Anaconda Mining – An Update on Goldboro and Thoughts on the Proposed Maritime Resources Takeover

As an investor, I believe it’s very important for the leader of a company to have a vision for where the company is headed and how they will get there. While the formation and expression of a vision is important, the execution of the actions that lead to the realization of that vision is even more important – it’s where the reasoning for your investment is rooted.

Anaconda Mining’s CEO, Dustin Angelo, is a great example of where the rubber hits the road, as his vision is in line with the execution of the company’s actions. Angelo’s goal of achieving 100,000 ounces of gold production per year is well on its way to becoming a reality with the advancement of the Goldboro Gold Project, and Anaconda’s latest PUSH toward adding 43-101 compliant gold ounces to their books – the formal offer to acquire Maritime Resources.

Regardless of whether they are successful in each acquisition offer, I’m very confident that management will keep moving forward toward their goal, which will, ultimately, add tremendous value for its shareholders.

Today, I have for you an update on the Goldboro Gold Project diamond drill program, and a few thoughts on the proposed acquisition of Maritime Resources and what it could mean for both sets of shareholders.

Enjoy!

Goldboro Gold Project

For new readers who may not be familiar, Anaconda’s Goldboro Gold Project is located on the northeast coast of Nova Scotia, roughly 250 km east of Halifax. The Goldboro Gold Project has a NI 43-101 Measured and Indicated Resource of 3,645,000 tonnes at 4.48 g/t for 525,400 oz Au, and an Inferred Resource of 2,542,000 tonnes at 4.25 g/t for 347,300 oz Au.

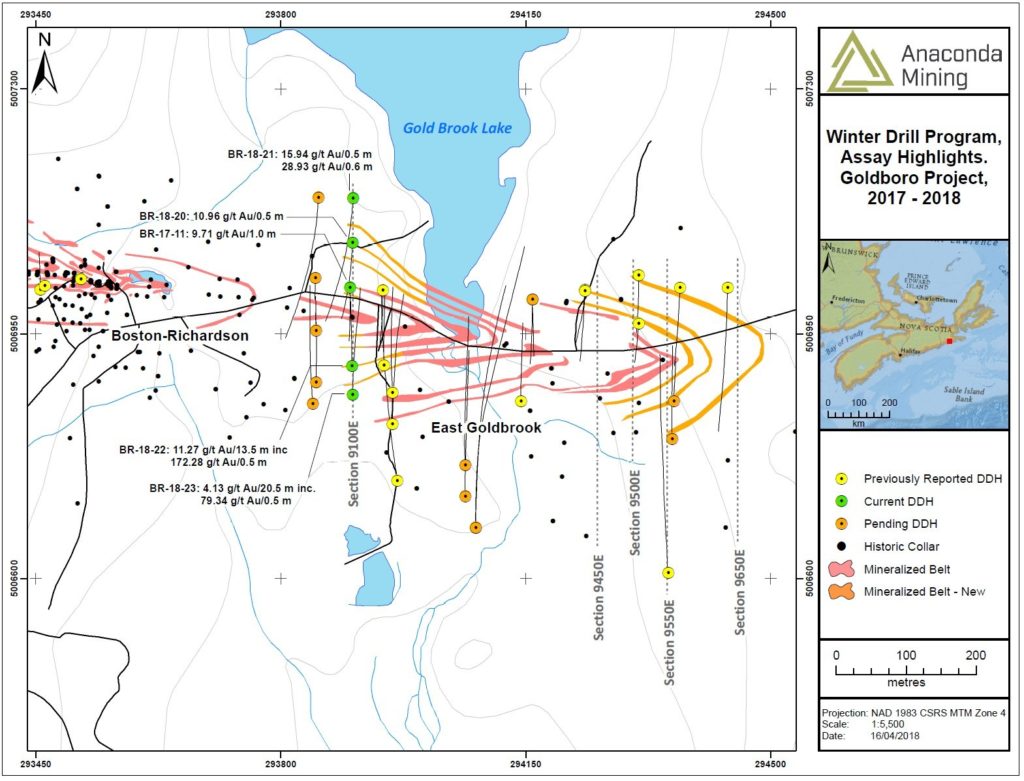

Last October, Anaconda began a 7,200 meter diamond drill program at Goldboro focusing on the Boston Richardson and East Goldbrook gold systems, with the aim of expanding the mineral resource along strike and down plunge, and to infill specific portions of the deposit to upgrade the Inferred Resources to the Indicated category.

