Newfoundland & Labrador – A New Frontier for Gold Exploration

Canada is well known for its gold mineralization; the Abitibi Greenstone Belt in Northern Ontario and Quebec, the Golden Triangle in Northern British Columbia and the White Gold District in the Yukon.

Source: Anaconda Mining – Viking Project

Lesser known, but quickly emerging as the next frontier in Canadian gold mining exploration and development, is Newfoundland & Labrador (NL). Over the last year, NL has seen a staking rush and looks to be added to the list of world-class destinations for mineral exploration.

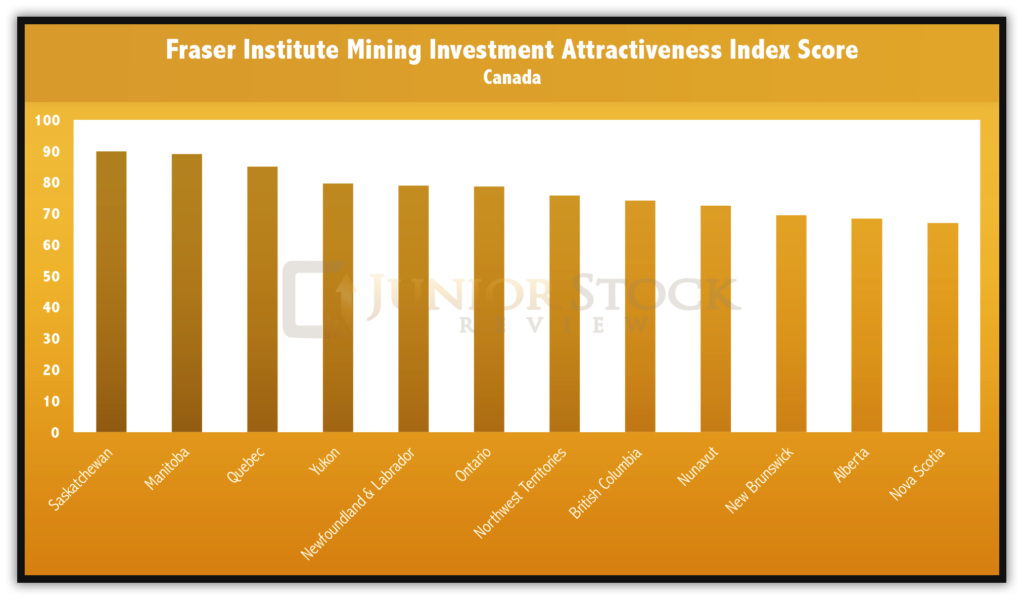

Source: Fraser Institute

This opinion is shared by the Fraser Institute, as it Ranks NL 5th in Canada and among the top in the world when it comes to mining investment attractiveness. The mining investment attractiveness score is a combination of the politics and, most importantly, the geological appeal of the region.

Examining the rankings, you can see that NL ranks ahead of a couple of the more well known Canadian provinces, Ontario and British Columbia.

Let’s take a look at why NL scores so well in politics and geologic attractiveness.

Newfoundland & Labrador’s Geology

NL’s Ministry of Natural Resources’ website has a tremendous library of resources available to anyone looking to learn what the island has to offer from a mineralization perspective.

The island can be broken down into 4 geological zones: (NL Ministry of Natural Resources)

- Starting on the western most portion of the island, we have the Humber Zone, which hosts Mid-Paleozoic extensional cover basins, Siluro-Devonian plutonic & volcanic rocks and Early Paleozoic rift, slope, shelf and foreland basin-facies carbonate and siliciclastic rocks.

- The Dunnage Zone sits on the Humber Zone’s eastern border and hosts Silurian marine to terrestrial volcano-sedimentary basins, Cambro-Ordovician marine volcanic and sedimentary rocks of arc and back-arc origin, including ophiolite.

