NOTE: This article was originally published on June 23rd, 2020 for subscribers. Subsequently, the share price has risen 40%.

As I mentioned in last week’s Market Update commentary, M&A is on my mind.

This new bull cycle in gold will bring fourth many new deals and with them a chance for investors to make a very good profit – if you choose right.

Picking the right company will be a reflection of the criteria you use.

Being picky and setting the bar high not only protects your downside risk, but also forces you to think like a major mining company, which is looking to add economic resources to their books.

Today, I have for you one company which I believe will be at the forefront of M&A activity in the not-so-distant future.

The company is Integra Resources (ITR:TSXV) and they are developing their flagship Delamar project in Idaho.

Let’s take a closer look.

Integra Resources (ITR:TSXV)

MCAP – $190.1M (at the time of writing)

Shares – 119.6M

FD – 130.7M

Cash – roughly $27M

People

Integra is led by CEO George Salamis, who has over 30 years experience in the resource sector and is a geologist by trade.

Salamis has a very good reputation in the sector and the resume to support it.

He has been involved in over $2B inM&A transactions over his career, with his most recent success coming from the acquisition of Integra Gold by Eldorado Gold Corporation for C$590M.

Salamis is supported by a strong team with CFO Andree St-Germain, VP Exploration Max Baker, and COO Tim Arnold.

Further, Integra has a great Board of Directors; Chairman Steve de Jong, David Awram (Co-Founder of Sandstorm Gold), Timo Jauristo (Former Executive VP with Goldcorp), Anna Ladd-Kruger, and C.L. “Butch†Otter.

Finally, and although not a Director, Strategic Advisor Randall Oliphant (Former CEO of Barrick Gold) brings 30 years of experience to the table.

Clearly, Salamis and his supporting cast have a history of developing projects into premier M&A candidates.

I fully expect to see the same story play out with Delamar, as the team works to improve Delamar’s economics and this gold bull market progresses.

Delamar Project

The Delamar project encompasses roughly 8,100 hectares in southwestern Idaho, about 80 km southwest of Boise.

Idaho is a premier mining jurisdiction and, while it may not have as deep a history and fanfare as its neighbour to the south, Nevada, it does rank very high in mining investment attractiveness.

In fact, the Fraser Institute agrees and ranks Idaho 8th in the world in mining investment attractiveness with a score of 82.78.

Delamar is a past producing mine and, prior to its acquisition by Integra in 2017, it was owned by Kinross.

The Delamar and Florida Mountain deposits have produced an estimated 1.3 million ounces of gold and 70 million ounces of silver over the course of their 100 year history.

Since its acquisition, Integra has converted 90% of its inferred resources to M&I between 2018 and2019, it has completed extensive metallurgical studies on both the oxide and sulfide portions of the deposits, and completed a PEA last fall.

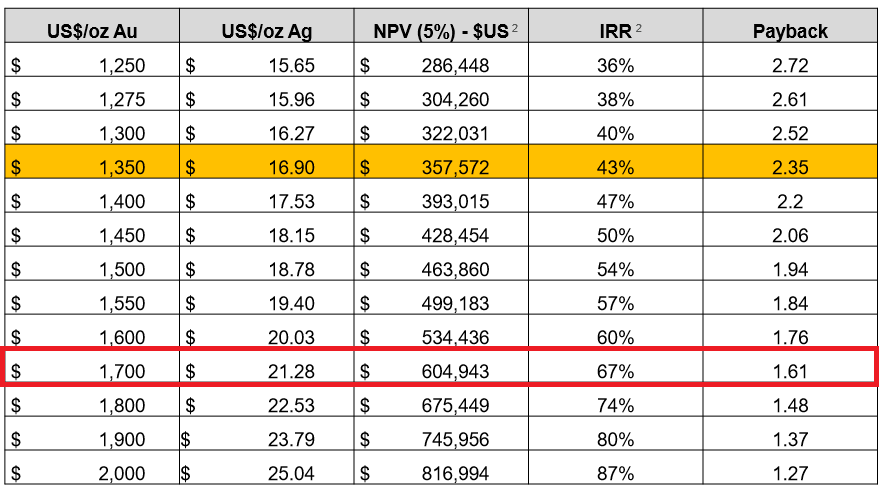

The PEA reveals robust economics at US$1350/oz gold and US$16.90 silver. Let’s take a look at some of the highlights.

2019 Delamar PEA Highlights:

After-tax NPV@5% – C$472M

After-tax IRR – 43%

Upfront CAPEX – US$161.0M

Sustaining CAPEX – US$93.4M

AISC – US$742/oz AuEq

Production Capacity – 124 Koz/year AuEq

Life of Mine – 10 years

M&I Resources – 1.8 Moz AuEq

These are great numbers, as the project has good size, comparatively low upfront capital costs, and the gold and silver price assumptions are well under today’s prices.

