A Look at Nickel & Why It’s The Best Performing Metal of 2019

The majority of resource sector investors are currently focused on precious metals, which I think is justified. Whether it be a trade war, the issuing of 30 year bonds with a negative yield, or the lowering of interests rates, clearly, there are issues with the global financial system that need to be rectified.

Precious metals, therefore, are acting like any insurance policy; their price is rising along with the increase in risk.

With that said, nickel has actually been the best performing metal of 2019 to date. Its price has risen more than 50% in the last 2 months and, today, sits at around US$8 per pound – a level not seen since 2014.

I have become well acquainted with the nickel market over the last few years and am really not surprised by the sudden price move; to me, it was inevitable. There are a number of factors that could drive the nickel price even higher in the future, the export ban in Indonesia being just one of them.

Today, I have for you an interview with someone who lives the nickel market every day, Martin Turenne, CEO of FPX Nickel Corp.

In our conversation, we touch on the history and strategy behind the Indonesian export ban, the various nickel end products in the market, global nickel inventories, the affect of the environmental policy moving forward and, finally, an update on FPX Nickel, which has recently released some fantastic news with regards to the Baptiste Deposit’s metallurgy.

Enjoy!

Brian: Many of the headlines surrounding this recent surge in the nickel price have concentrated on the Indonesian export ban and for good reason. In 2014, Indonesia introduced the first export ban and within 6 months the nickel price spiked above US$9 per pound. Now, 5 years later and the same scenario appears to be playing out.

Firstly, could you give us some historical background on why Indonesia instituted a nickel export ban in 2014?

Martin: Indonesian mines produce about 25% of the world’s nickel mine supply, but the country has traditionally been lacking in domestic refining capacity – for a long time, they were simply shipping low-value, unprocessed ore to refineries in China. Indonesians have a long history of resource nationalism, and the export ban in 2014 was implemented to force companies to build smelters in Indonesia so that the country could enjoy more of the economic benefits of producing refined nickel — to generate economic activity from capital investment and job creation. The ban was at least partly successful in achieving that goal – Indonesia is now a major producer of refined nickel.

Brian: Secondly, why are they having to ban exports again? Did the 2014 ban not produce the results they had intended?

Martin: After implementing the ore export ban in 2014, the Indonesian government partially relaxed the ban in 2017 to allow for the export of some ore by those companies which had committed to building smelters in-country. The buildout of those smelters was moderately successful, but it wasn’t happening as quickly as the Indonesian government would like it to. So, the re-implementation of a full ban is driven in part by the Indonesian government’s desire to force companies to act more swiftly in building out those smelters.

Brian: Background context is important, but really, what matters to investors is the impact of the export ban.

What is the impact of the export ban on the global market supply?

Martin:

There has been some good analysis come out in the past few days from BMO and Wood Mackenzie which concludes that the export ban will result in a 5-10% reduction in nickel supply for the next 2-4 years, versus their previous supply assumptions. The nickel market has already been in a long-term structural shortage since 2016, so this additional supply disruption is a major event. This could lead to the nickel price being sustainably higher for the next few years.

Brian: Examining the nickel price chart, while initially, instituting the nickel export ban in 2014 spiked the price, the impact seems to have dramatically declined in the second half of the year, bringing the price back to where it started at the end of 2014.

Today’s market looks much different than it did in 2014 – for a number of reasons. The first thing that comes to my mind is global nickel inventories, which are nearly half the levels in 2014.

For example, looking at the LME nickel warehouse levels, it shows that current inventory is sitting at roughly 150,000 tonnes.

An important question rarely asked, possibly out of ignorance, is what type of nickel makes up the Global inventories?

Martin: LME inventory is comprised entirely of Class 1 nickel products, typically briquettes, pellets and cathode – to qualify as a Class 1, the nickel product must contain 99.8% nickel, so basically pure nickel.

Brian: Okay, this brings us to a common misconception, that nickel sulphide mines produce class 1 nickel, which is incorrect.

So it begs the question, who does feed the Class 1 nickel market?

Martin:

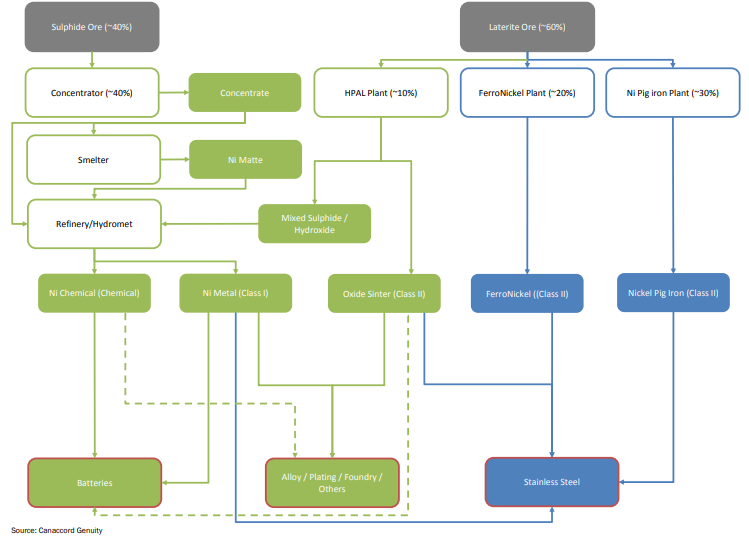

As I’ve said, Class 1 nickel is basically a pure nickel product. Class 2 nickel products have less nickel content, but they contain significant amounts of iron, which makes them highly sought after by stainless steel producers.

