Investing in high quality companies can bring you gains in any segment of the market cycle. But, when you’re buying a high quality company at the bottom of a commodity cycle, the result can be truly spectacular.

When I bought the best junior gold companies in 2014 and 2015, near the bottom of the last bear cycle, it turned out to be a fantastic contrarian decision, giving me incredible gains in 2016 as sentiment changed.

Today, I feel the same could be said for investing in the nickel market, which, up until 2016, has been decimated by over-supply. This change in the supply dynamic is just one of the reasons why I’m bullish on nickel. In August of this year (2017), I wrote a two-part series on the nickel market and why I’m bullish on its future. For those who would like a closer look at my analysis, check out my series on nickel, Part 1 and Part 2.

So, how do I look to profit from my bullish nickel thesis? For me, the key is FPX Nickel Corp. FPX is the 100% owner of its flagship Decar Nickel District, which is located in central British Columbia, just 80 km west of the Mount Milligan open-pit Cu-Au mine.

Let’s take a look.

FPX Nickel Corp (FPX:TSXV)

MCAP – $13.4 million (at the time of writing)

As of November, 2017

Shares – 133,770,339

Fully Diluted – 141,920,339 (no warrants outstanding)

Management & Directors – 19.3%

Cash – $750K

FPX Nickel’s People

If you have invested in the resource sector long enough, you have most likely heard the adage that people are the most important part of a company. It’s absolutely true. The fact is, however, like everything else in life, most people fall within the average moniker. Besides being average, you, of course, have the bottom feeders – the people you really want to avoid – and conversely, you have the cream of the crop at the top. Without a doubt, you want to be invested with the best people, as they give you the best chance of being right in the mining sector.

Peter Bradshaw is the co-founder and Chairman of the Board of FPX Nickel and, to me, is one of those outliers at the top of the industry . Bradshaw was inducted into the Canadian Mining Hall of Fame in 2015 for his achievements in what has been, thus far, a 40+ year career.

Bradshaw is best known for his involvement with Placer Development and their discovery of the high-grade zone VII at Porgera in Papua New Guinea, as well as co-founding the Mineral Deposit Research Unit (MDRU) at the University of British Columbia. Bradshaw has also worked or contributed to a few other companies, such as Barringer Research and Orvana Minerals. Today, he is Chairman of the Board for FPX and a Director with Aquila Resources.

Here’s a list of Bradshaw’s key discoveries and projects: Porgera Gold Mine, Kidston Gold Mine, Misima Gold Mine, Big Bell Gold Mine, Omai Gold Mine and Decar Nickel Project. As you can see, Bradshaw is a minefinder, and I think Decar will be his next mine. Here’s a link to Bradshaw’s must-see Canadian Mining Hall of Fame Tribute Video.

FPX is led by President and CEO, Martin Turenne. Turenne, a Chartered Accountant by trade, has worked in the commodities industry for over 15 years. Five of those years have been spent with FPX, where he was first the CFO from 2012 to 2015.

I have spoken to Turenne on a few occasions and am always impressed by his knowledge of the nickel market and, of course, the level of detail with which he answers my questions regarding FPX. Turenne is a major reason why I’m confident in investing in FPX and believe that their future is very bright given the quality of his leadership and vision.

FPX’s team is rounded out by consulting geologist and formerly FPX’s (formerly, First Point Minerals) VP of exploration, Trevor Rabb. Rabb has been busy this summer with FPX’s step-out drill program, which tested the southeast extension of the Baptiste deposit at Decar.

Last, but not least, is FPX’s CFO, J. Christopher Mitchell, who has more than 40 years of experience in the mineral industry. Mitchell has held senior roles with Viceroy Resource Corp. and Orvana Minerals Corp.

Board of Directors

Over the last few months, FPX has added two key pieces to its Board of Directors, with the appointment of Robert Pease and Peter Marshall. For those who aren’t familiar, both Pease and Marshall have extensive experience within the mining industry, more specifically, with the development and construction of mining projects in central British Columbia.

Both Pease and Marshall were a part of Terrane Metals; Pease as the founder and Marshall as the Senior VP of Project Development. Terrane owned the Mt. Milligan copper-gold project, which they developed from the PEA stage through to final feasibility and the commencement of project construction. To note, Terrane was later acquired by Thompson Creek Metals Company Inc. for $650 million in 2010.

Clearly, both Pease and Marshall have great knowledge and experience to draw on as they move toward the development of Decar with the rest of the FPX team.

Turenne’s comments with regards to his Board of Directors and how FPX will conduct themselves, moving forward;

Turenne: “We have begun to assemble a team of world-class mine builders and operators. The recent additions of Peter Marshall and Rob Pease are very important, as they have significant experience in developing and building mines in our region in central British Columbia.

Peter and Rob were the team behind Terrane Metals, which developed the similar scale, open-pit, bulk-tonnage Mt. Milligan project from the resource stage to construction in five years before selling the company for $650 million.

One of our other board members is Bill Myckatyn, who has built and operated several large-scale base metal mines in his career, most notably as the CEO of Quadra-FNX (acquired by KGHM for $3 billion in 2011). We will continue to add new team members with deep experience in mine development, construction and operation. This is a major company-style asset; our ongoing development of Decar will continue to be performed to major-company standards.”