In news released on April 19, 2018, Anaconda provided an update on 5 of the 30 holes planned in the 7,200m drill program. The news release reveals the successful extension of the Boston Richardson Gold System mineralization down-dip roughly 100m and extended the East Goldbrook system mineralization westward by 50m.

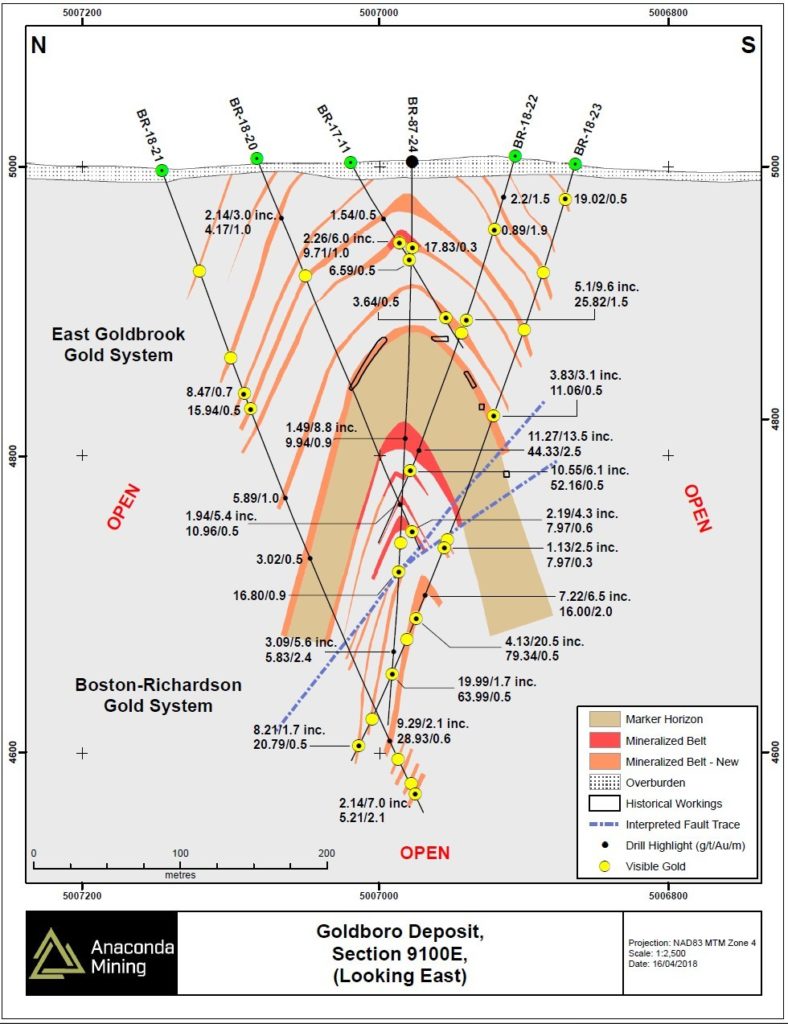

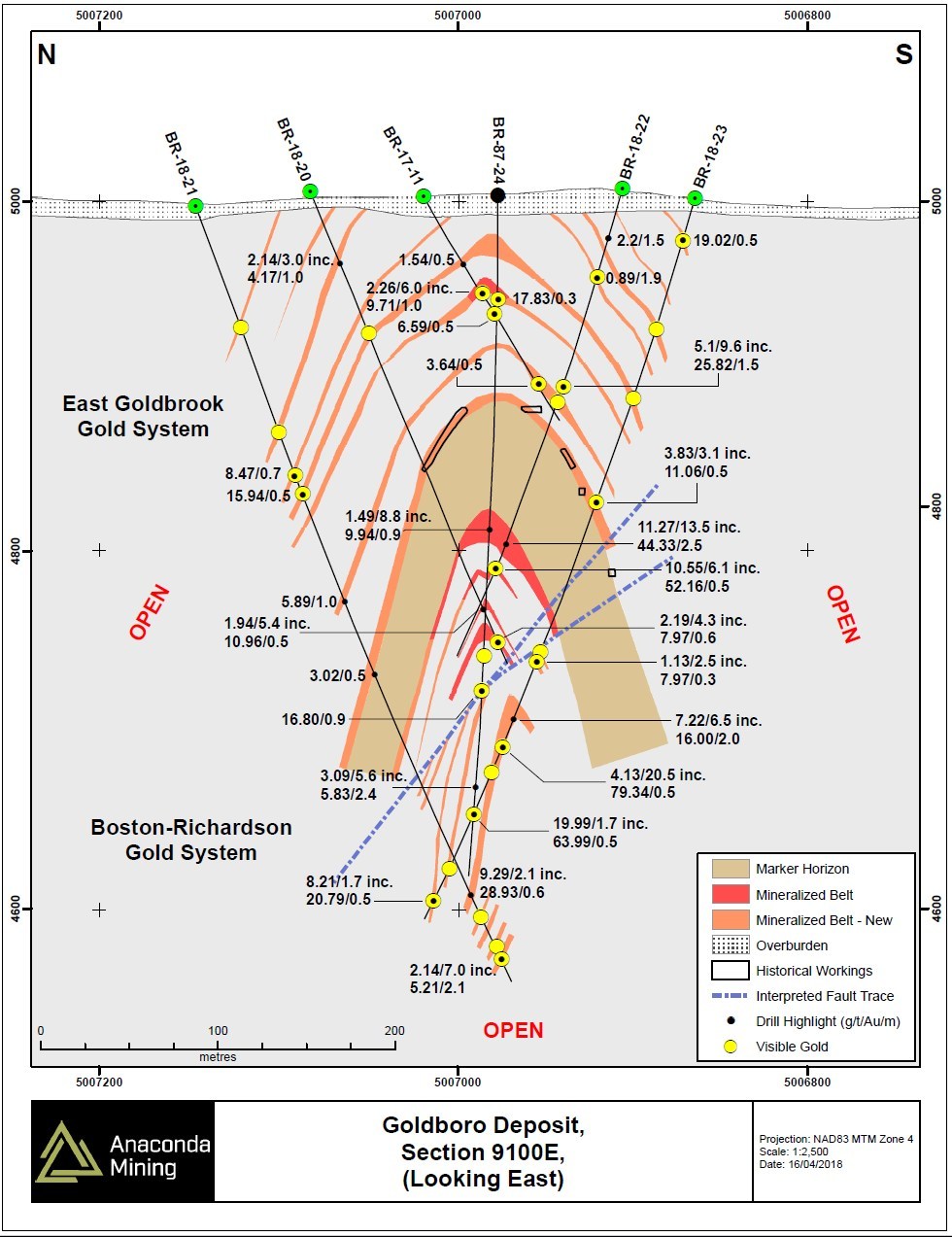

A few of the highlights of the 5 holes are as follows:

- 11.27 grams per tonne (“g/t”) gold over 13.5 metres (201.0 to 214.5 metres) in hole BR-18-22, including 15.63 g/t gold over 1.4 metres and 44.33 g/t gold over 2.5 metres;

- 4.13 g/t gold over 20.5 metres (324.5 to 345.0 metres) in hole BR-18-23, including 9.93 g/t gold over 7.5 metres and 79.34 g/t gold over 0.5 metres;

- 10.55 g/t gold over 6.1 metres (223.0 to 229.1 metres) in hole BR-18-22, including 18.78 g/t gold over 3.1 metres;

- 5.10 g/t gold over 9.6 metres (116.0 to 125.6 metres) in hole BR-18-22, including 25.82 g/t gold over 1.5 metres;

- 7.22 g/t gold over 6.5 metres (310.5 to 317.0 metres) in hole BR-18-23, including 16.00 g/t gold over 2.0 metres; and

- 9.29 g/t gold over 2.1 metres (420.6 to 422.7 metres) in hole BR-18-21.

