The Looming Recession Won’t Stop Me from Investing in Oil

Currently, a bullish thesis on oil is met with concerns about an impending recession.

It’s understandable, the market isn’t great right now.

The fear of the unknown can be troubling.

Especially when it comes to investing.

If you think that you can buy something cheaper in the future, it’s only natural to want to wait.

However, the problem is twofold.

First, will what you are predicting even happen?

When market perception is almost unanimous, in my experience, it usually doesn’t play out exactly the way you think it will.

Second, let’s say it does, the recession or crisis hits.

Will you have the courage to buy when things continue to erode or drop quickly?

Maybe, but again, in my experience, that mindset tends to lead the investor into thinking that a share price might go even lower – I’ll wait!

Buying when others are fearful is necessary as an investor, but it’s not easy.

Looking back on my own experience, I was able to muster the courage to buy tranches in good companies amidst the chaos of the falling market in 2020.

It’s this dollar cost averaging approach which gave me the best of both worlds.

Yes, this approach reduced my upside, but most importantly, it reduced my downside.

Courage doesn’t mean you are without fear…

It means that despite the fear, you logically move forward and execute.

Not surprisingly, 2020 was my most profitable year, thus far.

Buy in the bearish depths, have patience, and in years like 2016 and 2020, there is potential to make a lot of money.

Speaking of the 2020 Covid-19 pandemic, it’s easily the most cited example to refute buying oil and oil-related equities at today’s prices.

2020 was a traumatic year for many, not only oil investors.

But the situation in 2023 is not the same as 2020.

In 2020, the world was shut down due to Covid-19.

People across the world were locked down in their homes.

They weren’t driving to work, taking their kids to school, going to the movies or taking a holiday in the Caribbean.

Life as we knew it changed to the extreme during those early days of the Covid-19 pandemic.

Certainly in my lifetime, and arguably in the history of the world, humanity had never experienced something of this magnitude.

In response to this extraordinary event, the oil price for a short period of time went negative.

In essence, suppliers had to pay to get rid of their barrels of oil.

It’s a crazy thought.

Something I still have a hard time wrapping my head around.

In my view, the recency of that event hasn’t been forgotten by investors.

Today, I think it’s that risk of recession that has everyone in a state of fear.

Asking themselves, ‘how low can or will it go?’

It’s an appropriate question, but if your recency bias is toward the negative, obviously you are going to say, ‘very low.’

Maybe even jumping to the extreme conclusion that this is it, the end.

I can’t predict the future, but I will say that I think it’s unlikely that this is the end and I doubt that we will see a negative oil price anytime soon.

In my view, the Covid-19 pandemic was a unique event, one that may indeed happen again, but we won’t get to plan for it.

It’ll just happen…

If we are heading into a recession, yes I think it has the capacity to be a doozie, but we’re still going to consume oil.

Most of the people who live in the developed world are highly dependent on oil or natural gas in their daily lives.

Electricity generation, fuel for their cars, and a whole host of petroleum products – plastics, etc. are all consumed each and every day.

Consumption amounts may diminish, but they won’t disappear.

This is even more true for the developing world, whose sole reliance is almost exclusively linked to oil and its derivatives.

I do think in a recessionary setting the oil price can go lower, but I don’t think it will stay there for long.

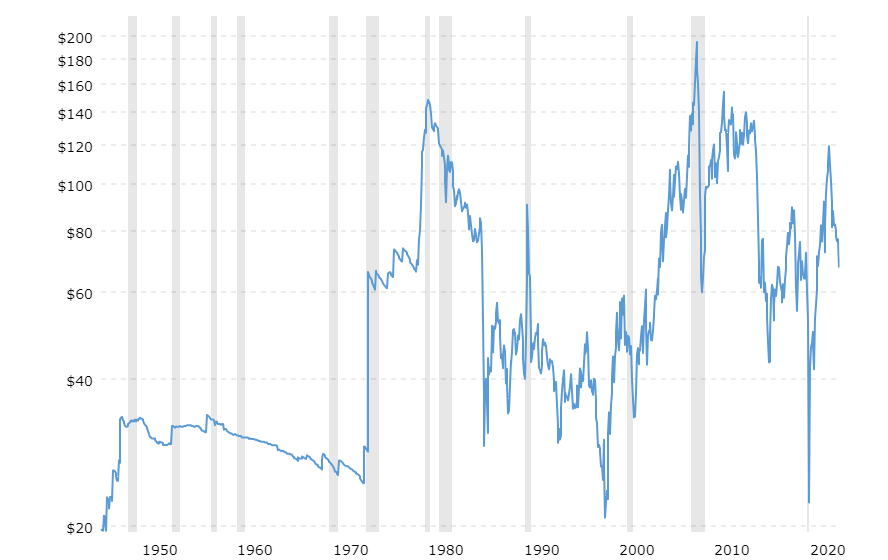

Examining the oil price chart above, you can see the volatility we have seen over the last 70 years.