- The Gander Zone is found in two spots on the island, amongst or in the middle of the Dunnage zone and on the Dunnage Zone’s eastern border. The Gander Zone is considered by many to be the most prospective for gold exploration in the province. The Gander Zone is host to Silurian synkinematic granitoids and high-level Devonian plutons, Silurian metamorphosed Early Paleozoic quartz-rich terrigenous siliciclastics; Ordovician magmatic rocks.

- Finally, the Avalon Zone makes up the eastern most portion of NL. It hosts Devonian terrestrial basins, Cambrian shallow-marine, shaley platformal cover, latest Neproterozoic (post-560 Ma) pull-apart basins and related peralkaline magmatic rocks and Neproterozoic (760-565 Ma) volcano-plutonic arc complexes and siliciclastic sedimentary basins overlain by shaley deltaic rocks.

The age, type and structure of the rock, especially in the Dunnage and Gander Zones, make them especially interesting for precious metals exploration. For me, I will be focusing on gold exploration and development companies in these regions, as I believe they have the highest probability of making and developing an economic discovery.

To note, most of the island of NL is covered with a glacial till or cover of some sort (most notably bogs), making the outcropping of mineralization much more rare than other provinces in Canada, where it is quite common.

This aspect of NL makes it that much more important to have a strong geological background in your exploration team, as they will be highly dependent upon their ability to interrupt much subtler geological information. NOTE: Pay close attention to the exploration teams for the companies you research, as they should (preferably) have a background in exploring in this type of terrain.

I had the chance to ask the CEO of Anaconda Mining, Dustin Angelo, and the CEO of Torq Resources, Michael Kosowan, a series of questions pertaining to the exploration and development of properties in NL. Who better to give us an idea of what it’s like to conduct mining business within the province than these two leaders?

Anaconda Mining (ANX:TSXV)

Gold Producer, Developer and Explorer

CEO – Dustin Angelo

Anaconda Mining is a gold producer, explorer and property developer in Newfoundland & Labrador and Nova Scotia. Their main producing property, Point Rousse, produces roughly 16,000 oz of gold per year and is located on the Ming’s Bight Peninsula located in the Baie Verte Mining District. Anaconda’s other projects include Goldboro and Viking, which bring Anaconda’s total gold resource to over a million ounces and counting.

Torq Resources (TORQ:TSXV)

Gold Explorer

CEO – Michael Kosowan

Torq Resources is a mineral exploration company with a goal to establish a tier-one mineral portfolio. Currently, Torq owns 120,000 hectares of prospective gold property in Newfoundland & Labrador. Torq is led by CEO, Michael Kosowan, and board members, Ivan Bebek and Shawn Wallace, who are serially successful entrepreneurs within the mining sector.

Brian: From a geological perspective, why explore for mineralization in Newfoundland & Labrador?

Anaconda Mining Inc. – CEO: Dustin Angelo

“The long geological history with diverse geological terranes that have seen multiple mountain building events and deep crustal scale fault zones lend themselves to strong potential for gold mineralization. The Appalachians as a whole is a mountain belt that has not seen a lot of exploration for orogenic gold deposits despite similar age rocks throughout the globe (e.g. Lachlan fold belt in Eastern Australia) being a significant host for gold mineralization. Recent discoveries and development projects (e.g. Valentine Lake, NL; Moose River Mines, NS) are starting to show the potential for the Appalachians to host large gold deposits. Newfoundland is becoming a recognized place to look.”

Torq Resources – CEO: Michael Kosowan

“Newfoundland presents a significant underexplored opportunity for Torq and its shareholders. Early indications demonstrate the potential for orogenic and epithermal styles of gold mineralization. High grade gold intersections have been reported throughout central Newfoundland, as demonstrated by the recent success of Marathon Gold at Valentine Lake and Antler Gold at Wilding Lake. There are a number of structural scale suture zones and thrusts (large faults) which represent large scale fluid pathways which potentially have focused fluid flux along them and, if these fluids carried metals, there can be significant mineralization.”

