North American Uranium Producers

This is a ‘For Your Information (FYI)’ style report on North American uranium producers. I’ve given a very brief overview of each company, where their assets are, the size of their resource, and a few other tidbits. If you haven’t already, check out the in-depth articles I’ve recently written on Cameco and Energy Fuels, as well.

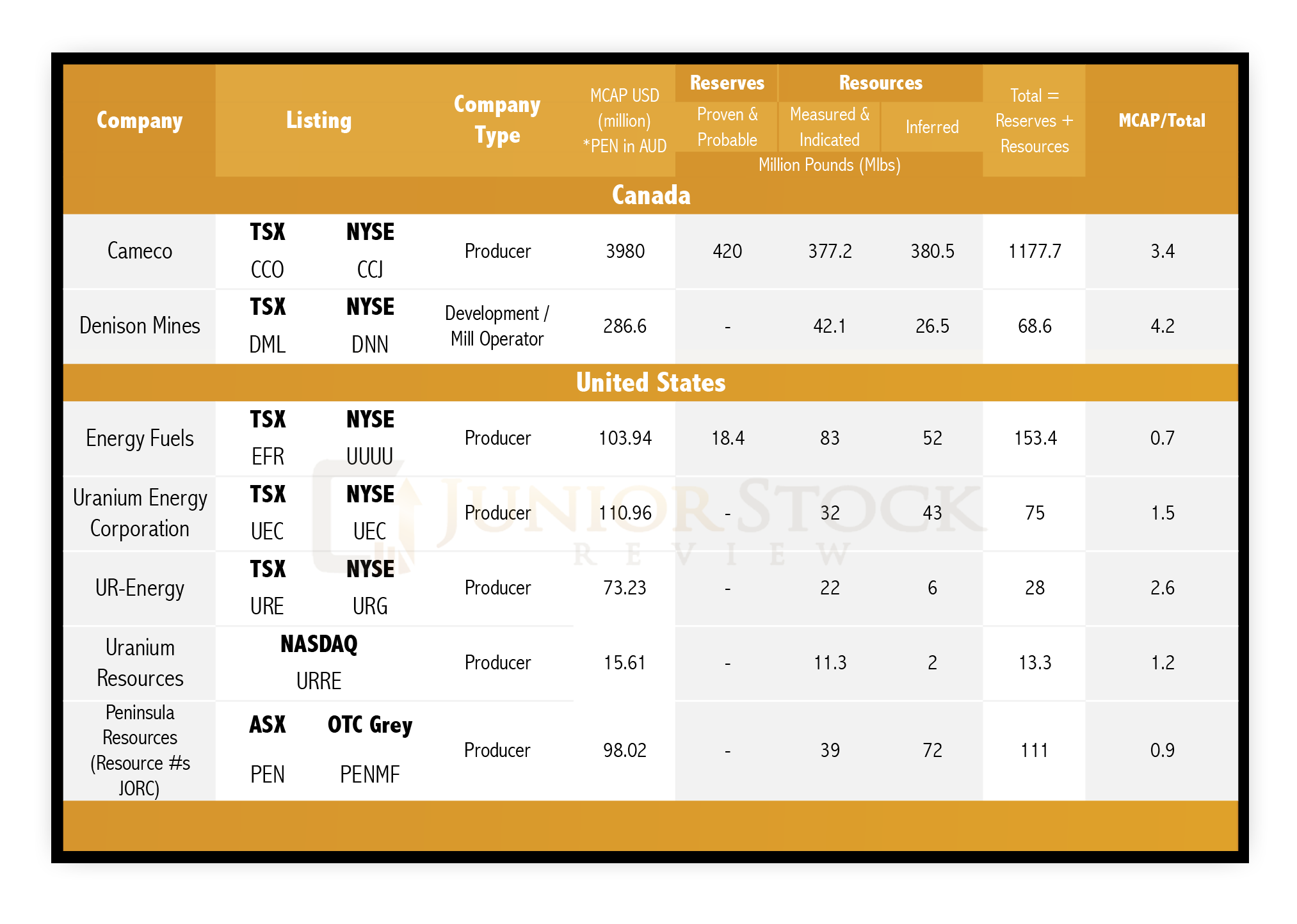

NOTE: The table above reflects MCAP and resource numbers taken at the time of the writing of the report and doesn’t necessarily reflect the current MCAP or resource numbers of the companies mentioned. Please do your own due diligence to get updated values.

