A mining jurisdiction’s investment attractiveness is determined by a number of different criteria, such as political ideology and stability – domestically and internationally, financial position, rule of law, culture, and mineral potential.

In the case of Brazil as a jurisdiction for mining investment, I believe that the next 4 years could present a great opportunity for investment. My reasoning is based on a few key points:

- Political Ideology – Current Presidential candidate favourite, Jair Bolsanaro – the “Brazilian Donald Trump,” has the potential to do a lot of good for the economy. Like Trump, judge him on his actions, not on his words!

- Political Stability – In a general sense, I believe there can be stability in the short term. My guess, however, is that the government corruption is not over, not by a long shot. While I believe corruption is inherent to government, in Brazil’s case it appears to be playfully accepted, with many Brazilians using the expression, “it will end in pizza,” when referring to the way that they deal with scandals.

- Culture – The Republic of Brazil was built around mining and farming. In my opinion, mining will always play a major role in the Brazilian economy and, therefore, in the majority of cases (not all) will be seen in a favourable light.

- Mineral Potential – Brazil has long been a world-class destination for iron ore, bauxite and gold. In my opinion, there are many more deposits to find and develop, making Brazil an important destination for mining investment dollars over the course of the next bull market.

While these points are the basis for my motivation to invest in Brazil, I’m still keenly aware of some of the sticking points that could quickly derail it.

- Politics – If Brazilians were to elect anyone but Bolsanaro, my economic outlook for Brazil would be much more pessimistic than it is today. Polling has two left wing candidates following Bolsanaro, and would, in my opinion, in the very best case scenario, bring about no change to the current system. However, I think it is far more likely that they would apply further socialist type policy measures to remedy the economy – and will ultimately fail.

- Culture – Government corruption is far too common in Brazil. Further scandals brought into the public eye could prove to be chaotic, given the state of the economy.

- Finances – Brazil has a major issue with their public pension obligations. A reform of this poor system is needed, but has been ingrained in the culture over the last 30 years. At some point in the future, this will be the cause of a major decline in the Brazilian economy.

No jurisdiction is perfect, weighing the risk to reward potential of any investment is key to success.

Enjoy!

Brazil by the Numbers

Became the Republic of Brazil on Nov. 19 1889

- Brazil is South America’s largest country by both population and by land size. The only two South American countries that aren’t bordered by Brazil are Ecuador and Chile.

Population: 209.205 million (2018)

Capital City: Brasilia

Largest City: Sao Paulo – 21.3 million

26 States, 1 Federal District – Acre, Alagoas, Amapa, Amazonas, Bahia, Ceara, Distrito Federal, Espirito Santo, Gioas, Maranhao, Mato Grosso, Mato Grosso do Sul, Minas Gerais, Para, Paraiba, Parana, Pernambuco, Piaui, Rio de Janeiro, Rio Grande do Norte, Rio Grande do Sul, Rondonia, Roraima, Santa Catarina, Sao Paulo, Sergipe and Tocantins

Language: Portuguese

Ethnic Groups: White – 47.7%, Mulatto – 43.1%, Black – 7.6%, Asian – 1.1%, Indigenous – 0.4% (CIA)

Religion: Roman Catholic – 64%, Protestant – 22.2%, Other – 13.8%

Unemployment: 11.8% (CIA)

Currency: Brazilian Real

GDP: $2.1 trillion USD (2017), 8th largest in the world

Fraser Mining Investment Attractiveness Score: 55.12 – 11th in the category which includes Argentina, Latin America and Caribbean Basin

Agricultural Production: Coffee, oranges, sugar cane, beef and soybeans

Heavy Industry: Mining – hard rock, Oil and Gas, forestry, steel, farming

Largest Company: Petrobras (Brazilian Petroleum Corporation) – Produces 2.3 million barrels of oil equivalent per day. Petrobras is a semi-public company, with over 50% ownership by the Brazilian government. Petrobras employs over 65,000 people and generated close to US$ 90 billion in revenue, in 2017.