Newfoundland & Labrador’s Base Metal Production

From a mining perspective, NL is most known for its base metals discoveries and production, with the Voisey’s Bay Discovery being the most famous, in my opinion. NL’s Ministry of Natural Resources released a report on the province’s mines in February of this year.

The report mainly covers the producing mines within the province, giving the reader an overview of the mine activities and some production statistics.

NL is currently home to 9 producing mines:

- Vale Newfoundland and Labrador Limited, Voisey’s Bay

- Iron Ore Company of Canada, Labrador City

- Tata Steel Minerals Canada Ltd., Menihek Area

- Atlantic Minerals Limited, Lower Cove

- Anaconda Mining Inc., Pine Cove – Open Pit Gold Mine

- Rambler Metals and Mining Canada Limited, Baie Verte Peninsula

- Barite Mud Services Inc., Buchans

- Hi-Point Industries Ltd., Bishop’s Falls

- Trinity Resources Ltd., Manueals

One of the graphs provided gives an overview of the gross value of mineral shipments over the last 8 years by metal type. The graph shows that, overwhelmingly, iron ore is the number one mineral export in the province, followed by nickel and copper. This heavy dependency on base metals makes the province even more susceptible to the global economy and its ebbs and flows.

However, the current push towards making NL a world-class destination for precious metals exploration will help bring some much needed jobs to the province and further diversify its metal exports.

I asked the NL Ministry of Natural Resources,

“Currently, the majority of the mine production comes from base metals such as iron ore and nickel. Do you see progress in any other metal(s)? Possibly gold?”

*Answer provided on behalf of the Newfoundland & Labrador Ministry of Natural Resources:

“There are a number of advanced exploration projects for potential investment, including opportunities for gold, base metals, rare earths and other commodities. High gold prices as well as new gold discoveries and new analyses of public geo-scientific data are fueling gold exploration.

Marathon is continuing to advance exploration and increase reported resource for its Valentine Lake Gold Property located in Newfoundland. They have currently reported measured and indicated resources totaling 1,388,200 oz. of gold at 1.91 g/t and inferred resources totaling 766,500 oz. of gold at 2.24 g/t. Drilling in 2017 is continuing to focus on expanding the Marathon Deposit at surface and to depth.

Anaconda Mining is continuing to actively explore to expand its resources and extend the life of its existing mining operations. Rambler Metals and Mining is producing copper-gold concentrate at their Nugget Pond mill from the Ming Mine on the Baie Verte Peninsula.”

Brian: Will there be an attempt to grow the mining industry within the province? If so, how will it be done?

*Answer provided on behalf of the Newfoundland & Labrador Ministry of Natural Resources:

“To increase exploration and development activity we are working on sharing mineral information globally – similar to sharing seismic data with oil and gas companies around the globe. We believe this will help attract mineral exploration activity that has the potential to generate significant new industrial activity in the coming years. We are committed to working closely with the mining industry and the communities in which they operate to attract investment and develop the economy of Newfoundland and Labrador.”

Ultimately, I believe the future is bright for base metals, and today’s lows may be great buying opportunities. Gold discoveries and further promotion of NL’s prospective gold properties should help to spur further investment into the province and help diversify NL’s base metal mining dependency, as there is no better way to spur investment in a region than to have a major discovery!

Newfoundland & Labrador Infrastructure

A jurisdiction’s geology is of the utmost importance when it comes evaluating the value of a prospective property. However, while a nice high grade gold discovery is fantastic, if there’s no power or road access to the property, the sexy high grade gold can soon become just an average or uneconomic discovery.

While the island portion of NL is, comparatively to the rest of Canada, just starting a major push towards precious metals exploration, it has long been a logging province. For many of the current companies that own prospective properties within the province’s interior zones, these logging roads provide much needed access to some of the more remote land claims.

I posed the question regarding infrastructure to Angelo and Kosowan;

“Is Newfoundland & Labrador’s infrastructure conducive to exploring and developing mining properties? Please explain.”