How does the project’s economics look at today’s metal prices?

Great question; while it’s imperative to understand our downside risk in-terms of the metal prices, we need to understand the value of the project today.

In Integra’s corporate presentation, there’s a great sensitivity table which reflects Delamar’s NPV and IRR and varying metal prices.

Highlighted in red is a snap shot of today’s metal prices. I will note that the silver price isn’t anywhere near US$21.28, yet, but silver’s impact on the project is much lower than gold’s given the metallurgical recoveries at this point.

The other thing to consider is that this sensitivity analysis only changes the metal price, it doesn’t account for the other positives that are derived from higher gold and silver prices.

Most notably in this base case scenario, is the increase in the pit shell and the possibility of mining underground, which is a very good possibility given the mineralization which Integra has encountered.

What was once waste in the low metal price environment is now ore.

In the US$1350/oz gold and $17.47/oz silver scenario, the Delamar pit would process 46,734,000 tonnes at 0.34 g/t gold and 19.14 g/t silver and have a strip ratio of 0.67.

Additionally, the Florida Mountain pit would process 53,142,000 tonnes at 0.47 g/t gold and 11.83 g/t silver and have a strip ratio of 1.25.

Conversely, if you consider today’s metal prices, US$1700/oz gold and $22.00/oz silver, the tonnage at the Delamar pit increases to 51,474,000 tonnes at 0.33 g/t gold and 19.76 g/t silver and have a strip ratio of 0.92.

Florida Mountain’s tonnage increases to 59,396,000 tonnes at 0.46 g/t gold and 11.69 g/t silver and have a strip ratio of 1.39.

NOTE: These figures can be found on pages 177 and 179 of the 2019 PEA.

In total, the higher metal prices, in terms of ounces, account for a further 35Koz of gold + 4Moz of silver from the Delamar pit, and 77Koz of gold + 2.1Moz of silver, bringing the grand total to 112Koz of gold and 6.1 Moz of silver.

Those aren’t earth-shattering numbers, but still contribute to the bottom line of the project.

Putting it altogether, I like the base case scenario for the project and, outside of exploration upside, which we have yet to discuss, I like how the project responds over a variety of metal prices.

Exploration Upside

#1 – Expansion of the Florida Mountain Deposit

As I explained in my thoughts on M&A, size matters.

While comparatively, the Delamar project is already large, an expansion of the resource would be highly advantageous for its economics and appeal to major mining companies.

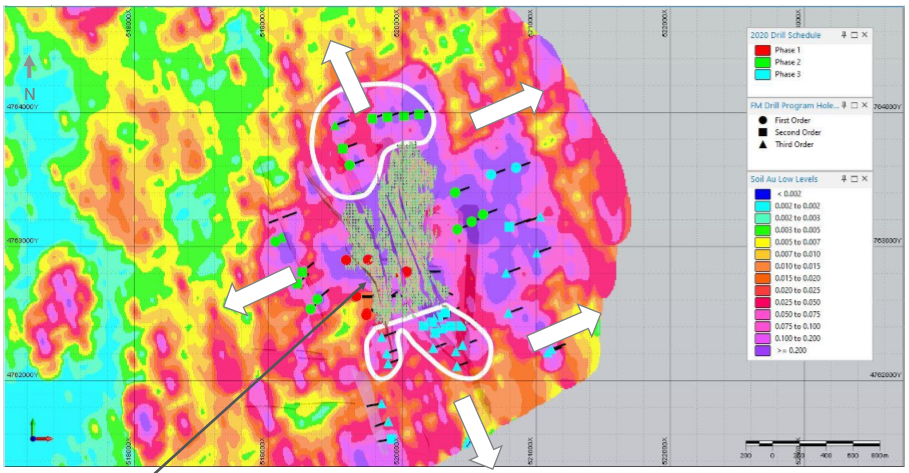

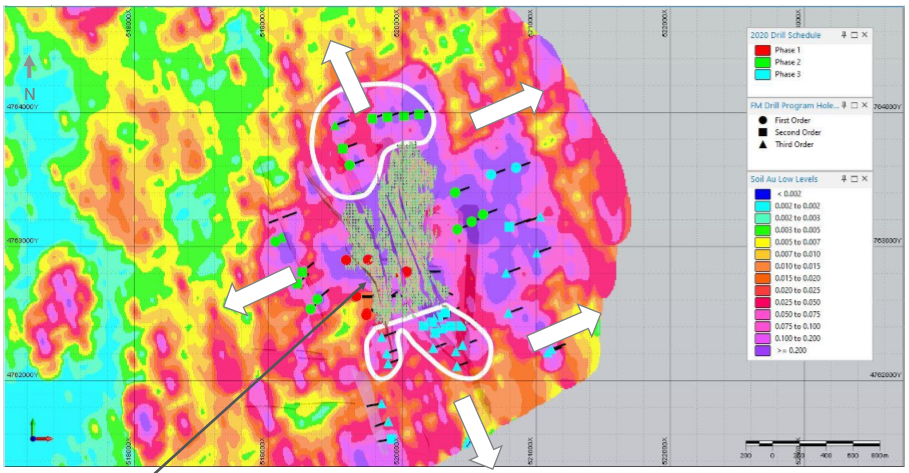

As you can see in the image below, there’s a large gold in soil geochemical anomaly which surrounds the existing deposit.