Class 1 nickel comes from both sulphide and laterite nickel mines. For both sulphide and laterite ore, there are several refining and processing steps required to convert the ore into a concentrate or slurry and then ultimately into Class 1 nickel – oftentimes, it’s the refiners and smelters who enjoy better margins than the actual miners themselves. That’s part of the reason that the nickel industry tends to be vertically integrated – if you’re a miner having to sell your product to a third party smelter, you are at the mercy of smelter payment terms.

Brian: Can you give us a break down of the most common end products produced by mining operations and how they fit into the global nickel market supply?

Martin: The nickel produced at most mine sites is not Class 1 nickel – sulphide miners typically produce nickel concentrate with about 15% nickel content, and laterite miners mostly produce Class 2 nickel in the form of ferronickel or nickel pig iron (NPI) with a nickel content ranging between 10% and 30%. Nickel sulphide concentrates are typically sold for a relatively low value (70-75% of the LME nickel price) to smelters, who then smelt and refine the nickel toward the ultimate production of a Class 1 nickel product. Ferronickel and NPI, on the other hand, bypass the smelting process and are sold directly to stainless steel producers for relatively high value (95-100% of the LME nickel price) due to the value of the iron contained in those products.

Brian: Keeping with the nickel supply side discussion, recently it was reported that there was a waste spill from the Chinese owned Ramu nickel mine in Papua New Guinea. The red discharge spilled from the mine was found clouding the waters of Basamuk Bay.

Personally, I only see the environment becoming a bigger issue in the future, as it’s become a hot politically driven subject.

Do you think more stringent environmental regulations will affect nickel supply in the future? If so, please explain.

Martin: In the last year alone, we’ve seen environmental and social issues lead to the closure or the threatened closure of mines in Papua New Guinea, Myanmar, Guatemala and Brazil – and that’s to say nothing of the ongoing environmental inspections in the Philippines, which is one of the largest producers of nickel globally. Well over 60% of nickel mine supply comes from emerging economies with lower environmental and social licence standards than say, Canada or Australia. As environmental and social concerns become more prominent in those emerging countries, that will ultimately lead to either the closure of certain nickel mines, or to increased operating costs for miners having to comply with higher standards. Over time, this will lead to an increase in the nickel cost curve, and therefore in the nickel price.

Brian: We have discussed all supply side issues within this interview on the current nickel market, which, in terms of gauging how strong the nickel market could be, it’s supply driven bull markets that are the strongest.

None of us have crystal balls, but in your opinion, is it realistic to think that we will see nickel prices higher than US$7.50 over the next 12 months?

Martin: Before the recent announcement regarding the Indonesian export ban, the long-term consensus nickel price forecast was $7.50/lb. The implementation of the export ban has accelerated the spot price move upward. We would expect to see more volatility in the nickel price over the next 12 months, but the updated forecasts from BMO and Goldman Sachs are already projecting an $8 to $9 price in that timeframe.

Brian: A few weeks ago, FPX released the results of their metallurgical optimization program which began late last fall. In my opinion, the results look great and should give the company a relatively unique end product which can bypass the smelter and be sold directly to the end user.

Firstly, can you give us an overview of the results? Secondly, can you speak to the possible benefits of being able to bypass the smelter?

Martin: The new metallurgical results mark a huge breakthrough for FPX. First, we are seeing recoveries in the range of 83-94%, which is a big improvement over the 82% recovery in the 2013 PEA – this will lead to an increase in projected nickel production and lower the unit cost of production. Second, we are now producing a separate iron ore by-product for the first time in the project’s history; depending on the market for our iron concentrate, this new product stream could have a positive impact on project economics. Third, the nickel concentrate we are now producing grades 63-65% versus the 13.5% concentrate in the previous PEA. Producing this high-grade concentrate means we will likely get paid a lot more for the product, something in the range of 90-95% of the LME nickel price, compared to the 75% payability assumption in the previous PEA. That’s because this high-grade concentrate is very low in penalty elements like sulphur and phosphorus, which means it will by-pass smelters and can be directly fed to stainless steel producers. By cutting out the smelter middle man, we can yield the types of payables achieved by similar products like ferronickel and NPI.

Brian: The metallurgical results certainly didn’t go unnoticed, as FPX’s recent private placement was oversubscribed. Now, with the influx of cash and the work completed over the last few years, I assume we may be headed for an update to the 2013 PEA in 2020.

What is the plan for 2020? Will we see an update to the 2013 PEA? Do the plans for 2020 require there to be sustained high nickel prices?

Martin:On closing our current private placement, we will have over $2 million in the treasury and will be fully funded to execute on more metallurgical test work, particularly leach testing of the nickel concentrates to understand if we can produce nickel in a form suitable for the EV battery market. Beyond that, and assuming the nickel price settles above the $7.00/lb level, we will be well positioned to deliver an updated PEA, with exact timing still to be confirmed.

Concluding Remarks

There is much to be gleaned from Turenne’s answers in the interview. In my opinion, many of the topics that we discussed are often over looked or misunderstood by investors. With this new or clarified knowledge of the nickel market dynamics, I think nickel investors are in a much better position to make informed investment decisions.

With that said, in my opinion, you should never buy a junior resource company because you are bullish on the price of the metal. Remember, junior resource companies are businesses that revolve around the people and their ability to execute on a plan which reflects the company’s overall vision.

If management can’t execute, nickel deposits don’t get discovered or developed and, therefore, no matter where the nickel price goes, you are most likely going to lose money.

I’m bullish on the future of nickel and, at the moment, am only invested in one junior nickel company – FPX Nickel Corp. (FPX:TSXV).

For those interested in knowing more about the nickel sector and why I believe FPX presents great risk to reward potential, check out these links:

2019 VRIC Presentation – Nickel: A Short and Long-Term Outlook

Nickel Laterite’s Integral Role in the Coming Nickel Boom

KE Report – Taking Note of the Run in Nickel

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with FPX Nickel Corp., however, I do own shares.