The recessions are highlighted in gray.

There is no real pattern that I can see that depicts how the oil price behaves during and after recessions as none of them are the same.

The oil market is extremely complex.

In my view, looking back at past performance doesn’t give us any indication of how things will work today.

The situations are totally different.

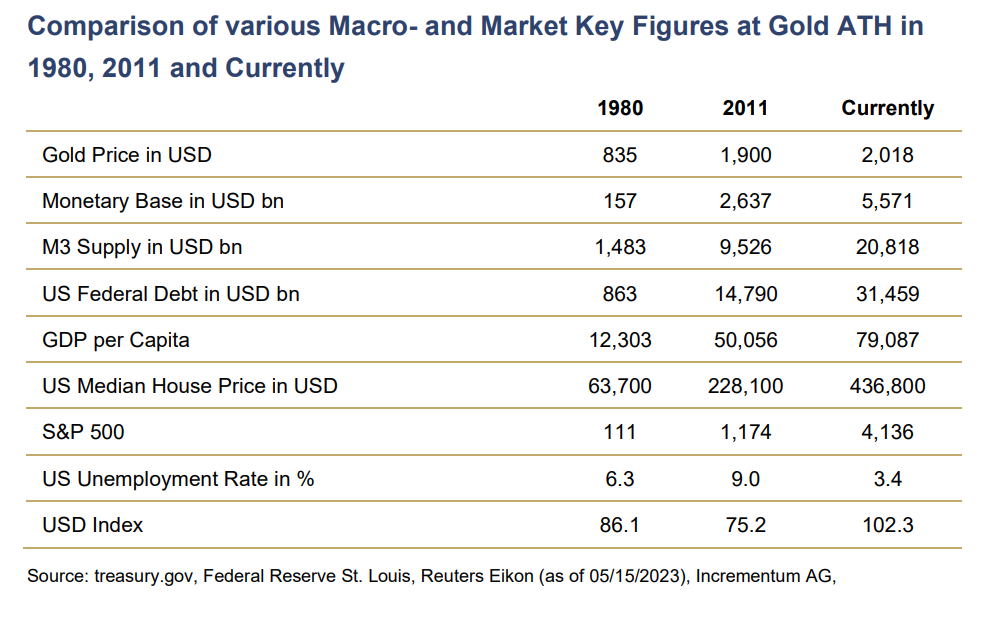

Look at this table from IGWT’s 2023 report regarding a few metrics in relation to the 1980s, 2010s and today;

As you can see, these various decades are completely different, incomparable, unless you are trying to point out how different they are.

Add in demographics, geopolitics, interest rates and a number of other factors and today we live at a distinct moment in time.

We have to evaluate today with today’s known metrics.

Let’s start with interest rates.

In my view, the Central Banks, mainly the U.S. Federal Reserve (FED), will deploy the same tactics that we have seen in past crises or recession moments.

Quantitative Easing (QE) is their desired remedy to a downturn.

I don’t think that changes anytime soon.

In 2020, the Covid-19 pandemic was met with unprecedented spending.

More money was infused into the system in 2020 than had ever been created in all previous years COMBINED!

A recession appears to be coming, how bad it will be is still a question mark.

Either way, I still think we’re in the mindset of expanding the money supply to combat the pain of economic turmoil.

Therefore, when you mix in the lack of oil exploration and development, war in Europe (escalating?), OPEC+ production cuts and the depletion of the U.S. Strategic Oil Reserves, I think the oil price recovers quickly – V Shaped.

We live in a world that is still very much dependent on oil and all of its derivatives.

We are fortunately or unfortunately multi-trillions of dollars and a whole bunch of years away from meaningfully cutting our dependency.

To me, US$70/bbl is much closer to a bottom in the oil price than a top.

Ergo the opportunity.

Opportunity in the resource market is usually accompanied by patience.

We’ll see where the oil price goes.

In the meantime, you should become a Junior Stock Review VIP and get my latest thoughts on the resource sector sent right to your inbox for free.

Until next time,

Brian Leni P.Eng

Editor – Junior Stock Review Premium