Brazilian Culture

In my opinion, political risk within any jurisdiction is the result of the region’s culture. Understanding the culture of a society is integral for gauging risk and predicting the future actions of the society in terms of how it will affect your prospective investment.

The vast majority of investors don’t take the time to try and understand the culture of the jurisdiction with which they are investing. Thus, for those of us who are willing to put in the time, a tremendous advantage is gained over the rest of the market, especially when it comes to those of us willing to invest in some of the more risky locales.

Keep this in mind – It take hundreds of years to create cultures and hundreds of years to change them, therefore, putting in the time to understand them is time well spent – they aren’t going anywhere quickly!

In my opinion, Brazil’s current culture was predominantly influenced by a few key facts:

- Politics/Governance over the course of Brazil’s history – From its colonial beginnings to its first steps toward independence in 1824, to the Old Republic between 1889 to 1930, and the military dictatorship from 1964 to 1985, and finally, its present day democratic government.

- Slavery – Brazil was the recipient of close to 5 million African slaves over the course of its historical slave trade, which ended in 1866.

- Geography – Possibly the most understated of the key factors affecting Brazilian culture and future growth as a nation is its geography, or better put, its topography.

Politics/Governance – Captaincies, Old Republic, Military Dictatorship and Democracy

The Portuguese discovered Brazil in the early 1500s. The original plan for governance over the new world didn’t involve a centralized government, but instead, divided Brazil’s east coast into 15 Captaincies.

These Captaincies were meant to act independently, with each individual leader to have complete control over his territory. Ultimately, these Captaincies were a failure and led to the formation of a central government around 1549.

Source: Wiki

Religion – Jesuits

Interestingly, in this new attempt at instituting a centralized government and garnering control over the new world, colonizers were aided by Jesuit priests, whose purpose was to bring religion – the catholic faith – to the indigenous people.

The Jesuits’ ability to earn the trust and eventually convert the indigenous peoples to the catholic faith is thought to be linked to their ability to understand the native culture, most importantly, the various languages of each tribe.

The native’s assimilation into the catholic faith helped them avoid the slave trade, which was driving the new world economies of the Americas at the time. It came at a high cost, however, as the tribal cultures of many of the indigenous people were lost in the process.

Religion has had a major effect on Brazil’s history, and in my opinion, will continue to shape the destiny of this growing country.

Old Republic

The Old Republic period of governance began with Brazil’s official recognition as a Federation, which occurred on November 19, 1889. Governance during this period began officially with the military, however, it quickly gave way to the Coffee and Milk Policy years, in which candidates from the Sao Paulo and Minas Gerias States took turns holding governing power over the Federation.

Why is it referred to as Coffee and Milk Policy? Going back to the original colonization days of Captaincies, the regions of Sao Paulo and Minas Gerias were the most successful economically.

Sao Paulo was a proficient coffee producer, which in those days made up the majority of the Brazilian economy, and Minas Gerais, as I’m sure you guessed it, had good diary producing capability. The economic prowess of these states allowed them to garner influence by favours and force and, thus, control the Brazilian Federation for close to 30 years.

Eventually, the people revolted against this monopoly of power and it led to the collapse of the Brazilian economy around 1930, due to coffee prices and the famous American stock market crash of 1929. With crisis brings opportunity and, in this case, it allowed a new regime of governance to takeover Brazil.

Military Dictatorship

In 1964, the Brazilian economy was ravaged by inflation, and as a crisis usually does, presented an opportunity. In this case, it was for Brazil’s military to overthrow President Joao Goulart and his government, establishing authoritarian rule over the country.

Throughout history, military coups such as this have been met with disaster, as sound economic policy has never been a military strong point. In Brazil’s case, it’s said that the military recognized this or at least had no interest in it, leaving economic policy to a select group of entrusted technocrats.

