Anaconda Mining – Takeover Candidate Criteria, Goldboro Update and Point Rousse Exploration

I have been keenly watching the progress of Anaconda Mining over the last 6 months; they have made some significant strides toward growing the company organically and through acquisition, as they were very close to executing a takeover of Maritime Resources. In my opinion, the merger would have been a terrific deal for both sets of shareholders and the people who live in and around Baie Verte, Newfoundland & Labrador.

With two drill programs set to commence in the 2nd half of 2018, I was eager to catch up with Dustin Angelo, CEO of Anaconda Mining, to review the Goldboro Gold Project, how or if the withdrawal of their Maritime Resources takeover offer has affected their growth strategy, some of the criteria for future takeover targets, and finally, an update and overview of the Point Rousse Project – production changes and exploration targets.

Let’s take a look at what Angelo had to say.

Enjoy!

Brian: Recently, you released some great drill results from your Goldboro Project in Nova Scotia. Could you give us an overview of some of the highlights and where you are headed with the Project over the final 5 months of the year?

Dustin: The Goldboro results are the final results of roughly a 12,000-meter program that we’ve been doing since we acquired the project back last year. Overall, it was a highly successful program. We demonstrated the fact that the deposit does continue down plunge, along strike, and down the dip of the limbs of the fold structure. We had some very good intersections, and then some of the top intersections were 151 grams over 2.6 meters. Some wide intersections like 21 grams over 11.5 meters; 4 grams over 20 meters; 17 grams over 7.5 meters. We were very successful in finding some new target areas within the deposit. We had 130 new visible gold occurrences.

We’re extending the Boston Richardson system down plunge and East Goldbrook, as well. We found new mineralized zones. Everything was what you would expect. It was pretty typical for the Goldboro deposit so we were pretty pleased with that. We worked on in-filling the areas where the inferred resources were a part of our PEA. We think that we will be increasing the confidence level of some of those, moving them into measured and indicated. Overall, the program was highly successful.

We’re now embarking on our second major program, which we just announced, and is a 10,000-meter program that we’ll be doing through the fall. That one will be very similar in that we will be looking at areas for expansion. We will still be looking at areas for in-fill related to the PEA. The one new area that we are going to be going to is the West Goldbrook system. We focused on Boston Richardson and East Goldbrook in the first 12,000 meters. Now, we’re going to open up and go over to the West Goldbrook area. We’re anticipating continuing to find more mineralization, continuing to extend the deposit down plunge and along strike. I’m confident we will have similar or better results than what we’ve had in the past.

Brian: Over the last 3 months, I received many questions from readers pertaining to Anaconda’s takeover bid of Maritime Resources. For those who are unaware, Anaconda formally commenced a takeover bid for Maritime in April of this year, but withdrew the offer on July 12th and are pursuing other opportunities in Atlantic Canada.

How has the outcome of this takeover bid changed Anaconda’s plans for growth in the future?

Dustin: It hasn’t changed our plans. We are still focused on growing by acquisition. Maritime doesn’t discourage us from doing that. However, any acquisitions we look at down the road will hopefully be friendly deals.

That’s what we were looking for with Maritime, but, unfortunately, we weren’t able to achieve that. There just wasn’t much of a response from the board and management going back to January/February. That’s why we had to take the bid to shareholders. In spite of the end result, the acquisition strategy continues on. There are other opportunities within Atlantic Canada and we’ll pursue those instead. Maybe, Maritime will come back at some point down the road, in which case we’d be interested in trying to get a transaction done under the right circumstances.

As we said from the beginning, bringing together the two asset bases on the Baie Verte Peninsula makes a lot of sense. We’ve got the operating infrastructure. We’ve got a very profitable operation. Our second quarter results just came out and it shows that we continue to make money and that the operation is pretty steady. If we can add higher grade ore, it can only make it better. We’ve got all the infrastructure, the workforce, the tailings capacity, and our own ore feed. They’ve got an underground resource and it makes sense to put the two together, because each side can benefit from what the other side has. Eventually, they might come back around.