Integra will be targeting oxide/transitional mineralization in this area.

As investors, we should be looking for assay grades around that which we have seen on the existing deposit resource, so roughly 0.5 g/t.

While this isn’t the flashy high grade stuff Integra will be exploring for at other targets, remember that it’s oxide/transitional mineralization which is the backbone of the future operation.

The drilling of this anomaly will occur this year and, in my view, represents a tremendous opportunity to add value to the project.

#2 – Underground Resource

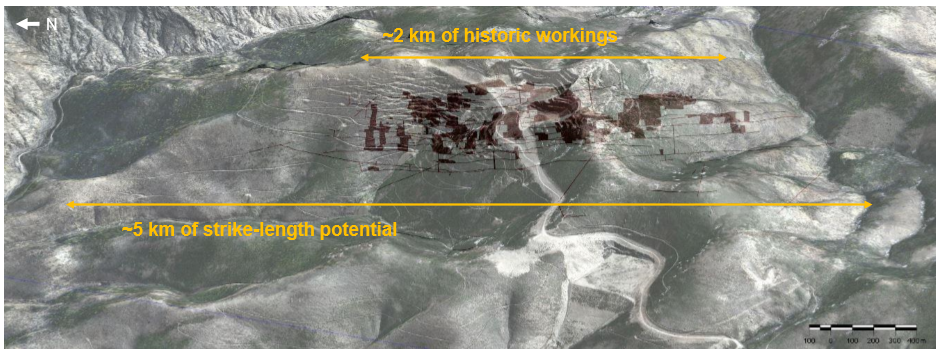

As I mentioned in the project introduction, the Delamar project was a past producing mine, both open pit and underground workings.

The underground workings at Florida Mountain are extensive, stretching over 2km, and will be the focus of high grade exploration this year.

In my discussion with management, these workings were encountered during the metallurgical drilling last year and returned some great intervals.

For example:

- IFM 19-054 – 9.70 g/t gold and 12.85 g/t silver over 1.52m

- IFM 19-062 – 2.12 g/t gold and 181.96 g/t silver over 37.95m, including 7.68 g/t gold and 623.86 g/t silver over 4.88m

- IFM 19-058 – 18.50 g/t gold and 850.70 g/t silver over 1.52m

Although this high grade mineralization is underground, it appears as though it’s easily accessible and, of course, is in close proximity to the future mill site.

Outlining a high grade underground resource at Florida Mountain, therefore, represents a tremendous opportunity to add value to Delamar’s NPV, especially if the high grade material can be mined early on in the production schedule.

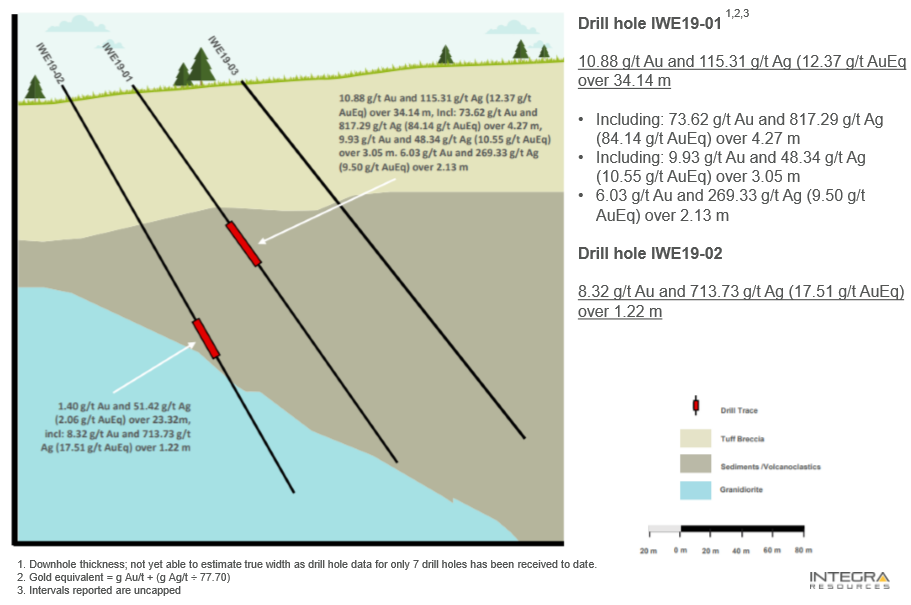

#3 – War Eagle

In Q4 of 2019, Integra drilled their War Eagle target, which sits roughly 3km southeast of Florida Mountain.

