Trump’s Executive Order on Critical Minerals & a Cypress Development Corp Drill Program Update

On December 20th, the President of the United States, Mr. Donald Trump, signed Executive Order 13817, which calls for an end to the United States’ reliance on foreign imports of “critical” minerals. Before getting into the details of this Executive Order, I would like to discuss what an Executive Order is.

A U.S. Presidential Executive Order (EO) is legally binding and does not require Congressional approval to take effect, but has the same legal weight as laws passed by Congress. Interestingly, EOs have occurred much more often than I would have expected, throughout the history of the United States. Examining Wikipedia’s EO page, you can see many Presidents have evoked this power during their terms, most notably Franklin D. Roosevelt who executed 3,522 EOs over the course of his presidency.

The basis of the EO is laid out in Section 1 of the report,

“The United States is heavily reliant on imports of certain mineral commodities that are vital to the Nation’s security and economic prosperity… An increase in private-sector domestic exploration, production, recycling, and reprocessing of critical minerals, and support for efforts to identify more commonly available technological alternatives to these minerals, will reduce our dependence on imports,…support job creation, improve our national security and balance of trade, and enhance the technological superiority and readiness of our Armed Forces, which are among the Nation’s most significant consumers of critical minerals.”

Interestingly, the United States Geological Survey (USGS) and the U.S. Department of the Interior released a report entitled, Mineral Commodity Summaries 2017, just a day before the EO was signed. I believe the report is important; the graph on page 6 is particularly revealing, as it lists all of the minerals and their net import reliance.

In Section 4 of the EO, it states that within 180 days of the date that Secretary of the Interior publishes a list of critical minerals, a report will be submitted to the President, outlining a strategy to reduce the dependence on imported minerals. I have paraphrased what the report will cover, please review the EO for further details:

- An assessment of the country’s ability to produce critical minerals through recycling.

- Plans for improving the topographical, geologic and geophysical mapping of the U.S. and make it available to the private sector for improved minerals exploration.

- Recommendations on how to streamline the permitting and review processes related to critical mineral resources. Therefore, enhancing access to critical mineral resources and increasing discovery, production and domestic refining of critical materials.

The economic and security merits of this EO can debated, however, putting it into the perspective of a resource investor, I think that this will translate into great things for mining companies with projects located in the U.S. that are exploring, developing or producing one of the deemed “critical” minerals.

I believe lithium will be a part of this “critical” minerals list, as the U.S. currently imports more than 50% of its lithium and looks to import far more, as Elon Musk’s Giga Factory, located in Nevada, is expected to have an annual capacity of 35 Gigawatt-hours, which is equivalent to the entire world’s current battery production.

This brings me to the subject of today’s article, an update on Cypress Development Corp.’s fall drill program on its contiguous Dean and Glory Lithium Projects in Clayton Valley, Nevada.

Cypress Development Corp. Update

In my last update, Cypress had just received their first round of drill results from its Dean Lithium Project. Overall, the results were great and supported the case for the continuity of the deposit. In that update, I mentioned the potential for some PUSH in the share price based on the results from holes DCH-13 and DCH-14, which were upcoming. Based on the news released this morning (January 9th), I was right; the stock is up on over a million shares of volume!

The latest results are highlighted by DCH-13’s intersection of 107 metres of 1134 ppm Li. This average grade is across the entire interval, which started just 5.5 metres below surface and reached a depth of 112.2 metres. The depth is in line with the results from the first round of drilling and DCH-13 remains open at depth.

Finally, DCH-14 intersected 76 metres of 733 ppm Li. While the grade is a little lower than the previous results, it is still very robust and is consistent with the other results in terms of being shallow, with mineralization being intersected just 2.9 metres from surface and stretching down to 78.6 metres.

