Nickel Laterite’s Integral Role in the Coming Nickel Boom

In my opinion, nickel laterite deposits will continue to play a major role in the future of the global nickel market. Nickel laterite deposits are, in relative terms, abundant and located at shallow depths within the earth’s crust, making them an ideal low-cost nickel source for the stainless steel industry. I, however, believe that in the future the role of laterites will expand to help fulfill the burgeoning electric vehicle revolution.

There are 3 reasons why I think this:

- EV battery market demand for Class 1 nickel will outpace, over time, the current production capacity of nickel sulphide deposits

- Both the production and development of nickel sulphide deposits is on the decline. High exploration costs, a slow development process (i.e. permitting) translate into what can be a minimum of 10 years and an average of more than 20 years from discovery to the development into a mine.

- An increasing proficiency in laterite ore processing techniques – Hydro-metallurgy

Electric Vehicle Revolution

In my opinion, EVs represent the most disruptive force within the resource sector since China began consuming metals on a huge scale during the last resource bull market. The reason I feel EVs will have such a disruptive force is a mixture of both metal supply constraints and the major influx of demand.

As I stated in my introduction, the metal I find the most interesting in this EV revolution, given its fundamentals going forward, is nickel.

Source: Glencore 2018 BMO Presentation

As you may or may not know, nickel is a key ingredient in the 2 most popular battery chemistries – nickel, manganese and cobalt (NMC); and nickel, cobalt and aluminum (NCA).

Source: Nornickel – May 2018

As you can see from the graph above, the most popular battery chemistry for the last couple of years has been NCM. Up until last year, NCM batteries were composed of equal parts, denoted 1-1-1, meaning 1 part nickel to 1 part cobalt to 1 part manganese. With the spike in cobalt prices, however, manufacturers have started to change the composition to be more economic, yet still have the stability needed for safe operation.

Currently, the newest commercially used ratio is 5-2-3, increasing the batteries’ reliance on nickel. As well, but still in the experimental stage, is the 8-1-1 ratio, which dramatically shifts the use of nickel higher, making it by far the major component of this future new generation of battery.

Along with the cost savings, the higher ratio of nickel provides the battery with a higher energy density, allowing a battery to maintain a charge longer and have a longer range.

EV Market Demand – Class 1 Nickel

The nickel used within the batteries is termed Class 1 nickel and is mostly but not exclusively derived from nickel sulphide deposits. Although the current EV market’s demand for nickel is low, the growth profile is incredibly large and is really where the EVs could cause a disruption in the nickel market – if not all of the battery metal markets.

NOTE – Battery related consumption is estimated to reach 85,000 tonnes by 2020, representing 4% of the 2017 nickel supply.