In the first decade of the military’s 20 year occupation, Brazil experienced what is commonly referred to as “The Brazilian Miracle,” which refers to the roughly 10% in average annual growth in GDP they experienced under the military’s control. Much of the growth is attributed to the industrialization of the Brazilian economy, with many people urbanizing themselves.

While the growth of the country’s economy was great, it was still under a government which had not been voted in and, like any force, repressive in this instance, has an equal and opposite reaction. In this case, Brazilian teens, who are now in their sixties or seventies, were forever changed by this period in history.

The last decade of military control was met with the oil embargo in the ’70s, which led to dramatically higher oil prices, sending countries dependent upon imported oil into crisis. To deal with the crisis, Brazil’s military government increased their borrowing from international lenders. This move would prove to be costly, because by the end of the ’70s, Brazil had become one of the most indebted nations in the world. This opened the door for political change, which occurred in 1985.

Democratically Elected Government

The ‘New Republic’ began a new era of democratically elected government and reflects the system which is currently in place. Fast-forwarding to the 2000’s, and we begin to see the political products of the military dictatorship emerge, beginning with one of today’s key political figures in Brazil; Lula da Silva, Brazil’s President from 2003 to 2011. In his early 20’s, Lula came of age, so to speak, during the military regime’s reign. He spoke out against the dictatorship, making him an enemy of the government and a hero to the people who followed him.

Parlaying this experience and recognition, Lula later became the leader of the Worker’s Party– which has a left-centre leaning social democratic ideology.

In the 2003 election, Lula and the Worker’ Party won the Presidency with more than 60% of the national vote, and so began da Silva’s two terms in office. Following Lula was Dilma Rousseff, a Worker’s Party member who was elected as Brazil’s first female President.

Unfortunately, unlike Lula, Rousseff didn’t make it to the end of her term as President as she was impeached for breaking budget rules while in the middle of one of the biggest scandals in Brazilian history – Operation Car Wash.

Operation Car Wash

In March 2014, in what began as a sting operation focused on money launderers, Operation Car Wash ended up becoming one of the biggest corruption scandals in the history of Brazil. Prosecutors uncovered a scandal that centred around the State-owned Petrobras, in which more than $5 billion in illegal payments were made to Brazilian politicians.

The political corruption surrounding Operation Car Wash wasn’t isolated to any one party or set of political ideology, as politicians on both sides have been implicated and charged.

One of the most notable politicians caught up in this mess was former President, Lula da Silva. Lula was sentenced to 9.5 years in prison after being found guilty on corruption and money-laundering charges – $1.1 million.

Presidential Election 2018

2018 is an election year in Brazil and its result could have a major impact on the short term outlook for the country. This year’s election is headlined by current Presidential favourite, Jair Bolsanaro, who was just downgraded from intensive care to semi-intensive care after being stabbed at a political rally on September 6th.

Bolsanaro leads the Social Liberal Party (PSL), which is considered to be right leaning in its political ideology. Bolsanaro began his career in the military before entering politics in 1988 as a city councillor in Rio de Janeiro.

The left wing media has attacked Bolsanaro for being what they say is sympathetic to the former military dictatorship and for his connection to the catholic faith. Many pundits have compared him to U.S. President, Donald Trump, for his promotion of nationalism.

There is an interesting video which looks at the role of religion in the coming Brazilian election and how it may affect its outcome. The video is produced by VICE Media and is worth watching, however, I do believe the content is presented from a leftist view point, so keep that in mind.

Talk is cheap, especially when it comes from politicians. If Bolsanaro is elected, however, it’s my belief that it would mean good things for the economy and, in at least the short term, could provide a nice boost to the Brazilian economy.

Fernando Haddad

Ironically, before Bolsanaro was given the crown as the Presidential front runner in this year’s election, it was former President and now convicted criminal, Lula da Silva, who wore the crown. Brazilian authorities, however, denied Lula’s candidacy, eliminating him from eligibility for the 2018 election.