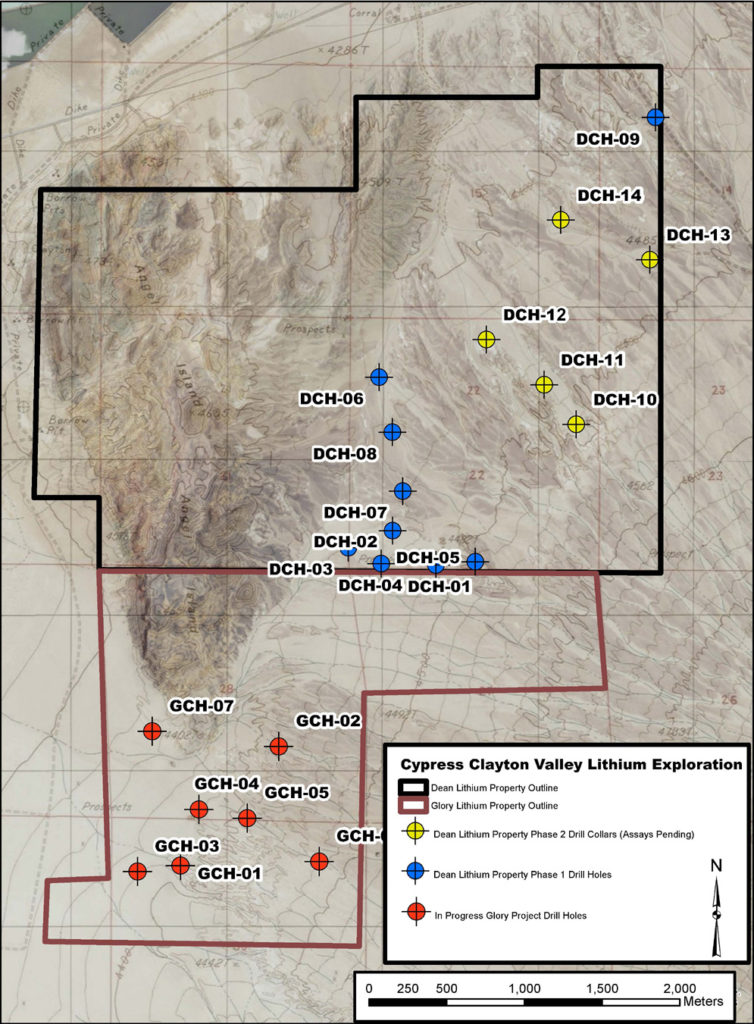

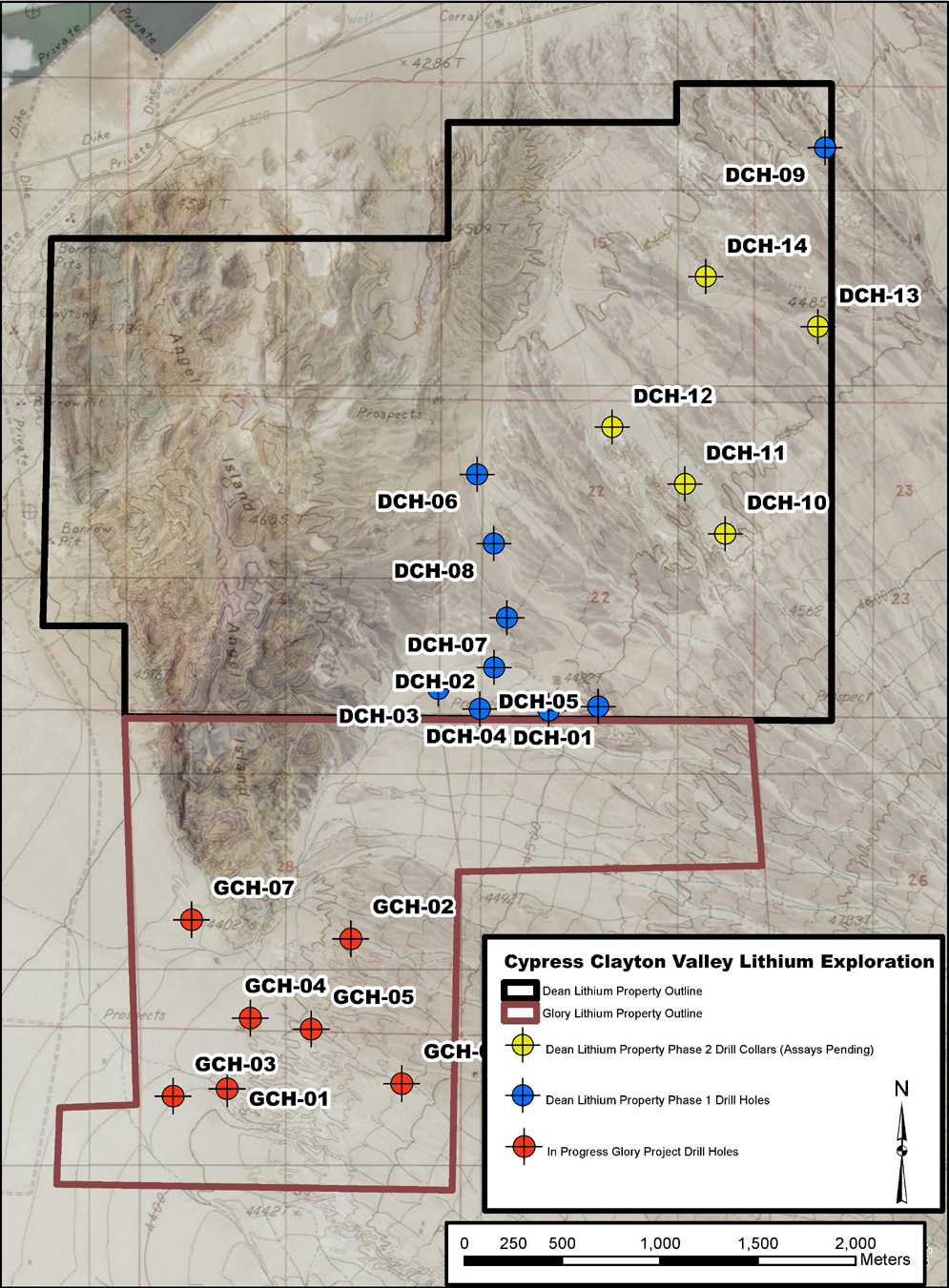

Overall, these are terrific results and, as you can see in the drill hole map below, both holes extend the Dean Project mineralization to almost the full extent of the northeast portion of the property. With the results from Glory on the horizon, I think it is easy to see that this has all the makings of a very large deposit.

Dean & Glory Lithium Projects, Clayton Valley, Nevada Drill Hole Map

PUSH: Later this month, look for drill results from the Glory Lithium Project to show similar grade and shallow interval thickness.

Dean and Glory Lithium Project Metallurgy

In my introductory article for Cypress Development Corp., I commented that I felt the ability to economically extract the lithium from the claystones would be the largest hurdle for the company in the future.

Well, the company has taken some great strides toward proving out an economic process for extraction, as they have started some bench-scale test work on a sample of Dean Project sourced lithium claystone.

The results, thus far, have revealed moderate extractions of lithium in sulfuric acid solution rising to 74% in both sample types as temperature increases. Additionally, it should be noted that the extractions were achieved with relatively low additions of sulfuric acid for lithium-bearing claystone deposits, with rates of 140 kg to 170 kg per tonne of material. They will continue to optimize the extraction process by refining the leach conditions, checking for any mineralogical variability across the properties and determining methods of recovery of the lithium from the leach solutions.

Concluding Remarks

The latest drill results confirm the continuity of the deposit and its extension out to the northeast boundaries of the Dean Project. If Glory’s drill results follow in a similar fashion, Cypress could be in possession of what looks to be a very large deposit of lithium claystone. As stated in the news release, Cypress will attempt to follow up the drill program with a resource estimate, giving us a clear path toward a Preliminary Economic Assessment (PEA).

Further, the progress made in the extraction of lithium from the Dean Project claystone is positive and, in my mind, a key point to the entire story. Further work to optimize the extraction process along with a resource estimate should provide the necessary inputs for what I think can be a very healthy PEA.

Putting it all together, Cypress Development Corp. is the 100% owner of what looks to be a large lithium claystone deposit in the heart of Nevada. Given the direction of the U.S. government and their push toward developing domestic sources of “critical” minerals, I believe the Dean and Glory Lithium Projects could become very valuable in the years ahead!

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company(s) and sector that is best suited for your personal investment criteria. Junior Stock Review does not guarantee the accuracy of any of the analytics used in this report. I do own Cypress Development Corporation shares. Cypress Development Corporation is a Sponsor of Junior Stock Review.