Source: U.S. Geological Survey and RBC Capital Markets

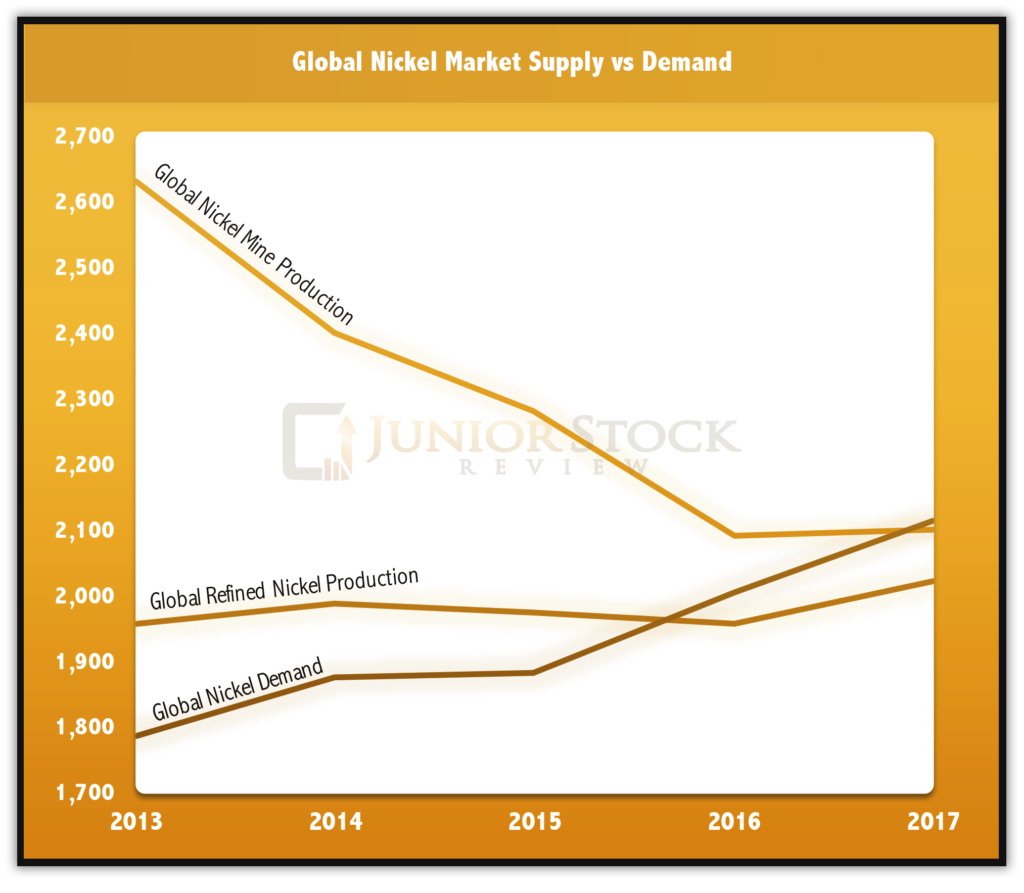

To put this into perspective, we need to take a quantitative look at supply and demand. First, let’s look at supply; the global refined nickel supply for 2017 was around 2.1 million tonnes (both sulphides and laterites).

Second, the global nickel consumption for 2017 was around 2.2 million tonnes, demonstrating that demand is currently exceeding refined supply. For the focus of this article, this is particularly important. As I stated earlier, the EV market, at its current consumption rate, has very little effect in the overall market, however, as you can see, consumption is still exceeding refined supply.

What is the effect of EV demand over the next decade? This is a great question and key to understanding the predicament with which the nickel market is faced, moving forward. A great estimation of future nickel demand is provided by Glencore in their 2018 Global Metals, Mining & Steel Conference presentation:

- Assuming a 30% market capture of the world car market by 2030, EV nickel demand will reach 1.1 million tonnes per year.

1.1 million tonnes of Class 1 nickel consumption in today’s market would encompass roughly 55% of the refined supply. Now assume that all 1.1 million tonnes can be serviced by the existing nickel sulphide refining capacity, which seems doable, but it isn’t!

There is going to be a proverbial “tug of war” between EV battery makers and speciality steel makers who consume Class 1 nickel for producing speciality grade steel products.

Source: Norlisk

Nickel Sulphide Deposits

What I find most interesting about nickel sulphides is that not only are their production figures predicted to curtail over the coming years, but the amount of projects awaiting development is low. Why is this? In my mind, there are 3 reasons; first, a bear market in the nickel price which pre-dates 2016; second, the fact that exploring for these deep deposits is very costly; and finally, in comparison to nickel laterites, which are estimated to account for up to 70% of the crustal nickel deposits on the earth, there are far fewer sulphides to find.

Let’s take a look at how a nickel sulphide deposit is formed. Instead of me describing this, I found a fantastic image on the Balmoral Resources website, which takes us through the process. See below.

Source: Balmoral Resources

Below are 2 pie charts depicting the distribution of known laterite and sulphide nickel deposits world-wide. Currently, the majority of nickel sulphide exploration is occurring in proximity to the world’s existing giant deposits, such as Vosiey Bay in Labrador, Russia, Finland and Australia.

Source: Nickel Institute

Nickel Laterite Deposits

Nickel laterite deposits are found in the tropical regions of the world, places such as Indonesia, Western Australia, New Caledonia and the Philippines. They are the result of the weathering of a nickel sulphide deposit and their composition is affected by a few key parameters, which include: the amount of weathering, drainage of groundwater and the tectonic setting.

Source: Murdoch University – Nickel Laterite Deposit Layers

There are 5 distinct layers or zones of a laterite deposit and they are as follows: ferricrust, red (upper) liminote, yellow (lower) limonite, transition or clay rich and saprolite/garnie. The key distinction between the layers is their composition, mainly the percentage of nickel and magnesium. Starting at the top and working our way down, you can see that the upper layers, the most weathered, have both the lowest percentages of nickel and magnesium. Conversely, the deeper layers contain the higher percentages of nickel and magnesium.

As you will see in Part 2 of this article, the composition of the laterite ore is key to how it is processed into its final product and, ultimately, how it will be consumed in its end use.

Sulphide Versus Laterite Deposits

Nickel sulphides and laterites are very different, not only in the basics such as composition, but on a higher level, such as the jurisdictions where they are found. In my opinion, while the demand fundamentals of the nickel market are bullish, developments in 2 of the bigger jurisdictions for nickel mine production – Indonesia and the Philippines – could have a major effect on the supply side of the market, good or bad. Time will tell.

NOTE: There is a 3rd but much less common nickel mineral called Awaruite. There is only one deposit that I know of, FPX Nickel’s Baptiste Deposit in the Decar District, which is located in British Columbia, Canada.

A summary of the key differences between the 2 types of deposits:

- Mining – Nickel sulphide deposits, which are typically found deep underground, are typically more expensive and difficult to mine in comparison to laterite deposits, which are found at surface and can be open pit mined.

- Grade – Comparatively, sulphides are typically a higher grade than laterites.

- Ore Processing – Comparatively, sulphides are easier and cheaper to process than laterites.