NOTE: One of the craziest suggestions I think I have ever heard, the United Nations (UN) supported Lula in his attempt to run for the Brazilian Presidency from prison, citing it is his right to exercise his political rights while in prison. What’s wrong with people?!

With his removal from the race, Lula publically stated his support for the new Worker’s Party leader, Fernando Haddad. Haddad, the former Mayor of Sao Paulo, is a career public servant who spent most of his working life in some part of the government.

If Haddad were to be elected, I’m sure we could expect much of the same policy decisions that we saw during the Lula and Rousseff years. Leftist ideology is not akin to great economics and, therefore, if Haddad or any of the other candidates of that persuasion were elected, it would be unfortunate, in my opinion.

Slavery

The world slave trade took place between roughly 1650 and 1860. Over the course of 200ish years, millions of Africans were enslaved and transported around the world – the Americas, Europe, Middle East and South East Asia – to work in many of the most labour-intensive jobs of that time, which included farming (sugar, cotton, coffee) and mining.

Brazil was one of the main destinations of the slave trade, with approximately 5 million slaves being transported over the course of history. The main ports for their entry were along the east coast, mainly Recife, Salvador and Rio de Janeiro.

Source: Chicago-Kent College of Law

Today, their influence on modern day Brazil is especially felt in these cities, with Salvador leading the way in Afro-Brazilian culture. Beginning with food, many of Brazil’s most famous dishes, including its national dish, Feijoada, a pork and bean stew, are derived from the staples of the African slave diet.

Musically, Samba is one of Brazil’s most recognized forms of dance and is derived from the Angola (West African nation) word semba, which means “a touch of the bellies.” Samba music and dance is featured in Brazil’s world famous Carnival celebration each year, between the Friday afternoon before Ash Wednesday and Ash Wednesday at noon, which, to those who aren’t familiar with the catholic faith, marks the beginning of lent.

Finally, while not having a major influence overall in the country, the main source of the Muslim faith within Brazil is derived from the West African nations – Nigeria, Gold Coast, Angola and Zaire – from which the salves came.

Brazil’s northeast coast remains heavily influenced by its African roots and, as such, maintains its own unique sub-culture.

Brazil’s Geography

There are many things that affect the evolution of a society’s culture. In my opinion, one of the most forgotten influences on culture is the physical geography of the land with which the society resides.

A country’s topography has a major influence on its growth and how communities interact with one another. Today, most of the world’s economic powers have the vast majority of their population located around water – either on the coast or on rivers that have access to the coast. The northeast portion of the United States is great example of this, as the low lying land provides plenty of opportunity for growth in both population and the transportation of goods between mega cities such a New York and Boston.

Brazil is no different with the vast majority of its population located around its Atlantic coastline. Brazil’s topography, however, may also be a hindrance to its future growth potential, as a few of its most populated centres, Sao Paulo, Rio de Janeiro and Belo Horizonte, are separated by large stretches of mountainous terrain.

Source: Nations Encyclopedia

The difficult topography surrounding and between these cities, limits the amount and type of infrastructure that can be developed – with reasonable cost, at least. While these are large cities, especially Sao Paulo with a population of roughly 21 million, we may be at a point where they have hit their peaks in terms of population growth potential.

Source: Wiki

As you can see in the image above, the population density is sparse throughout the central and northwestern portion of the country. This is both a good and a bad thing. Firstly, the once acidic and nutrient deficient soils of the central portion of Brazil have been transformed by the addition of lime to neutralize its acidity and fertilizers, such as phosphorus, to enrich its quality. The central region, while remaining relatively unpopulated has become a major source of agricultural products for the country.

On the other hand, the northwestern portion of Brazil has remained, comparatively, undeveloped. The clear reason for the lack of development, at this point in time, is the Amazon rainforest. Not only is it a matter of preserving biodiversity, but also a matter of topography, as this region doesn’t lack water, at least during the rainy season.