We’ll continue on our two-pronged approach which includes organic growth through exploration of our current properties as well as acquisitions. On the exploration side, we are kicking off again, using the $4.5 million that we recently raised in a flow-through financing. We will continue the organic path and grow through more exploration at Goldboro and Point Rousse. We see many opportunities to grow our mineral resources at these projects. Furthermore, we have now started our bulk sample at Goldboro and we filed the environmental assessment document so that we can begin the environmental review process. We are moving the project along from a development standpoint as well as an exploration standpoint, with the goal of production by 2020 / 2021. We believe we can extend the production life at Point Rousse while bringing Goldboro into production, ultimately reaching about 50,000 to 60,000 ounces per year of gold.

Brian: Secondly, if Anaconda will continue to pursue takeovers as a source of growth in the future, can you give us an idea of what you are looking for in a potential takeover target?

Dustin: What we’re looking for, primarily, are assets that have 43-101 resources already established on them. When you’re talking about Atlantic Canada, the only two gold producers, really, that are in commercial production are ourselves and Atlantic Gold, so all the other projects in the region are essentially pre-production. We would be looking at projects that we can put into production in the near term; properties that are ready to transition from an exploration asset or an idle asset into a development asset because it comes underneath our infrastructure, our management and our ability to raise capital. We’re looking for projects that would have anywhere from a couple hundred thousand ounces of gold to up to a million ounces, and you can find those types of projects in Atlantic Canada. It would be ideal if we can utilize some of our existing infrastructure with a project, but we’ll also evaluate it on a standalone basis.

Brian: As I confirmed during my site visit last fall, the Point Rousse Project will play a critical role in Anaconda’s future as you transition from the Pine Cove Open Pit Mine to the Stog’er Tight Open Pit Mine.

Stog’er Tight Deposit Area – Taken Fall 2017 During My Site Visit

Can you give us an update on the transition?

Dustin: We were in development on Stog’er Tight during the spring and we made the official transition into commercial production in May. In May/June, we produced almost 30,000 tons of ore from Stog’er Tight. We’ve still been processing ore from Pine Cove, ore that’s been stockpiled, and the transition has been smooth. You’re talking about another open pit mine. We have all the necessary infrastructure in place. We’re just trucking ore back to the mill. We’ve got the tailings capacity there. We’re using the same contract miners, so we’re just moving equipment over.

It’s our second pit and we have a tremendous amount of experience from Pine Cove, which we operated for about eight years. A lot of the knowledge base and the experience we gained there, the use of blast movement monitoring, GPS on the shovels, all the technology, the new processes and procedures that we implemented at the Pine Cove pit. We transitioned those over to Stog’er Tight. I think it’s been a fairly smooth transition, because of the experience.

Brian: Continuing with the Point Rousse Project, you have announced a 5,000 metre drill program.

What are you targeting with this drill program and what’s the timeline for its completion?