Anaconda Mining Inc. – CEO: Dustin Angelo

“Newfoundland has excellent infrastructure to support exploration work. Much of the province is transected by provincial highways that access historic fishing communities along the coast. The island has traditionally been logged for pulpwood and the island has an extensive network of logging roads that allow access to remote areas. Small hydroelectric projects occur throughout much of the island and in tandem with numerous coastal communities means that electricity is generally fairly close to most exploration areas.

There is a strong geo-scientific community on the island and historical exploration data and drill core are available through the government. Skilled workforce trained in mining and exploration.”

Torq Resources – CEO: Michael Kosowan

“There is great infrastructure throughout the majority of Newfoundland. That said, parts of Newfoundland, particularly the Central region, are very remote. Ninety five percent of Torq’s properties are accessible from the ground via forestry roads. There is also an analytical laboratory located in nearby Springdale for processing samples. Gander, the closest major town, is adjacent to and provides excellent infrastructure to our Gander suite of claims.”

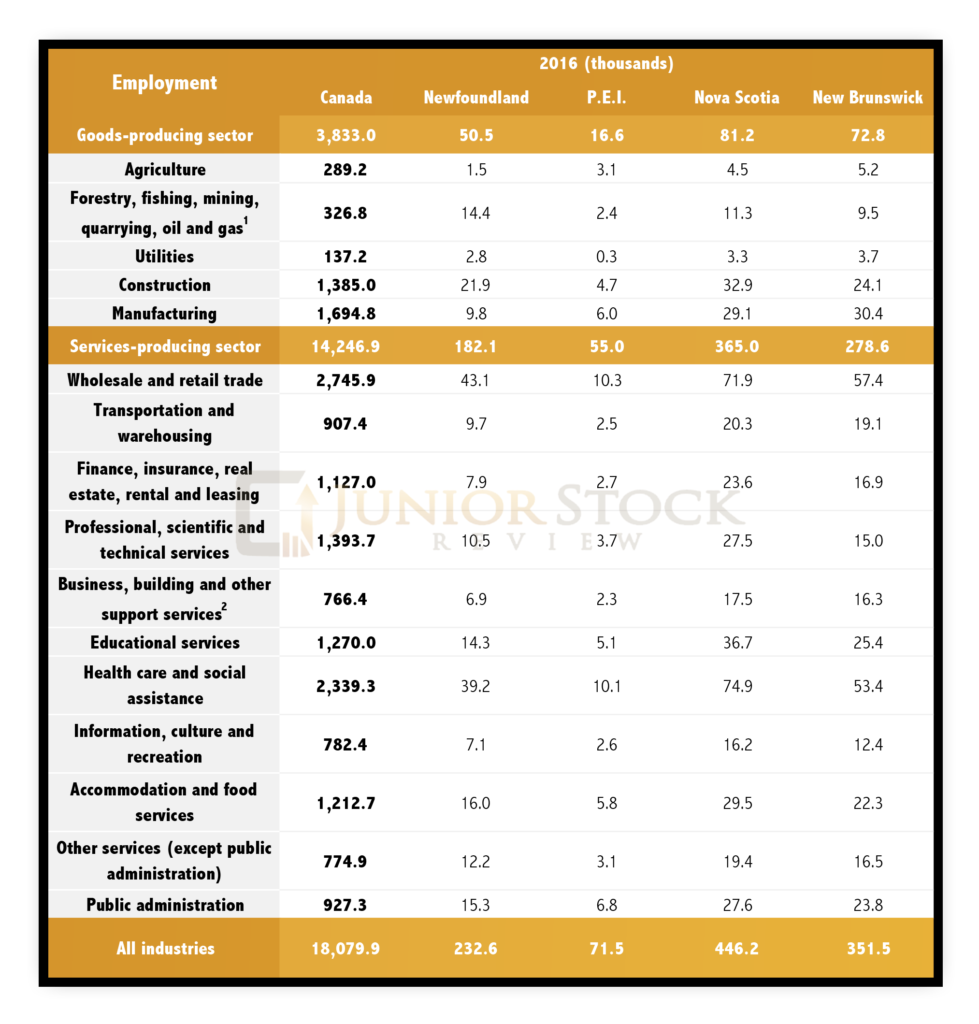

Mining as an Employer in Newfoundland & Labrador

Where does mining stand in NL’s employment rankings? Examining the table below, courtesy of Statistics Canada, mining represents 8.5% of the goods producing sector employment. For me, this is surprising as I would have thought that it would have represented a larger portion of the employment in the province already.

