In the first half of 2019, most of the questions I received from readers involved the gold price and where I thought it was headed. Now, 8 months later and with the gold price surpassing US$1500/oz, the focus of the questions has shifted to the other precious metal – silver.

Silver is often referred to as gold on steroids, as historically it has outperformed gold both to the upside and downside depending on the direction of the market. Today, the silver price has eclipsed US$18.50/oz and, at this rate, may even surpass US$20/oz by the end of 2019.

The factors driving the silver price are closely related to those driving gold, mainly the FED lowering interest rates, the talk of further QE, negative interest in Europe, the turmoil surrounding the U.S. and China trade war, and the ever-increasing list of financial calamities around the world.

Additionally, silver has a component of industrial use, which I think is the added driver of its volatility.

The rising silver price has brought with it a large amount of speculative cash which is flowing into many of the junior silver companies. Reviewing my watch list, many of these companies are up by huge amounts, mostly for no reason other than they offer perceived leverage to the silver price.

It’s the classic buying of junior resource companies because of a bullish outlook for a metal. This mentality in the junior resource sector, while it may bring short-term gains, will ultimately lose money for investors over the long term.

Junior resource companies are speculations on management’s ability to execute on a well thought out plan, which aligns with their overall vision for the company. If people can’t execute, it doesn’t matter where the metal price goes, the metal will either not be discovered or developed into a mine – period.

Today, I have for you a company which is led by good management, has roughly $3 million in cash, a high potential flagship asset – Diablillos – which has an existing M&I resource with around 140 Moz of silver equivalent, a portfolio of Chilean projects ready for JV, and a great plan to bring value to shareholders.

This company is the newly proposed AbraPlata Resources, which is expected to announce a definitive agreement regarding a merger with Aethon Minerals very soon.

Let’s take a closer look.

Merger – Aethon Minerals and AbraPlata Resources

Earlier this year, Aethon announced that they had struck a deal which would give them the exclusive right to perform technical due diligence, over a 5 month period, on AbraPlata Resource’s Diablillos silver-gold project in Argentina.

For this exclusive right, Aethon paid AbraPlata US$50,000 and agreed to spend at least US$150,000 on expenditures in connection with a metallurgical testing program and other related test work. At the end of the 5 month period, Aethon could then acquire a 50% or greater interest in the project.

Five months later, Aethon and AbraPlata announced that they had agreed in principle to a merger of the two companies, creating a new junior with a great flagship asset in Diablillos, a portfolio of JV ready projects in Chile, and around $3 million in cash.

Additionally, I think it’s important to point out that the merger signals that the money Aethon spent on testing the deposit’s metallurgy must have returned good results or this merger wouldn’t be happening. A HUGE plus for both sets of shareholders, because it’s one thing to own a deposit, but without the economic ability to liberate and concentrate the mineral, it’s worthless!

NOTE: In accordance with the merger agreement, AbraPlata will issue 3.75 shares for every share of Aethon. At the time of writing, there is an arbitrage opportunity in owning Aethon shares, which are selling at a discount to the deal.

I fully expect to see the announcement of a definitive agreement in the coming days, and would expect the transaction to close before the end of the year.

Aethon Minerals (AET:TSXV)

MCAP – $6.3 million (at the time of writing)

Share Price – $0.23

Shares – 27.6 million

FD – 46.3 million

AbraPlata Resources (ABRA:TSXV)

MCAP – $6.7 million (at the time of writing)

Share Price – $0.075

Shares – 96.7 million

FD – 131.5 million

People

In early 2018, Altius Minerals spun out a portfolio of its Chilean projects into Aethon Minerals. For those who don’t know, Altius is focused on the mining and resource sector through prospect generation, and the creation and acquisition of royalties and investments.

Over the course of my investing career, I have learned that to make money consistently, it’s of the utmost importance to identify and invest in the best people. I believe it’s a given that Altius has a keen interest in the success of the newly formed AbraPlata Resources and, therefore, with the appointment of Aethon’s interim CEO as its leader, John Miniotis, I believe it speaks volumes about his abilities and future in the mining business.

