In June, I had the pleasure of visiting the Yukon, Canada’s most westerly Territory and the land of the midnight sun. The point of my visit was to partake in the 2018 Yukon Property Tour, which, this year, brought together 3 large groups of investors, analysts and media to see a few of the Yukon’s most promising projects and to participate in a full-day investment conference.

The tour took me to 6 different projects in 4 days, giving me a great perspective of the Yukon’s mineral potential and the people who are exploring and developing within it. In all, I came away very impressed and believe that it’s just a matter of when for most of the projects in terms of their development into Canada’s next mines.

Here’s a look at the Yukon by the numbers and a few specific things that I, personally, look at when gauging the opportunity for investment within a jurisdiction.

Enjoy!

Yukon – By the Numbers

Population – 38,630 (December 2017) –23% of the Yukon’s population is Aboriginal.

Capital City– Whitehorse (has an International Airport) – Population 29,962 or 78% of the Yukon’s total population.

Demographics – 0 to 19 years of age: 8,217, 20 to 64 years of age: 25,627, 65+: 4,784 – This is a great distribution of demographics for a developing Territory.

Unemployment – 2.7% (May 2018) – This is a great statistic; essentially, those who are able and want a job can find employment. The issue may be, and this is a great issue to have, finding enough workers in what I see as a bright future for growth, especially in the mining industry.

Largest Cities by population, outside of Whitehorse – Dawson City: 2,200, Watson Lake: 1,441, Haines Junction: 911, Carmacks: 549

Real GDP – $2,345.3 million (2016)

GDP by Industry (in terms of NAICS – 2016) – Public administration: 23.1%, Real estate and rental and leasing: 14.2%, Mining, quarrying and oil and gas extraction: 12.8%, Health care and social assistance: 8.4%, Construction: 7.7%

- With higher precious and base metals prices in the future, a lot of prospective projects have a very good chance of re-starting production (i.e. Alexco Resources), or developing their deposit into a mine, (i.e. Western Copper and Gold). Given the relatively small size of the Yukon economy, major projects such as Western Copper and Gold’s Casino Project will have a tremendous effect on the overall Yukon economy.

- The Government of the Yukon and the Federal Government make up a major portion of the Yukon economy, as you can clearly see from the GDP break down. For the success of the Territory, this has to change in the future.

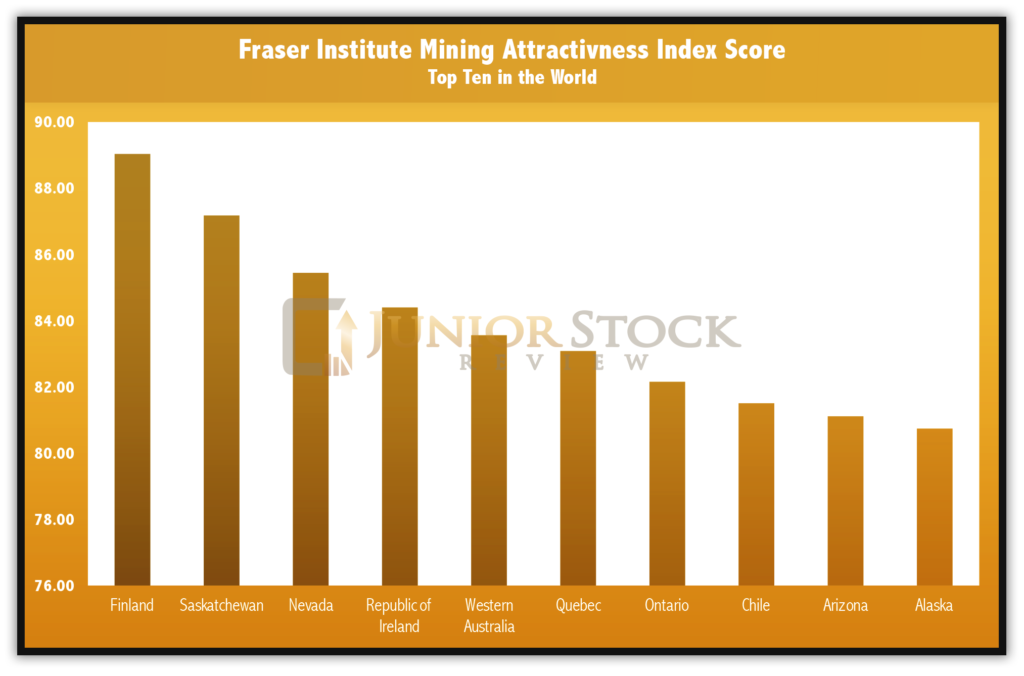

Fraser Institute Ranking for Mining Investment Attractiveness 2018 – 13th in the world