Source: Statistics Canada

I asked Kosowan and Angelo,

“Does Newfoundland & Labrador have the available workforce to fill the needs of the growing mining sector?”

Anaconda Mining Inc. – CEO: Dustin Angelo

“Yes, there are a great number of local experienced workers plus an equal number that are working a rotation (Fort McMurray, diamond mines, Ontario mines while waiting for employment at home). With the downturn in Alberta and Labrador, Anaconda has seen a significant influx of skilled workers looking for jobs.”

Torq Resources – CEO: Michael Kosowan

“ Yes, it does indeed − both in numbers and in experience. Torq attended the CIM conference in St. John’s last November (called Stratton Resources, at the time) and we were very impressed with the number of experienced prospectors and exploration services companies. Torq recently completed a regional scale sampling program with 90% of the crew residing in Newfoundland.”

While mining isn’t currently the largest employer in the province, mining jobs are typically well paid and, therefore, usually a priority for any provincial government. In the next section of this report, I will cover NL politics and how the provincial government is looking to increase the number of mining related jobs through improving its mining investment attractiveness.

Newfoundland & Labrador Politics

To many, the biggest risk associated with speculating in junior mining companies is the risk associated with the jurisdiction in which the company is exploring, developing or producing. Interestingly, not only do you have to look at a country’s overall politics, but it’s an absolute must to review the state or provincial politics to gain a sense of the amount of risk you are taking on.

Provincially, NL is governed by the Liberals, who have been in power since 2015. The Conservatives and Liberals have flip flopped control of the province since NL became a part of Canada in 1949.

How do the NL Liberals approach mining? I did a little digging and found their platform from the beginning of their term, called their Five Point Plan. On page 15 of that document, there are two paragraphs on the promotion of growth in mining. The Liberals say,

“Despite challenges associated with fluctuating commodity markets, the mining industry remains a valuable contributor to the provincial economy with strong potential for recovery and growth in the coming years. Liberals believe in continued development through industry partnerships and innovation, while also ensuring that benefits are maximized for local economic regions where mining operations take place.” ~ Five Point Plan

On page 15 of the Liberal government’s Five Point Plan, they outline a few points regarding the mining industry and what they wish to address during their term. How is that plan progressing?

*Answer provided on behalf of the Newfoundland & Labrador Ministry of Natural Resources:

“As a province, we support growth in the mineral industry through prospector training and mentoring, the mineral incentive program, which supports grassroots prospectors and junior mining companies, public geo-science, the core storage program, promotions, and efficient and transparent regulation.

In 2016, 21,000 claims were staked in the province, just over three times the amount staked in 2015, and the most in the last five years. We want to ensure that everyone, every growing company, has the opportunity to learn, grow and advance their operations. To support development and to streamline processes, government has created industry facilitators.

Assigned among existing staff, these facilitators will liaise with companies in early stages of exploration and development to guide them through the provincial policy and regulatory frameworks, helping facilitate their progress.

The industry facilitators also connect with our colleagues in other departments to ensure the companies they work with get timely support from departments across government.

Having this kind of support available to mining companies will help them navigate the various supports and regulatory functions so they can operate successfully in the province, now and well into the future.

By creating an attractive environment for exploration, we are strengthening the industry, and growing private sector jobs and the economy throughout our province.”

Further, I asked Kosowan and Angelo,

“Is Newfoundland & Labrador’s provincial government focused on improving its investment attractiveness for mining? If so, how?”