AbraPlata will be Miniotis’ first crack at being a CEO, but he certainly isn’t a newbie to the industry, as he has over 14 years of experience, previously working at AuRico Metals, Lundin Mining and Barrick Gold, as well as roles in equity research with BMO Capital Markets and Wellington West Capital Markets.

Miniotis is technically supported by Chief Geologist, David O’Connor, who is currently based out of Chile. O’Connor is a veteran of the industry with over 40 years of experience, founding or co-founding 5 publically listed companies, discovering the El Espino deposit in Chile, leading early exploration for Western Mining Corp. at the Olympic Dam deposit, and Chief geologist of Peko-Wallsend in Australia.

Additionally, with the merger of the two companies, a new Board of Directors will be announced. Right now, we know that current AbraPlata interim CEO and Director, Rob Bruggeman, will become the Chairman and the remaining seats will be broken down as follows: two directors nominated by AbraPlata, two directors nominated by Aethon, one director by SSR Mining and one director nominated by Altius Minerals.

This should prove to be very good for the new company, as this should ensure that there will be good representation on the board with people who have creditable mining experience in Argentina and, most importantly, in-depth knowledge of their flagship Diablillos Silver-Gold Project.

With the support of Altius and the financial backing of Sprott Asset Management, who is also a major shareholder, the newly formed AbraPlata has all it needs to be a success in the future.

Diablillos Silver-Gold Project

- 2018 PEA: After-tax NPV@7.5% – US$212 million, After-tax IRR of 30.2% at US1300/oz gold and US$20/oz silver.

- 6,000 tpd open pit mining operation, producing 9.8 Moz AgEq per year

- Open pit estimated initial CAPEX US$293 million, includes US$91 of pre-stripping cost

- 2017 Historical Resource – 140 Moz @ 161 g/t Ag Eq or 1.7 Moz @ 2.0 g/t Au Eq at spot prices

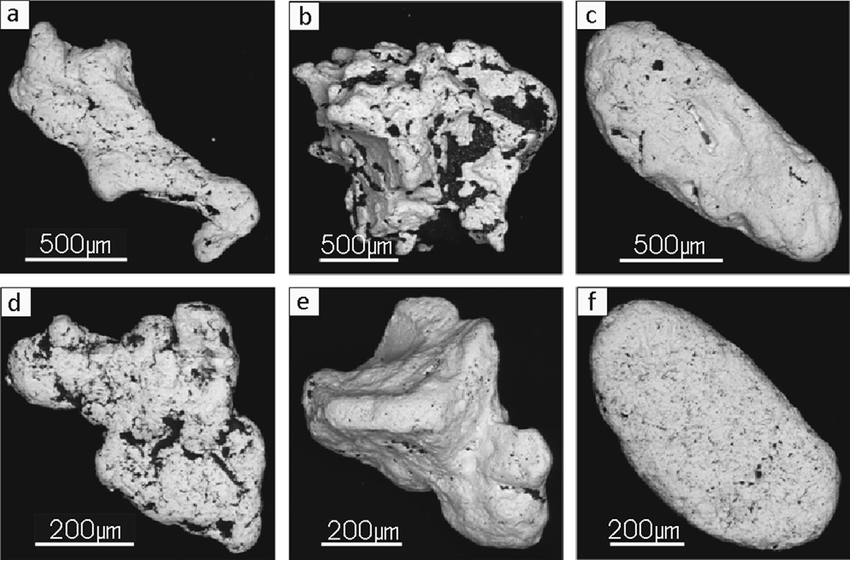

- Aethon successfully completed, pre-merger, extensive testing of the Oculto deposit’s metallurgy, ensuring that the PEA results are representative of the entire deposit, not just a specific zone.

- SSR Mining is the original vendor of the project and supports the transaction and has agreed to delay property payments of US$5 million and US$7 million by four years (see March 1st press release). I expect further detail of the payments to SSR to be given at the time of the announcement of the definitive agreement regarding the merger.