The State of Amazonas (2.25 times the size of Texas), Brazil’s largest State, has a population of just over 4 million, and over 50% of that population resides in Manaus, its capital city. Moreover, a great example of a lack of infrastructure is the fact that there is no bridge across the Amazon River, cutting off the northern portion of the state – unless you have a boat.

In the last couple of years, much controversy has surrounded the proposed development of some of the Amazonian lands for agricultural purposes and mining. Current President, Michel Temer’s, attempt to open up large parcels of land in the Amazon rainforest, mainly the National Reserve of Copper and Associates (RENCA), was quashed in 2017 by a federal judge.

An interesting mining story in relation to the Amazon is the precarious case of Belo Sun Mining. Belo Sun is a junior resource company listed on the Toronto Venture Exchange. In 2013, a Brazilian court suspended Belo Sun’s environmental and provisional licenses, essentially halting all development of their Volta Grande project, which is located in the State of Para (apart of the Amazon Basin).

The court stated,

“Belo Sun had not taken necessary steps to analyze the mine’s potential impact on indigenous peoples who live within a few kilometers of the mine site.” ~ Globe and Mail

Fast-forwarding to 2017, and Belo Sun had their construction license suspended once more, again citing the need for the completion of an indigenous study. This is an interesting situation; I’m not sure if this is a reflection of a tough Brazilian regulatory body or incompetency on Belo Sun’s part. Maybe it’s both. Regardless, it should be weighed when considering investments in the highly contentious region of the Amazon.

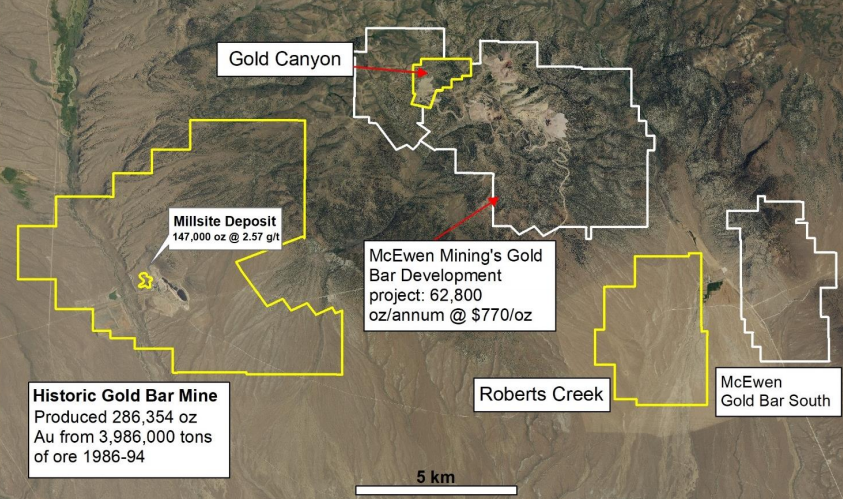

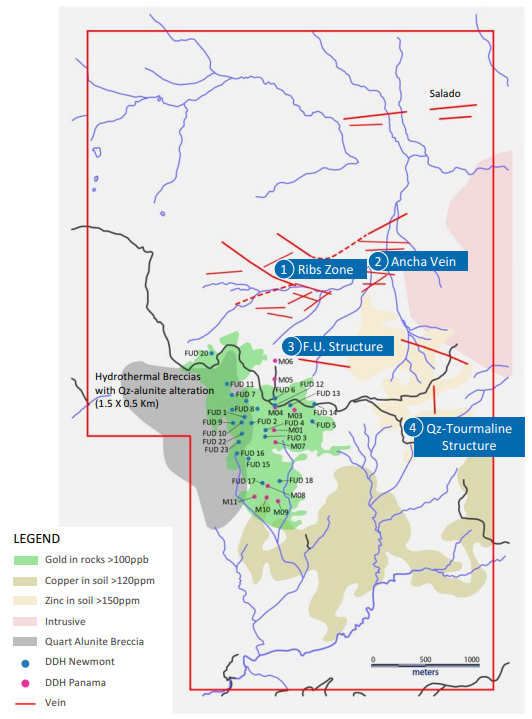

For me, when I’m considering investing in a Brazilian junior mining company, its location will be a big factor in my analysis. Proximity to an existing mining operation gets priority over projects that are essentially on their own.