The Decar Nickel District

Central British Columbia

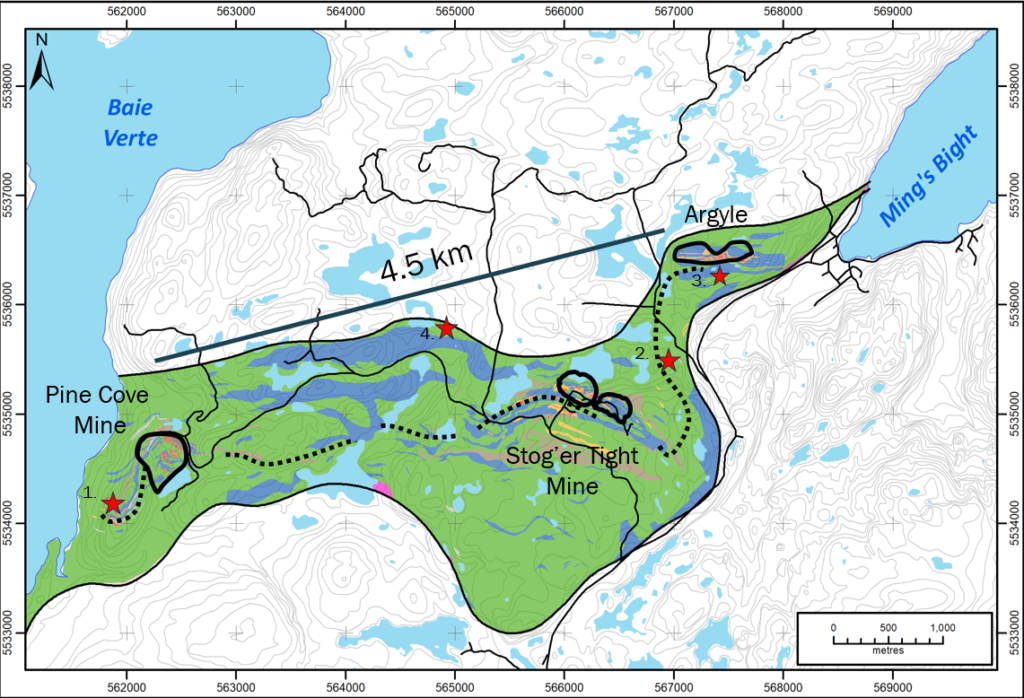

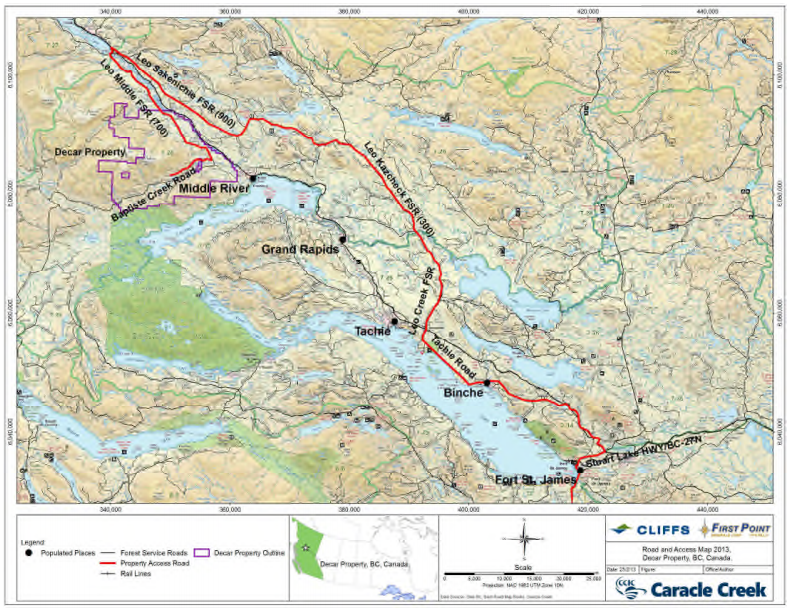

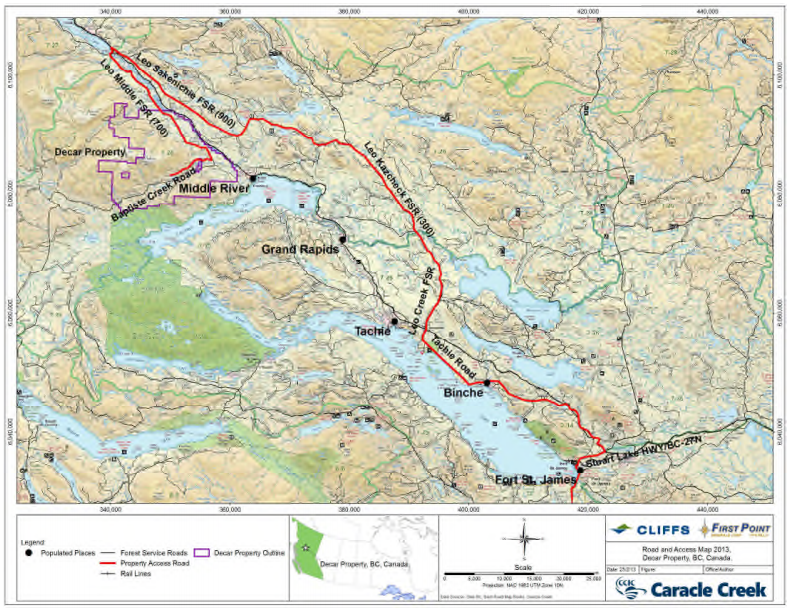

The Decar Nickel District consists of 4 main targets, Baptiste (the focus of the 2013 PEA), Van, Sid and Target B. They total 60 mineral claims and encompass a total area over 245 square kilometres. The Decar Nickel District is located in central BC within 5 km of an existing railroad and is accessible by 4WD on logging roads.Decar sits roughly 90 km northwest of the town of Fort St. James, which is well equipped with most services, including accommodation, stores, private airbase, a bank and medical services.

Decar is expected to require 106 MW of power for its production, which can be accessed via a connection to BC Hydro’s Glenannan Substation (GLN). Accessibility and power are two of the major needs for a developing mine.

BC and its NDP Provincial Government

I have written about BC’s NDP government in a previous article, so I won’t take up space repeating myself here. The long and short of it is that while I believe there is risk with any political party, I feel the most risk comes from the far left, which, in Canada’s political world, is represented by the NDP.

I had a great discussion about the BC political situation with Turenne. Here’s what he had to say;

“British Columbia has a long history as one of the most mining-friendly jurisdictions in the world. In fact, in a 2017 ranking of safest places to invest resource capital, the Mining Journal rated British Columbia as the second-most attractive jurisdiction in the world, second only to Saskatchewan. An Executive Summary of the report can be accessed on the Mining Journal website.

During this year’s election campaign and since taking office, the NDP government has expressed its support for safe and responsible mining in B.C. Mining will remain a key driver of economic growth in the province, regardless of changes in the governing party. As with most jurisdictions, there are some profound regional differences in the ability to develop mining projects in B.C.; in the case of our Decar nickel project, it’s located in north-central British Columbia, which has several active mines and projects. For example, Decar sits just 80 km from Mt. Milligan, a similar-scale operation which was permitted and put into production in the last five years, demonstrating that north-central B.C. is an attractive setting for bulk-tonnage, open-pit mining operations like Decar.“

In the end, besides the political risk, BC has one of the richest mineral endowments in the world, let alone Canada. Whether it be gold exploration in the Golden Triangle or the copper mines throughout the north and central part of the province, BC is a top tier destination for mining and exploration.

While I do see risk in the NDP, when I have the chance to invest in what I believe is a great company, like FPX Nickel Corp., I think it’s worth the associated risk and have been a buyer since the summer of 2017.

History of Decar District Ownership

In a 2009 option agreement, what was then First Point Minerals (now FPX) granted Cliffs Natural Resources Exploration Inc. the option to acquire a 75% interest in the Decar property contingent on a number of criteria being met over the coming years.

From 2010 to 2013, Cliffs went on to spend roughly $22 million USD leading up to the completion of a PEA in 2013, giving them a 60% ownership of the project. In August of 2014, however, following a proxy battle, Cliffs’ Board of Directors and management were replaced, and the new management initiated a fire sale of all of the company’s non-core assets, including Decar.

In September of 2015, FPX purchased Cliffs’ 60% ownership of Decar for $4.75 million USD, giving FPX 100% ownership of the project.