Take a look at the cross-section above. I want to draw your attention to the legend located in the bottom right; in particular, take a look at the new mineralization colour and contrast that against what you see in the image.

Stepping out along strike and down-dip, Anaconda is hitting new mineralization, which confirms that they’re getting closer to understanding the controls of mineralization within the Deposit. I had the opportunity to review the latest drill results from Goldboro with Anaconda’s VP of Exploration, Paul McNeill.

We reviewed some of the highlights of the drill program, but what stood out for me was McNeill’s excitement and interest in the fault system they encountered in this portion of drilling. As McNeill explained to me, an analogue to the Goldboro Project mineralization can be found in the Victorian Goldfields of Australia. Faults within these kinds of deposits are common and are can host high-grade gold.

With this in mind, McNeill and the rest of the Anaconda Exploration team will test the theory that the fault system is somehow a controlling structure for the deposit’s high-grade mineralization. A better understanding of it and how it has or hasn’t influenced the mineralizing fluids is a priority for them moving into the next round of drilling.

CEO, Dustin Angelo, affirms McNeill’s comments in the news release,

“We continue to prove that mineralization extends in all directions in both the EG and BR Gold Systems. We are encountering typical grade and thickness in most of the newly discovered mineralized areas and then we’re uncovering sweet spots that contain broader, higher grade intersections that are among the best results reported from Goldboro to date. The presence of a fault in the areas around holes BR-18-21 to -23 is an important feature that may control the localization of high gold grades and we plan to further test this potential for thicker high-grade intersections within the coming months.”

PUSH: Watch for the drill results from the next round of drilling expected within a few months,following more planned drilling in and around drill section 9100E.

Anaconda Mining Formally Offers to Acquire Maritime Resources

On April 13th 2018, Anaconda Mining made a formal offer to acquire all of the issued and outstanding common shares of Maritime Resources Corporation. The proposed deal would see each Maritime shareholder receive 0.39 of a common share of Anaconda for every common share held of Maritime. At the time of the deal, the offer represented a premium of 64% above the 20-day volume weighted average prices (VWAP) of the Maritime shares on the TSX Venture Exchange, and the Anaconda shares of the Toronto Stock Exchange.

In my opinion, this is a great deal for both Anaconda and Maritime shareholders because I believe there’s great synergy between the two companies. Firstly, let’s look at Anaconda’s contribution to Maritime shareholders:

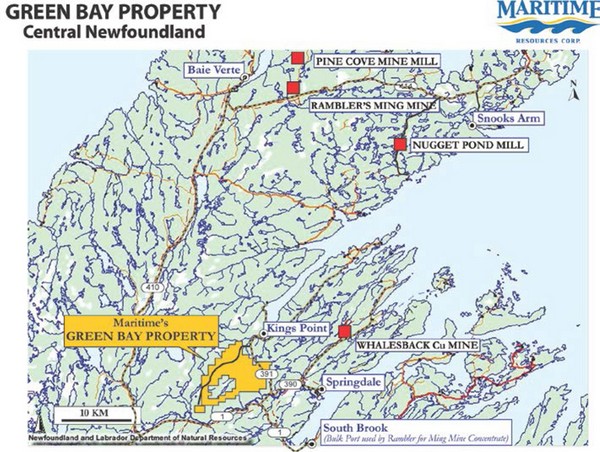

- Infrastructure, in my opinion, is Anaconda’s largest contribution to the deal. With the existing Pine Cove Mill and newly transitioning Pine Cove Pit to tailings facility, Anaconda brings the much needed infrastructure to process the gold ore mined on Maritime’s Green Bay Property in a timely manner. This point can’t be under stated as infrastructure construction not only requires permitting and access to capital, but it also takes time to develop. While there are other scenarios that exist for processing the Green Bar Property ore, I believe Anaconda’s is the best because, for Anaconda, it’s a matter of “when” the ore is processed, not “if” we get the permit, and “if” we raise the capital to fund construction.