Anaconda Mining Inc. – CEO: Dustin Angelo

“Yes, since the Liberal Government came in during late 2015, it has made a concerted effort to diversify away from the oil and gas sector. Anaconda has had several conversations with the relevant ministers and the Premier about focusing on mining. The government is working on mining centres of excellence in conjunction with its college campus system. From a financing standpoint, the government provides loans through the Department of Business, Trade, Culture and Rural Development to help companies, including mining companies, fund innovation initiatives. Anaconda has been the recipient of such loans. In addition, the Department of Natural Resources has embarked on a restructuring to better serve mining companies who are permitting for various activities.

Lastly, the Provincial Government funds the “Junior Exploration Assistance Program” (JEA), which aims to grow the mineral inventory of the Province through the discovery of new mineral districts, occurrences, prospects and deposits. Anaconda has benefitted from JEA as well as the provincial Research & Development Council (RDC), and federally from Atlantic Canada Opportunities Agency (ACOA) and the Industrial Research Assistance Council (IRAP). Recent financial support was received to develop technology for narrow vein mining.”

Torq Resources – CEO: Michael Kosowan

“Yes. They have a very well set up mineral incentive program through the Department of Natural Resources. This program provides rebates through the Junior Exploration Assistance Program (JEA). Grants top out at $150K in Newfoundland and $225K in Labrador. The 2017 budget is $1.3M and there were 39 JEA applicants this year. Additionally, the Newfoundland Geoscience Atlas website is a phenomenal source for minerals data including, but not limited to, downloadable claims, mineral occurrences, historic drilling, geology, available geophysical surveys and geology. The online staking system is also quite handy. The online staking and Geoscience Atlas make exploring in Newfoundland that much easier.

True story: in 2016, Torq’s prospectors filed more claims than the government’s online intake system could handle, and inadvertently crashed it. News spread, and Newfoundland is now considered, by some, to be the next hotbed of mineral exploration.

There is also the Matty Mitchell Prospectors Resource Room which is designed to help local prospectors connect with juniors through major companies. The majority of the historic drill core is available for viewing and sampling at core facilities throughout Newfoundland. Lastly, the Geologic Survey Division is well set up and open to meeting with industry and disseminating their knowledge. They are well staffed with some fantastic geologists who have a wide range of expertise.”

Newfoundland & Labrador First Nations

Not just in Canada, but around the world, First Nations’ involvement in mining are met with trepidation by investors. This isn’t without cause, as in the past and I’m sure in the future, disputes over the development of First Nations’ lands into producing mines will be disputed. However, there are many First Nations which welcome mining into their communities, along with the cash flow and improvements that typically follow with the development of an operating mine.

In my research, I found that the Mi’kmaq First Nations occupy some areas in Newfoundland, with their main reserve in Conne River. Excluding Labrador, do the Mi’kmaq First Nations or any other First Nations control any lands that are being mined or have the potential to be explored and developed in the future?

*Answer provided on behalf of the Newfoundland & Labrador Ministry of Natural Resources:

“First Nations on the island of Newfoundland are encouraged to participate in any public regulatory review process in which they are interested, and we often work bilaterally with each of the First Nations to address concerns related to areas of local or cultural significance to the First Nations, regardless of Aboriginal rights to the lands in question (The Mi’kmaq First Nations do not have Section 35 rights of the Constitution Act on the island of Newfoundland).”

Past is typically prologue, so looking at a First Nations’ track record in negotiating land development is key, in my opinion, to understanding the risks associated with investing in a company which is exploring or developing a property in a First Nations’ controlled area.

Newfoundland and Labrador have 3 groups of First Nations peoples: the Inuit, the Innu, and the Mi’kmaq. Let’s take a closer look.

Inuit

The Inuit communities are found along the north coast of Labrador. The people of these communities are descendants of the prehistoric Thule, a marine oriented group of hunters, which were drawn to the north coast of Labrador due its abundance of both marine and land wildlife. The Thule are originally from Alaska and moved across to the Arctic and further east to Greenland and the Labrador coast around 1250 AD.