Decar Nickel-Iron Alloy Project PEA 2013

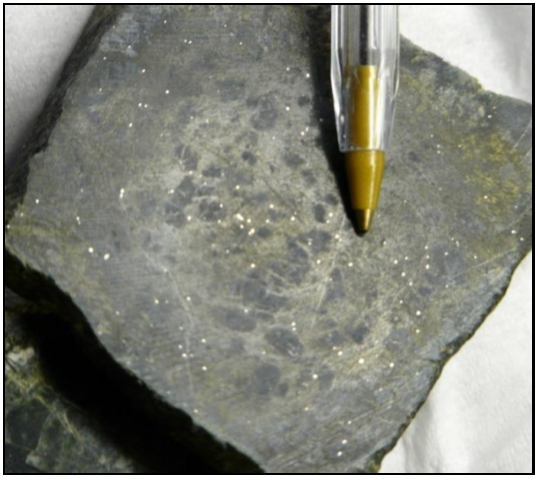

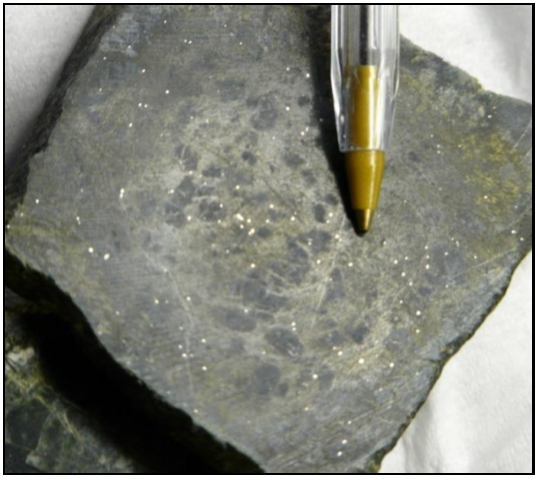

Decar’s nickel is found in a mineral called Awaruite. Awaruite is a dense and highly magnetic nickel-iron alloy, Ni₃Fe, which is commonly referred to as a ‘ naturally occurring stainless steel.’ Awaruite’s physical properties make it perfect for conventional processing and extraction techniques such as grinding, magnetic separation and gravity concentration.

Additionally, in the case of the Baptise Deposit mineralization, there are little to no sulphides present, meaning that both the host rock and tailings are non-acid generating, which is a huge plus when it comes time to permit the project.

Mineral Processing and Metallurgical Testing

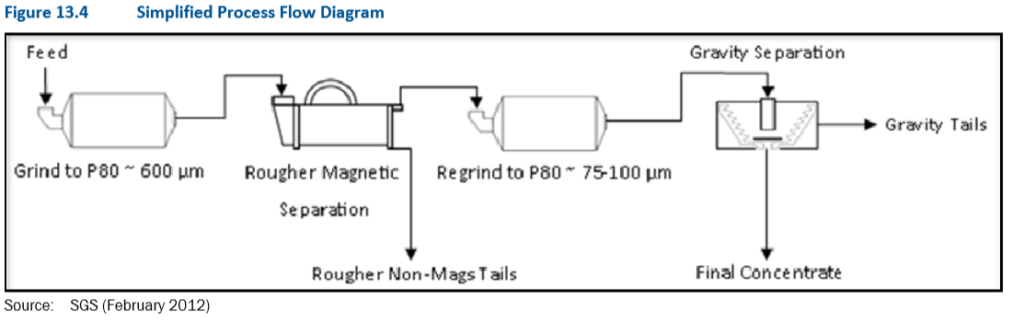

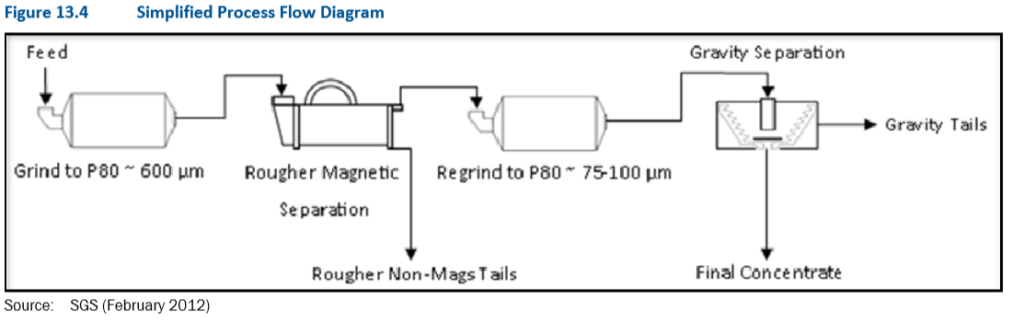

In 2012, SGS Minerals Services conducted “A Bench-Scale Investigation into the Recovery of Nickel from the Decar Awaruite Deposit.” From their tests, SGS selected a process which uses a grind size of 600 µm for the magnetic concentration stage, and 70 µm for the gravity concentration stage. This process results in an 84.7% recovery of DTR nickel, resulting in a concentrate with a grade between 12% and 15% total nickel.

The concentrate produced by FPX should be highly desirable in the stainless steel market, as steel producers, particularly in China, shift toward using higher grade sources of feedstockl to supply their steel making operations. For your information, lower grade concentrates or pellets have higher amounts of impurities, which, if not properly captured by a Bag House (essentially a massive vacuum), are exhausted into the atmosphere.

For those who aren’t familiar, nickel pig iron (“NPI”) is a major additive in the stainless steel making process, as it contains both nickel and iron, two of the main constituents in stainless steel. The FPX concentrate or pellet, as mentioned earlier, will have a nickel grade of around 13.5% and iron content around 50%, which compares favourably to the specs of high-grade NPI.

I had the chance to ask Turenne about the metallurgy of the Decar Project and the outlook for the concentrate. Here’s what he had to say;

Turenne: “Decar will produce a premium nickel-iron product in the form of either a concentrate or a pellet with a nickel grade in the range of 12-15% and containing 40-50% iron. The closest market analogues to the Decar pellet are high-grade Chinese nickel pig iron (which typically grades 10-12% nickel with iron making up the balance) and ferronickel (grading 30% nickel, 70% iron). The significant iron content in ferronickel and Chinese NPI makes these products highly desirable for the production of stainless steel, which requires nickel and iron as key inputs; these products, therefore, attract premium pricing in the range of 102 to 110% of the LME nickel per contained nickel unit, as compared to typical nickel sulphide concentrate, which yields 70-75% of the LME nickel price when it is sold to a smelter.

In 2014, FPX conducted market testing of Decar product samples with six of the largest ferronickel and stainless steel producers in the world. The results of this program confirmed the potential for Decar product to bypass smelting and be injected as direct feed for the production of either ferronickel or stainless steel. The commercial feedback provided by the market test participants indicated that Decar product may achieve payability up to 95% or more of the LME nickel price, which is a material improvement over the 75% payability assumed in the 2013 Decar PEA. This improvement will be a key driver underpinning potentially robust economics in an upcoming updated PEA.”

From Turenne’s comments, I think the comment about the potential difference in payability, 20%, is a big deal and should be realized in an updated PEA in the future.

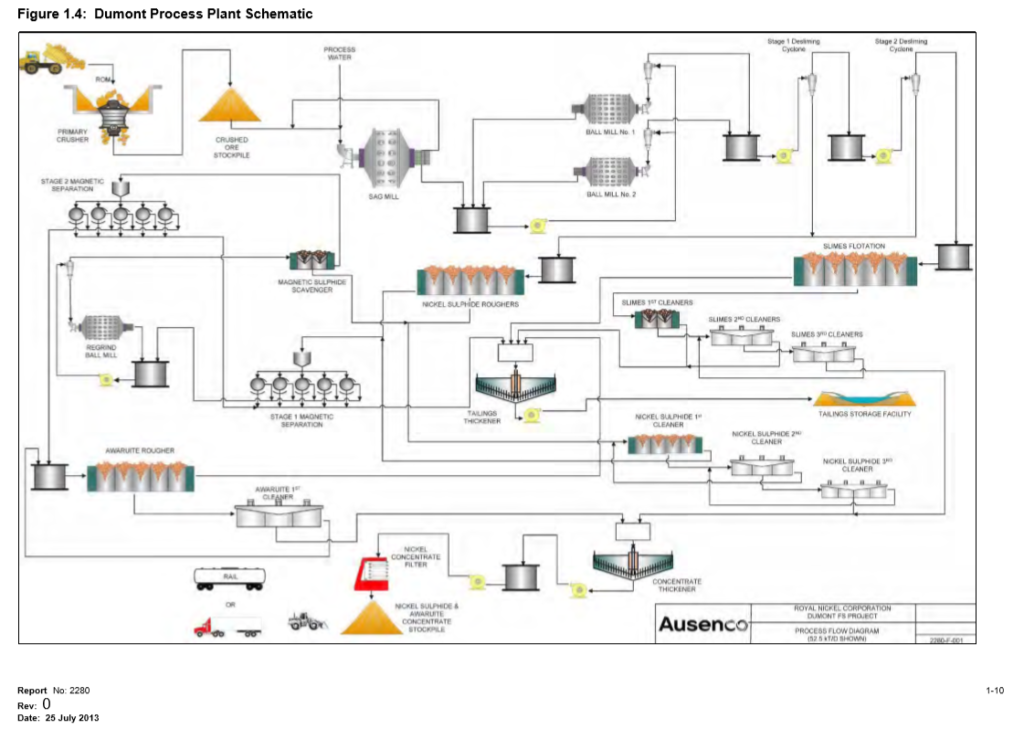

Metallurgical Comparison to RNC Nickel

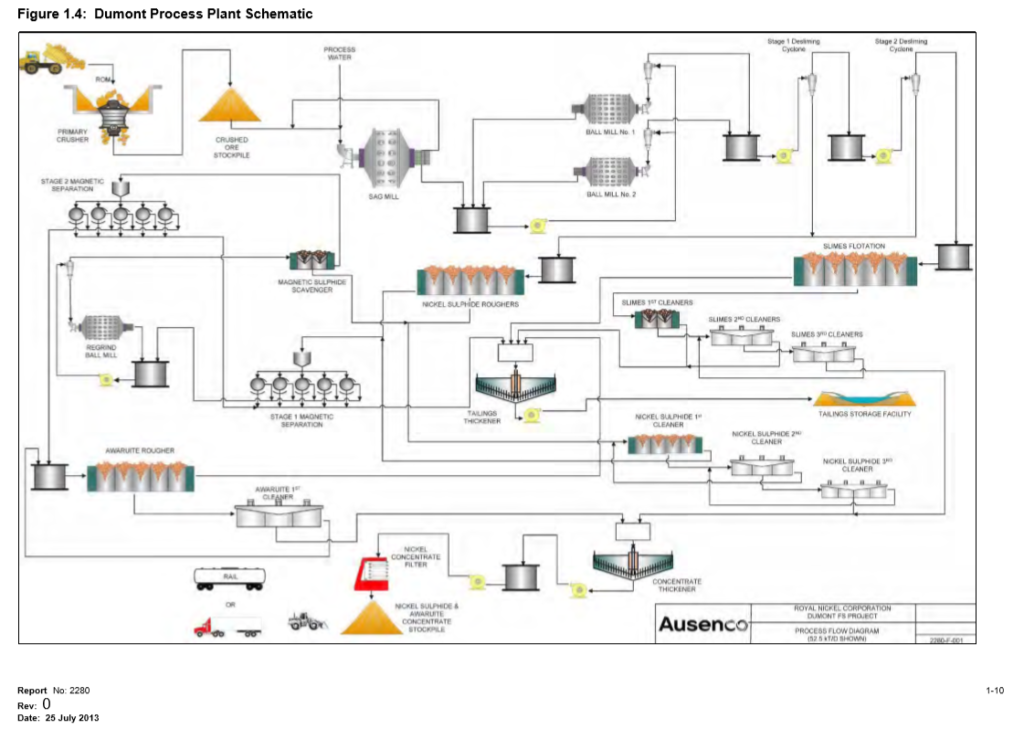

For a better perspective of FPX’s metallurgical advantage, I have a comparison of Process Plant Schematic’s or Flow Sheets of RNC Nickel and FPX. First, let’s take a look at RNC Nickel’s Dumont Feasibility Study Technical Report, which shows the following flowsheet for the Dumont nickel sulphide deposit:

Source: RNC Nickel’s Dumont Feasibility Study Technical Report – pg.1-10

I am not showing RNC’s flow sheet to be critical of their process, but more to point out its complexity versus FPX’s flow sheet. FPX’s process is simple and widely used in the iron ore industry, and, in my opinion, presents fewer risks for economic production in the future.

Source: FPX Nickel’s Decar PEA Technical Report – pg.13-12

You be the judge. In my mind, metallurgical processing is arguably the most important part of a mine and, therefore, for me, FPX is clearly the better place for my investment dollars.

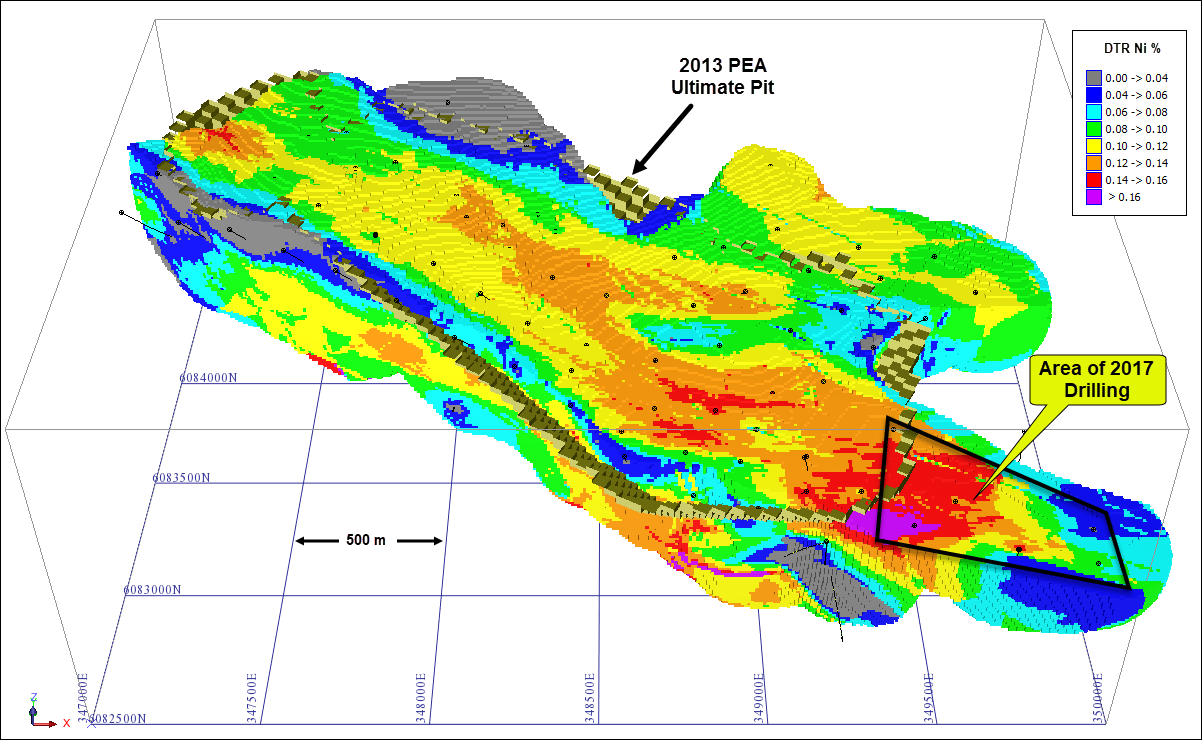

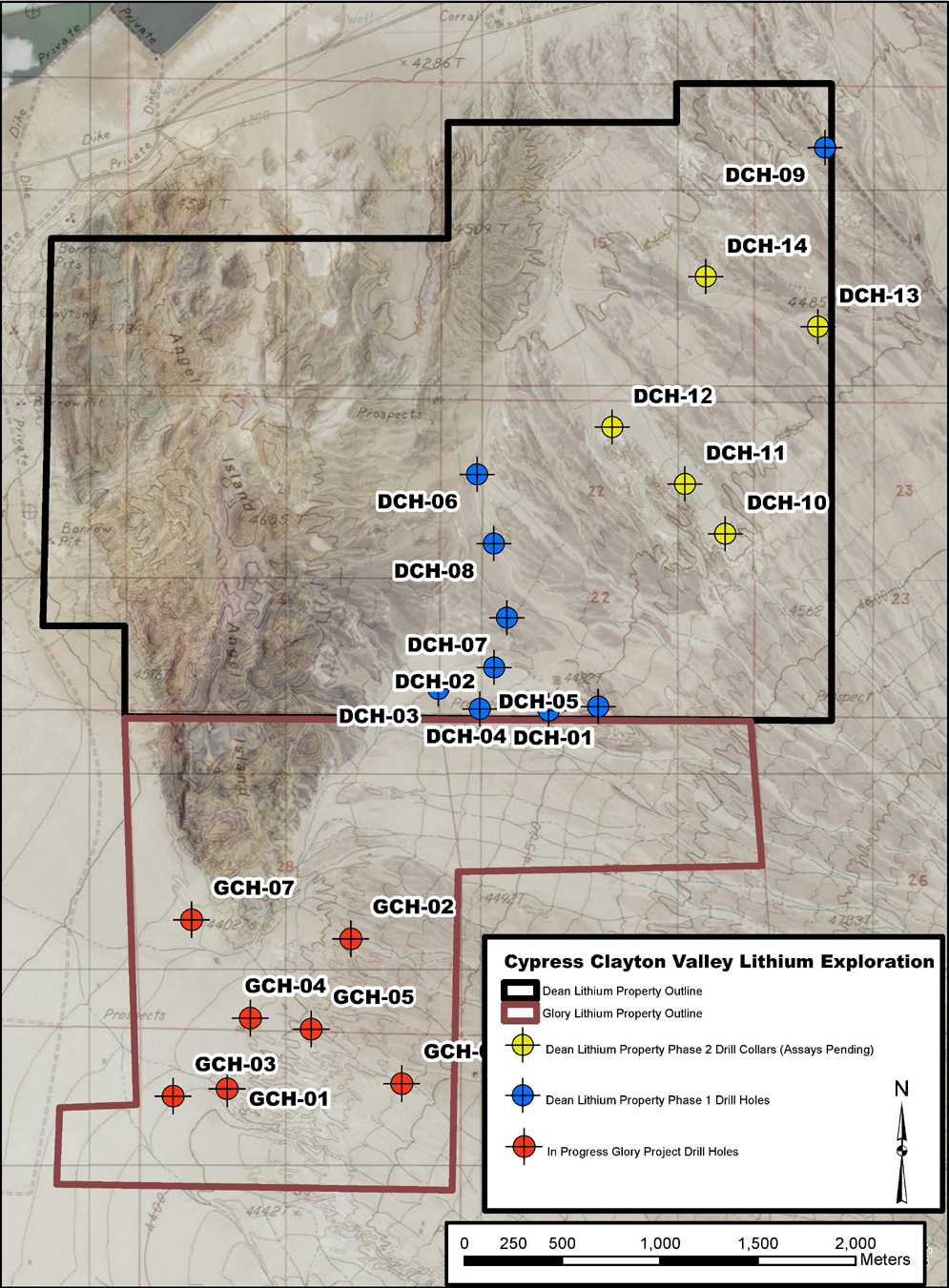

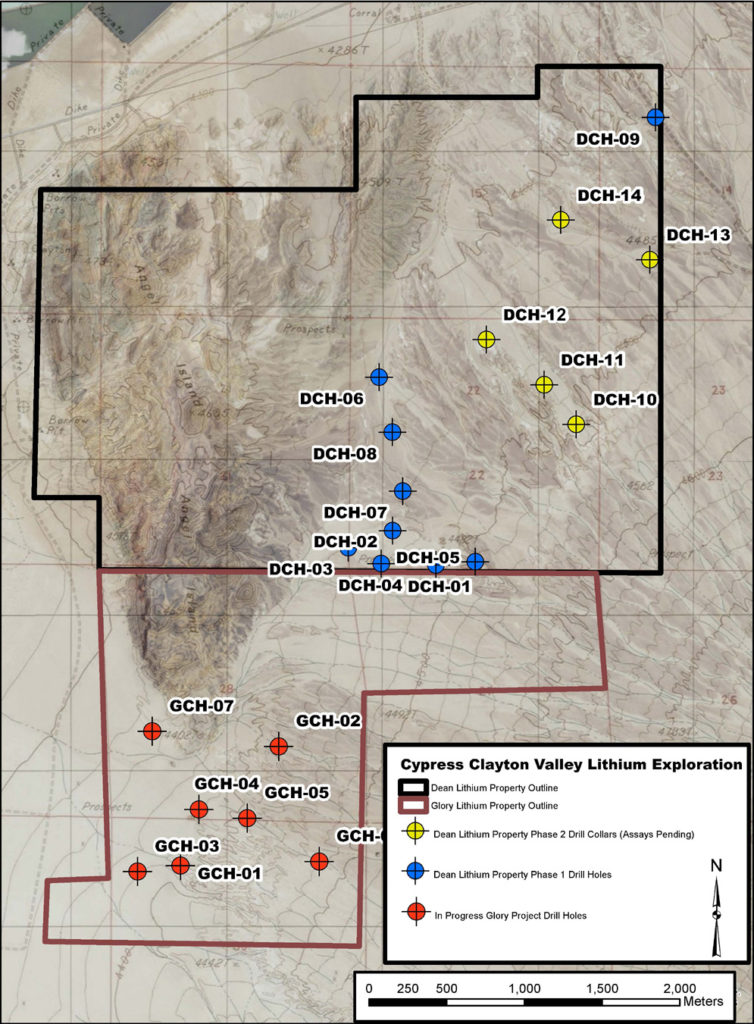

Summer Step-Out Drill Program

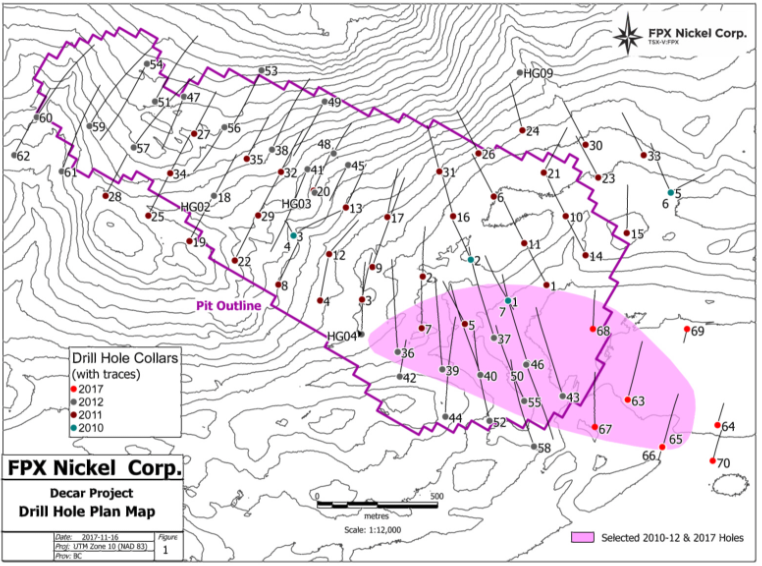

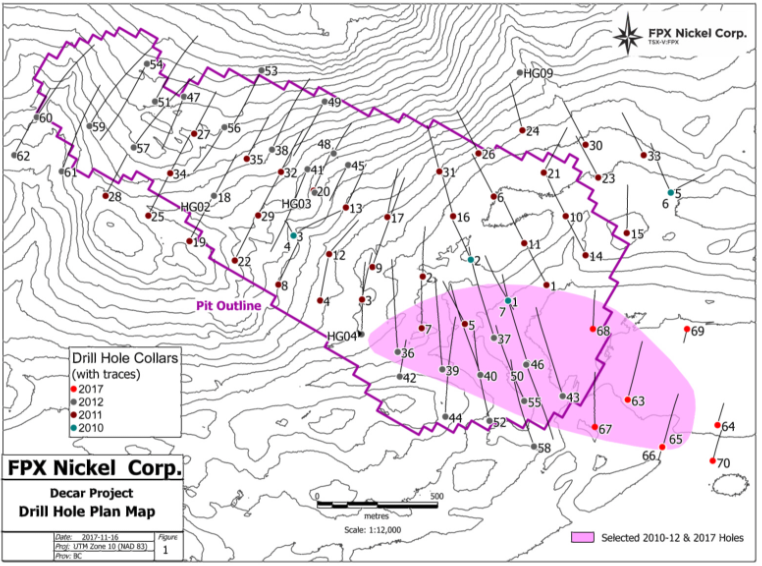

On September 25th , FPX completed their step-out drill program on the Baptiste Deposit. Eight diamond drill holes were completed, totalling 1,917 metres. The drill program area was 500 metres along strike from historical drilling, and covered a width of 500 metres.

On October 18 and November 20th, the results of the 8 hole program were released. The highlights from the program are as follows:

- Hole 63 had an interval containing 104 m of 0.163% Davis Tube magnetically-recovered (DTR) nickel at a vertical depth of 66 metres below surface.

- Hole 65 had an interval containing 132 m of 0.147% DTR nickel at a vertical depth of 32 m below surface.

- Hole 67 had an interval containing 96 m of 0.167% DTR nickel at a vertical depth of 42 m below surface.

- Hole 68 had an interval containing 124 m of 0.133% DTR nickel at a vertical depth of 20m below surface.

In my opinion, these results are excellent. To understand, let’s put it into perspective; the Baptiste deposit’s indicated DTR nickel resource estimate has a grade of 0.124%, and its inferred DTR nickel resource estimate has a grade of 0.125%.

The highlighted drill results are significantly higher-grade than the existing indicated and inferred resource estimate grades, they are large intervals and they are shallow. These are very positive signs that an updated PEA on the project should have better economics.

The question is how much of an impact can the step-out drill results have on the project’s economics? Well, the historically identified strike length totals 2.5 km in length, the summer drill program stepped out a further 500 m or a roughly 25% extension of the strike length. Given that the mineralization is shallow and higher grade than the existing resource estimates, I think this is going to have a very positive effect on the PEA update.

2013 PEA Results

The Baptiste Deposit will be mined via an open pit which is estimated to contain an Indicated Resource of 1.1 billion tonnes of 0.124% DTR Ni, and an Inferred Resource of 0.87 billion tonnes of 0.125% DTR Ni. Based on this, Tetra Tech calculated the following 2013 PEA results:

- Post-Tax NPV @8% – $579 million CAD

- Post –Tax IRR – 12.8%

- Pre-Production CAPEX Cost – $1.3 billion CAD

- Total CAPEX Cost over life-of-mine –k $2.1 billion CAD

- Post-Tax Payback – 6.4 years

- Nickel Price – $9.39 USD/lb.

- Mining Rate – 114,000 t/day or roughly 40 million t/year

- Exchange Rate – $0.97 CAD/ USD

Nickel Price Assumption

As you can see, the Decar project has some robust economics, with a post-tax NPV @8% of $579 million and an IRR of 12.8%. The downside to these numbers is that they were calculated using a nickel price of $9.39 USD/lbs.

For those who have been following the nickel price, you will know that nickel currently trades at roughly $5.50 USD/lbs, with most industry experts using $7.50 USD/lbs as their long-term target price.

At face value, the nickel price assumption is a troubling aspect of the 2013 PEA. A lot, however, has changed in the last 4 years, since the PEA was conducted.

- Firstly, as outlined in the previous section of the report, FPX’s 2017 step-out drill program, completed this past fall, intercepted large intervals of shallow, high-grade DTR nickel, which appears to have extended the existing deposit by another 500 metres or roughly 25%.

- Secondly, as outlined in the metallurgical section of this report, the PEA considered a conservative concentrate payback of 75%. However, FPX’s latest market testing suggests that a payback of 85 to 95% is more realistic due to the product’s high quality.

- Thirdly, the CAD to USD exchange rate was almost 1 for 1 back in 2013. Today, in 2017, according to the Bank of Canada website, for every Canadian dollar we would receive 0.7911 American dollars, making the difference between the two exchange rates almost 20%.

It is my contention that given the 3 outlined changes since the original PEA was conducted, that a new PEA at a lower nickel price will again show robust economics.

CAPEX Cost

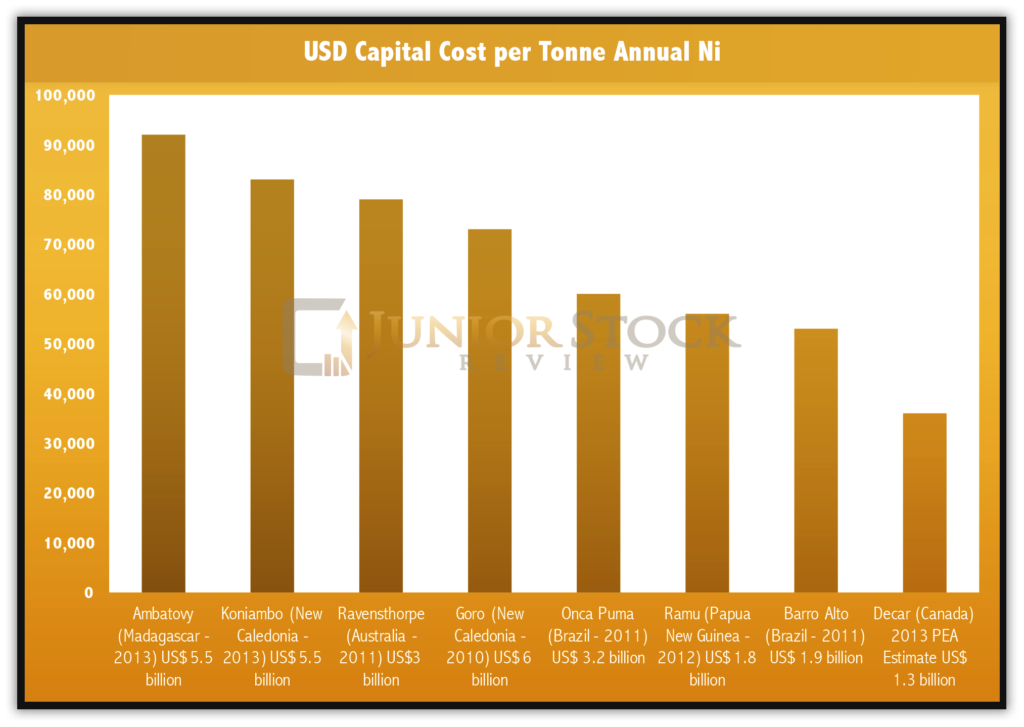

With a pre-production CAPEX cost of roughly $1.3 billion CAD, you may be thinking, ‘how are they going to pay for this?’ Well, in actuality, for those who aren’t familiar with base metals project development costs, US$1.3 billion is relatively cheap.

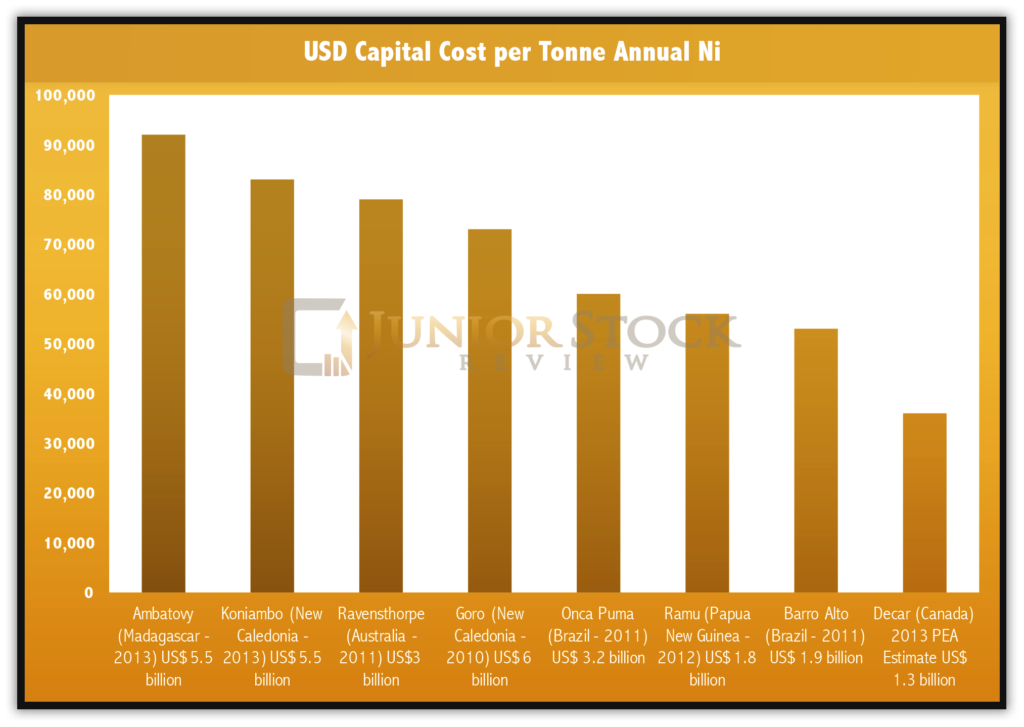

FPX’s most current corporate presentation, on slide 23, has a great graph depicting the capital cost (USD) per tonne annual nickel production of the largest nickel mines built around the world since 2010.

As you can see, Decar has the lowest capital cost (USD) per tonne of annual nickel production of all the listed nickel mines. The key take away from this graph, in my opinion, is two-fold; First, CAPEX costs in the billions of dollars won’t be the reason why this project isn’t developed. As you can see, the average CAPEX cost of the listed comparisons is close to $4 billion, making Decar’s current US$1.3 billion look quite low. Second, if FPX were to complete an updated PEA on Decar, they could potentially lower the throughput rate, which would have an effecton the overall CAPEX value.

Here are Turenne’s comments surrounding the $1.3 billion pre-production CAPEX cost;

Turenne: “The estimated pre-production capital cost in the 2013 PEA was C$1.3 billion for a 114,000 tonne-per-day operation, or approximately US$1.1 million at today’s exchange rate. We are looking at a potential smaller-scale operation, which could potentially reduce capital costs.

We believe that Decar is the most attractive undeveloped nickel asset in the world, truly a tier-1 asset due to the size of the ore body (supporting a top-15 annual nickel producer over a 25+ year mine life) and bottom-quartile operating costs (C$3.23 on-site operating costs in the 2013 PEA).

Due largely to the somewhat depressed state of the nickel market, and due to the modest headline economics in the 2013 PEA (resulting mostly from the low assumed nickel payability and high Canadian dollar assumption), FPX’s current valuation is absurdly low. Our strategy is to continue to demonstrate the technical and economic feasibility of the project, and to commence the permitting process, so that as the nickel price continues to rise, the market will begin to value us more appropriately. As and when this occurs, this will give us a better basis on which to raise funds to advance the project on our own, or to advance the asset with a senior partner. “

FPX’s Plans for 2018

In my opinion, it’s important to have a long-term outlook when it comes to your investment within the resource sector, as it gives you the best chance for your thesis to be right and helps you manage the ebbs and flows of a volatile sector.

In saying this, I asked Turenne about 2018 and what they had planned. Here’s what he had to say;

Turenne: “We will continue to advance the Decar project, likely with the release of an updated resource estimate for the Baptiste deposit which will incorporate the results of our very successful 2017 step-out drilling program. The 2017 drilling defined the Southeast Zone, which is the highest-grading portion of Baptiste.

There are a couple of key features of the Southeast Zone: first, it’s a very large zone measuring 1,000 metres long east-west and up to 600 metres north-south; second, long, near-surface drill intercepts in the Southeast Zone have returned grades in a range between 0.14% to 0.16% Davis Tube recoverable nickel. These results compare very favourably with the undiluted head grade in the first five years of the 2013 PEA mine plan, which ranged from 0.105% to 0.116% DTR nickel. The incorporation of this near-surface, higher-grade tonnage in the early years of a new mine plan has the potential to significantly improve project economics.

Once we have completed an updated Baptiste resource estimate, the next major step is the completion of an updated PEA. Since early 2017, we have been evaluating a number of parameters to optimize project economics, including the development of an optimized mine schedule and process flowsheet, an evaluation of various alternatives for minimizingupfront capital, and incorporation of the results of market testing on payability for our nickel product.

The point on payability is particularly important to understand the upside in a new PEA. We have conducted market testing of Decar nickel product with some of the largest ferronickel and stainless steel producers in the world to confirm the technical and commercial viability of Decar product. The response received from those potential offtakers have demonstrated the potential to achieve nickel payability in the range of 85% to 95% of the LME nickel price, as compared to the 75% LME payability assumed in the 2013 PEA. This implies a significant potential for increased revenue over the life-of-mine, with obvious positive implications for overall project economics.”

Nickel Company Comparables

For perspective on the value of FPX, I have put together a comparison with another junior nickel company which has a development project in BC.

Giga Metals

MCAP – $27.4 million (at the time of writing) based on the current share price of $0.70/share, with 41.4 million shares and 26 million warrants outstanding at exercise prices ranging from $0.07 to $0.70/share

Giga Metals owns the Turnagain Nickel-Cobalt Project in northern BC. Turnagain is a large, low-grade sulphide deposit containing nickel and cobalt-bearing pentlandite and pyrrhotite. The project’s main economic value is found in its nickel, with a much smaller portion being derived from its cobalt credits.

As you will see below, many of Giga’s Turnagain Project economic valuations are very similar to FPX’s Baptiste Deposit. However, I see some areas in which, I believe, FPX is stronger than Giga – let’s take a look:

- Metallurgy – Complex mineralization, which, if successfully processed into a concentrate, will not fetch a premium price in the market, meaning payability of 75% of the LME price, at best. Please read the section of the PEA regarding metallurgy.

- Location – remote location in northern BC with higher hydro power access and concentrate shipment costs

- Limited Upside – The 2012 PEA has a high nickel price assumption ($8.50/lb.) and GIGA has not defined a clear path to making Turnagain an economic project below $8.50 USD/lb nickel.

- Share structure – while the shares outstanding is lower than FPX, this is only after a couple of recent share roll backs, and keep in mind that GIGA’s share count will almost double if all the outstanding warrants and options are exercised.

Here are a few of the highlights from the PEA:

- Measured and Indicated Resource – 865 Mt @0.21% Ni and 0.013% Co and an Inferred Resource – 976 Mt @0.20% and 0.013% Co.

Giga’s Results:

- Post-Tax NPV @8% – $724 million

- Post-Tax IRR – 13.5%

- Initial CAPEX – $1.357 billion

- Year 5 Expansion CAPEX – $492 million

- Total CAPEX Cost over life-of-mine – $1.849 billion

- Post-Tax Payback – 7.3 years

- Nickel Price – $8.50 USD/lb. and Cobalt Price – $14.00 USD/lb.

- Mining Rate – 28.1 Mt/year (average LOM)

- Exchange Rate – $0.95 USD/CAD

Currently, Giga Metals trades more than double the MCAP of FPX, which I don’t think is justified. Giga’s Turnagain has a lot of positive aspects, however, when it comes down to valuations, I don’t believe it’s more valuable than FPX’s Decar Nickel District, given the reasons I outlined.

Concluding Remarks

I’m very bullish on the future of nickel and am investing my money into what, I believe, are the best investments to capitalize on a rising nickel price.

Even if you agree with my bullish nickel outlook, you may have a different risk tolerance when it comes to investing. For me, I prefer the junior portion of the resource sector, as I believe it gives the investor the best risk to reward ratio.

In saying this, I will continue to buy shares in FPX Nickel Corp. because, in my opinion, their Decar Nickel District is among the best undeveloped nickel projects in the world.

As I outlined in the report, there’s some risk associated with FPX, mainly in the nickel price assumption from its 2013 PEA and the NDP political party which currently leads the BC provincial government. I do believe, however, that given the step-out drill results, the expected 85-95% payability on the concentrate and a change in the exchange rate, the Decar Nickel District will be economic at sub $8 USD/lb. nickel.

In my opinion, there’s more upside potential than downside, especially at its current MCAP. Here’s a list of the reasons I’m investing in FPX Nickel:

- Great leadership from CEO, Martin Turenne, and a group of proven mine builders, beginning with Peter Bradshaw and Board members, Robert Pease, Peter Marshall and Bill Myckatyn. This team is being assembled with the successful development of Decar in mind.

- A desirable concentrate or pellet which is made via a simple metallurgical process. Market research carried out by FPX suggests that the concentrate could sell for around 85-95% of the LME price, which is 20% higher than the 75% used in the 2013 PEA.

- The Baptise Deposit mineralization has little to no sulphides present, meaning that both the host rock and tailings are non-acid generating, which is a huge plus when it comes time to permit the project.

- Low Pre-Production CAPEX cost of $1.3 billion – World-class nickel projects come with large price tags, making Decar look very reasonable, if not cheap.

- Low on-site operating costs of C$3.23/lb, which would position Decar in the lowest quartile of the nickel industry cost curve.

- Given the PEA nickel production rate of 82 million lbs. per year, at today’s nickel price of US$5.75/lb, Decar would yield around US$250 million in annual pre-tax operating cash flows.

- Large resource containing over 5.5 billion pounds of nickel in the combined indicated and inferred categories, making Decar one of the five-largest undeveloped nickel deposits in the world

- Successful step-out drill program results from the Southeast Zone, which has increased the strike length by 500 metres or roughly 25%.

- PUSH – An update to the Baptiste Deposit’s resource estimate should come in 2018, setting the stage for an updated PEA.

- FPX is trading for less than half (in terms of MCAP) the value of a comparable junior nickel company which, I believe, doesn’t have as high quality an asset as FPX.

In my opinion, all of these points make a great investment proposition. One that I think will be very hard for a major mining company to ignore in the future. With the completion of an updated PEA, a rising nickel price, and the overall lack of comparably great projects in the world, I believe FPX is HIGHLY undervalued and am looking forward to its re-rating in the market.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

Brian Leni is an online financial newsletter writer. He is focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, Brian Leni is not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Junior Stock Review, especially if the investment involves a small, thinly-traded company that isn’t well known.

Brian Leni’s past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in his newsletters or on this website.

In many cases Brian Leni owns shares in the companies he features. For those reasons, please be aware that Brian Leni can be considered extremely biased in regards to the companies he writes about and features in his newsletters. You should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. Brian Leni may buy or sell at any time without notice to anyone, including readers of this newsletter.

Brian Leni shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Junior Stock Review does NOT have any business relationship with FPX Nickel Corp.

Junior Stock Review does not undertake any obligation to publicly update or revise any statements made in this newsletter.

Brian Leni does own shares in FPX Nickel Corp.