As you can see in the image below, they hit some very nice high grade intervals.

Given its proximity to the main project, it’s reasonable to think that at some point, depending on a number of factors, War Eagle could become a high grade production source for the mill.

A feed of high grade ore from this potential satellite deposit would be gravy on top of what already looks like a profitable operation.

Drilling at War Eagle will commence within the next 2 to 3 weeks.

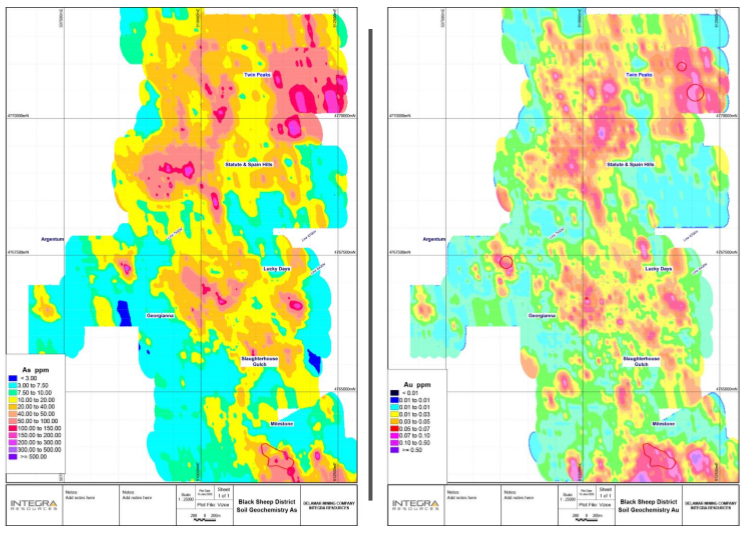

#4 – Black Sheep

Finally, there is the Black Sheep target area, which sits to the northwest of Florida Mountain.

At Black Sheep, Integra has a 25 square kilometre target area, with multiple geochemical and geophysical anomalies to follow up on.

Integra plans to drill 3,000m in this area later this year.

Risks to Investment

Exploration – The Delamar project has tremendous exploration potential across its 4 main target areas: the oxide/transitional geochem anomaly at Florida Mountain, the high grade underground target at Florida Mountain, War Eagle and, finally, Black Sheep.

With that said, with exploration comes risk.

If mineralization is intersected, what is the grade? At what depth was it discovered? Is there enough of it? All these questions need to be answered before any discovery can be deemed economic and, therefore, a positive addition to a future mine plan.

Covid-19 – The contagion of the Covid-19 virus remains a risk to every junior mining company. Any future lock down could put Integra’s action plan in neutral and, therefore, delay Delamar’s development. With a high burn rate, G&A + development/exploration costs, time not spent developing the project comes at a high cost to investors.

Gold Price – At this point, the gold price is arguably the biggest risk to company valuations, as a fall back to US$1350/oz, I believe, would result in a massive sell off and, thus, dramatic drops in company valuations.

Much like Covid-19, however, downside risk associated with the gold price is an ubiquitous risk across the sector.

With gold holding, more or less, at US$1700/oz for many weeks now, I believe it’s less and less likely that we see US$1350/oz gold any time soon.

Time will tell.

Concluding Remarks

Integra’s Delamar project is excellent, it has robust economics at US$1350/oz gold and, more importantly, its sensitivity to the metal prices allows it to respond very positively to the rising gold and silver price environments that we see today.

Protecting your downside risk is integral to success in the junior resource market.

With that said, in terms of company valuation, Integra is well known within the sector and, therefore, with reference to Delamar’s base case valuation, doesn’t present a huge discount to value, in my view.

However, when you consider the exploration potential and, if successful, the impact it will have on the economics of the project, I believe this is where the true upside potential lies.

In my opinion, Integra’s story is as much about exploration as it is about development.

To add, Integra is run by a stellar group of people, who have a history of success in developing companies into premier M&A candidates.

I’m very confident that Salamis and team will continue to make the right decisions as the Delamar project continues to grow and take shape in this very important exploration season.

A PFS is expected in the second half of 2021; the discovery of further high grade mineralization could further separate Integra from the other gold development companies in Tier #1 jurisdictions.

Get the e-book Junior Resource Sector Investing Success: The Risks, Rules & Strategies You Need to Know today, when you become a FREE Junior Stock Review VIP .

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review Premium

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with Integra Resources (ITR:TSXV). I do own shares in Integra Resources.