Energy Fuels – Link to the Report

Denison Mines is led by CEO, David Cates, who is an accountant (CPA, CA) by trade. Cates has worked in the resource sector for a number of years, previously working with Kinross and PwC LLP before joining Denison in 2008.

While Denison Mines is better known for its uranium development project, Wheeler River, it does own 22.5% part of the McClean Lake Mill. The mill processes uranium ore produced by Cameco’s McArthur River, up to 18 Mlbs/yr U3O8. The remaining 6 Mlbs/year in excess capacity has been incorporated into Denison’s PEA for Wheeler River.

The mill cash generation isn’t spectacular, but does give Denison a revenue stream regardless of the uranium price.

- Traded on the DML:TSX, DNN:NYSE

- Executive Chairman – Lukas Lundin

- All properties are in Canada

- 25% ownership of GoviEx Uranium (GXU:TSXV)

- Sold its African uranium assets to GoviEx in exchange for ownership stake

- GoviEx Uranium is a uranium development stage company with two permitted projects, Madaouela (Niger) and Mutanga (Zambia) – this is a bigger deal than you may think – check out my article written earlier this year.

- Total M&I resources – 124.29 Mlbs U3O8 and Inferred resources – 73.11 Mlbs U3O8

UR-Energy is led by Executive Director and Acting CEO, Jeffery Klenda. Klenda’s background is in finance, having been an officer and/or director for numerous publicly traded companies throughout his 30-year career.