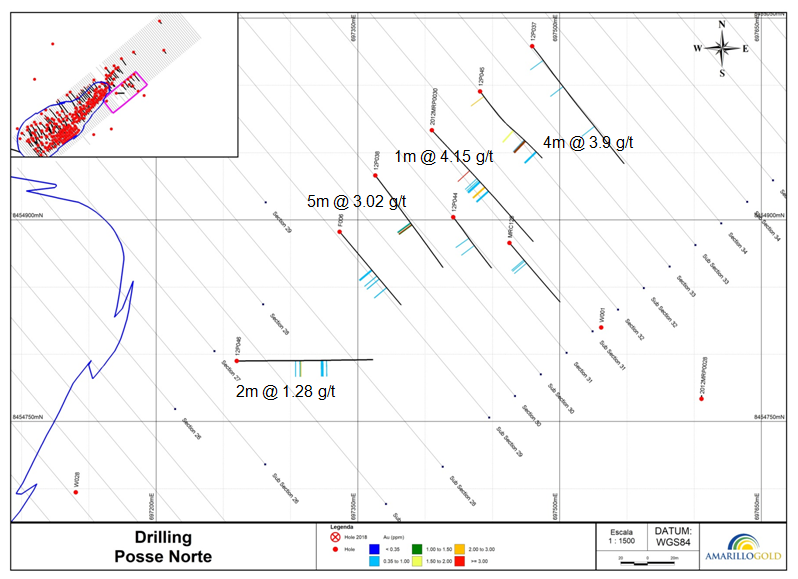

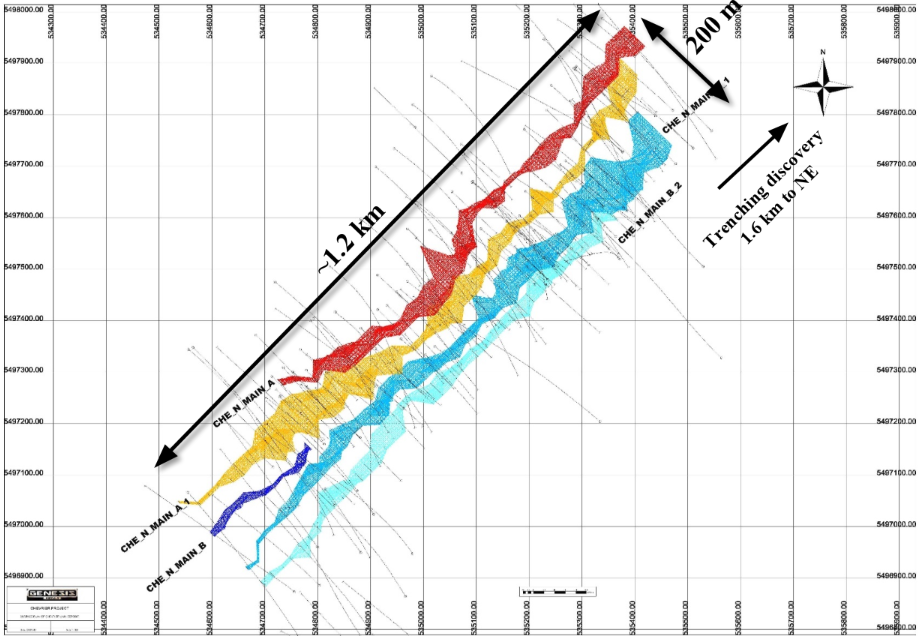

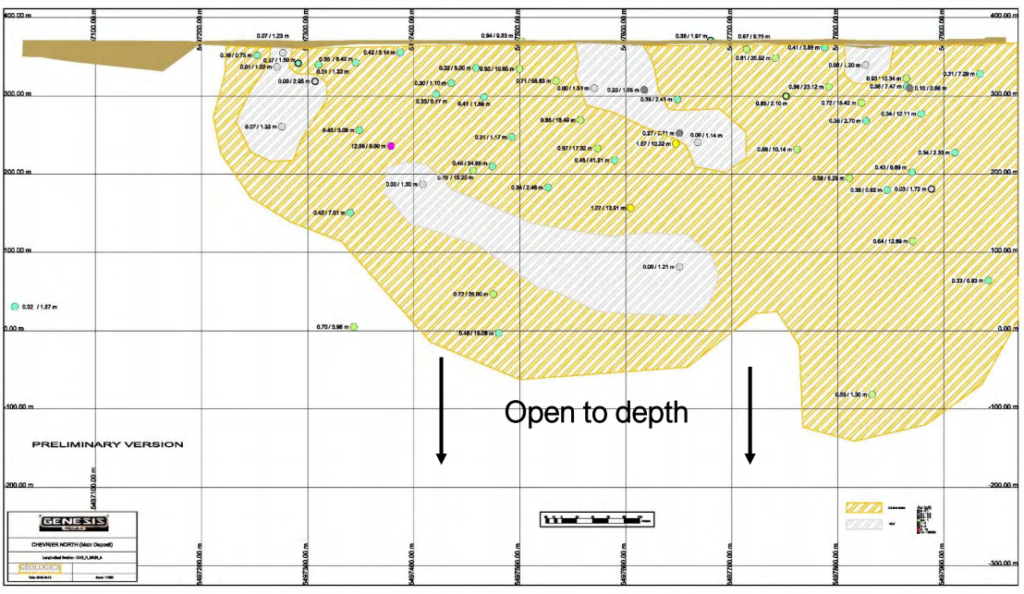

Last week, I discussed the potential of the Oculto deposit expansion with Miniotis and O’Connor. O’Connor highlighted some of the high grade core associated with breccias zones, where high grades have been intercepted over broad widths in historical drilling.

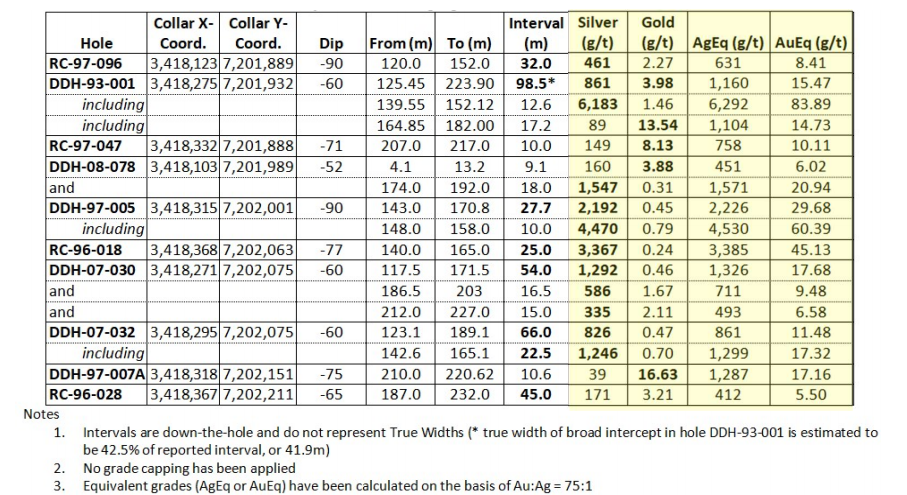

Interestingly, reviewing some of the historical results, you can see that these intercepts have some really good high grade hits. A few of the highlights are: 98.5m of 861 g/t silver and 3.98 g/t gold, 27.7m of 2,192 g/t silver and 0.45 g/t gold and 54m of 2,292 g/t silver and 0.46 g/t gold.

This is especially great because, in our discussion, Miniotis brought up the possibility of changing the mine plan from open pit to an underground operation, which has the potential to dramatically drop the initial CAPEX cost needed to bring Diablillos to production.

Upon completion of the merger, priority number one for AbraPlata will be to establish continuity between these intercepts, at a drill spacing where they can be added to an updated resource calculation. Miniotis expects the drill program will cost roughly $1 million, making it easily affordable with their cash position.

The second priority will be to explore some of the satellite breccia deposits, which sit within 1 to 2 km of Oculto and could be potentially mined in a future production scenario.

In my opinion, there’s a clear path to improving the NPV of Diablillos in a big way and, most advantageous, is investors really don’t have to wait that long to get an idea of how much better the project economics will be.