The Nunatsivut First Nations are a self governing community in Labrador of Inuit descent. The Nunatsivut have 55,000 square miles of land which they are willing to develop if the opportunity presents itself, as they describe in this quote,

“We have a lot to offer including 55,000 square miles of land that is rich in natural resources; a recognized and responsible self-government; a willing and innovative workforce; and a challenging but rewarding climate for new ideas and businesses. Our goal is to create long-term benefits for our people.” ~ Nunatsiavu

Mi’kmaq

The Mi’kmaq First Nations are located on the island of Newfoundland. While they were recognized by the Government of Canada in 2011 as an indigenous Band, the Mi’kmaq do not have Section 35 rights of the Constitution Act on the island of Newfoundland. What does that mean? Section 35 provides Aboriginals with constitutional protection on fishing, logging, hunting and the right to land.

The Miawpukek First Nations (Conne River) community, the largest of the Mi’kmaq, is located in an area known as the “Coast of Bays Region,” which is on the south coast of Newfoundland. The community is approximately 224 km south of Gander and has approximately 787 on-reserve members and 1779 off-reserve members.

Qalipu is a Mi’kmaq First Nation located in Newfoundland which has no reserve land. The Qalipu community is made up of 66 traditional Mi’kmaq communities, spread out across 9 different electoral wards. Offical Qalipu offices are held by community reps in Corner Brook, Glenwood, Grand Falls-Windsor and St. George’s, giving the widespread Qalipu community representation.

Innu

The Innu First Nations (Naskapi-Montagnais) are located in central Labrador and are made up of two main communities, Sheshatshiu and Natuashish. The roughly 2200 members of the Innu community elect a Band counsel which represents the community’s need and concerns.

In 2001, they established the Innu Business Development Centre (IBDC) to formally deal with companies that want to conduct business with their community. An example of a successful negotiation with a mining company is with Inco, now Vale, on a mining royalty for the Voisey’s Bay Project.

Two Final Questions Regarding Newfoundland & Labrador

Finally, before making my concluding remarks, here are two final questions which I posed to my three interviewees:

What differentiates Newfoundland & Labrador as a destination for mining versus the rest of Canada?

Anaconda Mining Inc. – CEO: Dustin Angelo

“Newfoundland and Labrador has a young mineral tenure system.Modern claim staking began in the late 1970’s. Prior to that, the only exploration undertaken was on Charter Land. The advent of the mineral tenure system in the late 1970s led to a boom in gold and base metal discoveries in 1980s to present. As such, gold exploration in Newfoundland is still relatively shallow compared to the Timmins area, for example (over 1.5km deep).

There are 722 gold showings on the island. The Baie Verte Peninsula went from ~ 35 to 150+ during the exploration boom in the mid 80’s with 4 gold deposits discovered on this peninsula alone. Several new discoveries in recent years illustrate the potential (ie: Argyle, Wilding Lake, Frank Zone, Hope Brook).”

Torq Resources – CEO: Michael Kosowan

“Newfoundland is differentiated by the lack of exploration history by juniors. The island has really only been open for exploration for about 25 years. The vast majority of Newfoundland was tied up in leases or grants to the big forestry companies until recently.”

*Answer provided on behalf of the Newfoundland & Labrador Ministry of Natural Resources:

“Mining is one of the oldest and leading industries in Newfoundland and Labrador and is a major contributor to our economy. Today, more than 5000 people are employed in the industry, particularly in rural communities, and almost $3 billion in mineral shipments are forecast. Globally, Newfoundland and Labrador is currently ranked 16th on the Fraser Institute’s 2016 International Mining Survey as one of the most attractive jurisdictions worldwide for investment attractiveness.