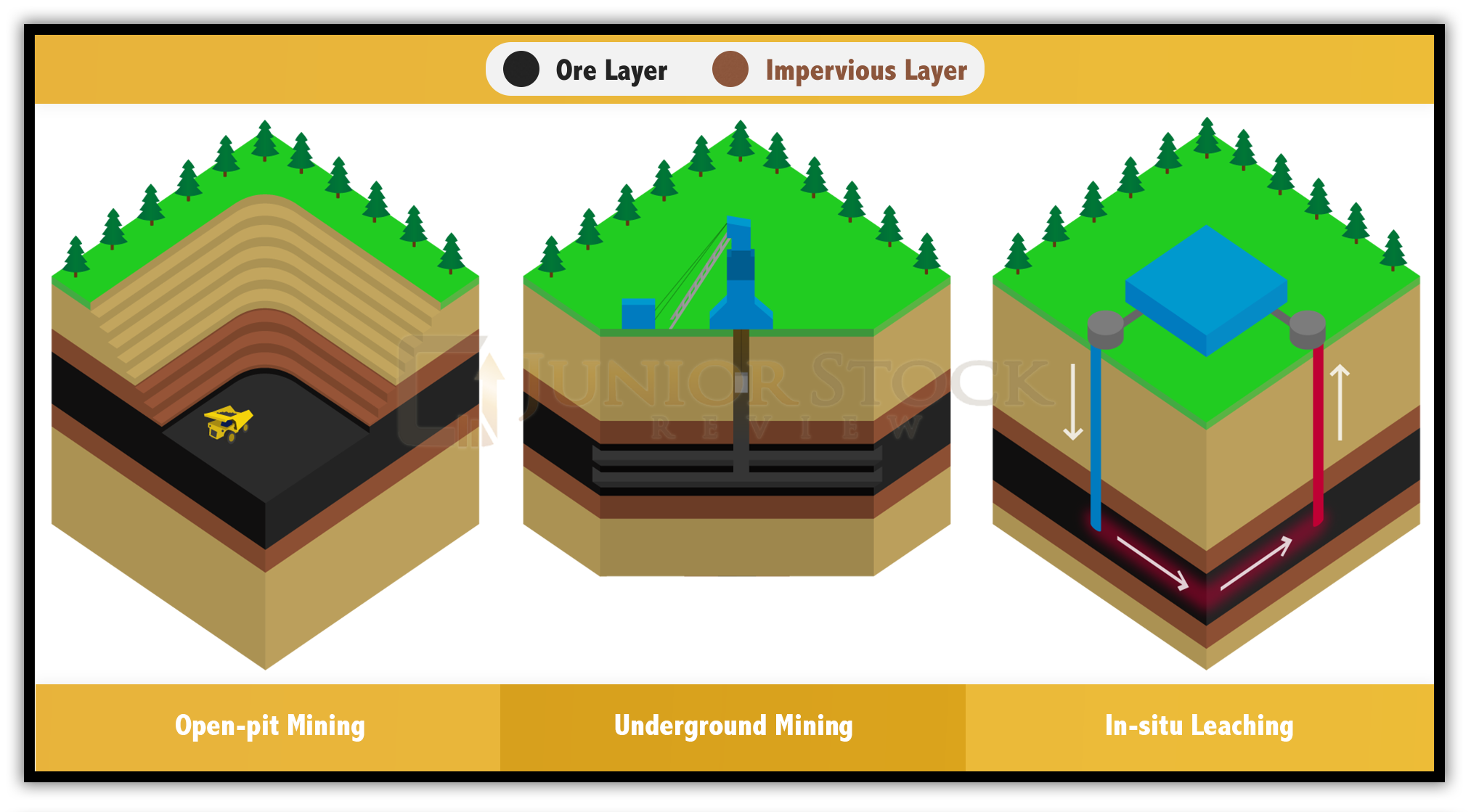

UR-Energy has a hedged sales book that stretches out to 2021 (See December 2016 Corporate Presentation), meaning a percentage of its current U3O8 sales are contracted at a higher than spot uranium price and, thus, is currently producing from its main asset, Lost Creek ISR Uranium Facility.

- Traded on the NYSE: URG and the TSE: URE

- All properties are located in the United States:

- Lost Creek ISR Uranium Facility (6 individual contiguous projects)

- Facility is located in Wyoming

- M&I Resource of 13.251 million lbs U3O8 and Inferred Resource of 6.439 million lbs (Source)

- Newly added pounds of uranium have the potential to be pipelined to the processing facility, giving the Lost Creek property a scalability factor

- Shirley Basin Mine Site

- Located in Wyoming

- Purchased from AREVA in 2013

- Preliminary Economic Assessment was completed in Q1 2015 and a mining permit application filed in 4Q 2015.

- Estimated total of 6.3 million lbs of U3O8 may be produced from the project

- Lost Soldier Project

- Located in Wyoming

- Exploration property located 14 miles north of the Lost Creek Facility

- Requires more funding for further exploration and development. Not a priority given the current market

- Lucky Mc Mine Site

- Located in Wyoming

- Part of the Pathfinder acquisition in 2013

- Exploration property, with past production from the 1960s through to the 1990s. Historical conventional mine production of more than 46.7 million lbs.

Uranium Resources is led by CEO, Christopher Jones, who has been in the mining industry for 30 years. Currently, Jones leads a business which has recently branched out from its core business in uranium and entered the lithium exploration business. Uranium Resources refers to this as their “energy metals strategy,” which is meant to capitalize on the near and the longer term. (Source – slide 10)

Uranium Resources producing uranium assets are currently on standby until there is a sustained improvement in the uranium market. Their Turkish Temrezli property is by far their largest uranium project and is currently in the permitting stage of development.

NOTE: With its listing on the ASX, Uranium Resources is listed according to JORC standards, which are different than NI 43-101.

