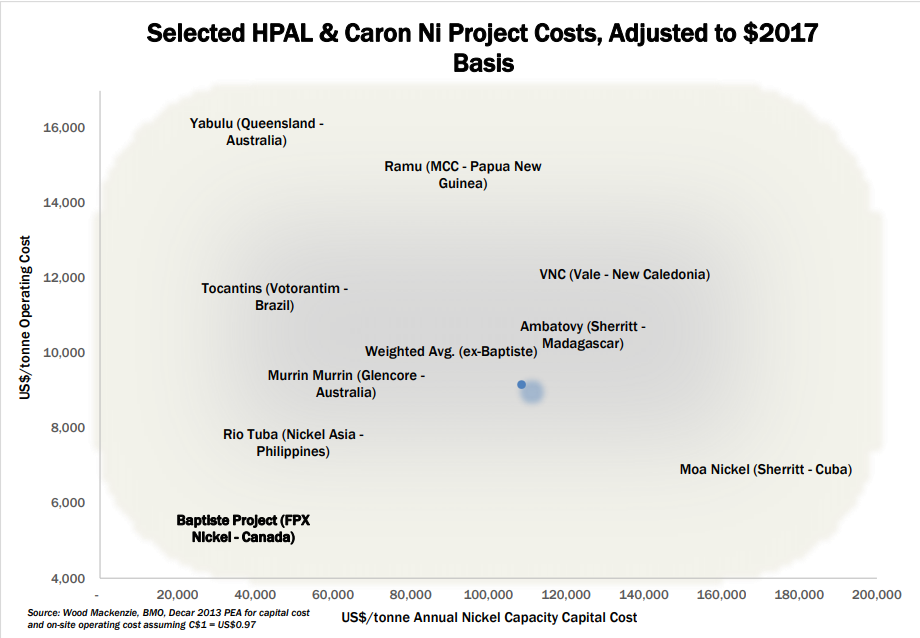

Martin: On CAPEX, building large nickel projects is very much like building large porphyry copper projects – these are inherently capital-intensive industries. During the last cycle of nickel mine construction from 2010 to 2013, major companies like BHP, Glencore and Vale built nickel mines at an average capital cost of US$4 billion. So while the CAPEX for Baptiste is by no means low, it is, actually relatively modest in the comparison to the CAPEX for other large nickel operations – either those build during the last cycle, or those projected for the next cycle.

In terms of IRR, it helps to understand the typical “hurdle rates” that major companies use to guide their mine construction decisions on large projects. An IRR over 10-12%, this is considered a strong rate of return for a large, multi-generational asset – so at over 18%, Baptiste is actually very robust given the scale of the project and duration of the project. Remember that IRR and NPV are discounting metrics – they apply a discount rate to future cash flows, so any free cash flow beyond the first 10 years of operations are heavily discounted and add very little to IRR and NPV calculations.

Brian: It isn’t a stretch to believe that the world is headed toward more stringent environmental controls. Musk’s comments are a great example of how culture shapes the direction of corporate culture.

In terms of FPX, UBC and Trent University are currently completing a study on the Baptiste deposit waste rock, which they believe may have the capacity to sequester carbon.

Can you give us an update on the study and explain how carbon sequestering, if possible, could play a large role in a future mining operation?

Martin: A few nickel companies are starting to talk about the potential for developing zero-carbon operations, but we are really taking the lead in terms of testwork and publishing data to support these claims. Our Baptiste deposit is uniquely rich in a mineral called brucite; when brucite is exposed to air in the context of a tailings facility, the mineral will naturally absorb carbon dioxide from air and sequester the CO2 in mineral form forever. The researchers at UBC and Trent University believe that Baptiste has high potential to sequester enough CO2 to completely offset the carbon footprint of the mining operation, making this a carbon neutral operation. We will be publishing test data in the coming months to support the potential for this to become a reality.

When you consider Baptiste’s scale and strong economics, and then factor in its potential to be a low- or zero-carbon project, we believe this could be very important in attracting interest from investors working under an ESG mandate, and also major mining companies, most of whom have committed to making their operations carbon neutral in the coming decades.

Brian: With the updated PEA now behind you, what is the priority for FPX over the next 6 to 12 months?

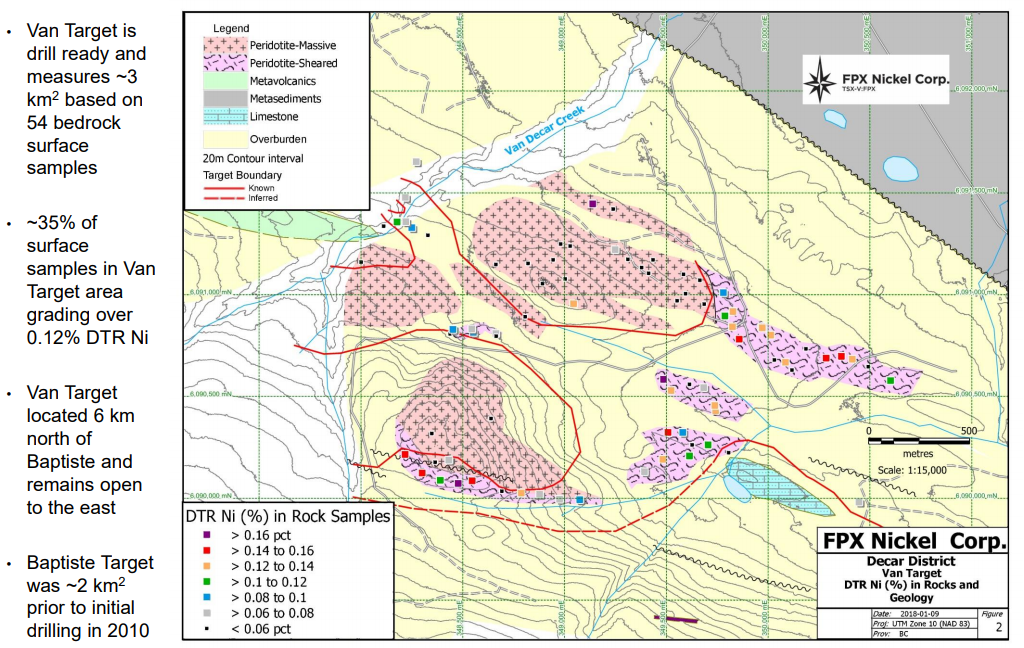

Martin: We have a dual-track strategy. First, we will advance Baptiste into the initial stages of a preliminary feasibility study, with a big focus on metallurgical test work and market testing of nickel products for both the stainless steel and EV battery markets. Second, we would like to undertake a drilling program at the Van target, which sits 6 km north of Baptiste within our 245-square km land package at Decar. Baptiste has a lateral footprint of 2.5 square km of mineralization; at Van, we have already delineated a 3 square km footprint of outcropping bedrock mineralization, with stronger grades at surface than those at Baptiste. The Van target has never been drilled, but we think there’s a strong possibility that it could prove larger and/or higher grade than Baptiste, and that we could delineate a second world-scale nickel orebody to truly make Decar a multi-generational nickel district with the scale and mine life potential that approaches the Sudbury complex. The PEA has already demonstrated that Baptiste is one of the most robust large-scale nickel deposits in the world – we’re really excited to see if Van can be even better than Baptiste in that regard.

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review Premium