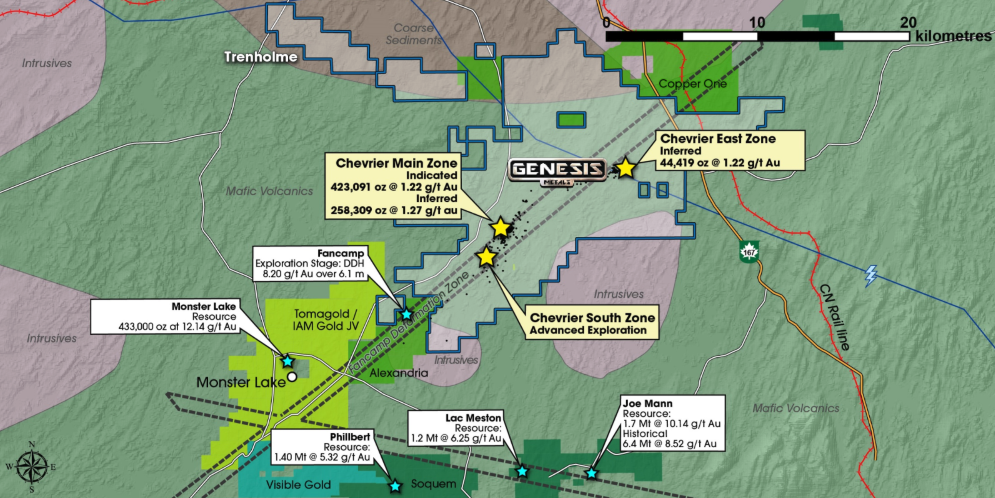

Chilean Project Portfolio

The newly formed AbraPlata will own 100% of a large prospective land package, totalling over 100,000 ha in northern Chile. The land package includes the Arcas Copper-Gold Project, Maricunga Gold Project and the Peineta Gold-Silver Project, which all sit in close proximity to some of the most prospective ground in South America.

Each project is ready for JV with a partner and I fully expect to hear news of a new partnership before the end of the year. The prospect generator model is great way to mitigate risk in the mining industry, and for a company like AbraPlata, who has a focus on their flagship Diablillos, any JV partnership is like icing on the cake, as the partner is on the hook for the exploration funding.

Currently, this aspect of the company has been overlooked by the market, but I expect that to change quickly in the weeks ahead.

Chile and Argentina

Jurisdictional risk is everywhere; no matter where you look, there’s always a chance that your money will be lost due to some country or region’s political calamity.

In saying this, I do think that certain countries come with a higher probability of an investor realizing a loss in their investment due to their chaotic state.

The newly formed AbraPlata Resources has projects in Chile and Argentina, two countries which, besides sharing a border, are very different in terms of their perceived mining investment risk profile. Currently, Chile is considered one of the best places for mining investment; the Fraser Institute which ranks countries in terms of their mining investment attractiveness gave Chile a score of 84.90, placing it 6th in the world.

Given this, I don’t think that we have to go into much detail about the merits of Chile and why I believe it’s as good as it comes in terms of mining jurisdictions.

While Chile ranks very high, Argentina on the other hand has been riddled with issues over the last 20 years, from 2001’s $100 billion sovereign debt default, to the controversial two term presidency of Christine Fernandez de Kirchner from 2007 to 2015.

Here’s a brief summary of some of the most contested issues during her reign:

- Heavy government spending in social programs by both Nestor Kirchner (President 2003 to 2007) and his wife, Christine (President 2007 to 2015).

- In 2012, Argentina’s congress nationalized Repsol’s (a Spanish oil company) portion in the national energy company, YPF. Kirchner defended the move by stating, “it failed to boost oil and natural gas production needed to keep up with local demand” (Reuters).

- Nationalized private pension funds, known as “Las Administradoras de Fondos de Jubilaciones y Pensiones (AFJP)” (Wiki).

- Kirchner fostered relationships with China, Venezuela and Iran.

- Nisman Allegations – Kirchner and Argentine Foreign Minister, Hector Timerman, were allegedly involved in a plot to cover up Iran’s role in the 1994 bombing of the Amia Jewish Community Centre, in which 85 people were killed. Alberto Nisman, who was investigating this bombing, made the allegations against Kirchner and Timerman. Days after the allegations, Nisman was found dead in his apartment.

- Raised taxes on exports, which the government later overturned, due to mass protests.