- Traded on the Nasdaq: URRE and ASX: URI

- Uranium Properties are located in the United States and Turkey:

- Temrezli Uranium Project

- Located in Turkey

- 44,700 acres of prospective property

- M&I and Inferred Resource Total of 13.3 million lbs U3O8

- Pre-Feasibility study completed in 2015 (see presentation for further detail)

- Permitting is underway

- Kingsville Dome Processing Facility

- Located in Texas, United States

- 17,000 acres of prospective ISR projects

- In-Place Reserves – 50,000 lbs (not NI 43-101 compliant)

- Production suspended until “there is a sustained improvement in the uranium market” ~Uranium Resources

- Rosita

- Located in Texas, United States

- In-Place Reserves – 624,000 lbs (not NI 43-101 compliant)

- Like Kingsville, production has been suspended

- New Mexico Projects

- Located in New Mexico, United States

- 190,000 acres of prospective property

- Lithium Properties

- Columbus Basin (Nina) Lithium Project

- Located in Nevada

- 2017 Outlook: Geophysical sampling, geological analysis and follow-up drilling

- Sal Rica Lithium Project

- Located in Utah

- 2017 Outlook: Sampling, geophysics and target prioritization for drilling

- Columbus Basin (Nina) Lithium Project

Uranium Energy Corporation (UEC)

UEC is led by Amir Andani, who is also the CEO of the precious metals company, Brazil Resources. Andani has used the bear market in uranium to purchase uranium properties throughout the western United States and Paraguay.

Currently, UEC has one producing asset, Palangana, and its Hobson Processing Facility. Its other two main assets are Bruke Hollow, which is in the process of being permitted, and Goliad, which is permitted and under construction.

Andani is a premier marketer and presents UEC fantastically with their website and investor material. This type of promotion is an X-factor in the junior market and definitely sets Andani apart from his competitors, regardless of how you view the rest of the company.

- Traded on the NYSE: UEC

- Properties in the United States and Paraguay:

- Hobson Processing Facility

- Fully licensed and permitted

- Operational

- 2 million lbs of processing capacity per year

- Palangana

- Fully permitted and producing

- Located in Texas

- M&I resource – 1,057,00 lbs U3O8 and Inferred resource – 1,154,000 lbs U3O8

- Burke Hollow

- In development – permitting underway

- Inferred resource – 5,121,853.25 lbs U3O8

- Goliad

- Fully permitted and under construction

- M&I resource – 5,475,200 lbs U3O8 and Inferred resource – 1,547,500 lbs U3O8

- Exploration Projects:

- Nichols (Texas)

- Longhorn (Texas)

- Salvo (Texas)

- Dalton Pass (New Mexico)

- Long Park (Colorado)

- Slick Rock (Colorado)

- Anderson (Arizona)

- Los Cuatros (Arizona)

- Workman (Arizona)

- Oviedo

- Exploration project in Paraguay

- Yuty

- Exploration project In Paraguay

Peninsula Energy is led by CEO, John Simpson. Simpson has over 25 years of experience in the management of listed mineral companies. Simpson is at the helm of a company which operates a producing uranium mine, the Lance ISR Mine in the United States, a uranium exploration property in South Africa, and a gold exploration property in Fiji.

Peninsula is unique because it boasts a hedged contract sales book that stretches 10 years and 8.1 million pounds (Mlbs) which, at maximum capacity for their processing plant, is almost 4 years of full production. With an average contracted selling price of $55 USD/pound for the 8.1 Mlbs, investors are given a lot of risk mitigation to a sliding uranium price. However, this could also mean a loss of upside potential, depending on where you think the uranium price may go in the future.

Peninsula is traded on the ASX and, therefore, expresses all of their resources according to JORC code.

- Traded on the ASX: PEN

- Properties located in the United States, South Africa and Fiji (Gold Project)

- Resources are listed by JORC Code (not NI 43-101)

- Lance ISR Uranium Project

- Located in Wyoming, United States

- Three deposits totalling 53,674,224 lbs U3O8 (JORC code resources): Ross -Measured & Indicated (M&I) and Inferred total 11,184,612 lbs U3O8, Kendrick – M&I and I total 29,617,020lbs U3O8, and Barber – M&I and Inferred total of 12,872,592 lbs U3O8

- Fully permitted and producing

- Exploration potential on the property

- Production levels to follow their hedged sales book, with 400,000 lbs to be delivered in 2017 at approximately $55 USD per pound.

- Currently, Peninsula has 8.1 million pounds of U3O8 under contract to deliver to major utilities in the United States and Europe over the next 10 years. These 5 contracts total approximately $44o million USD and an average 3O8 selling price of $55 USD per pound

- Project is expected to produce 2,300,000 lbs U3O8 per annum at full capacity

- Lance ISR Uranium Project

- Karoo Project (Joint Venture with BEE Groups)

- Located in South Africa

- Exploration property

- JORC Code-Compliant Mineral Estimate (Indicated and Inferred) total of 56.9 million lbs of eU3O8

- In the next 3 to 5 years, the company plans to expand this resource further, focusing drilling on the eastern sector, RystKuil channel.

- Raki Raki Gold Project (JV – 50% ownership)

- Located in Fiji

- Exploration property

Anfield is led by CEO, Corey Dias, whose 10 years of experience prior to Anfield was in capital markets on both the buy and sell sides. Dias is leading this uranium development company to “near term” production; I use quotations because they still need to refurbish their conventional mill and acquire the proper mining licensing and permitting – ‘near term’ is subjective.

Conventional uranium mills are hard to come by in North America, therefore, owning one can be an asset, as the conventional mining of uranium is not complete with milling. Anfield has used the uranium bear to acquire a variety of properties across the western United States which have past production and historical uranium resources.

- Traded on the TSX Venture: ARY, Frankfurt: OAD

- Steps to production: Well field development, mill refurbishment, and mine licensing/permitting

- Potential uranium production across all assets – 1,500,000 lbs U3O8 per year

- Properties located in the United States

- Shootaring Canyon Mill

- 750 tpd conventional uranium mill

- Located in Utah

- Velvet-Wood Mine

- Located in Utah

- M&I resource of 4.6 Mlbs U3O8 (Slide 10 )

- Surface stockpile of 370,000 lbs U3O8

- PEA completed in 2016

- Exploration Properties (some properties have historical resources and past production)

- Arizona – Brecca Pipes and Date Creek Basin

- Colorado – Slick Rock District, Western Gypsum Valley District, Paradox District and Gateway District

- Utah – Lisbon Valley, Henry Mountains Area, Moab Uranium District, Dry Valley Area, Paradox Area, Monticello-Cottonwood, Monticello-Motezuma Canyon, Thompson District, Green River District, White Canyon and San Rafael District

- Wyoming – Black Hills, Great Divide Basin, Laramie Basin, Powder River Basin, Shirley Basin and Wind River Basin

- Shootaring Canyon Mill

- Directly or indirectly is 85.6% controlled by the French State

- Not just a miner, they are involved in each aspect of the nuclear fuel cycle

Uranium One – Owned by AMRZ – Mining Arm of ROSATOM State Atomic Energy Corp.

- State owned and controlled

- Operations in the United States and Kazakhstan

- Willow Creek ISR located in Wyoming with Proven and Probable (P&P) Reserves of 6,754,000 lbs U3O8, M&I of 16,798,000 lbs U3O8 and Inferred of 141,000,000 lbs of U3O8

- Kazakhstan Properties (5 properties) have a total resource (M&I + Inferred) of 148,460 tU

If you believe the future is bright for uranium, but aren’t sure when the market is going to turn for the better, a producer is a great way to ride the bear market out, while having exposure to a sector that, in my opinion, could change on a dime. Each of the companies listed have merits for investment. Be objectively critical and find the company or companies that fit your personal investment criteria.

Until next time,

Brian

DISCLAIMER: The following is not an investment recommendation, it is an investment idea. I have not been compensated to write this article, however, I do own shares of one or more of the companies mentioned in this article. Please perform your own due diligence to decide whether it is a company that’s best suited for your personal investment criteria. All analytics were taken from the company websites and press releases.