Our diversified minerals industry provides a wide variety of commodities to the world market. Eleven mineral commodities are produced or mined in the province. Five metal mines currently produce: iron ore, nickel, copper, cobalt, silver, and gold. In Newfoundland and Labrador, we have armed ourselves with public geo-science, clear regulations and support for prospectors and junior mining companies through the Mineral Incentive Program, all in order to create the greatest opportunity for exploration and development.

We are also doing more work online and providing services and information through a digital format. One of the services we provide is our online mineral staking system or MIRIAD – which was the first of its kind in Canada. Development of MIRIAD began in 2002 with the system going live on February 28, 2005. This is a great resource that gives companies or individuals the ability to obtain the mineral rights of an area by staking a claim online from anywhere in the world. We also make geo-science data publicly available for free through the Geological Survey’s Geo-science Online (Geo-science Atlas). Online geo-science data has been available to the public for the past 20 years.

And, we are moving to establish online services to help increase exploration and development activity. The Department of Natural Resources plans to share core sample information with more companies worldwide through digitization and web access.

We believe this will help attract mineral exploration activity that has the potential to generate significant new industrial activity in the coming years.”

What are the greatest challenges for exploring and developing mineral properties in Newfoundland?

“The greatest challenges for exploration on the island is the generally extensive glacial till cover and presence of extensive bogs, lakes and ponds across much of the island. These obscure the geochemical and geophysical signature of low lying areas (valleys that are host to faults, eroded alteration zones) that potentially host mineralization.

In some areas that have some of the best potential there is a lack of systematic geo-scientific and exploration data that requires companies to start from scratch.”

Anaconda Mining Inc. – CEO: Dustin Angelo

“We’ve had very few challenges. We see opportunity and significant potential in Newfoundland. The remoteness is one of the attractions, as it has led to the Island being underexplored historically. As frontiersmen, this excites us.

Torq searches the globe for high-quality precious metals assets. We’re looking for the next big discovery. Our team is visionary and not bound by convention. We have the confidence and budget to conduct grassroots exploration. We also have the experience and tenacity to manage the risks for which the majors have little appetite. Exploring Newfoundland and unlocking its value is our first step in building a world-class portfolio.”

Torq Resources – CEO: Michael Kosowan

Concluding Thoughts

Summarizing my thoughts on Newfoundland & Labrador, I believe it’s a province which is set to play a much larger role in Canada’s mining industry in the years ahead. Newfoundland checks all the boxes when it comes to being a desirable jurisdiction for investment:

- Newfoundland & Labrador’s geology has long been associated with base metals such as iron ore and nickel, however, I think this is quickly changing as a number of precious metals companies look to explore and develop some highly prospective properties. Comparatively to the rest of Canada, NL is under explored, especially for precious metals, such as gold.

- Newfoundland & Labrador encourages mineral exploration within its borders with the Junior Exploration Assistance Program (JEA). While the available funds in the program are small, it is a step in the right direction towards encouraging mining investment in Newfoundland & Labrador.

- Newfoundland & Labrador has a workforce which is accustomed to heavy industry. With low oil prices hurting the oil fields of Alberta, many native Newfoundlanders are finding their way back to the island and with them comes multiple years of heavy industrial experience. As properties develop, there is both a workforce to fill the needed positions and the infrastructure to produce and export their goods.

- The people of Newfoundland & Labrador have consistently voted for Conservative and Liberal governments since joining Canada in 1949. I expect this tradition to continue, which presents a stable political landscape for mining companies looking to explore and develop properties within its borders.

- From an investment standpoint, First Nations’ involvement in the mining sector can cause trepidation for the investor. In Newfoundland’s case, this isn’t an issue, as the First Nations do not control any large blocks of land that are prospective for mineralization. NOTE, this is a different story for Labrador.

Newfoundland & Labrador is a great jurisdiction for mining and is a place where I ‘m looking to deploy some of my investment dollars. Stay tuned for future articles on specific companies that have garnered my interest.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company(s) and sector that is best suited for your personal investment criteria. I do own Anaconda Mining shares. I do not currently own Torq Resources shares. I have NOT been compensated to write this article.