- Milling Cost – As cited in Anaconda’s conference call on April 16 2018, the Pine Cove Milling cost has averaged roughly $20 per tonne, which is approximately 40% lower than the processing cost of $32.89 per tonne which was used in the Green Bay Property Technical Report. Anaconda stated in their conference call on April 16th,

“we would bypass flotation and employ a similar whole ore leach process at the Pine Cove Mill that was done at Nugget Pond. Flotation accounts for a large portion of our losses when processing Point Rousse ore. When you take that out of the equation for Hammerdown ore, we should have similar recovery rates as experienced historically.”

- 64% premium to the 20-day VWAP or a Maritime share price of $0.16 – this is a nice premium on the Maritime shares, and when mixed with what I believe is great upside potential in Anaconda, the risk to reward potential here, I believe, is very good.

What does Maritime Resources contribute to Anaconda as an acquisition target?

- 43-101 estimated resources which are in close proximity to the Pine Cove Mill. The Hammerdown Deposit has an existing Measured and Indicated Resource of 727,500 tonnes at 11.59 g/t for 271,000 ounces of gold and an Inferred Resource of 1,767,000 at 7.68 g/t for 436,000 ounces of gold. The Orion Deposit has an existing Measured and Indicated Resource of 1,096,500 tonnes at 4.47 g/t for 157,500 ounces of gold and an Inferred Resource of 1,288,000 at 5.44 g/t for 225,100 ounces of gold.

- Further exploration potential on the 12,775 acre Green Bay Property

Source: Maritime Resources

Simply, a takeover by Anaconda gives Maritime shareholders a premium on the current share price and, most importantly, in my opinion, moves it from an “if” investment to a “when” investment with the added upside potential of Anaconda’s existing exploration and development projects. The cumulative effect of these points is, in my opinion, a major de-risking of investment for Maritime Resource shareholders, and a great addition of 43-101 estimate resources for Anaconda Mining Shareholders.

PUSH: A successful conclusion to this takeover offer of Maritime Resources would be a major plus for Anaconda Mining.

Concluding Remarks

In my opinion, Anaconda Mining continues to present a great risk to reward investment proposition and a lot of value at its current price. Here are a couple of reasons why I think this:

- First, the updated PEA on the Goldboro Gold Project, released just a couple of months ago, presents a low case scenario of gold at $1450 CAD/oz (roughly $1160 USD/oz), which gives the Project an estimated after-tax NPV at a 7% discount rate of $44 million CAD. Not only do I believe the gold price will be higher than $1450 CAD/oz in the future, given the drill results just released from Anaconda, I believe this deposit is getting bigger and possibly higher grade. This would mean a higher probability of better project economics and, thus, a higher NPV.

- Second, Anaconda is growing through acquisition and, with the latest bid for Maritime Resources, has taken great strides toward their goal of becoming a 100,000 oz of gold per year producer.

- Third, Anaconda’s current MCAP (at the time of writing) is roughly $41 million CAD, which, in my mind, only roughly values the assets found within the Point Rousse Project – with its in-situ ounces (Stog’er Tight Deposit and Argyle Deposit) and infrastructure (Pine Cove Mill, Port and Tailings Facilities). In my opinion, no value is given to the Goldboro Gold Project and its estimated after-tax NPVm, which is cited above. Additionally, I don’t see any value given to The Great Northern Project (Rattling Brook and Viking) which contain ~600,000 ounces of combined Inferred and Indicated gold resources.

I’m long Anaconda Mining and am eagerly awaiting upcoming news flow on the Maritime Resources acquisition and further Goldboro drill results.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do own Anaconda Mining stock. All Anaconda Mining analytics were taken from their website and press release. Anaconda Mining is a Sponsor of Junior Stock Review.