- The Yukon is a premier jurisdiction for mining and attained a score of 79.67, or 13th in the world, for mining investment attractiveness, according to the Fraser Institute’s 2018 rankings. The Fraser Institute uses a number of criteria for evaluating a jurisdiction, such as political stability, mining law, taxation and, arguably the most important, mineral potential.

NOTE: All statistics taken from the Government of the Yukon Statistics

Aboriginal Land Claims and Self-Government

11 of the Yukon’s 14 First Nations have comprehensive land claim (Final Agreements) and Self-Government Agreements. It was in 1993 that the template, the Umbrella Final Agreement (UFA), was signed and used toward the negotiation of individual land claim agreements.

Source: The Government of the Yukon

With the settling of their land claims, each First Nation has the power to control and direct their own affairs. Most importantly for the subject of this article, they have direct control over the exploration and development of the mineral projects on their property.

The following First Nations have settled their land claims and are now self-governing:

For most investors, First Nations involvement in mining projects is typically met with skepticism; given the history of some of the dealings around the world, this isn’t unfounded. However, each situation should be examined for its individual merits, as well as the history of the specific First Nations where the prospective investment may occur.

The Yukon’s First Nations are no different and, given the immediate history with mine development, such as Victoria Gold Corp.’s development of the Eagle Gold Project within the traditional territory of the Na-Cho Nyäk Dun First Nation, it would appear to me that mutual benefit from mining is the driving force behind the cooperation agreement.

Another great example of a mutually beneficial cooperation is the synergy that has been found between the Kluane First Nation and Nickel Creek Platinum. The Kluane First Nation provides many of the key non-technical services to the Nickel Shaw Project camp, such as a great cafeteria service, which I had the pleasure of trying!

Looking up at the Nickel Shaw Project Deposit

I think the bottom line is companies that begin their relationship early in the project’s life, work to maintain that relationship, and can prove that they are as concerned about the environment and the people who inhabit that environment will, ultimately, be successful in moving toward the end goal of developing an operating mine. When researching a company, these can be key things to look for and to ask about when interviewing management. Of course, nothing matches doing a site visit and seeing it first-hand.

Yukon’s Political Landscape

Currently, the Government of the Yukon is controlled by the Yukon Liberal Party, which is led by Premier Sandy Silver. Generally speaking, the Liberal Party’s business philosophy is typically thought to be somewhat in the middle of the left-leaning New Democratic Party (NDP) and the right-leaning Conservatives.

In November 2016, the Yukon Liberal Party defeated the Yukon Party (conservatives), which was in power for many of the terms dating back to 2000. With a very low unemployment level and 80% of the population located in Whitehorse, politics in the Yukon are somewhat unique. Much like the rest of the country, however, issues surrounding the environment – carbon tax, power generation and housing – price and availability seem to be hot topics in the land of the midnight sun.

From an investment perspective, I’m always most concerned with left-leaning government power. Although, NDP governments have been in power in the past, the conservatives have dominated the leadership of the Territory for much of the last 20 years. Given this fact, I believe that past will be prologue in terms of the Yukoners’ general political philosophy, but it’s always something that should be watched.

Yukon Mining Alliance

Uniquely, to my knowledge, many of the junior and major mining companies with projects in the Yukon have formed the Yukon Mining Alliance (YMA) with the Government of the Yukon and the Canadian Northern Economic Development Agency.

The YMA’s mandate is to,

“promote Yukon’s competitive advantages as a top mineral investment jurisdiction and its member companies and their Yukon-based project.†~ YMA

In my opinion, this is a huge advantage of investing in companies with projects in the Yukon, because clearly the marketing and promotion of mining within the Territory’s borders is a major priority. Bottom line, narrative plays a big role in the success of junior mining companies, and with the added help of the YMA, Yukon-based companies have a distinct advantage working together to promote the Yukon mining jurisdiction narrative.

Personally, I have seen the YMA presence at a couple of the top mining conferences in Canada, such as PDAC and Cambridge’s Vancouver Resource Investment Conference (VRIC). The YMA is putting the Yukon on the map for interested resource investors, which, I believe, will pay off in spades as we move into the next leg of the bull market.

Infrastructure

In my opinion, the biggest knock against the Yukon in terms of risk to investment is the lack of infrastructure. With close to 80% of the Yukon population concentrated in Whitehorse, the need for roads, telecommunications and power infrastructure to the remote or uninhabited portions of the Territory hasn’t been a high priority or practical, given the cost. However, this is rapidly changing as it’s now abundantly clear that access to power, telecommunications and roads have become the major sticking points for a few of the Yukon’s most advanced mineral development projects.

Yukon / Northwest Territories Fibre Optic Line

As you can see in the image below, the thick black line represents the existing fibre optic line which feeds the Yukon with its high-speed internet access. With only one fibre optic line feeding the Yukon’s internet demand, the system was highly susceptible to disruptions due to the fibre cable being cut along the Alaska Highway.

Source: CBC News

To improve the reliability of the internet access, the Government of the Yukon initiated the$50 to $70 million North Canada Fibre Loop Project, which would connect the Yukon to the Northwest Territories’ (NWT) fibre network via fibre optic lines running north from Dawson City to Inuvik, NWT.

During my site visit tour, it was announced that this project was successfully completed and, thus, has brought a new age of reliability to the Yukon’s internet access. This project is a major milestone for the Territory and should provide a reliable base from which to build, moving forward.

LNG Power Generation

In 2017, 97% of the Yukon’s electricity was produced from 3 hydro-electric power generation plants. For a number of years, these hydro-electric operations were backed up by diesel generators, which kicked in during peak demand scenarios.

With carbon emissions and the overall price of power generation becoming bigger constraints to development, in 2014, the Government of the Yukon made the decision to green-light Yukon Energy’s plan to move to a liquefied natural gas (LNG) as a fuel for generating backup power for the grid.

The fracking revolution dramatically changed the supply to demand balance in the oil and gas world, causing a major swing upward in the availability of natural gas for the market. Thus, natural gas prices have hovered around their multiple decade lows for a while, now.

While natural gas is one of the cheapest and cleanest burning fossil fuels available, the issue has been economic transportation. To allow for a meaningful amount of natural gas to be transported over a significant distance, it’s currently converted into LNG.

The natural gas is extracted from the ground and then refrigerated to minus 162 degrees Celsius, turning it into a liquid and, thus, more amenable to economic bulk transportation.

Source: Yukon Energy

LNG Storage

A big step toward making LNG a viable option for developing mines in the Yukon could be the construction of an LNG storage facility. Currently, Ferus Natural Gas Fuels Inc., the LNG supplier to the Yukon, is working with Yukon Energy to gauge the potential of such a facility.

If the LNG storage facility were to be built in Whitehorse, it could not only feed the backup generators, but also act as a depot for future mines that incorporate LNG into their long-term energy plan.

Having a reliable power infrastructure is paramount to the success of large-scale mining operations. With a number of sizable development projects waiting for their opportunity to be developed into mines, in my opinion, the Yukon is headed in the right direction by pursuing an LNG storage facility.

Yukon Resource Gateway Project

On September 2, 2017, the Yukon received a major commitment toward its development when it was announced that the Canadian Federal Government would contribute $247 million to the Yukon Resource Gateway Project. The $247 million represents just over half of the $469 million needed to construct a road from Carmacks to Dawson City.

In my opinion, the main reason for this major undertaking was Goldcorp’s Coffee Project, which sits roughly half way between Carmacks and Dawson City, and is in the process of being developed into Canada’s next producing gold mine. Additionally, Western Copper and Gold’s Casino Project sits in the permitting stage of development and looks to benefit greatly from this announcement, as the road will give access to what is now a remote location.

Further, the Government of the Yukon will contribute $113 million to the Gateway Project, leaving the remaining $109 million to the mining companies to fulfill. The construction of the road has begun and, given the comments from Western Copper and Gold representatives, should take roughly 3 years to reach their property from Carmacks.

I think there’s no doubt that this road will be a major turning point for the Yukon and its development into a destination for mining, because I believe it and possibly slightly higher metal prices are the only things keeping this area of the Yukon from being developed, right now.

Mineral Potential

In my opinion, one of the most compelling reasons for investment in the Yukon is its mineral potential. With a good portion of the Yukon still not accessible by road, much of the Territory is still yet to be explored and, therefore, presents a blue sky type of opportunity for those who are willing to go off the beaten path.

Yukon Geological Survey

Both the Federal and Territorial Governments clearly recognize both the potential and the large expense associated with mineral exploration and development and are, therefore, directing funding accordingly. One such Territorial organization at the forefront of this PUSH is the Yukon Geological Survey (YGS).

The YGS’s mandate is to ‘provide the geosciences information required for resource and land management for the benefit of Yukoners, by acquiring and disseminating geological and geo-hazard knowledge to support exploration, inform resource and land management planning, and engage communities, schools and the public.’

Additionally, it manages the Yukon Mineral Exploration Program (YMEP), which has been set up to promote mineral prospecting and exploration activities in the Yukon. The YMEP has a $1,600,000 funding level for the 2018-19 fiscal year and is accepting applications for prospective projects.

It’s initiatives such as this that are keeping the pipeline of prospective geological targets full and, therefore, of keen interest to investors.

Tintina Gold Province

One of the most prospective regions for mineral exploration in the north-western portion of North America is the 150,000 square kilometre Tintina Gold Province (TGP). TGP runs east-west across the middle portion of the Yukon and Alaska, and is roughly 200 kilometres wide in its entirety. The TGP is essentially bound by the Kaltag-Tintina fault system to the north and the Farewell-Denali fault system to the south.

TGP encompasses arguably the Yukon’s most famous geological region, the Klondike gold fields which lay just south of Dawson City. As stated earlier, the Resource Gateway Project will open this region up to development and exploration. Companies such as Klondike Gold, Trifecta Gold, Goldcorp, White Gold and Western Copper and Gold will greatly benefit from the road access to theirprojects.

View from the helicopter while flying over White Gold’s Property

White Gold Core Shack – red circle signifies visible gold

Klondike Gold Rush

The Klondike Gold Rush began in August of 1896, as three prospectors, George Carmack, Jim Mason and Dawson Charlie, discovered gold in what they referred to as ‘Rabbit’ Creek, or what is now referred to as Bonanza Creek. With the discovery and the rush to stake their claim, word quickly spread of their discovery, and so spurred an historic gold rush in Canada’s Yukon Territory and the United States’ Alaska.

Source:Â Yukon Government Archive

It’s estimated that the Klondike Gold Rush attracted 100,000 people from all walks of life, testing their luck against the odds to find their fortune.  Many of the new American prospectors found their way north via ships boarded in Seattle. Former ports, such as Dyea, Alaska, were accessible at high tide and allowed prospectors to begin the lengthy trip north toward the centre of the Gold Rush, Dawson City, which is roughly 700km north.

Source:Â Yukon Government Archive

Unfortunately, for the vast majority of newly minted prospectors, their dream of discovering a fortune never came to fruition; if it wasn’t the weather and the long trip to the prospective gold claims, it was the exorbitant costs that came with exploring and living in the north. In many of the articles I read while researching the Klondike Gold Rush, many estimated that costs were 10 times higher than what most of the people would have experienced in their former lives, living in Toronto, New York or Chicago.

Source:Â Yukon Government Archive

The Klondike Gold Rush is estimated to have produced $29 million in gold over its 3-year span. Additionally, the Yukon Geological Survey estimates that a total of 20 million ounces of gold has been extracted from the Klondike goldfields since 1896. Gold mining can be credited with spurring the development of much of Canada and America’s northern most territories and states. In my opinion, the Yukon holds tremendous mineral potential and will only increase its prestige within the mining community.

Selwyn Basin

Moving to the eastern portion of the TGP within the Yukon, you enter the Selwyn Basin, host to the famously rich, Keno Silver District, which has 214 Moz of historic silver production and is located north-east of Mayo. It’s also in the immediate vicinity of Keno City, one of the Yukon’s smallest communities with just 24 residents.

For those who may not know, Alexco Resource’s Bellekeno silver mine is located in the Keno Silver District, which began operation in 2011 and produced until its suspension in 2013. The Keno Silver District is not only famous for its past production, but its high silver grades, which range up to 1,000 grams per tonne, putting them near the top in the world.

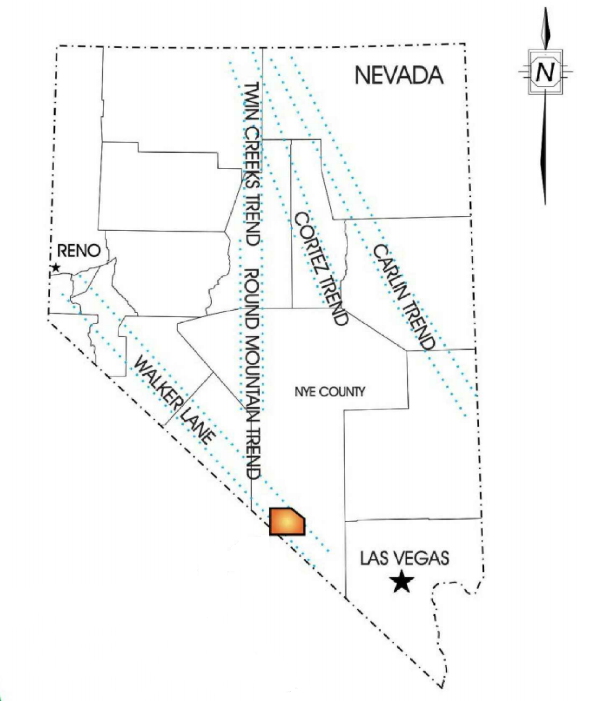

Standing in Alexco’s Flame & Moth decline

ATAC Resource’s Rackla Gold Project, also in the Selwyn basin, is a standout, in my mind, given the Carlin Style gold mineralization which has been found on the property. With its typically cheap mining and recovery methods, Carlin Style gold mineralization has made Nevada one of the premier gold producing jurisdictions in the world. In recent news, ATAC released their maiden resource on their Osiris Project, which has an inferred resource of 1.685 Moz at an average grade of 4.23 g/t.

ATAC Resources – Rackla Gold Property

Finally, the Selwyn Basin is home to sedimentary exhalative (SEDEX) deposits (Pb-Zn-Ag), which, in terms of Fireweed Zinc’s Macmillian Pass Zinc Project, rank near the top of the world’s largest in terms of zinc and overall mineral content.

In my opinion, world-class mineralization potential awaits those exploring in the Yukon. As the infrastructure quality improves and cash begins to pour back into the mining sector on a whole, I have no doubt that the Yukon will play a major role in Canada’s mining future.

Concluding Remarks

No investment is without risk, and for many companies within the junior resource sector, jurisdiction is the greatest risk. Personally, having researched the Yukon and now visited, I have to agree with the Fraser Institute rankings and believe the Yukon is a premier jurisdiction for mining investment.

In terms of the risk that I see with the Yukon, it’s mainly related to infrastructure and the time required to build it. In terms of investment, however, I like that the risk is associated with what I believe is a ‘when’ and not an ‘if’ question – it’s just a matter of time before the necessary roads, power and telecommunications are in place to move many of these projects forward.

I must note that there’s a good portion of projects in the Yukon that sit in close proximity to everything that is needed and, therefore, I caution anyone from painting all of the projects with the same brush.

The Yukon has world-class mineral potential and it’s attracting the world’s major mining companies, which, over the last few years, have taken either portions of a few of the juniors or have acquired the entire project for development into a mine.

With what looks to be a politically stable government and a good relationship with its self-governing First Nations, the Yukon is ready for investment, and I will be looking to invest in a couple of the companies that I believe present the greatest price to value propositions.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder –Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company, sector or jurisdiction that is best suited for your personal investment criteria. Brian Leni does not own any shares of the companies mentioned in this article at this time.