Mauricio Macri defeated Kirchner in Argentina’s 2016 Presidential election and was widely regarded as the man to turn Argentina’s economy around. While he didn’t stir up as much controversy as Kirchner, he has had his own issues trying to turn around Argentina’s economy.

Today, Argentina sits with higher levels of poverty than four years ago, a Peso which has dramatically devalued against the US dollar, and now an upcoming election which could see the return of Kirchner, albeit in a Vice President’s role to Presidential candidate, Alberto Fernandez, who just recently won the primary election, called PASO (Primarias Abietas Simultaneas y Obligatorias).

PASO allows parties that receive at least 1.5% of the vote to participate in the general election on October 27th, 2019.

Fernandez hasn’t won yet, but the results of the PASO election put a lot of doubt on Macri retaining the presidency. The possibility of Kirchner having any political influence given what happened during her past terms as President is a great glimpse into the culture of Argentina.

I have said it before, cultures take hundreds of years to change and, while they may appear to be better in the short term, rarely is it ever sustainable, as the society’s true colours will always show.

So what does this mean in terms of investment in Argentina?

First and foremost, no doubt there’s risk associated with this potential change in government leadership, as left-leaning political ideology has a long history of being bad for a country’s economics.

Given Kirchner’s history, I’m sure many investors may be concerned with the possibility of the government nationalizing the Diablillos Project. However, I think that there is very little chance of that happening at this point, because of where the project is in its development.

Bottom line, Diablillos is at least a couple of years away from this becoming a mine and, by that time, we should have a better idea of how much of a threat the Argentine government might be.

Salta Province

One other note; all of the discussion, thus far, has centred around the politics at the federal level, however, it’s arguably more important to focus on how mining is viewed within the specific Argentine province with which the project is located, as there’s a lot of variation among them.

Diablillos is located in the Salta province, which is in the northwest portion of the country. Salta has a long history with mining, with a variety of metals being mined across the province. The most famous, because of the battery metal craze, may be Salta’s lithium brine mines, which are a part of the world-famous lithium triangle.

Thus, Salta is known for being supportive of mining and have provided a framework in which permitting applications are expeditiously vetted.

Further, amongst the political turmoil at the federal level, senior mining companies such as First Quantum have continued to put money into Salta. In 2014, they acquired the Taca Taca Project for roughly $500 million; not a small amount of money.

Finally, with all things considered and you contrast the political risks against the upside potential in the newly formed AbraPlata, I think the political risk associated with Argentina is acceptable.

Concluding Remarks

AbraPlata Resources presents an attractive investment proposition as demonstrated by its MCAP; the investor has a high potential for success versus the risk associated with the company.

Here’s a summary of AbraPlata’s upside potential:

- Good management – supported by Altius Minerals, SSR Mining and Sprott Asset Management

- MCAP is currently valued at roughly 10% of 2018 PEA on Diablillos

- After-tax NPV@7.5% of US$212 million, After-tax IRR of 30.2% at US1300/oz gold and US$20/oz silver

- Indicated Resource – 80.9 Moz @ 93.1 g/t silver and 732 koz @0.84 g/t gold

- Potential to improve NPV through resource expansion at depth and along strike

- Potential to drastically reduce initial CAPEX by changing the mine plan to an underground operation

- No value given to its Chilean Project Portfolio – Arcas Copper-Gold Project, Maricunga Gold Project and Peineta Gold-Silver Project – All are JV-ready opportunities.

- The prospect generator business model has the JV partners fund the exploration of the projects – drastically reducing the risk associated with exploration.

- If you consider that many prospect generators, albeit with JV partners in place, have, in many cases, MCAPs of CAD$30 million alone, AbraPlata’s current value proposition is very good.

- Roughly $3 million in cash

No investment is without risk, including an investment in AbraPlata. Given the upside potential that I see in the company, however, especially in a rising precious metals environment, I believe AbraPlata is in for a dramatic market re-rating once the merger is complete.

I’m an owner and will continue to be a buyer of AbraPlata on weakness in the weeks ahead, as they set forth on what should be an exciting fall of exploration at Diablillos.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with any of the companies discussed in this article – Altius Minerals, Aethon Minerals, AbraPlata Resources. I do own shares in Altius Minerals and Aethon Minerals.