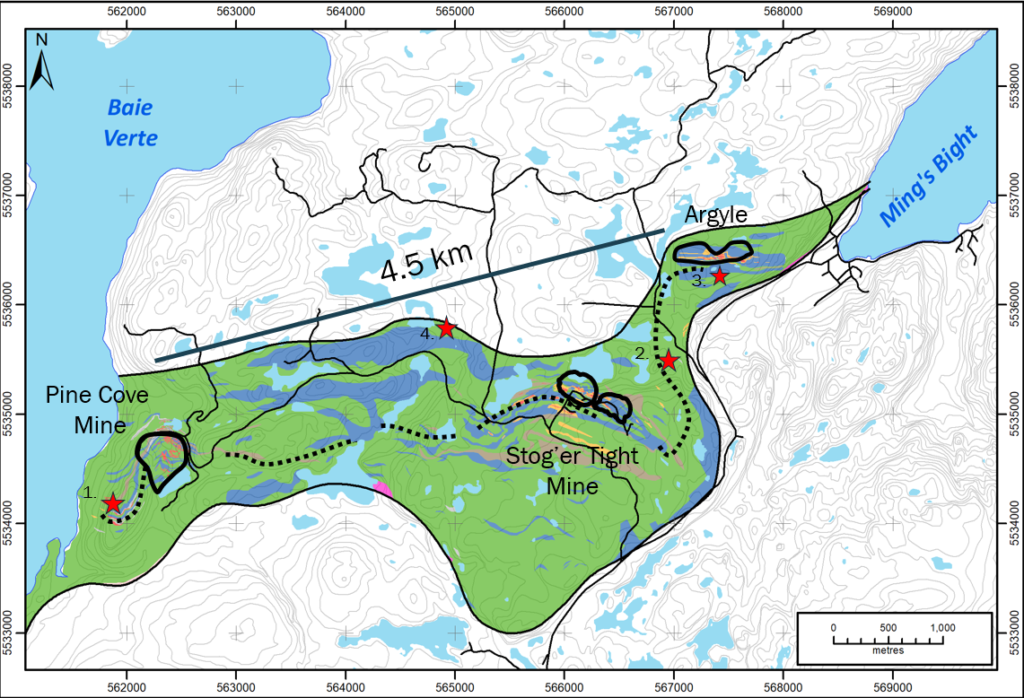

Dustin: The 5,000-meter drill program at Point Rousse has three main targets. It has Argyle, which is our new deposit. We’re looking to expand that deposit, essentially going north east of the known mineral resource. The other area that we’re looking at is a discovery called Anoroc. It’s roughly 600 meters southwest of the Pine Cove pit. We’re going to target the entire area between the southwest part of that pit all the way down to the discovery. So, along that 600-meter strike length, we’re going to be poking holes in there.

At the northern end of our property package, there’s an area we call Deer Cove. We did some drilling a while ago at Deer Cove, but in a really concentrated area where there is an old adit and a vein system that was discovered prior to Anaconda’s involvement in the area. Our program was very narrowly focused, but the Deer Cove area is situated just north of a thrust fault, similar to Pine Cove. We’re going to more broadly explore along the thrust fault and look for another Pine Cove. Those are the three main exploration areas for Point Rousse.

Right now, we are doing some ground IP and soil sampling around the areas that we’re going to drill, ultimately, at Argyle. We’re waiting on a permit at Anoroc, and then we’ll finish up at Deer Cove. It’ll take us most of the fall.

Scrape Trend – Target #1 in the Image above is Anoroc

Concluding Remarks

From an organic growth perspective, Anaconda appears to be set to add ounces to its production profile in the coming years. As Angelo outlines in the interview, Goldboro is showing tremendous progress toward its development, and with a new 10,000-meter drill program initiated and a planned / permitted bulk sample in the 2nd half of 2018, we should see a lot of news flow.

Additionally, the progress in production out of the new Stog’er Tight Open Pit Mine, the development of the Argyle Deposit and the further exploration of the Scrape and Deer Cove Trends, Anaconda’s organic growth plans look to be very healthy.

In terms of valuation, with Anaconda’s MCAP roughly sitting at $36 million, I personally see tremendous value in buying Anaconda shares at this price point. Consider these 3 thoughts:

- First, the updated PEA on the Goldboro Gold Project, released just a couple of months ago, presents a low case scenario of gold at $1450 CAD/oz (roughly $1160 USD/oz), which gives the Project an estimated after-tax NPV at a 7% discount rate of $44 million CAD. Not only do I believe the gold price will be higher than $1450 CAD/oz in the future, I believe this deposit is going to get bigger, which could mean better project economics and, thus, a higher NPV.

- Second, Anaconda has a two-pronged approach to growing the business; first, through the organic growth of existing assets and, second, through acquisition. With the steps taken over the last year, it is clear to me that the Anaconda management team is putting their money where their mouth is, so to speak.

- Third, with Anaconda’s current MCAP (at the time of writing) at roughly $36 million CAD, which I believe only roughly values the assets found within the Point Rousse Project with its in-situ ounces (Stog’er Tight Deposit and Argyle Deposit) and infrastructure (Pine Cove Mill, Port and Tailings Facilities). In my opinion, no value is given to the Goldboro Gold Project and its estimated after-tax NPV, which is cited above. Additionally, I don’t see any value given to The Great Northern Project (Rattling Brook and Viking) which contain ~600,000 ounces of combined Inferred and Indicated gold resources.

Good management teams are what make companies successful in the junior resource sector, and in saying this, I believe the Anaconda team is one of those good teams that will execute on their plans to create value for their shareholders.

I’m a buyer of Anaconda Mining and look forward to plenty of news flow the rest of the summer and into the fall.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company(s) and sector that is best suited for your personal investment criteria. Junior Stock Review does not guarantee the accuracy of any of the analytics used in this report. I do own Anaconda Mining Inc. shares. Anaconda Mining Inc. is a Sponsor of Junior Stock Review.