Personal Note: In 2011, my wife and I spent 2 weeks in Brazil, visiting Sao Paulo, Rio de Janeiro and a few smaller towns along the coast. I can attest to the mountainous terrain between Sao Paulo and Rio, and the fact that there aren’t really any significantly sized towns or infrastructure besides the road itself and a few gas stops.

Another interesting cultural reference that we experienced firsthand, and one which many Brazilians will attest to is ‘Brazilian time.’ ‘Brazilian time’ can mean a couple of things but we heard it used most in reference to (especially in the smaller towns) the amount of time it takes to get your lunch or Caipirinha at a restaurant. It wasn’t uncommon for it to take well over an hour to receive a ‘quick bite,’ and this had nothing to do with cooking time or how (not) busy the restaurant was at the time.

This, I’m sure, is by no means typical of the entire Brazilian population, but it’s interesting and different from how many of us, at least in Canada, tend to operate.

Pension Liabilities

When scanning articles surrounding Brazil’s economic outlook, it’s hard to find one that doesn’t reference Brazil’s large pension obligation. Thus far, attempts to reform the public pension plan have been rejected, and many pundits believe they have now passed the point in which a reform would even make a difference.

The Brazilian public pension policy is very generous; it allows men to retire at 55 and women at 53, while retaining nearly the same salary that they did when they worked. Additionally, pensions are transferrable to surviving spouses, pushing the obligation even further into the future.

The current pension system was born in 1988, just after the Brazilian democratic revolution ousted the military dictatorship and took control of the country. For more than 30 years, the pension plan system has worked, for the most part, because there were enough new workers entering the economy to pay into the pension. Times, however, are changing.

In Brazil, workers are taxed 20% of their income toward the public pension system. As a comparison, Canadians currently pay 4.95% of their salaries into the Canadian Pension Plan (CPP), up to a maximum income level of $54, 900. The Brazilian contribution percentage drastically out-weighs that of the Canadians and, yet, it still comes up short of their future obligations. This tells us just how lucrative the Brazilian pension is and, more importantly, how radically the retiree to worker ratio must be changing.

In my research, I have found estimates stretching out to 2060 which suggest the ratio could get as high as 44 retirees to every 100 workers, which is 4 times higher than the current calculated ratio of 11 to 100. In 2017, the Brazilian government experienced a 181 billion real ($US 318.58 million) gap between contributions and pension obligations. With deficits like that, you may think it’s a no brainer, something needs to change, but you would be wrong.

In April of 2017, the Globe and Mail reported that 75% of Brazilians opposed the reform of the pension plan, and given Brazil’s cultural dynamics, I would bet against any significant change occurring before this causes some real damage.

Concluding Remarks

Understanding a culture is not easy; our own cultural bias sometimes prevents us from objectively analyzing the nuances of another culture. Brazilian culture is diverse and has been influenced by many different events and groups throughout its history.

In terms of Brazil’s culture and how it pertains to investments, provided Bolsanaro, the Brazilian Donald Trump, is able to win the Presidential election, I believe the short-term prospects for Brazil are very good.

The public pension system, however, needs to be reformed and political corruption needs to be drastically reduced for the future of Brazil to remain bright for the long term. To this, I’m highly skeptical and would suggest that the Brazilian culture, as it stands right now, is unable to reconcile these major hurdles.

As well, extra marks are given to companies that have projects located in close proximity to existing mining operations. This point is especially important in the Amazon Basin, where there is obvious risk associated with satisfying both biodiversity and indigenous groups.

I’m invested in Brazil and believe, at least in the short term, there is money to be made in this beautiful South American country.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria.