I’ve broken Part 4 of my series on uranium down into segments, as I review the companies I believe have the best chance for success in the upcoming uranium bull market. The companies covered thus far include Cameco, Energy Fuels, GoviEX, and today, NexGen Energy Limited.

For this report on NexGen, I had the opportunity to exchange emails with a fellow resource market researcher and publisher, Peter Epstein of Epstein Research. Epstein is a Chartered Financial Analyst (CFA) and possesses an MBA from NYU’s Stern School of Business. Epstein is well versed in the analysis of junior resource companies, and in particular, NexGen.

Enjoy the interview!

Interview:

Brian: 2016 has marked 12 year lows for the uranium spot price, hitting $17.75 USD / lbs just a few weeks ago. While the uranium price action has been devastating to most of the companies in the sector, the market has responded to stories like NexGen’s.

NexGen’s maiden resource estimate was strong enough to propel its share price from the 60 cent CAD range all the way to a high of $2.86 CAD in the months after. NexGen is receiving recognition in a down market; it’s speculation, but one can imagine the valuation in a uranium bull market.

None of us have a crystal ball and can tell the future, but what do you see happening in the future for uranium?

Peter: Yes, crystal balls around the world have failed miserably to predict the uranium price for 3-4 years running. Sell-side research firms have fared no better. I really do believe that $17.75/lb. is a low in the cycle, but I’m not sure how far or how fast the spot price might rebound. I mean, adjusted for inflation, $17.75/lb. in 2004 dollars is equal to ~$14/lb. Longer-term, I’m comfortable with contract prices in the $60-$70/lb. range, with periods above and below that level.

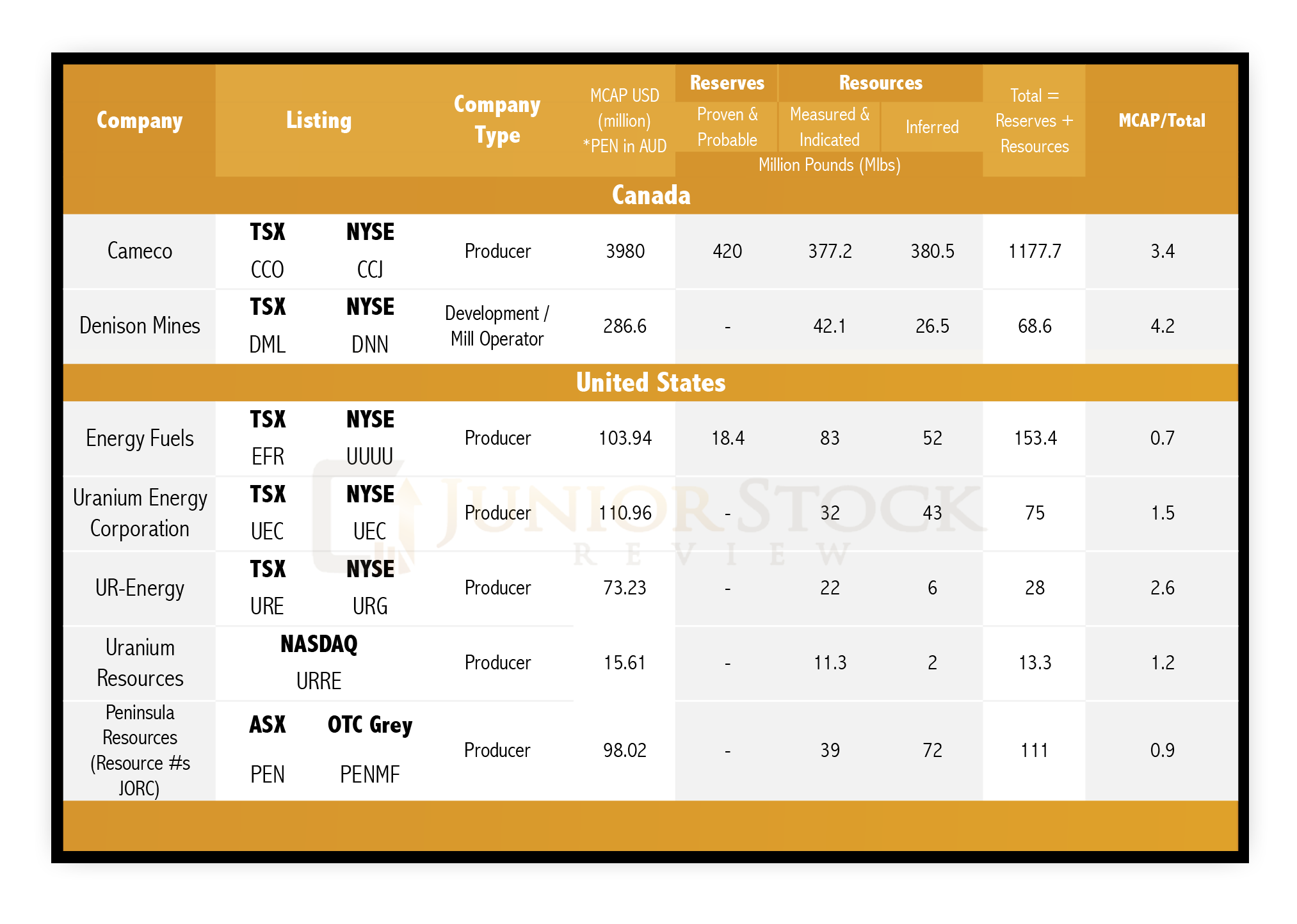

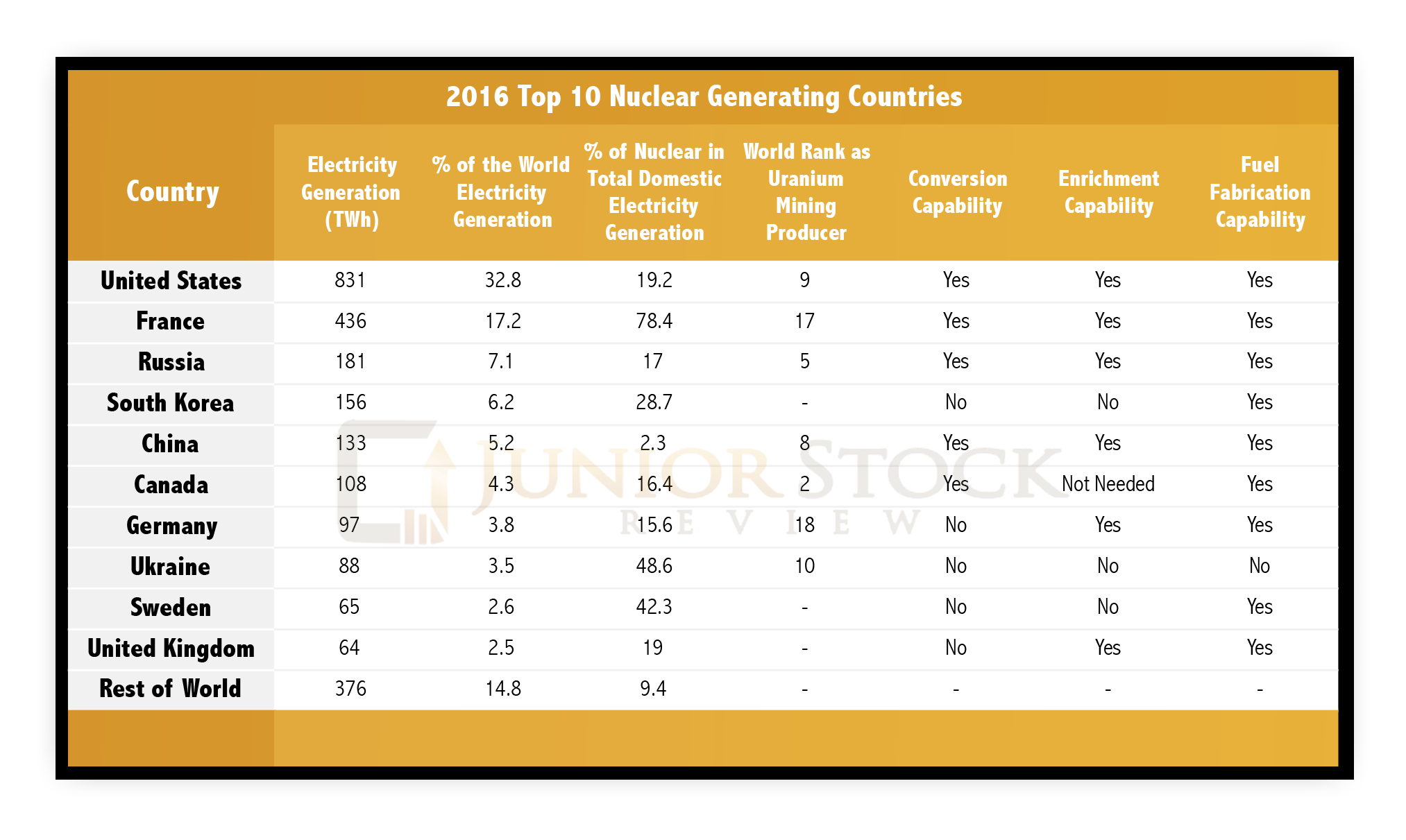

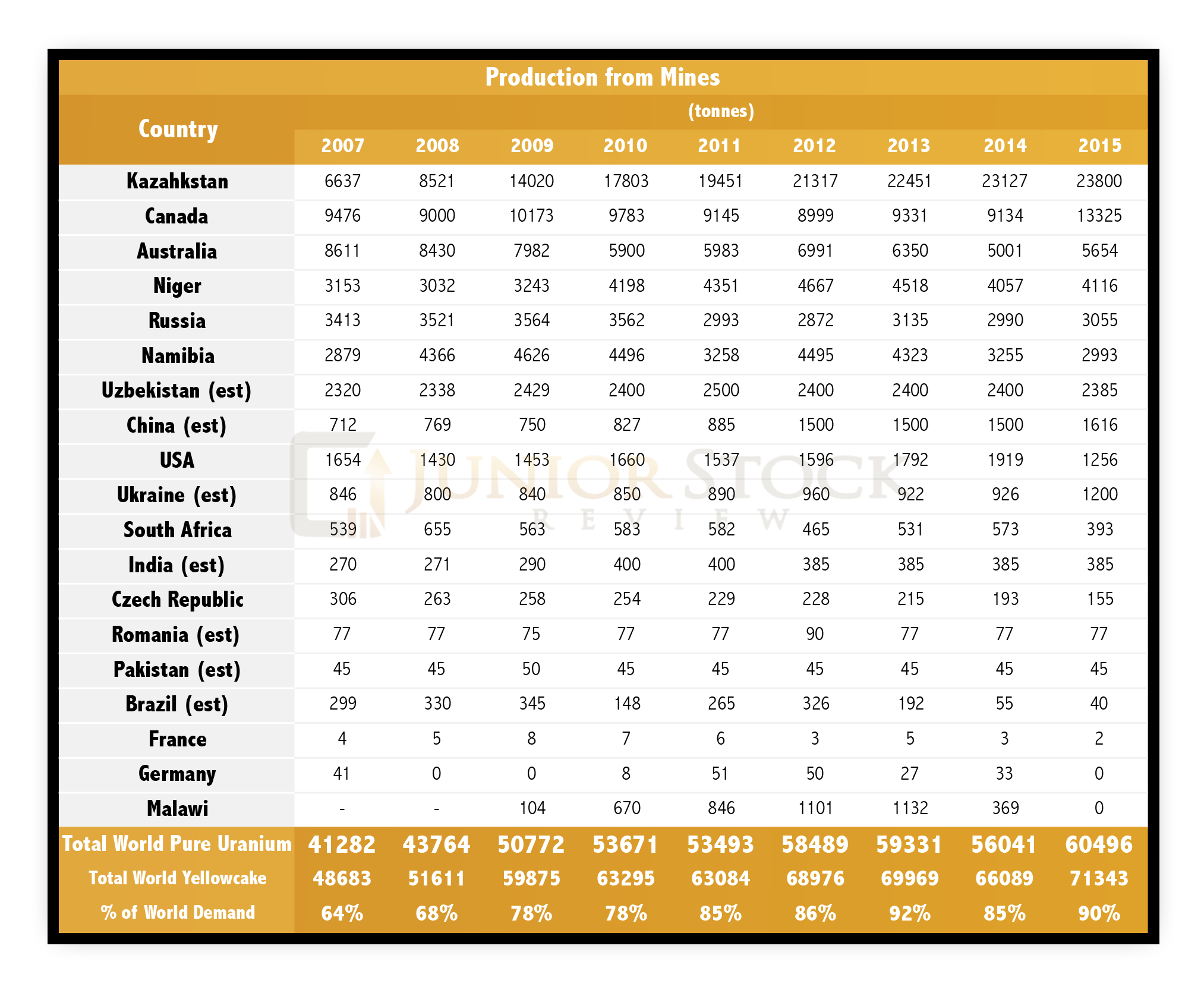

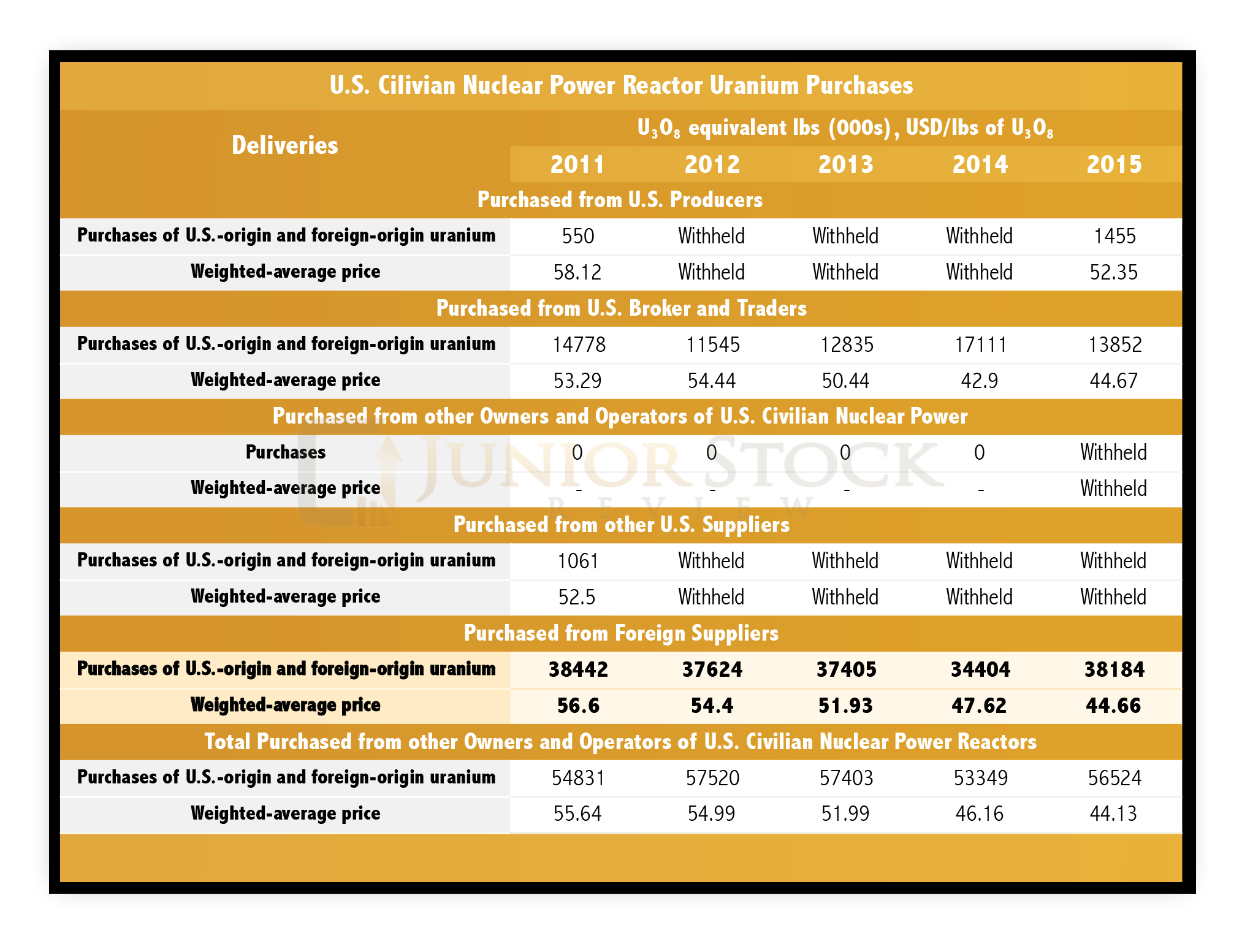

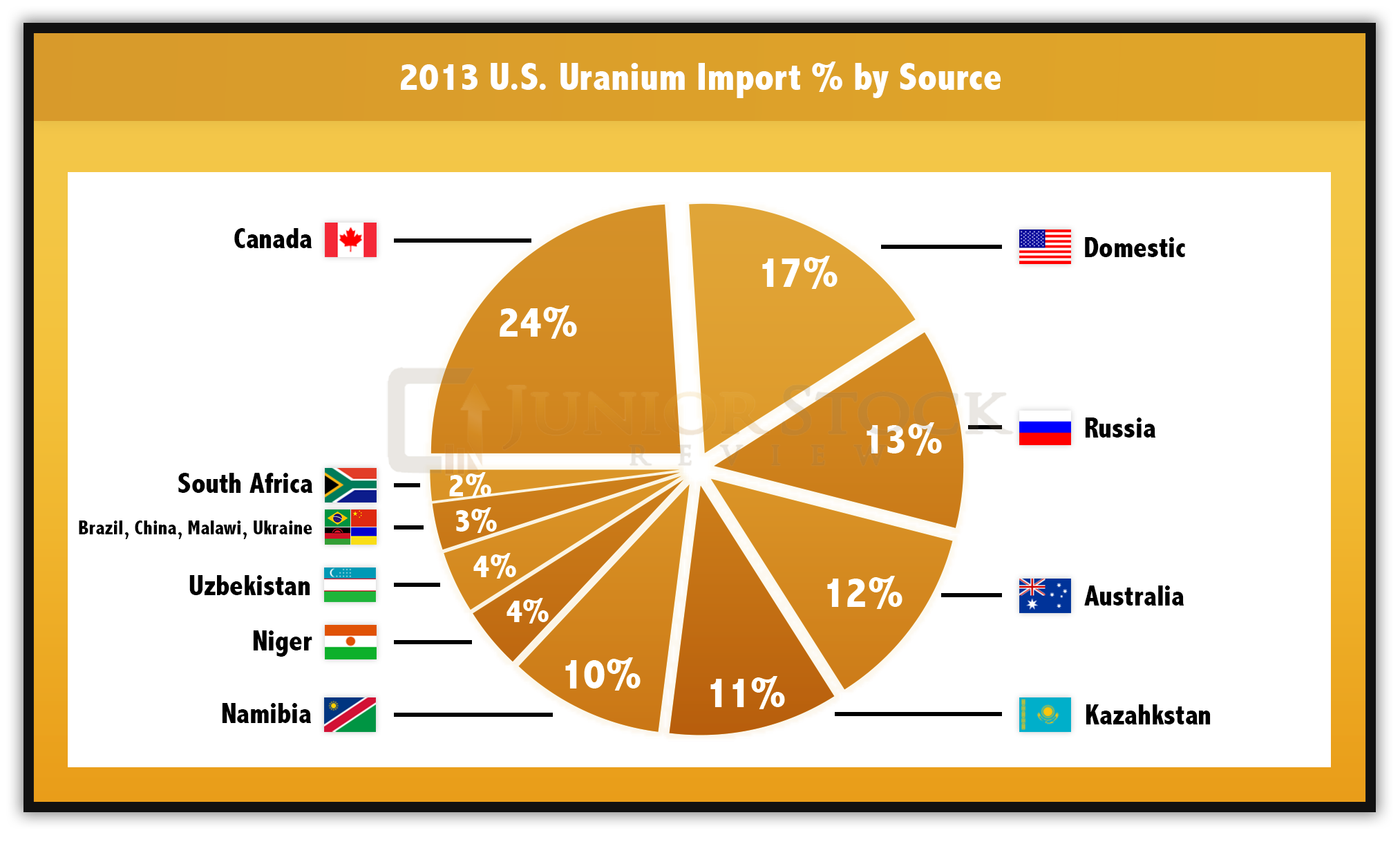

Headwinds are centered on supply and shadow inventory (lbs. that might come to market if prices rise). But, offsetting that, from say 2020 on, is the serious risk of security of supply. In 2015, a combined 47% came from top producing country Kazakhstan, along with Russia & Ukraine. By contrast, 34% came from Canada, Australia & the U.S. Further, with depressed prices, a lot of projects have been delayed, cancelled/abandoned. Some large projects require prices of $70-$85/lb. to be viable (while maintaining a reasonable margin for error).

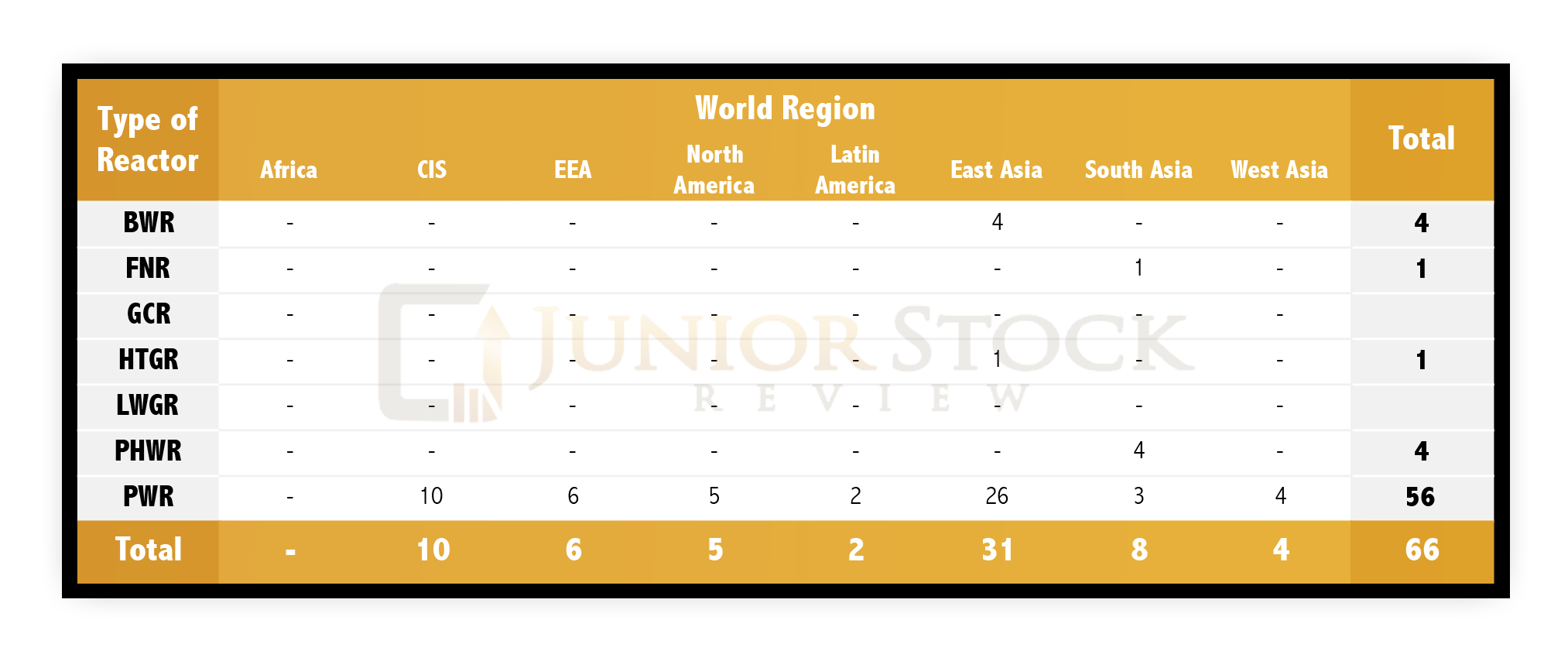

Regarding demand, despite euphoria over China, it’s hard to move the global demand needle. Still, 3% growth year after year for 20-30 years could be all it takes to spark a sellers’ market, that’s not near-term, but certainly a decent possibility by the early 2020’s.

Brian: As I’m sure you will agree, investing your money with the junior resource sector’s best people is the most tried and trusted method for success in an unforgiving junior market. Let us take a look at the key members of NexGen’s team.

NexGen is led by Mr. Leigh R. Curyer, who has over 20 years experience in the uranium sector. Curyer’s formal education is in accounting and finance from the University of South Australia. As Head of Corporate Development with Accord Nuclear Resource Management and CFO of Southern Cross Resources (now Uranium One), Curyer has gained significant experience in evaluating prospective uranium projects around the world. Also, before being appointed to CEO of NexGen in 2012, Curyer spent just over 5 years running his own consulting business, offering services to resource sector companies that included incorporating, corporate development, international financing and directorship services. Finally, Curyer has raised over $500 million in equity over the course of his career in North America, Europe and Australia, which is a KEY skill to have in the junior resource sector.

Next on Curyer’s team is VP of Exploration and Development, Garrett Ainsworth. Ainsworth is a Professional Geologist, receiving his degree from the University of London. Before joining the NexGen team, Ainsworth was a project manager with Alpha Minerals Inc. and Fission Uranium Corporation. Ainsworth is credited with being instrumental in the success of the Patterson Lake South project, where he oversaw the staking of new claims, the discovery of the boulder field and a number of high-grade uranium drill hole discoveries.

On November 9, 2016 NexGen announced the appointment of Dr. Mark O’Dea to its Board of Directors. O’Dea is a powerhouse in the resource sector; his company, Oxygen Capital Corporation, has helped grow a host of successful junior resource companies, such as True Gold, Pilot Gold and Fronteer Gold. Personally, I have made a lot of money speculating in companies that O’Dea was involved in. My most recent O’Dea winner was True Gold, which sold their Burkina Faso property to Endeavour Mining this past spring.

In my mind, O’Dea is game changer, and his interest and involvement in NexGen Energy speaks to the quality of NexGen’s Arrow project and other future prospects.

Curyer’s management team is rounded out by Travis McPherson, Corporate Development Manager, and Grace Marosits, CFO. To me, it’s clear that NexGen has a great management team and a board of directors to steer the company towards success in the coming uranium bull market.

Brian: NexGen’s property is set in a premier jurisdiction, the Athabasca Basin in northern Saskatchewan, Canada, which is home to the highest-grade uranium deposits in the world. For those unfamiliar with the NexGen story, its Rook 1 Project (Arrow, Bow and Harpoon Discoveries) is located in the Basin’s Southwest corner.

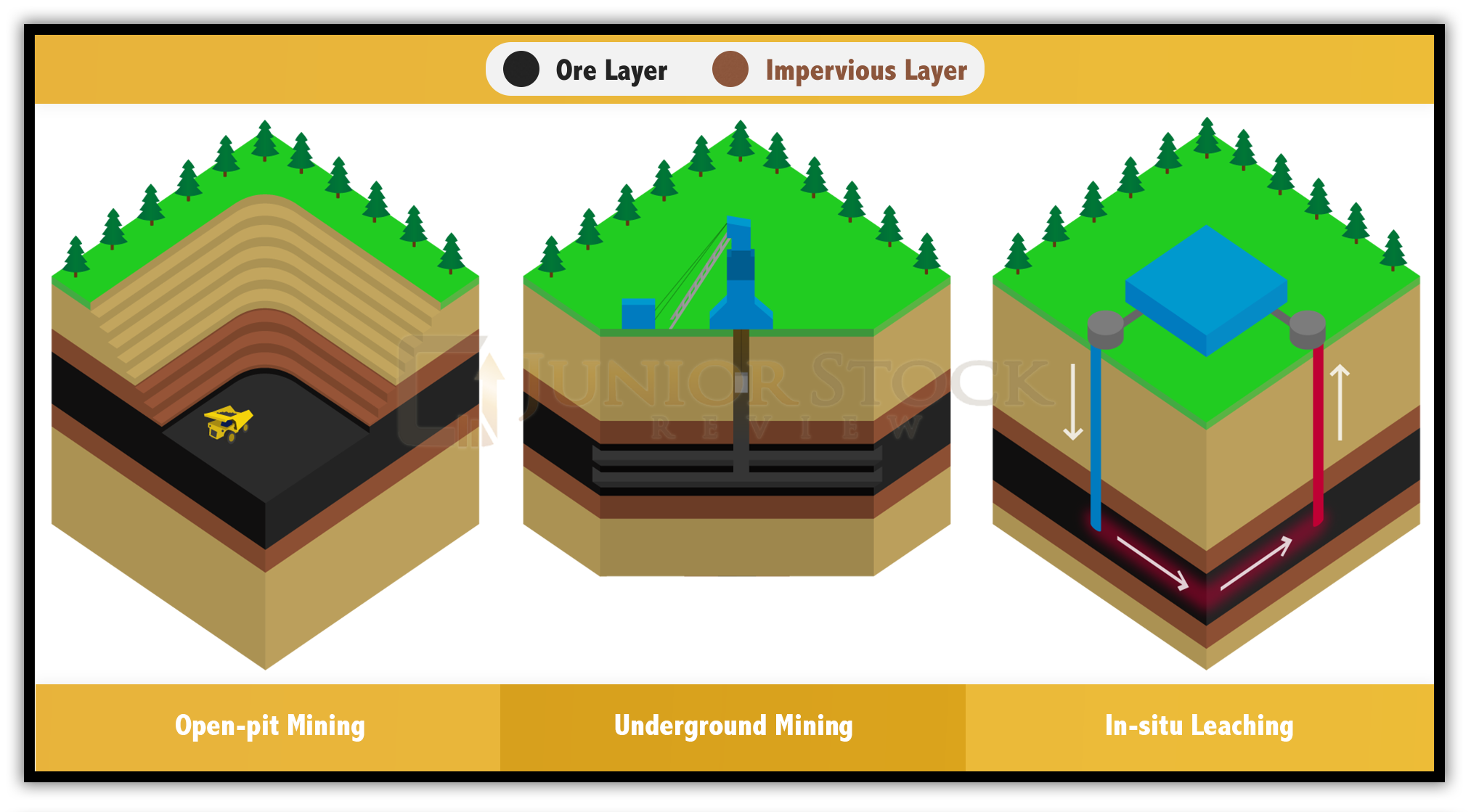

Unlike Cameco’s Cigar Lake and others in the Basin, which are sandstone-hosted (egress type) deposits, NexGen’s Arrow discovery is basement-hosted (ingress type).

Why is this an advantage for NexGen?

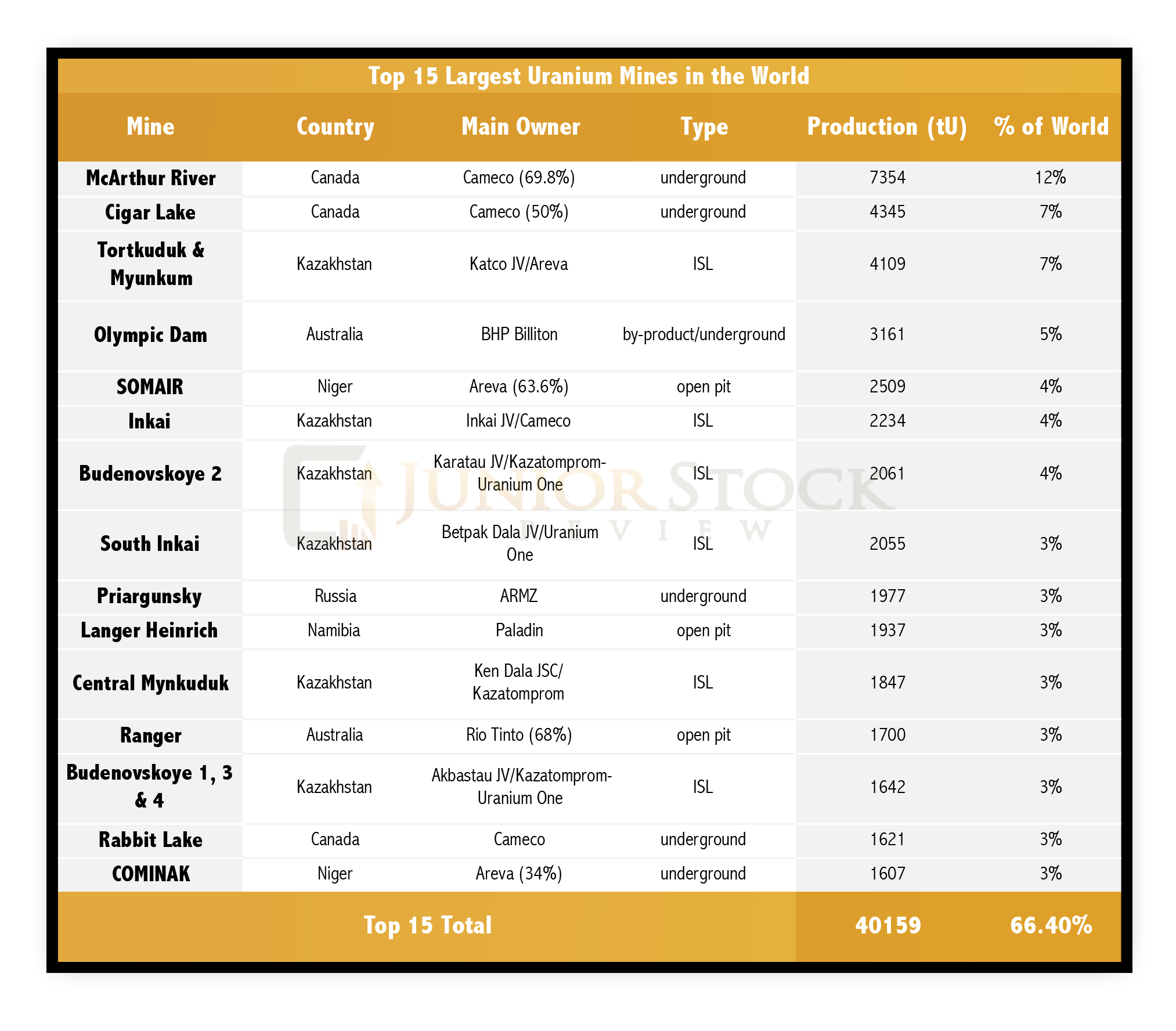

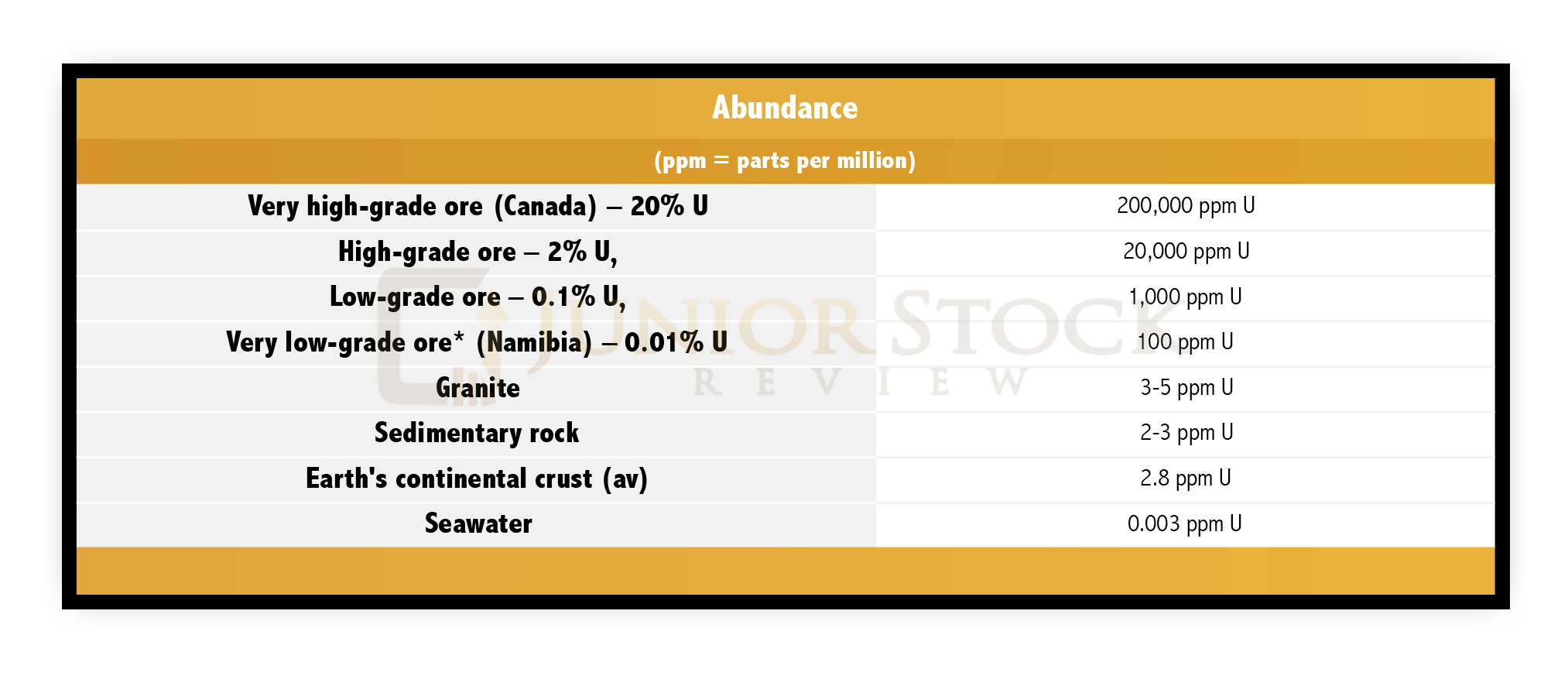

Peter: That’s a great question. This distinction is what makes the Arrow discovery the single best un-developed project on the planet. You correctly mentioned Athabasca grades being ~100x greater than the global average; that begs the question – why doesn’t Cameco have ridiculous, insane margins? Because its two giant mines, McArthur/Key Lake & Cigar Lake are subject to substantial, ongoing technical risks and commensurate elevated capital and operating costs, mostly due to the challenge of keeping water out. McArthur & Cigar are aptly named, they are both underneath bodies of water!

So, the crucial advantages NexGen’s Arrow project has are 1) it’s basement hosted and 2) it’s not under a lake. This should enable the Company to incur less capital & operating costs, and fewer and less costly technical challenges, while benefiting greatly from the monster uranium grades in the basin.

As one major NexGen shareholder explained, “The sandstone is water-charged and has a toothpaste-like consistency. It is unstable for mining and requires complex freezing techniques. Basement hosted deposits can be mined with conventional techniques.”

Brian: NexGen’s maiden resource estimate, which was announced this past March, is an Inferred 201.9 million pounds @ 2.63% U3O8, making it the largest undeveloped uranium deposit in the Basin. The deposit is large and it appears that the NexGen management is focused on making it bigger, with some terrific drill results released on December 20th.

While the best people and great properties in good jurisdictions top most people’s lists of considerations when speculating in a junior resource company, the next is often whether or not the company has the cash to execute its plan.

Does NexGen have the cash needed to execute their drilling plans for 2017, and to complete a Pre-Feasibility Study (“PFS”)?

Peter: NexGen’s balance sheet is an underappreciated factor in assessing the Company. They are funded for the next 2 years. That’s expected to cover funding for aggressive drill campaigns, a few updated mineral resource estimates and delivery of a PFS. Perhaps more important, in my opinion, management has access to additional funds from the market, if needed. To be clear, I don’t think the Company will need much if any equity capital in 2017. But even if they did, it would very likely be an issuance of less than an additional 5% of outstanding shares.

Most pre-production juniors are under a tremendous amount of pressure to keep the coffers full, which is a material drain on management resources. NexGen has moved beyond that difficult phase and can concentrate fully on advancing its projects. I like to say that NexGen is fully funded through takeout.

Brian: I attended the Subscribers Investment Summit in Toronto this past March, and caught Tommy Humphreys’ (of CEO.ca) interview with Warren Irwin of Rousseau Asset Management. They primarily discussed NexGen and the merits of its world-class discovery.

At the time, Irwin’s outlook was that this discovery could get much bigger, making it a strategic asset for takeover by any of the major uranium producers in the world.

In your opinion, what’s the end game for a deposit like this?

Peter: Look, the end game is clear, my crystal ball says that NexGen will get acquired in 2018 or 2019. By then, the uranium price will likely have improved and demand for secure supply will be higher as a muted supply response shines a light on how tight the market might get from 2020 on. What really strikes me though is the sheer number of global natural resource companies with the financial wherewithal to take NexGen out.

Dozens could make that move, and not just uranium companies. I often say that Teck Resources is an ideal suitor. It has invested billions into an Oil Sands venture that can’t be looking that exciting at current oil prices. Due to a global march towards zero % interest rates, Teck can borrow low-interest capital to fund acquisitions. And, it’s share price was up something like 800% in 2016! That’s a powerful currency to deploy for M&A.

Any global natural resource player like a BHP, Rio or Vale should care, but why not E&P companies? Why not precious metal Majors? Why not coal & iron ore companies? NexGen offers compelling geographic, geopolitical and commodity diversification. I mean, a company prudent enough to make a move into uranium near the low of the cycle would presumably be smart enough to shoot for the very best, that leaves NexGen as the prime target.

Brian: Thank you very much, Peter, for answering my questions on NexGen Energy.

Where should readers go to learn more about yourself and Epstein Research?

Peter: Readers should, dare I say must, go directly to Epstein Research and enter an email for FREE, instant delivery of my work. It takes 12.5 seconds. Fear not, one will not be inundated, I post only 2-3 times a week.

In addition, I post my articles and written interviews on up to 15 unaffiliated websites including, equities.com, StockHouse, SeekingAlpha, TalkMarkets, MiningFeeds, MetalsNews, EquityGuru. I’m very well versed, but not an expert like Donald Trump, in uranium, gold, silver, copper, lithium and coal.

NexGen’s story is compelling and has the ability to improve with further drilling and a PFS to be completed over the next couple of years. I completely agree with Peter; NexGen will most likely be acquired in the future, giving the purchasing company, arguably, the uranium sector’s most influential mine site, as its size and production costs should be amongst the top in the world.

Putting it all together, you get a great management team, a tier 1 property, and the cash needed to execute further drilling and a PFS. NexGen presents a great value proposition in a depressed uranium market.

Until next time,

Brian

Disclaimer: Junior Stock Review – The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence. I have not been compensated to write this article. However, I do own shares in NexGen Energy Ltd.

Disclaimer: Epstein Research – Please note the following. Mr. Epstein had no prior or existing relationship with NexGen Energy until [1/15/16]. As of that date, NexGen Energy became a paid Sponsor of Epstein Research. At that time, Mr. Epstein owned shares in NexGen Energy Ltd. He is not a registered or licensed financial advisor. His article(s) on NexGen Energy and others must be considered carefully in this context. The content contained in articles and written interviews on NexGen Energy is for informational and/or illustrative purposes only. Readers are strongly advised to consult with their own licensed or registered financial advisors before making investment decisions. This company is highly speculative, and therefore not suitable for all investors.