- Exploration – Sulphide deposits are more expensive to find in comparison to laterite deposits. Sulphides are found deep in the earth’s crust and, therefore, are much harder and costlier to find.

As you can see, there are advantages and disadvantages to each type of ore. Currently, the sulphide ore mainly feeds class 1 nickel users, and the laterite ores mainly feed the stainless steel industry (which, by the way, currently accounts for 2/3 of the global nickel demand).

Nickel Laterite Ore Processing

Nickel laterite ore processing depends on the zone from which the ore is mined. As outlined earlier, each zone within a laterite deposit is very different in its chemical composition and, therefore, restricts the processing technique that can be used to extract the nickel.

Pyro-metallurgy

Smelting

Arguably the most well known and widely used processing technique for extracting payable metals is smelting. The smelting of nickel laterite ore is no different, as the smelting process is the dominant technique and is typically used to make nickel pig iron (NPI) for the Chinese stainless steel market.

NPI is created by mixing, saprolite ores with coking coal and a mixture of fluxes. The process culminates in an electric arc or blast furnace, which renders the unwanted impurities into slag and allows the molten mixture to be cast into molds, forming nickel pig iron.

The main advantage of the smelting process is that it is a proven technology and can process saprolite ores (high magnesium), in relative terms, quickly. As well, it has high nickel recoveries. The smelting process, however, it requires a higher grade laterite ore, a large amount of energy to operate, and finally, doesn’t separate cobalt in the process.

Hydro-metallurgy

Hydro-metallurgical processing of nickel laterite ores can produce either a pure metal or an intermediate product such as mixed hydroxide precipate (MHP), mixed sulphide precipate, nickel carbonate or mixed nickel oxide.

The production of pure metals comes at a higher cost, as it requires additional facilities for purification, cobalt separation, and electro-winning – which can be expensive from an energy perspective. Alternatively, the production of intermediate products can be advantageous for all the opposite reasons that make pure metals less cost effective – less CAPEX and less energy intense.

The future of the hydro-metallurgical processing is most likely in high pressure acid leaching (HPAL), which has its own pros and cons, but has been gaining popularity in the last few years.

High Pressure Acid Leaching (HPAL)

The HPAL process’ re-emergence on the world stage as a technique for processing laterite ore is gradually gaining popularity as companies have begun to realize the need for laterites to be processed into Class 1 nickel units. Unfortunately, while the HPAL process is gaining more attention, it’s only really effective at processing the low magnesium limonite ore, as high magnesium levels have a neutralizing affect on the sulfuric acid which plays a key role in the extraction of the payable metals in the process.

The HPAL processing begins with the crushing of the ore, which is then mixed with water and preheated before being placed into an autoclave. The autoclave then elevates the temperature (up to 255 degrees Celsius) and pressure (725 psi) of the slurry and sulfuric acid and, over the next 60 minutes, the mixture reacts, extracting the nickel and cobalt from the slurry.

Once the autoclave portion of the HPAL process is completed, the slurry must be brought back down to atmospheric pressure and, thus, requires at least a couple of pressure letdown stages, which reduces the overall pressure of the slurry. Once at atmospheric pressure, it can be washed and the nickel / cobalt separated from the liquid.

Overall, the main advantages of the HPAL process are its ability to process low grade nickel laterite ores and its high and separate recoveries of nickel and cobalt. These advantages, however, are contrasted by a few negatives, which are its inability to process high magnesium or saprolitic ores, high construction and maintenance costs due to the highly corrosive sulfuric acid and, finally, the proper disposal of the magnesium sulphate effluent (waste).

NOTE: There are a few other types of nickel laterite processing techniques that are used throughout the world, such as, Caron Processing, Pressure Acid Leaching (PAL), atmospheric leaching, and bioleaching.

Global Nickel Refinement

The following flow chart produced by UBS Research is a great depiction of how the current nickel supply is consumed. It’s my contention that the 10% of nickel laterite consumption, which is currently diverted to create nickel chemicals and metal, will increase over time and fulfill the Class 1 nickel demand, which I believe will outpace sulphide ore production.

Source: UBS Research

Concluding Remarks

The EV revolution is here and, to me, it’s not a matter of ‘if’ but at what rate will the global population adopt EVs into their lives. As a result, all of the battery metal markets will be affected, each in its own way. The metal that I believe will play the largest role in this revolution is nickel.

This future onslaught of demand will be fulfilled by nickel laterites, which, today, have a minimal role in the Class 1 nickel market. In my opinion, the drop in nickel sulphide production, exploration and development over the coming years will force battery makers to consume nickel produced from the HPAL processing of laterite ores.

This, in turn, will have to be met with a rise in nickel prices to allow for these low grade laterite ores to be cost effectively processed for their use within the battery market.

Ultimately, I believe the future is very bright for nickel, but don’t get too caught up in the narrative; as I’ve shown, there are other ways the market can change to accommodate this major influx of demand.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria.