For no particular reason, I have always concentrated my resource sector speculations on the hard rock juniors.

Hard rock mineral exploration and development has an allure that most other sectors can’t compete with.

In particular, the anticipation for drilling and discovery success can incite copious amounts of greed from the market.

In this regard, it’s arguably the gold companies that garner the most attention.

It’s the portion of the sector that first grabbed and kept my attention all these years.

That said, all exploration comes with major risks to your investment dollars.

Risk factors range from those associated with jurisdiction – permitting, taxes & social unrest, to exploration failure, to poor market sentiment and/or technical failure – metallurgical, geo-technical, etc.

There is always the risk to lose it all.

Another often overlooked risk to your cash is the “dead money” risk.

Dead money represents an investment in a junior whose share price is stuck in a tight range for a prolonged period of time.

There can be a number of reasons why this happens.

For example, it could be a drawn out permitting process.

The market loses interest and then often sells or, possibly worse, forgets about it.

Dead money mixed with low liquidity means you’re stuck.

Your investment dollars aren’t able to move into new opportunities and, given the rising cost of inflation, you’re actually silently losing your purchasing power with those dollars.

Dead money is tough because it’s a risk across the sector.

On a whole, the juniors are mostly illiquid and even the best companies can have stretches where their share price doesn’t move.

That isn’t always a problem, but when you mix it with bad news, it can be terrible.

As an investor, I think you can develop a framework of decision making to minimize this, but never eliminate it.

Which brings me to the topic I wanted to discuss today, the merits for investment in oil and gas companies.

Oil exploration and development companies are susceptible to the same risks as hard rock companies, with one slight difference.

A junior oil exploration company moves from explorer to producer on the same day of discovery, while for a hard rock company, the discovery just marks the beginning of what is usually a long path to production.

Hard rock discoveries must go through resource delineation, further financing, environmental studies and permitting.

This process can often take 10+ years.

Those years in between are the ones where those risks I spoke about earlier can come back to bite you.

Now, don’t get me wrong, I love speculating in hard rock exploration and development, these comments are not meant to dissuade you.

I continue to be a hard rock junior company investor.

I’m merely pointing out a difference and what is a big reason why I’m so attracted to the oil and gas space, right now.

As an added bonus, I’m very bullish on oil.

Late last year, my interest in the sector was sparked by a friend’s investment in a tiny western Canadian oil junior.

After a site visit, some good conversation and a whole ton of research, I’m convinced that the oil price is headed to uncomfortably high levels in the future.

When exactly you might ask?

I wish I knew, but I don’t.

While I can’t tell you when, I can take you through some of the factors that I think will propel the oil price higher in the future.

From there, you can decide for yourself.

To me, the story starts with the pace of financial and social change worldwide.

In my view, it’s quickening.

Major transitions in society, especially those related to commodity consumption, mark huge opportunities to make money, on both the old and new side of the trade.

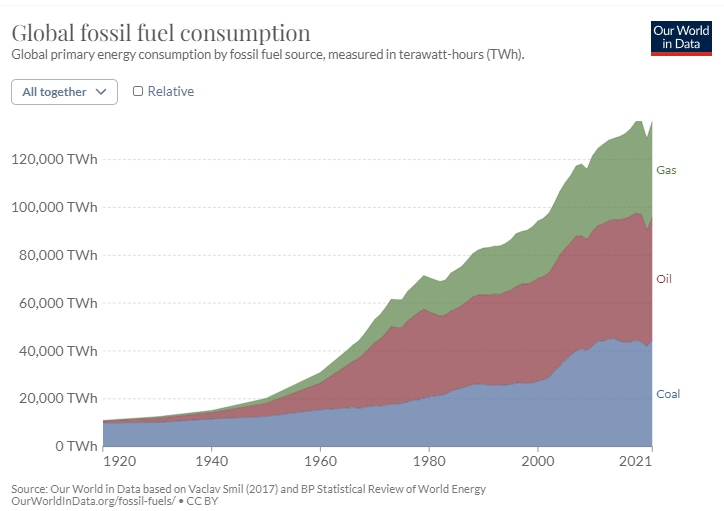

The biggest shift in commodity consumption is the transition away from fossil fuels, mainly oil, to renewables or non-carbon emitting sources of energy.

This is a monumental challenge, one that will undoubtedly be rocky and take much longer to execute than many may think.

Moreover, while the Western nations try to virtue signal their way politically away from fossil fuels, they can’t escape the fact that their bottom lines are still highly tied to the oil market.

Today, the ESG investment movement has pushed investors, banks and funds away from the oil companies.

Further, it has forced oil companies to further cut exploration and development of new wells and, instead, shift a portion of their development dollars into renewable energy sources.

While this trend, at first glance, would seem detrimental to the oil price, it’s in fact just the opposite.

In my view, it will lead to supply constraints and, ultimately, much higher sustained oil prices in the future.

If you’re bullish on the world’s electrification, you have to be bullish on oil.

Fortunately or unfortunately, the two go hand in hand.

In my view, this is an opportunity for investors who can see through the politics and realize that our dependence on oil is far from being over.

ESG investment policies and electrification diminish the supply side of the oil market.

Further, there are a bunch of other factors that I believe will drive the oil higher, such as:

- Rise of the 3rd World (Developing nations)

- OPEC production cuts

- Lack of new oil exploration & development

- High interest rates

- Depletion of the US Strategic Oil Reserves

- War – Russian Sanctions, Petro Yuang and BRICS+

I can’t cover all of these bullish factors in one article.

It’s going to take a few to discuss all of these points in detail.

So stay tuned.

In the meantime, you should become a Junior Stock Review VIP and get my latest thoughts on the resource sector sent right to your inbox for free.

Until next time,

Brian Leni – P.Eng

Editor – Junior Stock Review Premium